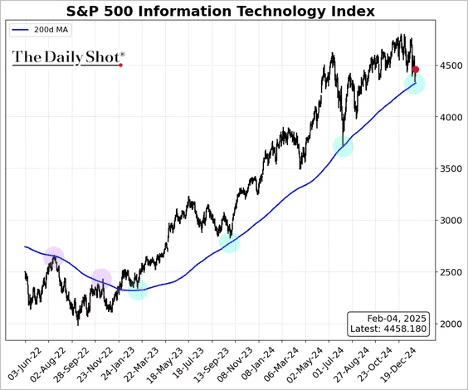

Sentiment among large-cap firms continues to improve, but small firms are less upbeat. The S&P 500 tech index held support at the 200-day moving average.

US firms with international sales exposure have been underperforming. Companies generating a significant share of revenue from government sales have been outperforming.

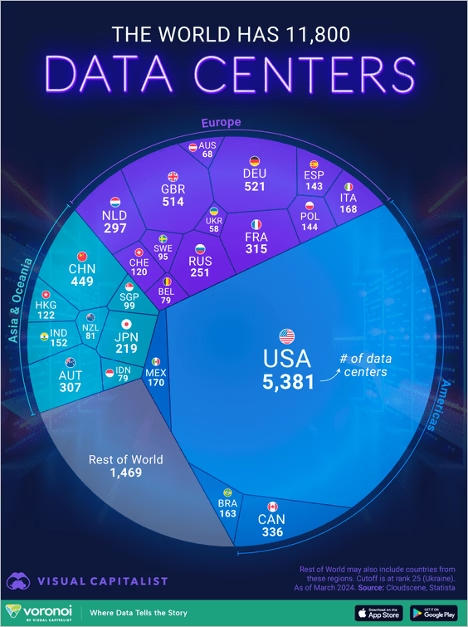

Data centers:

Economy:

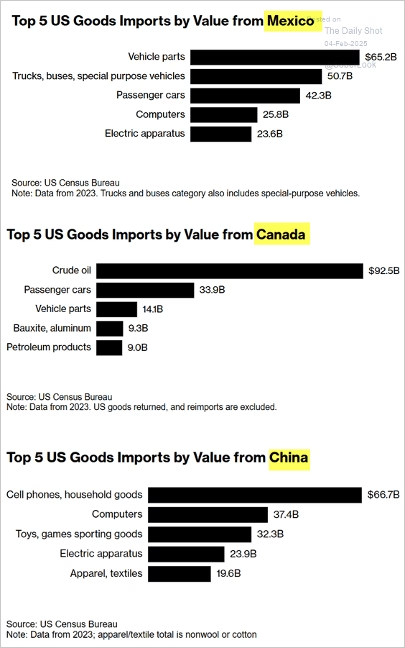

The US is imposing 25% tariffs on imports from Mexico and Canada. Canadian energy products will be subject to a 10% tariff, and Chinese imports will be subject to an additional 10% tariff.

Source: CBS News Read full article

Source: Reuters Read full article

Below are the top US goods imports from Mexico, Canada, and China.

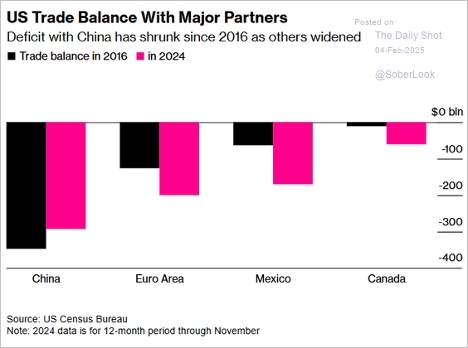

Here is a look at the US trade deficit with key trading partners.

Source: @bpolitics Read full article

The US dollar is up sharply, potentially leading to further tightening of financial conditions this week. Market-based inflation expectations have been rising.

The US Employment Cost Index rose at a faster pace in Q4, driven by wage growth. Consumer inflation accelerated in December, according to the PCE report. Consumer spending growth was robust going into the year-end, topping expectations. The increase in spending was not matched by higher savings, as consumers sought to front-run tariffs.

According to the ISM Manufacturing PMI, US factory activity returned to growth in January as demand strengthened. The gap between orders and inventory indices suggests a further acceleration in US factory activity.

US job openings dropped in December, falling short of expectations. The breadth of job openings deteriorated. The stock market continues to signal improving job openings ahead.

US container imports climbed in late 2024, reaching their highest level since 2021. This was due to businesses front-loading shipments ahead of potential tariffs. For example, US firms have been front-running tariffs on Chinese lithium-ion batteries.

The Logistics Managers’ Index surged to 62.0 in January, reflecting continued strength in freight activity and supply chain recovery. Optimism remains high, with expectations for further expansion in 2025.

The share of net operating surplus going to large, listed firms has surged, while smaller, unlisted firms have seen their share decline significantly, highlighting a growing concentration of economic power among publicly traded corporations.

Service sector growth slowed last month as demand softened. However, hiring picked up momentum. Treasury yields fell amid weaker service sector performance.

Source: @economics Read full article

The ADP private employment report topped expectations. US labor productivity rose for the ninth consecutive quarter in Q4.

Source: @economics Read full article

The massive investment in AI is expected to sustain US productivity gains.

Source: @technology Read full article

The Fed:

The NY Fed’s multivariate core trend of PCE inflation, which tracks underlying inflation persistence, fell to 2.3% in December—its lowest level in four years. Economists are forecasting a total of 55 bps in Fed rate cuts this year (average estimate).

Great Quotes

“We cannot pull people to our side, but we can make it easier for them to cross.” – Unknown

Picture of the Week

Golden bridge, Ba Na Hills, Vietnam

All content is the opinion of Brian Decker