Market breadth continues to improve. Goldman sees the S&P 500 dipping below current levels by the end of the year. IPO activity has been depressed. Hedge funds remain cautious on tech. October is the most volatile month for US stocks.

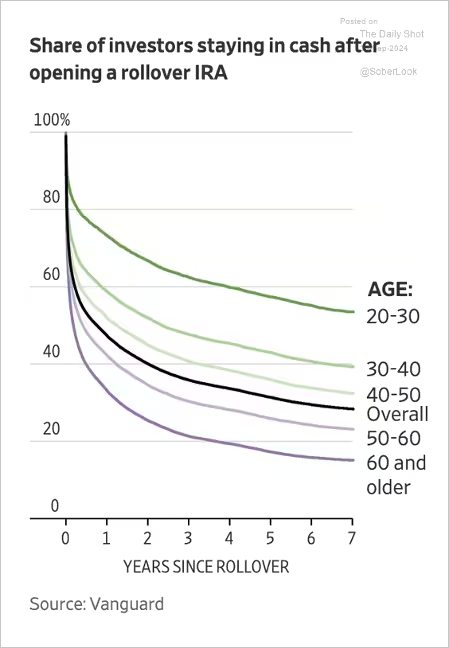

Nearly a third of IRA rollovers made at Vanguard in 2015 were still entirely in cash seven years later.

The S&P 500 often encounters some challenges in October but typically ends the month on a strong note.

Economy:

Real consumer spending edged higher in August, in line with expectations. The PCE inflation report showed slower inflation in August….except Housing inflation remains elevated. Economists have once again upgraded their estimate for this year’s GDP growth amid robust domestic private demand. Goldman’s GDP tracker points to 3.2% growth in Q3. Economists expect another 50 bps of rate reductions this year. US assets increasingly dominate global investors’ portfolios. Job openings increased again in August, topping expectations. US automobile sales improved in September.

Construction spending unexpectedly declined in August, marking the third consecutive month of decreases. The ISM Services PMI surged in September, exceeding expectations and signaling robust service sector activity. However, the employment index dipped into contraction territory. Initial jobless claims remained low last week, signaling a potential decline in the unemployment rate. Personal bankruptcy filing rates remain relatively low.

The dockworkers strike has been suspended, pending the finalization of a full agreement.

Source: ABC News Read full article

The Fed:

US financial conditions eased sharply in September, as the Fed delivered a jumbo rate cut. However, Chair Powell struck a cautious note on the pace of additional rate cuts, …

Source: @economics Read full article

… sending Treasury yields higher. Nonetheless, the market still expects over 70 bps of rate cuts before the end of the year.

US employment ticked unexpectedly higher in September while revisions made the two previous months look better than originally reported. This could all change again, but for the moment it is inconsistent with the extensive rate cuts markets were expecting.

Key Points:

- September payrolls grew by 254,000, about 100,000 more than expected. The two prior months were revised up by a combined 72,000.

- The unemployment rate ticked down to 4.1%.

- Hiring picked up in construction, government, leisure/hospitality, private education/health, retail and even information tech.

- Average hourly earnings rose 0.4% for the month and 4% in the last year.

- On the negative side, temp jobs declined and the average workweek slowed to 34.2 hours, matching its slowest since 2010 (excluding the COVID period).

- Inflation expectations ticked up, dampening hopes for a sustainable trip back to 1-2% inflation.

It’s been two months since the July jobs report triggered the “Sahm Rule” that signals imminent recession. Now more recent data looks significantly better. The numbers could worsen again, but it’s getting harder to see the Fed cutting rates as much as markets – and their own dot plots – expected just a few weeks ago.

Great Quotes

– Thomas Fuller

Picture of the Week

Happy World Architecture Day – The Elbphilharmonie on the Grasbrook peninsula of the Elbe River in Hamburg, Germany

All content is the opinion of Brian Decker