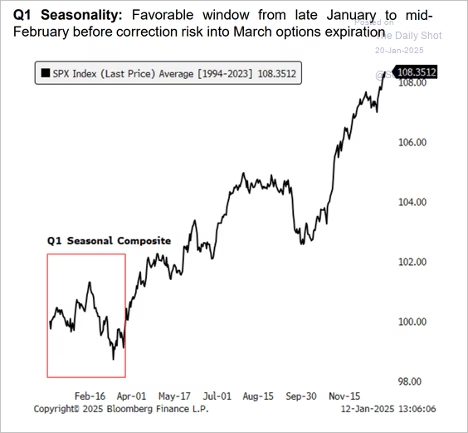

The S&P 500 has entered a seasonally favorable period, albeit short-term.

Small caps typically outperform large caps when the S&P 500’s forecasted return is low/negative. Treasury yields are declining amid a rebound in global bond markets. Fund managers’ cash levels have dropped to their lowest point since June 2021, with institutional sentiment diverging from that of retail investors. The strength of the US dollar is projected to reduce S&P 500 EPS growth by about 1.5% in Q1 2025, posing challenges for multinationals. Equity fund inflows since 2020 highlight a dramatic preference for US markets, with $1.2 trillion allocated compared to just $215 billion for the rest of the world. This disparity underscores a significant global shift toward US equities in the 2020s. Defensive ETFs are outperforming early in 2025, reflecting increased demand for inflation hedges and diversification.

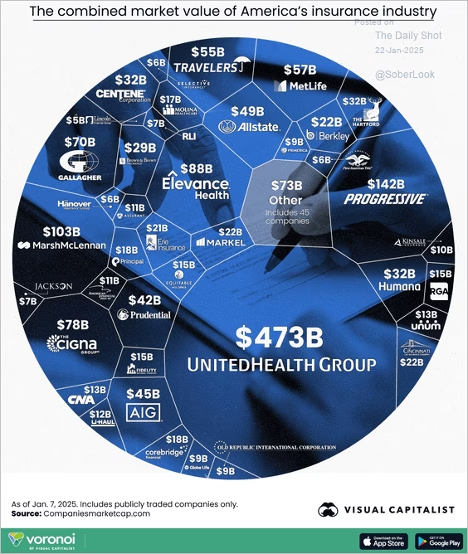

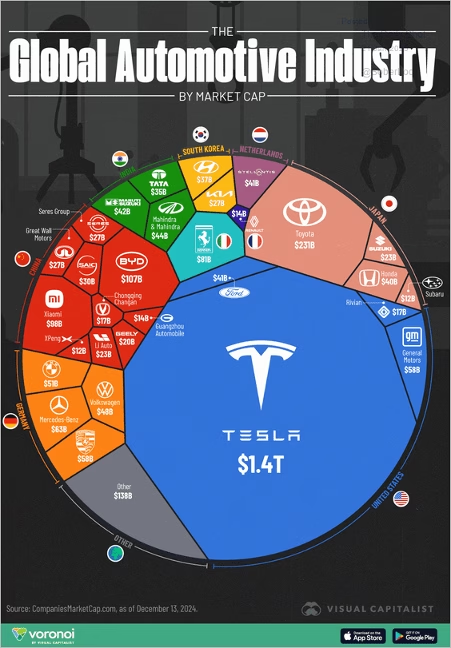

Only 29% of S&P 500 companies have outperformed the index over the past two years, one of the lowest levels since 1990. The US insurance industry’s market value totals $1.7 trillion.

Economy:

US December manufacturing output exceeded expectations, fueled by a rebound in aircraft production following the end of Boeing’s strike. Capacity utilization improved. Housing starts strengthened last month, as multifamily construction rebounded. The Citi US Economic Surprise Index increased sharply last week, which is a good thing.

Import prices unexpectedly increased last month, in anticipation of tariffs? Meanwhile, the US has grown increasingly reliant on imported fresh produce, with imports now accounting for nearly 60% of fresh fruit and over 25% of fresh vegetables. Escalating domestic labor challenges could further deepen this dependency.

The trade policy uncertainty index has surged in recent months, amplifying overall economic uncertainty. The federal budget deficit reached $711 billion in the first fiscal quarter. Interest expenses are outpacing last year’s levels. Interest payments on the national debt now exceed spending on national defense.

The aging US population is projected to slow household formation. Labor productivity growth in the US historically accelerated with major technological shifts, peaking at 2.8% during the electricity era and 3.2% during the computer revolution. The emergence of transformational AI is projected to drive productivity growth to 3% by 2030, suggesting a potentially equivalent economic impact to prior revolutionary technologies.

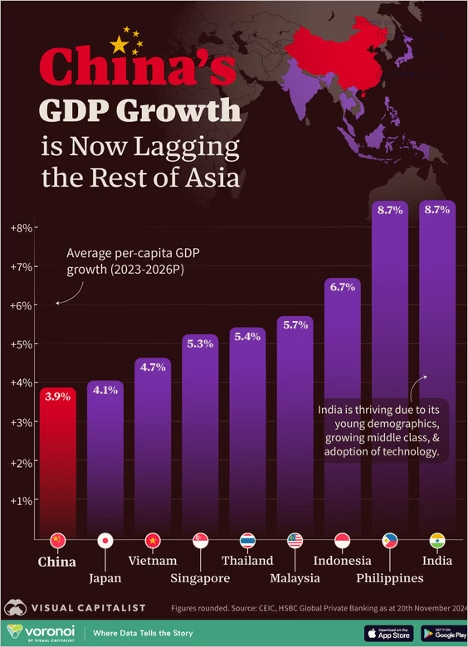

China’s per-capita GDP growth trails other Asian economies.

The Philly Fed’s regional service sector index indicated subdued activity this month. However, the new orders index moved into positive territory, while the region’s unfilled orders measure climbed to a multi-year high, signaling improving demand. Fewer service firms are boosting wages. Companies have stopped raising prices this month.

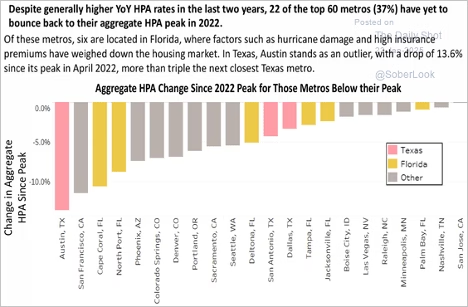

Home prices in some metro areas remain well below the 2022 peak. Freddie Mac’s 30-year mortgage rate index dipped below 7%. Homes are taking longer to sell. The housing market is overvalued relative to rents.

Jobless claims remain above 2024 levels, boosted by a sharp rise in California following recent wildfires. The percentage of Americans making only minimum payments on their credit cards continues to increase.

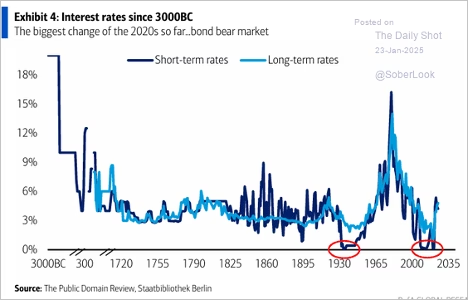

Here is a look at interest rates going back to 3000 BC.

The Fed

Despite a softer core CPI, December core PCE is expected to show acceleration driven by PPI components. While the Fed’s preferred market-based PCE suggests stability, the rebound in acyclical PCE—which the Fed has limited influence over—signals potential upside risks to inflation.

Investors are worried about the possibility of the Fed being compelled to raise rates this year. Morgan Stanley expects one Fed rate cut this year before the central bank pauses.

China isn’t the only country with excess industrial capacity, says Lacy Hunt. It is a growing global problem, and is one reason why he thinks inflation and higher interest rates will both fall, possibly soon.

Key Points:

- Industrial capacity utilization, or CAPU, has fallen significantly in the US and other developed countries.

- CAPU appears to be the dominant supply-side variable in determining inflation rates.

- Underutilization of available resources has historically led to lower economic growth.

- China is experiencing outright goods deflation, which is being transmitted globally via a depreciating yuan.

- Falling CAPU is also linked to a rising unemployment rate.

Combined with the falling global money supply discussed in his last letter, Lacy Hunt believes lower CAPU points to lower inflation. He suggests the 30-year Treasury bond yield could see a surprising drop in 2025.

Bubbles?

Equity fund inflows since 2020 highlight a dramatic preference for US markets, with $1.2 trillion allocated compared to just $215 billion for the rest of the world. This disparity underscores a significant global shift toward US equities in the 2020s. A bubble?

Spot the bubble?

Semiconductor companies with the highest market value: NVDA Bubble?

![]()

Great Quotes

“Twenty years from now, you will be more disappointed by the things that you didn’t do than by the ones you did do. So, throw off the bowlines, sail away from safe harbor, and catch the trade winds in your sails. Explore. Dream. Discover.” – Mark Twain

Picture of the Week

Petra, Jordan

All content is the opinion of Brian Decker