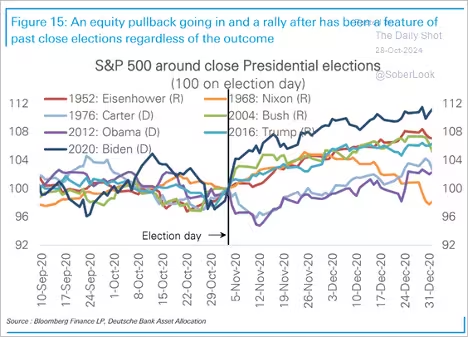

How do stocks perform going into close presidential elections?

Source: Deutsche Bank Research

The Magnificent 7 earnings growth has slowed.

Source: @markets Read full article

The US dollar continues to rally.

Gold reached another record high:

… marking 268 consecutive sessions above its 200-day moving average and 86 sessions above its 50-day moving average, as Goldman forecasts further gains. Hedge funds are largely short clean energy stocks. Uranium prices have been reversing recent gains, but shares of utility companies with exposure to nuclear energy are surging.

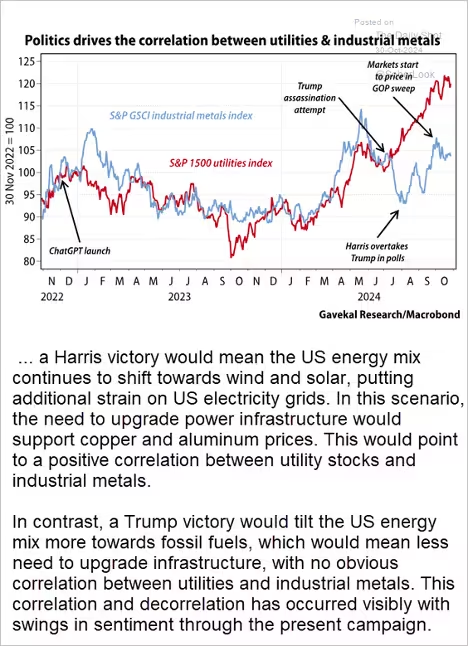

Gavekal Research highlights the relationship between utilities and industrial metals, suggesting that this dynamic could shift depending on the US election outcome (see comments below).

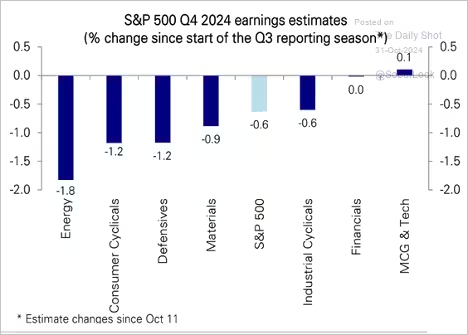

The market wasn’t impressed with the earnings reports from Meta and Microsoft. Semiconductor shares took a beating on Wednesday. Consensus earnings estimates for the S&P 500 this quarter have been revised downward. Here are the revisions by sector.

Source: Deutsche Bank Research

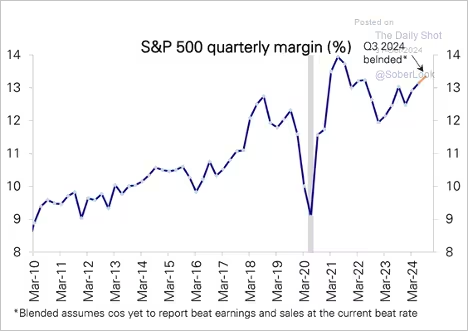

Large-cap margins continue to climb.

Source: Deutsche Bank Research

Tech shares pulled the market sharply lower on Thursday, with the S&P 500 and Nasdaq 100 nearing their 50-day moving averages.

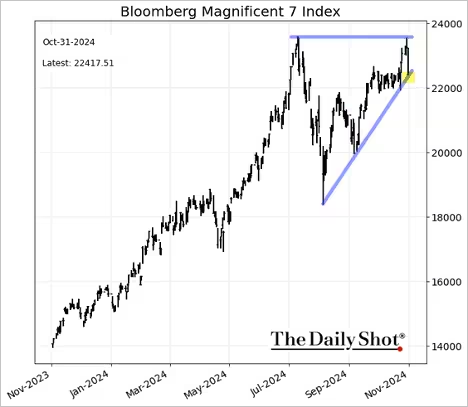

The Magnificent 7 index has formed an ascending triangle.

Economy:

US durable goods orders declined in September, dragged lower by Boeing’s challenges. Excluding transportation, durable goods orders exceeded expectations, with capital goods orders showing robust gains. The U. Michigan’s final October consumer sentiment report came in stronger than earlier estimates. Inflation expectations were revised lower. The Atlanta Fed’s GDPNow Q3 growth estimate remains above 3% (annualized), surpassing economists’ forecasts. Growth is expected to slow in the current and the following quarter.

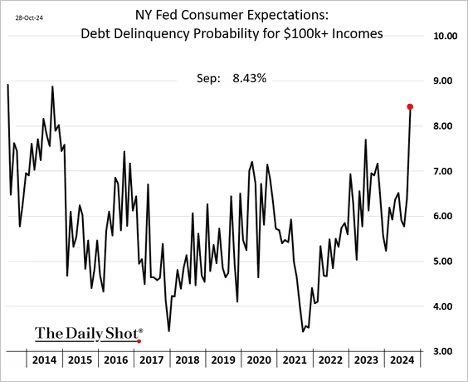

An increasing percentage of higher-income households are struggling with debt.

The Dallas Fed’s manufacturing index is showing significant improvement, with a strong surge in outlook. Forward-looking indicators are considerably stronger than those reflecting current conditions.

The US trade deficit in goods widened sharply in September, far surpassing estimates, as imports surged and exports slowed. Import gains were driven by consumer and capital goods, partly due to companies preparing for potential US East Coast/Gulf port closures. The trade deficit shock sent the GDPNow Q3 growth estimate below 3%, which is still pretty good. US job openings dropped sharply last month, falling below their pre-COVID peak. Home price appreciation topped expectations in August. Home prices continue to outpace wages. The Conference Board’s index of consumer confidence jumped this month. More households plan to buy a vehicle. The share of US consumers planning a foreign vacation hit a record high. Households are less worried about a recession.

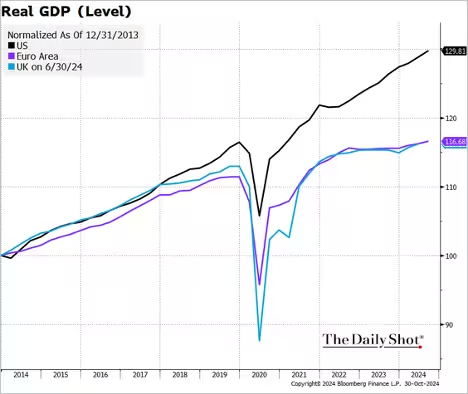

The US GDP trajectory continues to outpace that of Europe.

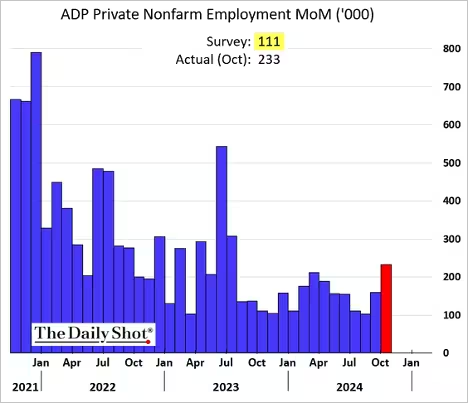

The ADP private payrolls report surprised to the upside.

Consumer spending posted solid growth in September. Growth in employment costs slowed more than expected last quarter, suggesting that the Fed is likely to deliver a 25 bps rate cut in November.

The Fed

Treasury yields continue to rise, with this morning’s bond selloff driven by what appears to be a “calibrated” Israeli response to Iran’s attack earlier this month.

Economists anticipate an additional 50 bps of Fed rate cuts this year, followed by approximately 120 bps of reductions next year. Market expectations for Fed rate cuts have been significantly scaled back, with a total of 170 bps of reductions anticipated before the end of the easing cycle.

Growth in employment costs slowed more than expected last quarter, suggesting that the Fed is likely to deliver a 25 bps rate cut in November. Markets largely anticipate a 25 basis point rate cut in November, with 44 bps of reductions priced in for the rest of the year.

Great Quotes

“Easy now, hard later. Hard now, easy later.” – Victor Harrison

Picture of the Week

Grasmere, Lake District, Cumbria, England

All content is the opinion of Brian Decker