While the official data from Uncle Sam continues to show a relatively strong labor market –

December saw another increase in job openings, surpassing expectations and underscoring the labor market’s ongoing resilience.

However, the number of available jobs rose past 9 million in December, the government reported – I can’t help but notice the reports of layoffs I’ve been seeing lately. The downward trend in quits (voluntary resignations) hints at diminishing employee confidence in the job market. Economists often consider this metric a more telling indicator of labor demand.

The latest one that came to my attention was global shipping giant United Parcel Service (UPS). During its quarterly earnings call, UPS said it plans to cut 12,000 jobs and $1 billion in costs as it deals with a “difficult and disappointing year” amid declining volume, revenue, and profit.

UPS shares fell 8% on all that not-so-rosy news. But there’s more to say than just the movement about its share price.

The performance of a company like UPS is often emblematic of the economy in general. That’s due to its business of shipping all kinds of things around the U.S. and the world, the number of sectors it touches and the fact that it has to deal with the realities of the economy like everyone else.

That’s why I find this example so telling. Recall that six months ago, UPS reached an agreement with its employees’ labor union to pay drivers $170,000 a year – because, you know, inflation. Now, it’s cutting 12,000 jobs because everything is more expensive while demand for UPS’s services is down and the company doesn’t expect the trend to turn around until the second half of this year.

Take note.

After the Federal Reserve meeting wraps up tomorrow, we’ll be watching for the next big jobs report from Uncle Sam. That’s the “nonfarm payrolls” numbers for January, which come out Friday morning and will include an updated national unemployment rate.

According to the free resource layoffs.fyi – a tool created by a startup founder that tracks tech layoffs when reports are available – 98 tech companies have let go 25,136 employees in January alone.

If that sounds like a lot to you, you’re right.

At the current pace of layoffs (again, this is only the tech industry but worldwide), that would mean more than 300,000 layoffs by the end of the year. This would surpass the roughly 263,000 tech jobs eliminated in 2023 and 165,000 in 2022.

Looking a little deeper at the data, most of the employees who have lost jobs worked at retail or consumer-facing businesses. For example, online furniture seller Wayfair (W) laid off 1,650 people, or 13% of its workforce, on January 19.

Microsoft (MSFT), one of the high-flying “Magnificent Six” stocks, announced just last week it is letting 1,900 employees go. (Remember that I no longer count Tesla among the “magnificent” stocks, since its shares are down about 23% for the year.) Microsoft’s layoffs are mainly connected to its acquisition of gaming company Activision Blizzard.

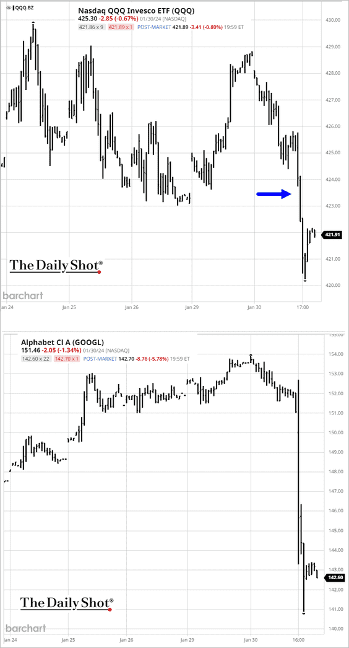

Yet fellow Magnificent Six name Alphabet (GOOGL) also cut at least 1,000 jobs across multiple divisions earlier this month.

Plus, Alphabet is reportedly shutting down its “moonshot lab” – called X – as part of a broader cost-efficiency push, Bloomberg reported last week.

Reports of layoffs in other areas of Alphabet have also been coming out of Silicon Valley in dribs and drabs.

US Economy

- The US economy continues to surprise to the upside, with the fourth-quarter GDP report exceeding forecasts. Consumer spending held up well.

- Business investment has increased for nine consecutive quarters.

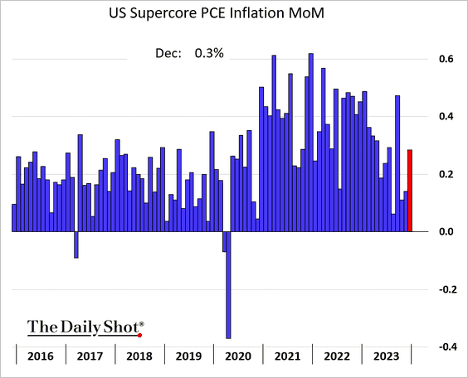

- The December core PCE inflation measure was in line with forecasts. The year-over-year indicator dipped below 3%

- The supercore PCE inflation measure (core services ex. housing) strengthened.

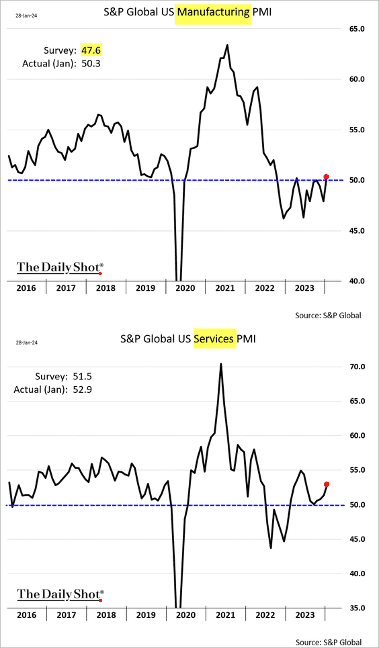

- The PMI report from S&P Global showed both manufacturing and services in growth territory this month.

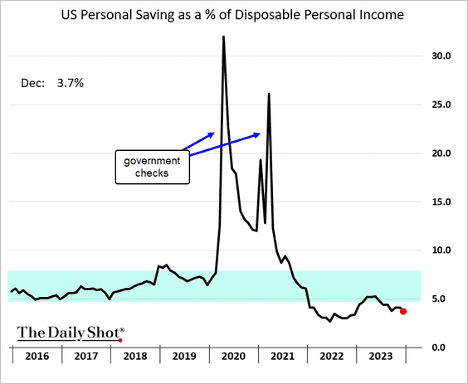

- Consumers continue to save less than they did prior to the pandemic (relative to their disposable incomes). The rate has been trending lower since last spring.

- US new home sales were trending higher going into 2024

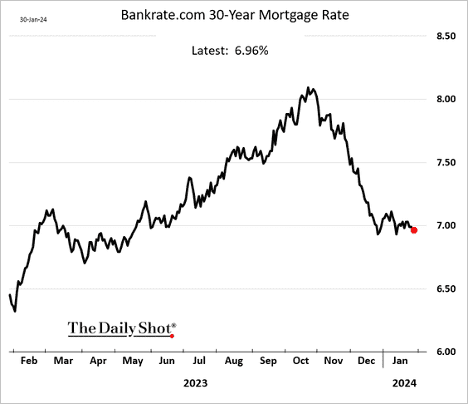

- This is partially explained by homebuilders reducing home sizes to offset the affordability challenges posed by higher mortgage rates.

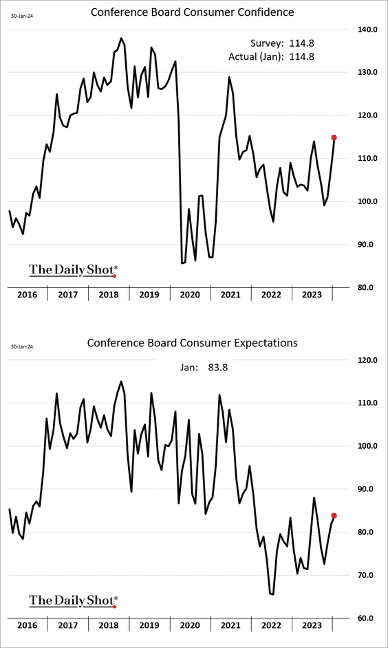

- The Conference Board’s consumer confidence index showed further improvement this month.

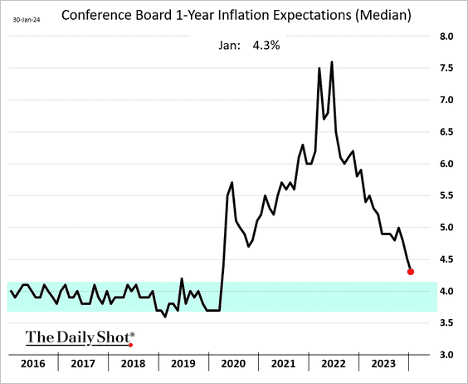

- Inflation expectations eased.

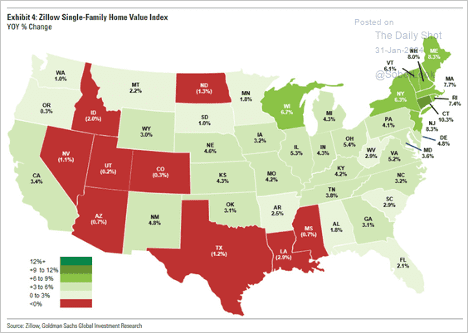

- Home price appreciation slowed in November.

- Here is a look at Zillow’s home price appreciation by state (year-over-year).

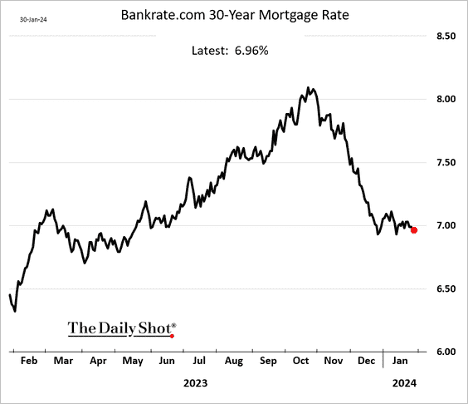

- Resilient home prices across most of the country and mortgage rates stabilizing well below the highs …

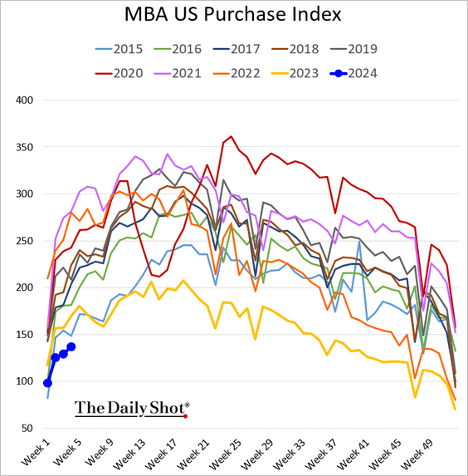

- Mortgage applications are running at multi-year lows.

- The US is facing a housing shortage due to underinvestment in new construction.

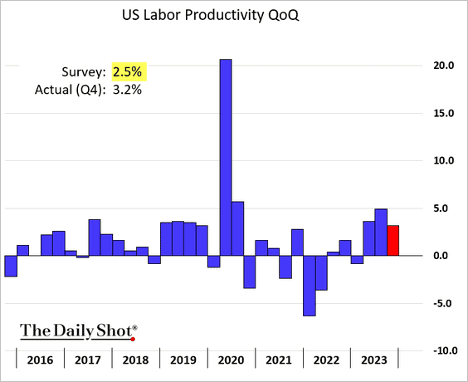

- Labor productivity climbed again last quarter, surprising to the upside.

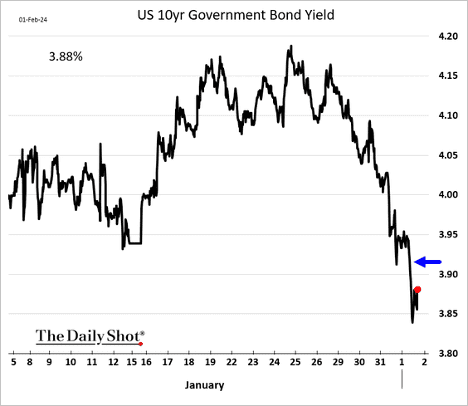

- Treasury yields declined further in response to the productivity report.

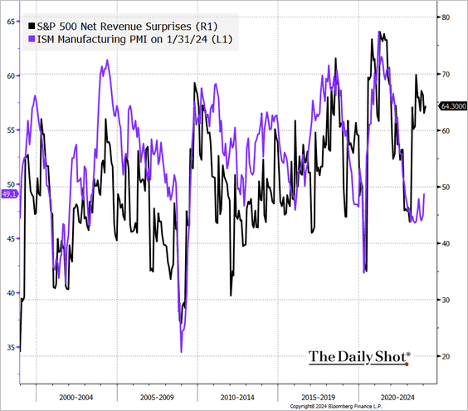

- The ISM Manufacturing PMI showed improvement in January, signaling a possible conclusion to the nation’s manufacturing slump.

- New orders returned to growth mode for the first time in almost two years.

- Leading indicators point to further improvements ahead.

- Corporate revenue surprises:

- Construction spending increased more than expected in December, boosted by residential construction.

Market Data

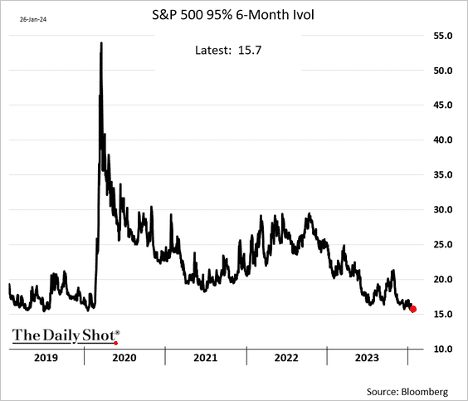

- Downside protection on the S&P 500 hasn’t been this cheap since before the pandemic. Below is the 6-month 95% implied vol.

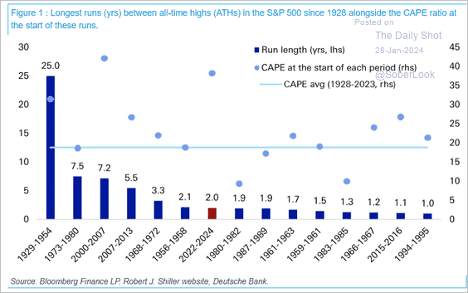

- Historically, the longest periods without a new high in the S&P 500 have a strong bias to a high starting valuation. The recent two-year stretch is only the seventh longest, going back to 1928.

- The S&P 500 hit a new high, marking its sixth record close in the past seven trading sessions. The index is now in overbought territory.

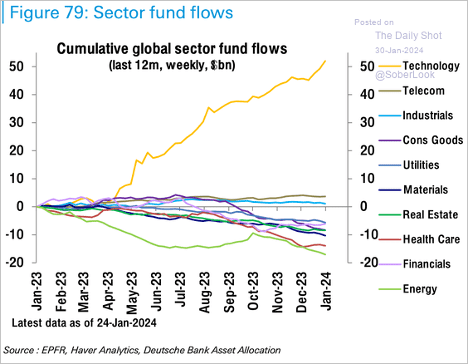

- Flows into tech funds remain robust.

The AI magic isn’t happening fast enough for investors. Tech stocks are down after the close.

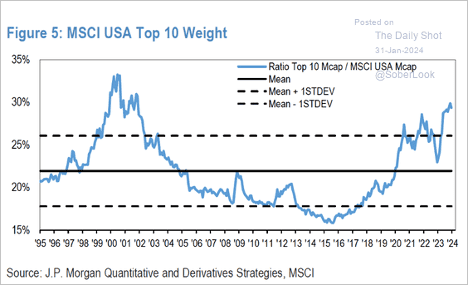

- The US market remains highly concentrated.

Source: @markets Read full article

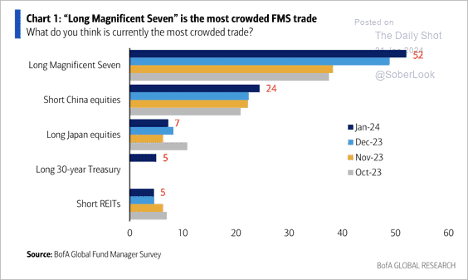

- Fund managers view long “magnificent seven” stocks as the most crowded trade, according to a survey by BofA.

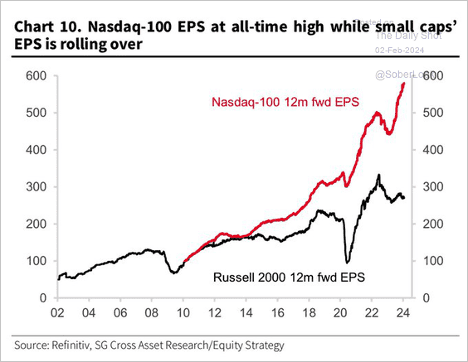

- The divergence between the Nasdaq 100 and Russell 2000 earnings expectations has blown out.

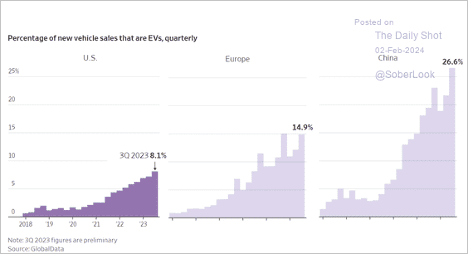

- EV sales:

Great Quotes

“Adventure is the invitation to common people to become uncommon.” – Warren Miller

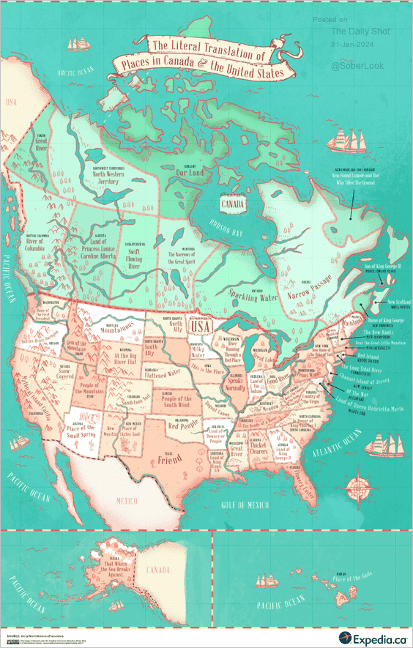

Picture of the Week

The literal meaning of every state’s name:

All content is the opinion of Brian Decker