How far can $2 million really go in retirement? This week, we explore $2 million retirement by state and why location is becoming a critical financial factor.

Economy

Consumer spending growth slowed in April as households reduced their purchases of durable goods. Income growth exceeded expectations. Personal interest income has climbed to a record high, surpassing $2 trillion (annualized) in April. This marks a sharp turnaround from the 2020 lows, reflecting the cumulative effect of higher rates and strong demand for yield-bearing assets. Consumers increased their savings again.

The ISM Manufacturing PMI came in softer than expected in May, indicating continued weakness in US factory activity.

Imports contracted at the fastest pace since the Great Financial Crisis in 2008. Public construction spending hit a record high.

Construction spending unexpectedly fell for a third consecutive month in April, with declines in both residential and nonresidential categories. Apartment vacancies continue to rise.

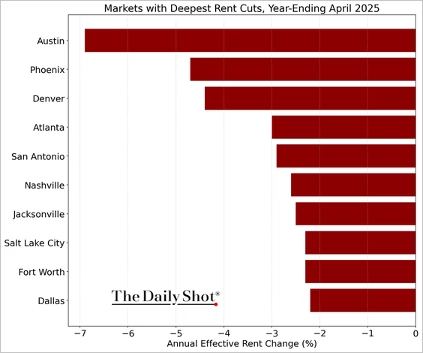

Here’s a look at the largest rent declines and increases across major metro areas. (2 charts)

Austin, Phoenix, and Denver lead the U.S. in rent declines, with effective rents down nearly 7%.

Source: RealPage Read full article

Chicago, Kansas City, and San Francisco top the list for strongest rent increases.

More Americans are choosing to rent than own as housing affordability remains an issue.

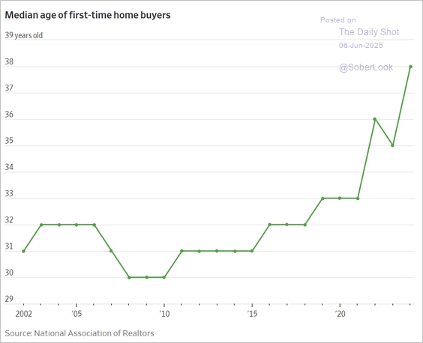

Job openings increased in April, topping expectations. Vehicle sales declined in May. Factory orders excluding transportation unexpectedly fell in April, marking a second consecutive monthly decline. Median age of US first-time home buyers:

The median age of U.S. first-time homebuyers hit a record 39 in 2025.

Source: @WSJ Read full article

Markets

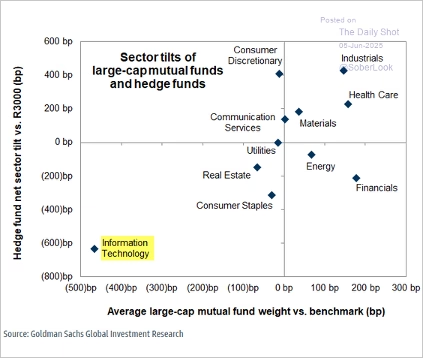

Wall Street’s year-end 2025 S&P 500 targets have shifted decisively higher, with several strategists now projecting gains of 10% or more as tariff concerns ease. Both hedge funds and mutual funds are underweight tech stocks.

Funds are overweight healthcare and consumer discretionary, while underweighting tech.

Source: Goldman Sachs; @dailychartbook

US tech leadership has been correlated to earnings growth. Foreign ownership of the US equity market has climbed steadily over the past four decades, rising from just 5% in the mid-1990s to a record 18% in 2025.

The Fed

Economists expect inflation to strengthen in the months ahead. Softer data pushed the Citi US Economic Surprise Index back into negative territory.

Economic data is underperforming expectations, pushing the index back into negative territory.

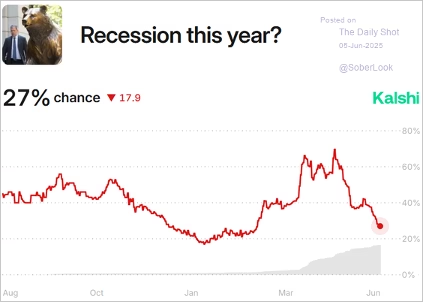

However, betting markets further lowered the implied probability of a 2025 recession.

Markets now estimate a 27% chance of a recession in 2025, down from over 60% earlier this year.

Source: Kalshi

Treasury yields declined, …

Yields have fallen below 3.9%, reflecting increased expectations of monetary easing.

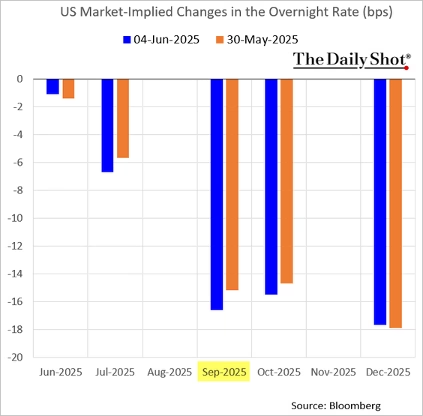

… with the probability of a September Fed rate cut increasing.

Markets are pricing in up to 56 basis points of rate cuts by year-end.

The market is now pricing in 56 bps of rate reductions this year.

Tariffs

The trade deficit in goods narrowed sharply in April as imports plunged by 20%.

How Far Will $2MM Go in Retirement in Different States?

Several key factors influence how long your $2 million will last in retirement:

- Cost of Living: States with higher costs for housing, food, transportation, and healthcare will deplete your savings more quickly.

- Taxes: State income taxes, property taxes, and sales taxes can significantly impact your annual expenses.

- Healthcare Costs: As you age, healthcare becomes a more substantial part of your budget. States with higher medical costs can shorten the lifespan of your savings.

- Lifestyle Choices: Your personal spending habits, including travel, hobbies, and entertainment, will affect how quickly you use your funds.

States Where $2 Million Lasts the Longest

- Mississippi: With a low cost of living and affordable healthcare, your savings could last approximately 25 years.

- Arkansas: Similar to Mississippi, lower expenses mean your funds may stretch to around 24 years.

- Oklahoma: Affordable housing and living costs could allow your savings to last about 23 years.

- Missouri: With moderate expenses, expect your funds to cover roughly 22 years.

- Tennessee: No state income tax and reasonable living costs could extend your savings to about 22 years.

States Where $2 Million Lasts the Shortest

- Hawaii: High housing and food costs may reduce your savings’ lifespan to approximately 10 years.

- California: With elevated living expenses, expect your funds to last around 11 years.

- New York: High taxes and the cost of living could deplete your savings in about 12 years.

- Massachusetts: Healthcare and housing costs may limit your funds to roughly 12 years.

- Connecticut: Elevated expenses could mean your savings last around 13 years.

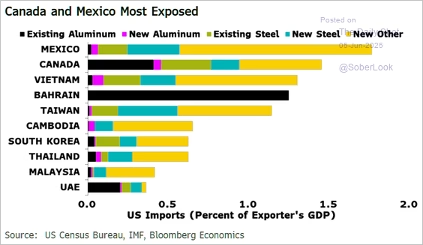

Mexico and Canada are the most vulnerable to the doubling of US tariffs on steel and aluminum, with affected exports accounting for over 1.5% of each country’s GDP. While other exporters like Vietnam, Bahrain, and Taiwan also face notable exposure, the direct hit to North America’s integrated supply chains is likely to drive the sharpest economic and political impact.

Mexico and Canada are most exposed to U.S. tariffs, with key sectors over 1.5% of GDP.

Source: @MaevaDebarge, Bloomberg Economics Read full article

Great Quotes

“In matters of style, swim with the current; in matters of principle, stand like a rock.”

-Thomas Jefferson

Picture of the Week

Sea Lion

Picture of the Week: A playful sea lion captured in a Sea Lion Exhibit

All content is the opinion of Brian Decker

Leave A Comment