Despite softening economic data, markets are pushing higher—betting that current headwinds, including tariffs, will be short-lived. Meanwhile, oil production dynamics and Fed credibility are front and center. We explore U.S. energy dominance, China’s position, and why the Fed may risk overcorrecting if it waits too long to act.

Economy

There is a tug-of-war with the economy showing weakening data and the stock market nearing new, fresh highs. The stock markets look forward by about six months and is saying that the tariffs and the weakening economic data will be short lived.

Markets

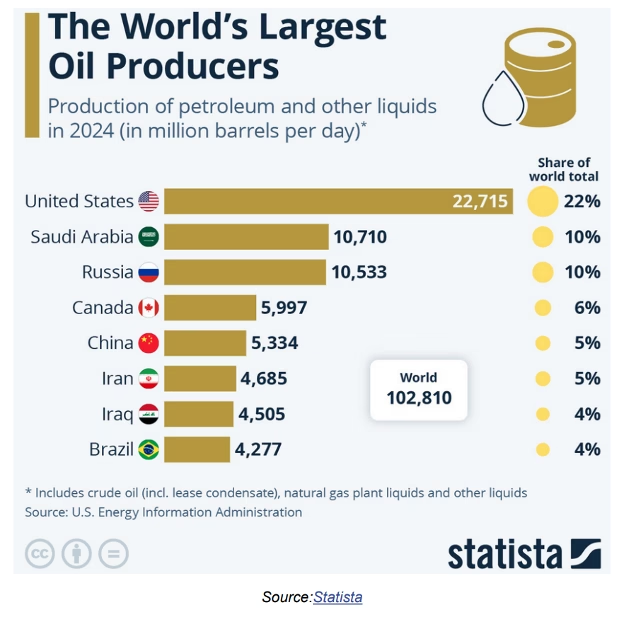

With oil prices in the headlines, here’s a look at where oil comes from. The United States is by far the world’s largest oil producer, more than double that of second-place Saudi Arabia. That was last year, even before any Trump deregulatory effect.

Note also who is in 5th place. We don’t usually think of China as a major oil producer, but its production almost matches Canada and exceeds Iran, Iraq, and Brazil. China’s domestic oil production still lags far behind its consumption, making China also a major oil importer. Much of it comes from the Persian Gulf, including Iran. Beijing is no doubt watching developments there closely.

The Fed

The Fed’s credibility rests not on never being wrong, but on being adaptive and forward-looking. Inflation has cooled, wage growth has moderated, and economic momentum is slowing. Now is the time for the Fed to focus not on headline fears, but on real-time data.

If tariffs have not yet translated into price increases, and employment indicators suggest slack is growing, the Fed should not delay necessary rate cuts to defend its credibility. Doing so risks repeating the mistake it made during the pandemic: ignoring the lagging effects of previous decisions.

Cutting rates too late would be just as damaging as hiking them too slowly.

The media mocked the Fed’s “transitory” narrative, but inflation was short-lived in the grand scheme. What mattered more was how long the Fed waited to act. With tariffs yet to trigger a real inflationary response and the economy showing signs of deceleration, the greater risk may be inaction, not inflation.

Investors should be alert to the Fed’s tendency to overcorrect past mistakes. Just as policy stayed too loose after COVID, it may now stay too tight for too long in 2025. Recognizing that monetary policy must adapt, not just react, will be key for policymakers and market participants navigating the road ahead.

Great Quotes

“Try not to become a person of success, but a person of value. “ – Albert Einstein

Picture of the Week

Cinque Terre, Italy

All content is the opinion of Brian Decker

Leave A Comment