Trade rulings are creating confusion, but not resolution. In this week’s update, we unpack the market rally, weakening rate cut expectations, and what a U.S. trade court’s tariff reversal means for investors.

Economy

Existing home sales remain soft, with inventories continuing to rise.

On the other hand, new home sales climbed above last year’s levels, with inventories easing.

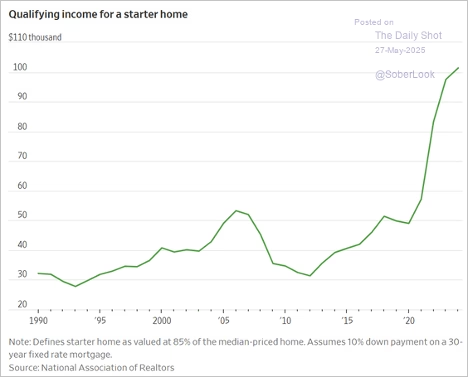

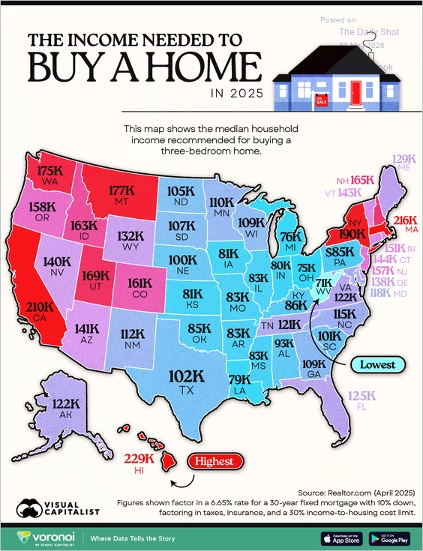

The median size of new homes has steadily declined since peaking around 2016, reflecting a shift toward more entry-level construction. However, affordability remains elusive as land, labor, and material costs continue to rise, limiting price relief despite the shrinkage in square footage. US house prices declined in March for the first time in 26 months. According to data compiled by Redfin, the gap between home sellers and buyers in the US housing market hit a record 33.7% in April, with nearly 500,000 more sellers than buyers. With inventory piling up and buyer demand softening, market dynamics have shifted decisively in favor of buyers. Condo markers are especially oversupplied.

The share of job openings at small businesses (1–249 employees) has risen since 2020, now approaching 80%, while openings at medium-sized firms have declined.

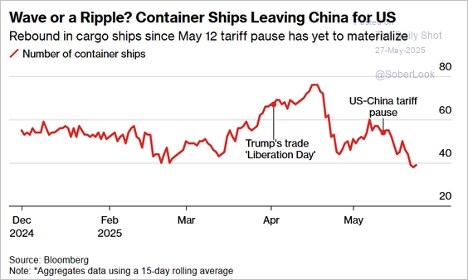

Despite the May 12 US–China tariff pause, container ship departures from China to the US have continued to decline, suggesting weak demand or uncertainty around future trade policy.

Source: Bloomberg Read full article

US parcel delivery market share by company:

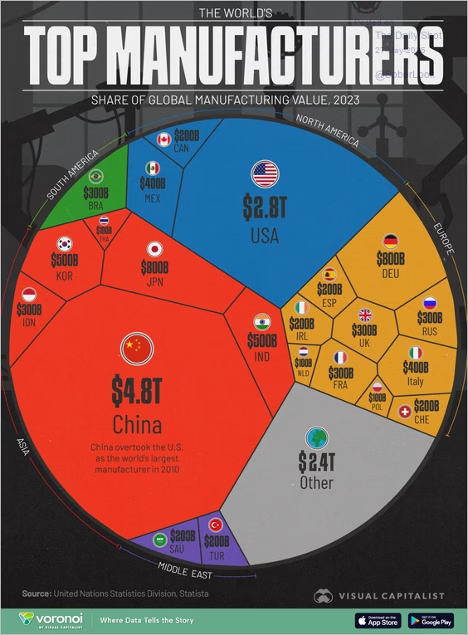

Global manufacturing output by country in 2023:

US consumer confidence rebounded this month, boosted by trade optimism. Inflation expectations eased. Durable goods orders, excluding transportation, rose last month. The Dallas Fed’s regional manufacturing index rebounded this month.

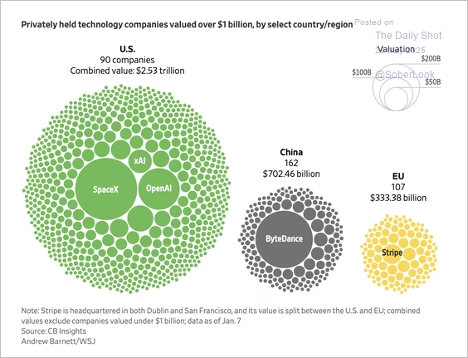

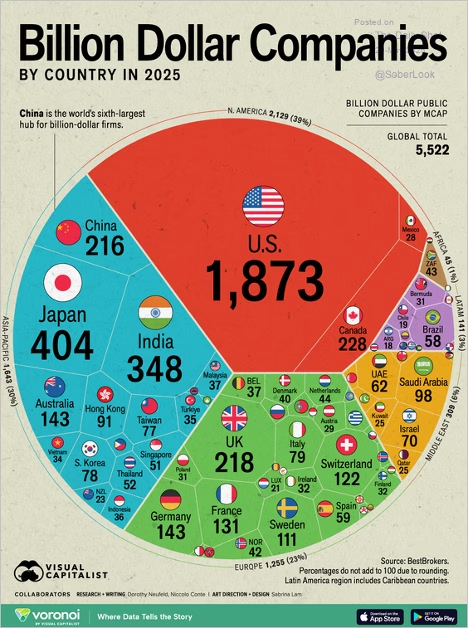

The US continues to lead in high-value privately held tech companies.

Number of billion-dollar public companies by country in 2025:

Q1 GDP growth was revised slightly higher, supported by increased inventory accumulation and government spending.

Median household income needed to buy a three-bedroom home:

Markets

The US dollar remains under pressure.

In China, the dividend yield on equities has consistently exceeded government bond yields since 2022, creating a rare and persistent incentive for corporates to borrow and repurchase shares. In contrast, the US maintains a wide positive yield gap favoring bonds, reducing the appeal of equity buybacks on a yield-spread basis.

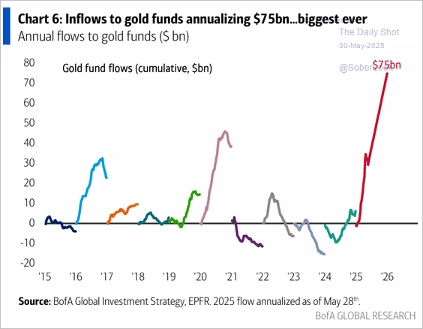

Gold fund inflows are on track to reach a record $75 billion in 2025, reflecting an unprecedented surge in demand.

Source: BofA Global Research

Companies with significant international sales have sharply outperformed domestically focused firms this month.

Yesterday, we noted the healthcare sector falling to multi-year lows as a share of the S&P 500. This chart shows a similar trend for the combined defensive sectors—healthcare, utilities, and staples.

The Fed

The SOFR Dec ’25–Dec ’26 spread has dropped to new lows, reflecting a sharp repricing of expectations toward rate cuts being pushed into 2026.

Tariffs

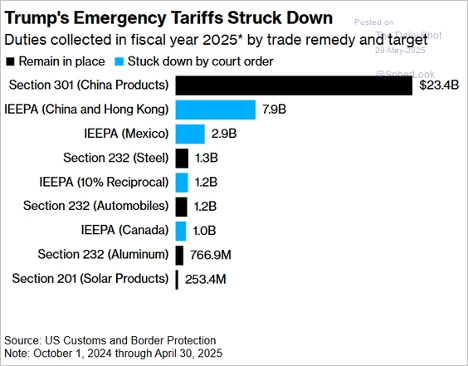

A US trade court has overturned most of the administration’s emergency tariffs, invalidating nearly $17 billion in duties collected under the IEEPA. While Section 301 tariffs on Chinese goods remain in place, the ruling significantly narrows the scope of unilateral trade actions and introduces uncertainty over future enforcement.

Source: Bloomberg Read full article

Source: Reuters Read full article

If you’re wondering whether the court ruling means the trade war is over, the answer is “Nope.” President Trump has other ways to impose most of the tariffs he wants, as Gavekal’s Will Denyer explains.

- A federal court ruled Trump had exceeded his authority in ordering tariffs under the 1977 International Emergency Economic Powers Act, or IEEPA.

- The ruling will be appealed but meanwhile, the administration can use two other statutes to impose tariffs.

- “Section 301” lets the president order tariffs to retaliate against “unfair trade practices.”

- Also, “Section 122” tariffs can be used to address the same kind of trade imbalances Trump wishes to eliminate.

- While these provisions are more limited than IEEPA, they can still be powerful tools.

The latest ruling may help by giving investors and businesses more time to adjust, but the trade war and its associated policy uncertainty will continue.

Then last Thursday, this came in….A federal appeals court temporarily reinstated the most sweeping of President Donald Trump’s tariffs on Thursday, a day after a U.S. trade court ruled that Trump had exceeded his authority in imposing the duties and ordered an immediate block on them.

The United States Court of Appeals for the Federal Circuit in Washington said it was pausing the lower court’s ruling to consider the government’s appeal, and ordered the plaintiffs in the cases to respond by June 5 and the administration by June 9.

Great Quotes

“The only bad workout is the one that didn’t happen” – Unknown

Picture of the Week

Mt. Rainier

All content is the opinion of Brian Decker

Leave A Comment