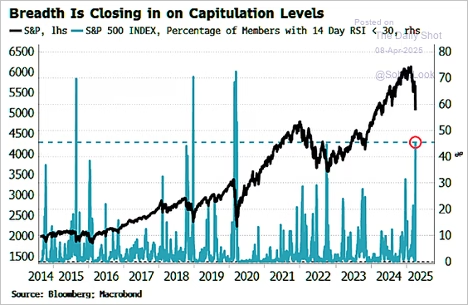

Treasury yields keep moving lower along with the stock markets. From a technical standpoint, US indices are firmly in oversold territory.

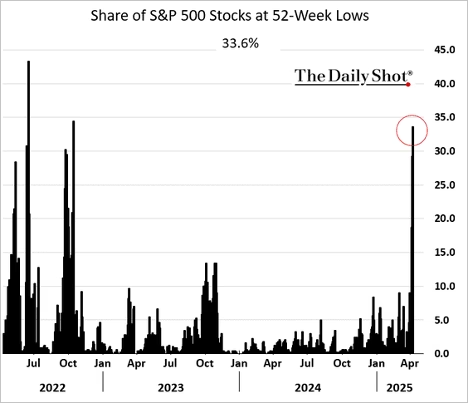

This chart shows the share of S&P 500 stocks at 52-week lows.

Breadth is near capitulation levels.

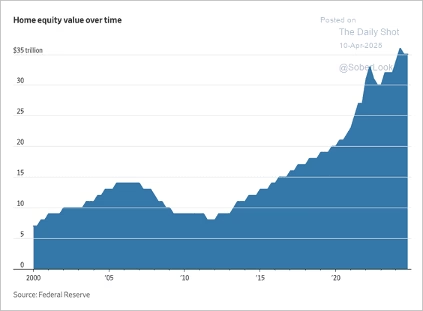

Home equity values have climbed nearly 80% since early 2020.

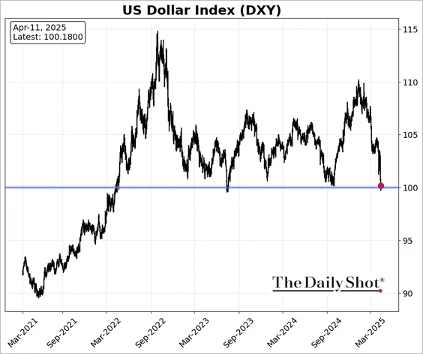

The US dollar index (DXY) tumbled 2% on Thursday and is testing a key support level.

The US dollar no longer functions as a safe-haven currency.

Economy

The March jobs report exceeded expectations, signaling strong hiring last month. Healthcare posted the largest gain, but investor sentiment toward the sector has turned negative, suggesting downside risks for future job growth.

Public construction spending remained robust. Copper has sold off sharply.

The CPI report surprised to the downside.

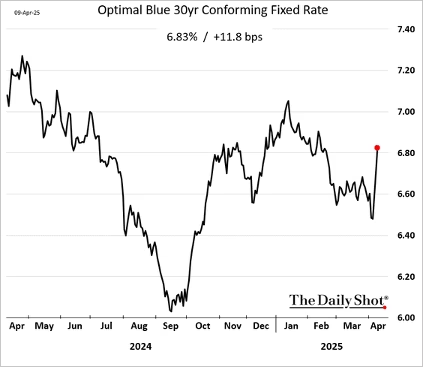

Mortgage rates have been rising.

Tariffs

China retaliated against the US with a 34% tariff hike on American goods, alongside additional punitive measures. The global trade war is on.

Source: SCMP Read full article

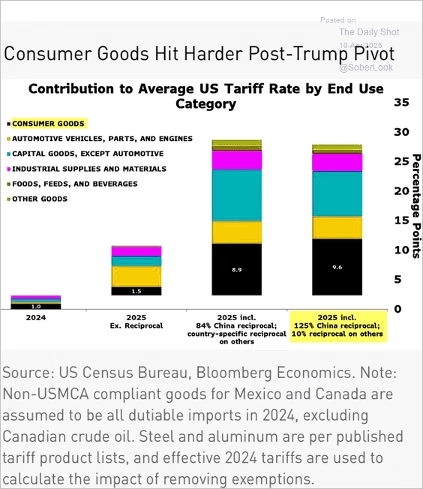

The 125% tariff on Chinese goods is likely to impose significant costs on US consumers.

Source: @AnnaEconomist, @economics

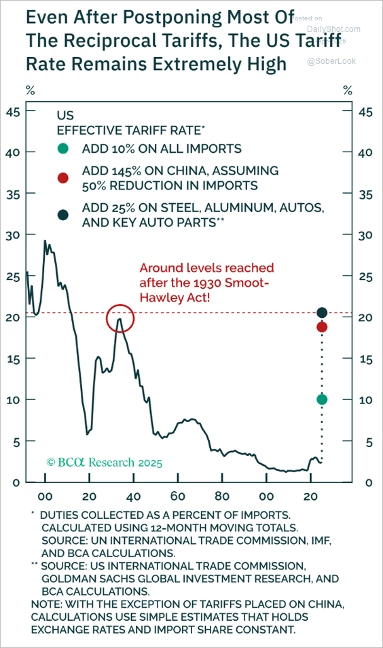

Despite postponing many reciprocal tariffs, the US effective tariff rate remains near historical extremes—approaching levels last seen under the 1930 Smoot-Hawley Act. The modeled impact of new China-specific and sectoral tariffs suggests a sharp escalation in trade barriers even with reduced import volumes.

The Fed:

The market is now assigning a substantial probability to five Fed rate cuts this year, with growing odds of the first coming as early as May.

Great Quotes

“Extraordinary people survive under the most terrible circumstances and they become more extraordinary because of it.” — Robertson Davies

Picture of the Week

Springtime in Holland

All content is the opinion of Brian Decker