In this May 2025 economic update, we explore the latest shifts in Fed policy, tariffs, inflation, and market sentiment.

Economy

The US and China agreed to suspend most tariffs following talks in Geneva, reducing the total US tariff rate on Chinese goods from 145% to 30% for 90 days. This includes cutting the 125% reciprocal tariff to 10%, while retaining a separate 20% levy tied to China’s role in fentanyl trafficking. Further negotiations will be led by Treasury Secretary Scott Bessent and USTR Jamieson Greer for the US, and Vice Premier He Lifeng for China. Betting markets’ implied probability of a 2025 recession has dropped sharply and now aligns with economists’ projections.

The Atlanta Fed’s GDPNow model signals robust growth in Q2.

Atlanta Fed’s GDPNow forecast outpaces consensus estimates, signaling stronger Q2 growth ahead.

Source: Atlanta Fed

Home listings are rising at the fastest pace in years. More home sellers are cutting prices. Apartment vacancies continue to rise, which could weigh on asking rents.

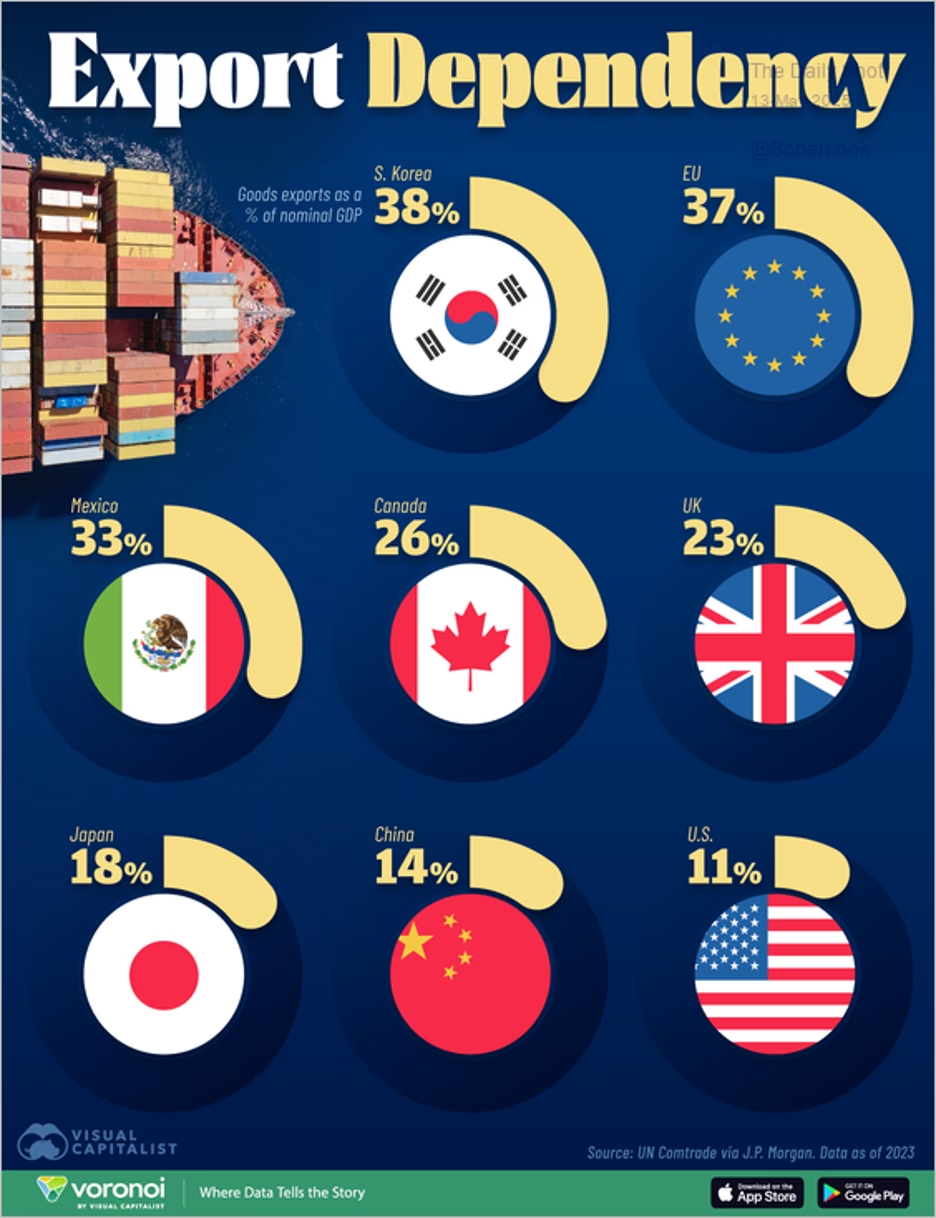

Goods exports as a share of GDP for major economies:

South Korea, the EU, and Mexico lead the world in export dependency; the U.S. ranks lowest.

The April CPI report came in softer than expected, as grocery prices declined. US inflation has been surprising to the downside.

Markets

Market breadth continues to improve.

Hikes in home insurance costs:

Home insurance premiums rise sharply, with the biggest jumps seen in Nebraska and Montana.

Source: Oxford Economics

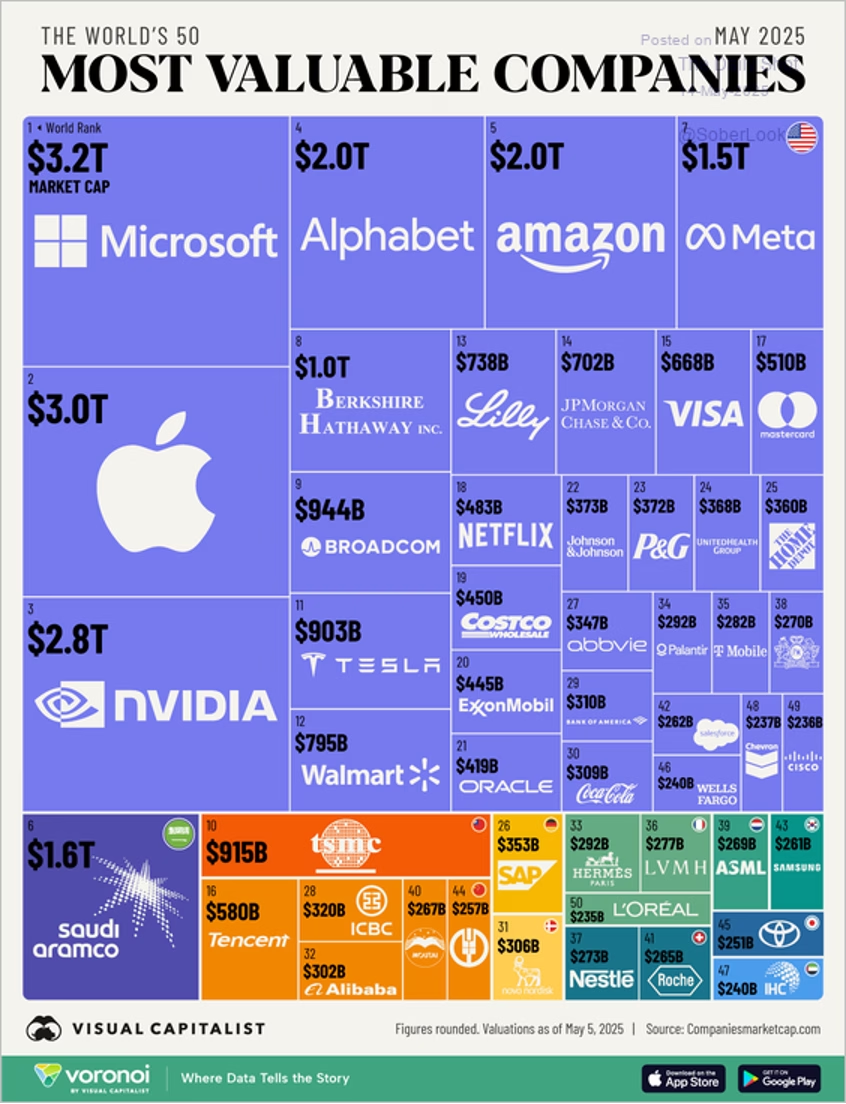

The world’s most valuable companies by market capitalization:

Microsoft, Apple, and Nvidia top the global rankings for company market capitalization.

The Fed

The market is now pricing in just slightly more than two rate cuts this year. The PPI fell unexpectedly last month, led by a sharp decline in services. Downward earnings revisions suggest that the Fed should be cutting rates.

Tariffs

The US and China agreed to suspend most tariffs following talks in Geneva, reducing the total US tariff rate on Chinese goods from 145% to 30% for 90 days. This includes cutting the 125% reciprocal tariff to 10%, while retaining a separate 20% levy tied to China’s role in fentanyl trafficking. Further negotiations will be led by Treasury Secretary Scott Bessent and USTR Jamieson Greer for the US, and Vice Premier He Lifeng for China. The effective US tariff rate has dropped to roughly 15% following a 90-day de-escalation deal with China. This rollback—primarily reflecting the cut in China tariffs from 145% to 30%—marks a significant shift toward Oxford Economics’ prior best-case scenario and could ease inflationary pressure while supporting growth and market sentiment.

Barclays estimates the current US weighted average tariff rate to be around 14%. Economists project mounting inflationary pressures in core goods, with tariffs playing an increasingly significant role.

Great Quotes

“The battles that count aren’t the ones for gold medals. The struggles within yourself—the invisible battles inside all of us—that’s where it’s at.” – Jesse Owens

Picture of the Week

Patagonia, Chile

Picture of the Week: The striking peaks and still waters of Patagonia remind us to pause and reflect.

All content is the opinion of Brian Decker.

Leave A Comment