From a purely technical perspective, the market remains on a bullish buy signal and has not become grossly overbought. On Friday, the market retested the breakout of the previous highs and held. Next week, if the market can hold these levels without breaking that support, the breakout will be confirmed, which should provide a bullish bias into the end of the month.”

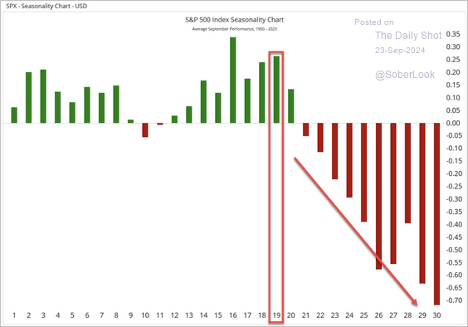

Such remains the case this week. Notably, completing the “cup and handle” pattern suggests a potential further upside to 6000 by year-end. While that target may seem ambitious, it aligns with recent Wall Street upgrades…. although seasonality suggests weakness ahead. (2 charts)

Source: @Optuma

Source: @Optuma

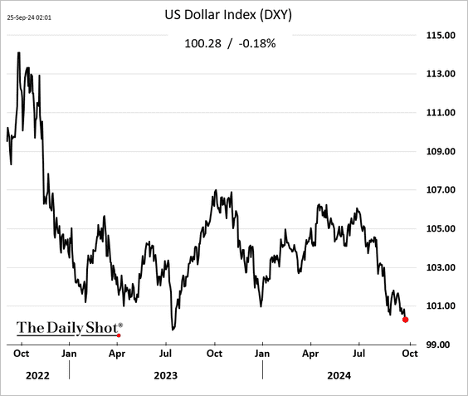

- The US dollar continues to weaken, which is a tailwind for Gold.

Economy:

The Tax Foundation shows that the top 10% of income earners paid 59.1% of taxes. The top 25% of income earners comprised nearly 70% of all tax revenue, with the top 50% paying 97% of all taxes.

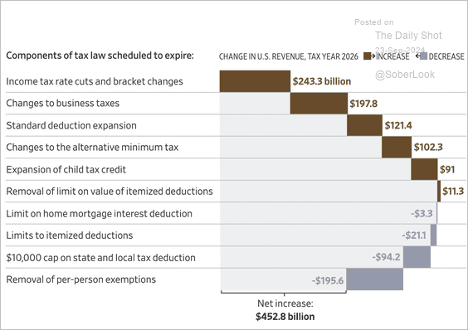

Projected US revenue changes if the 2017 Tax Cuts and Jobs Act expires at the end of 2025:

Source: @WSJ Read full article

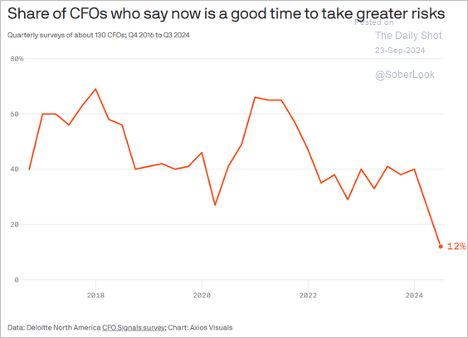

- Companies have turned cautious ahead of the elections.

Source: @axios Read full article

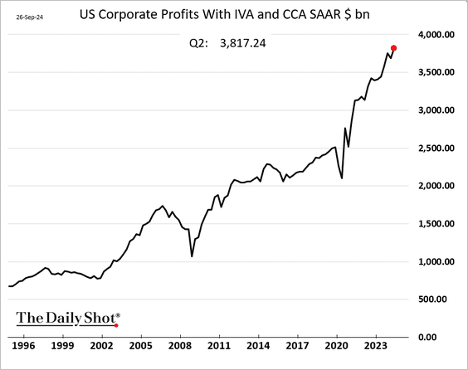

- Corporate profits hit a record high in Q2.

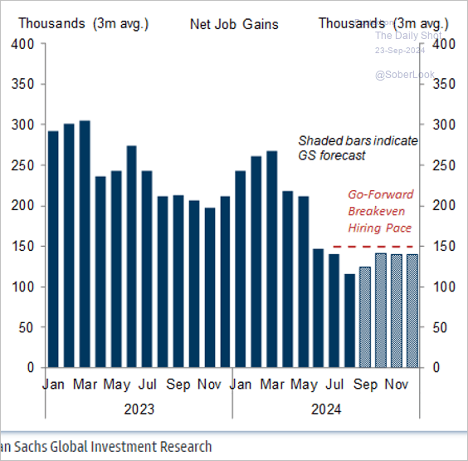

- Here is Goldman’s forecast for US job growth.

Source: Goldman Sachs; @MikeZaccardi

- Did the negative revision in jobs data lead the Fed to implement a 50 bps rate cut? The Sahm Rule modification based on the prime-age nonemployment rate does not signal a recession. IT unemployment is climbing as more companies incorporate AI tools.

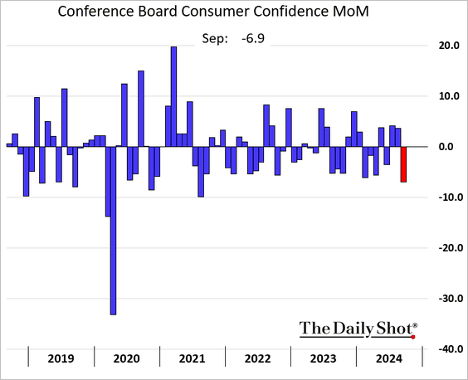

- The Conference Board’s consumer sentiment index surprised to the downside, reflecting growing concerns about the labor market. Election uncertainty has weighed on hiring.

- The index registered its biggest monthly decline since 2021.

- Households are increasingly losing confidence in their ability to find a job, as evidenced by the Conference Board’s Labor Differential (2nd panel), which has dropped significantly below pre-COVID levels.

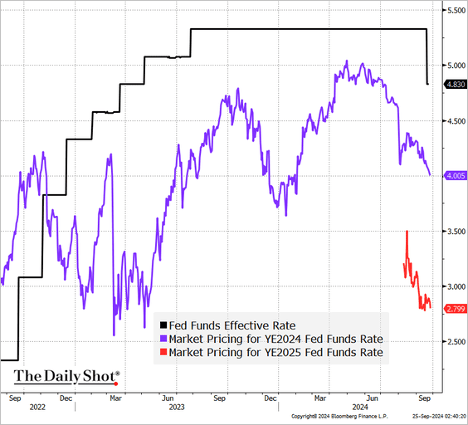

- The stock market remains confident in additional jumbo Fed rate cuts, driven by uncertainty in the labor market. Initial jobless claims show no signs of increasing layoffs, suggesting companies are in a holding pattern-hiring less but not resorting to layoffs either.

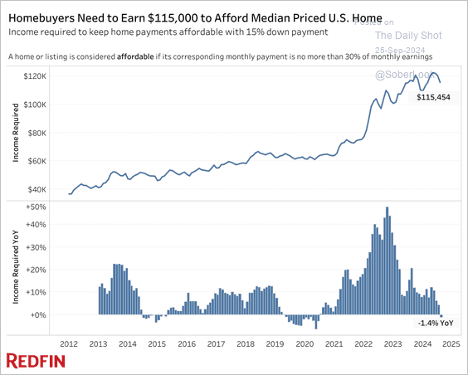

- Housing affordability has improved slightly, but homebuyers still need an income of $115k/year to afford a median-priced home.

The Fed:

This chart illustrates market expectations for the year-end 2024 and year-end 2025 fed funds rate.

Great Quotes

“The earlier you find your passion, the better—because it won’t seem like a chore to follow your dream, and you’ll outwork everyone in the process.”

— Todd Combs

Picture of the Week

Fall in Buttermere, England

All content is the opinion of Brian Decker