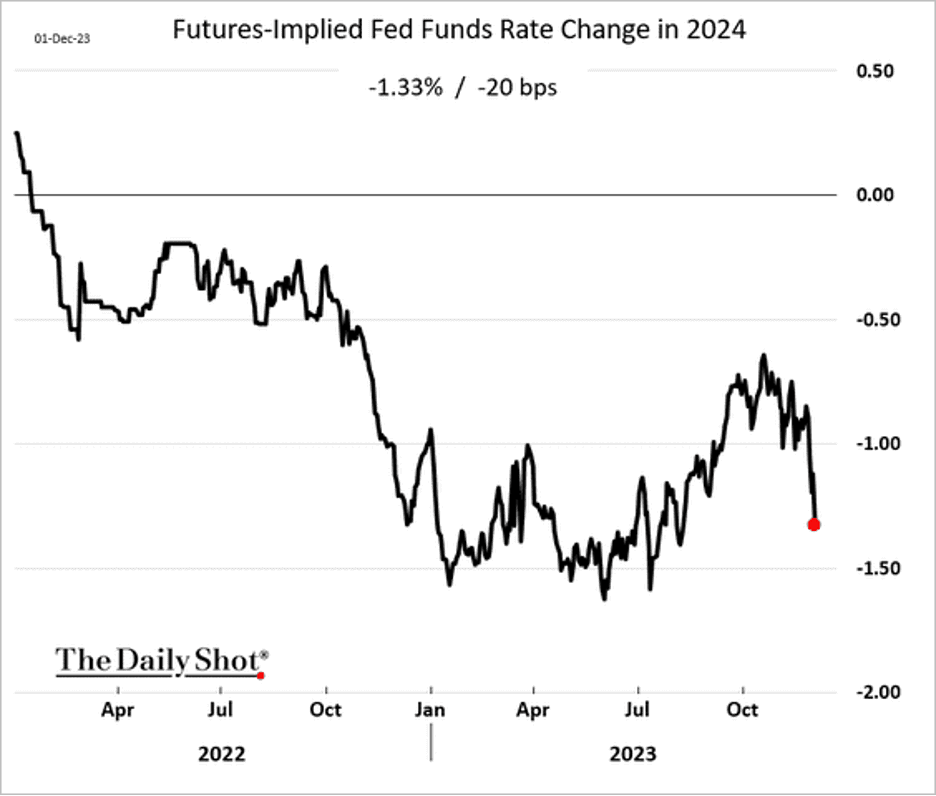

Despite Chair Powell’s pushback, the market now sees some 130 bps of rate cuts in 2024.

Source: @financialtimes Read full article

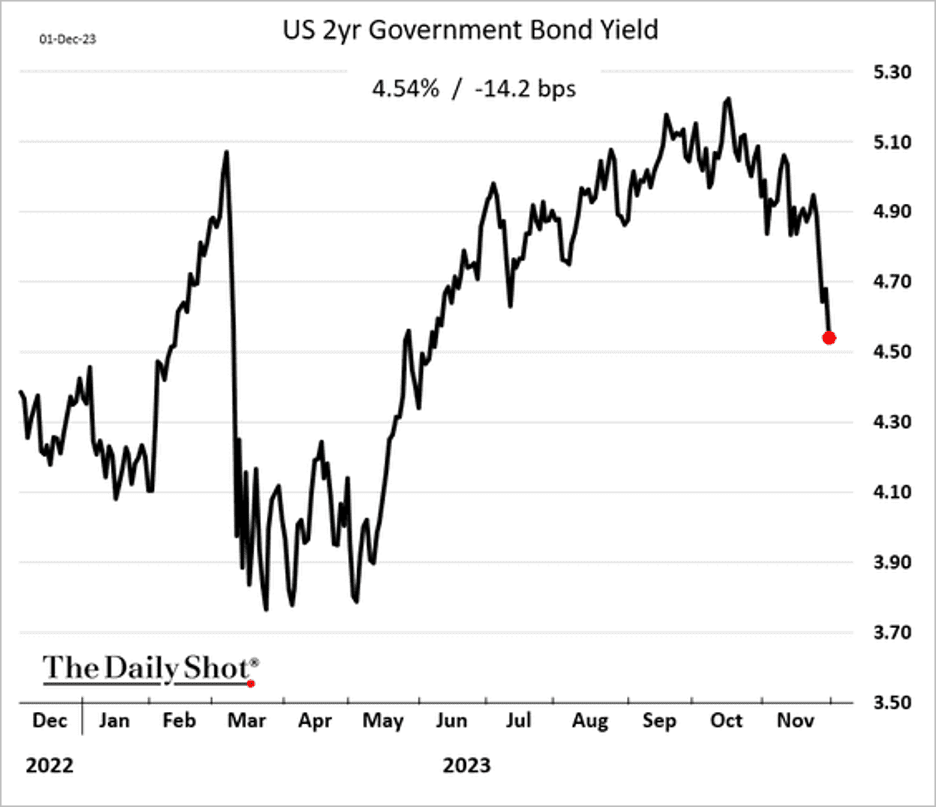

Here is the 2-year Treasury yield.

US Economy

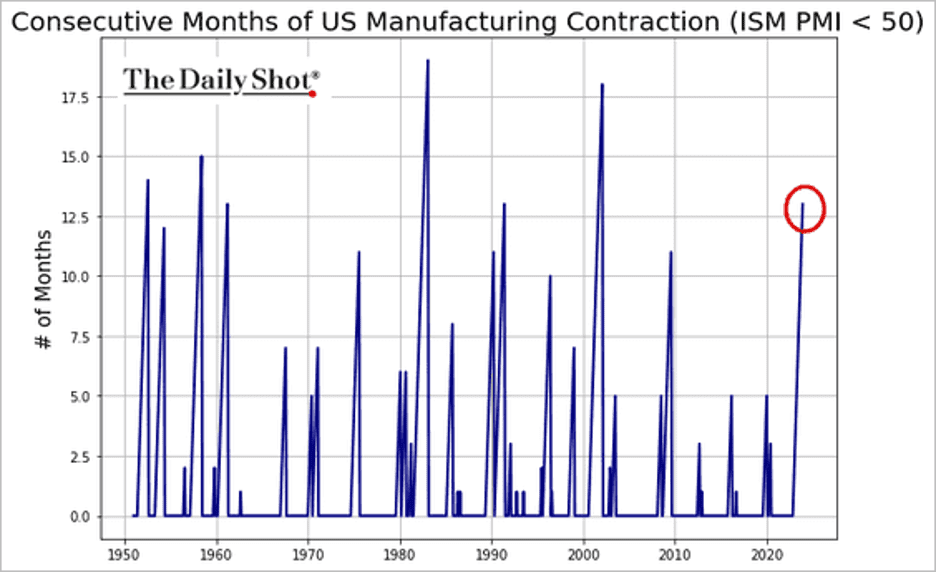

- The ISM Manufacturing PMI surprised to the downside, …

Source: Reuters Read full article

… with US factory activity now contracting for thirteen consecutive months.

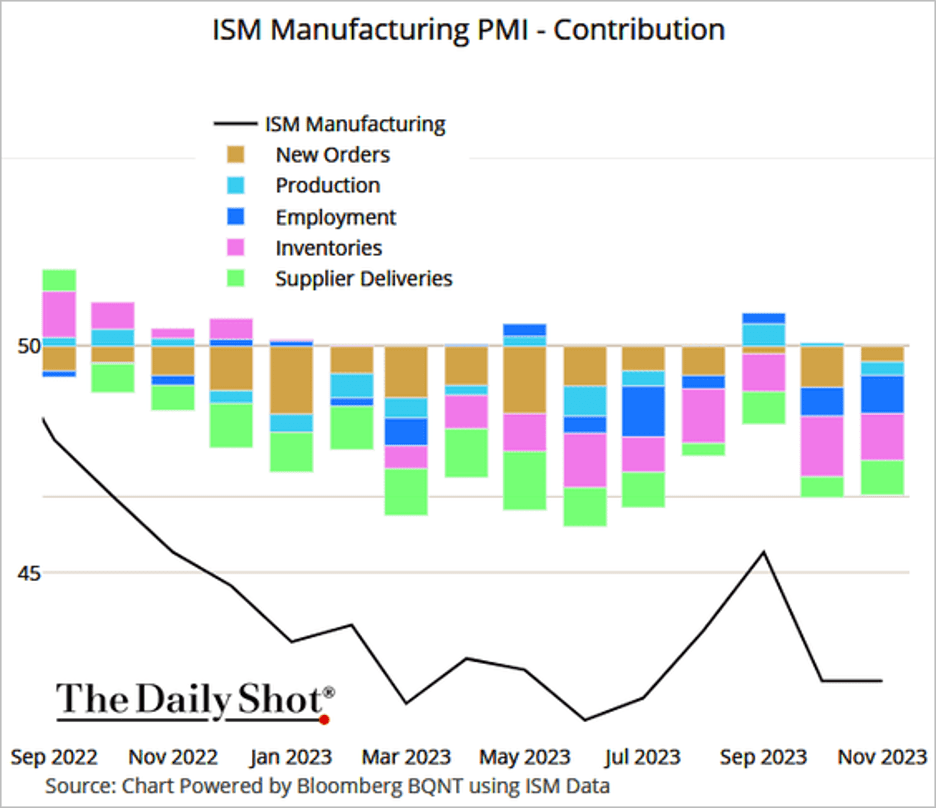

- All ISM PMI components were below 50 last month.

- Construction spending topped forecasts in October, boosted by residential construction.

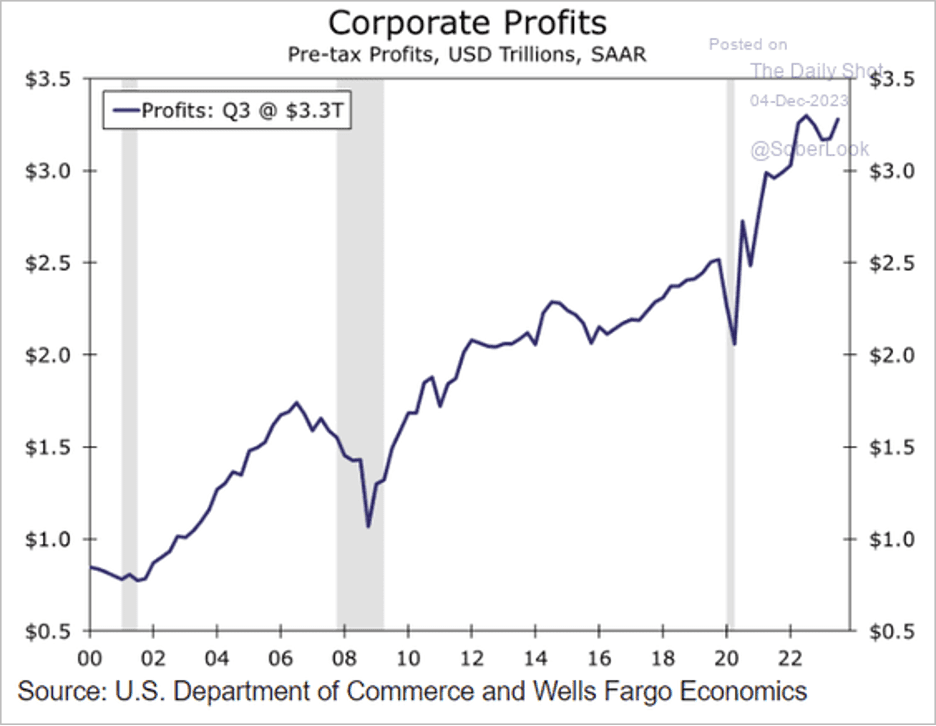

- Economy-wide corporate profits (including non-public companies) strengthened in Q3.

- Factory orders declined in October.

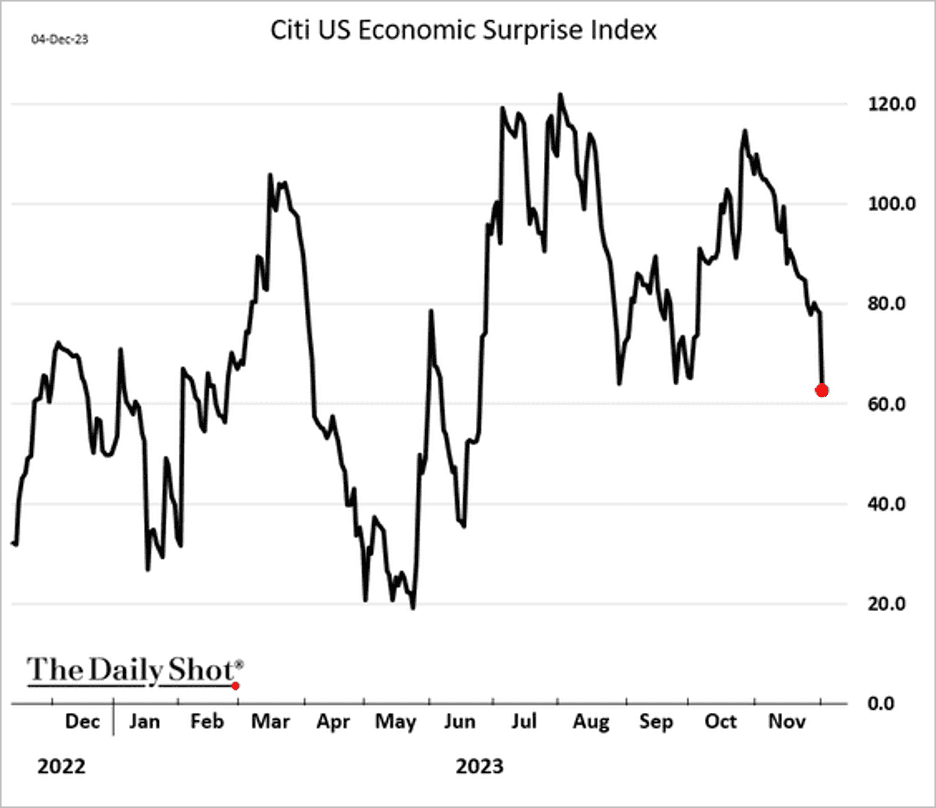

- The economic surprise index has been rolling over.

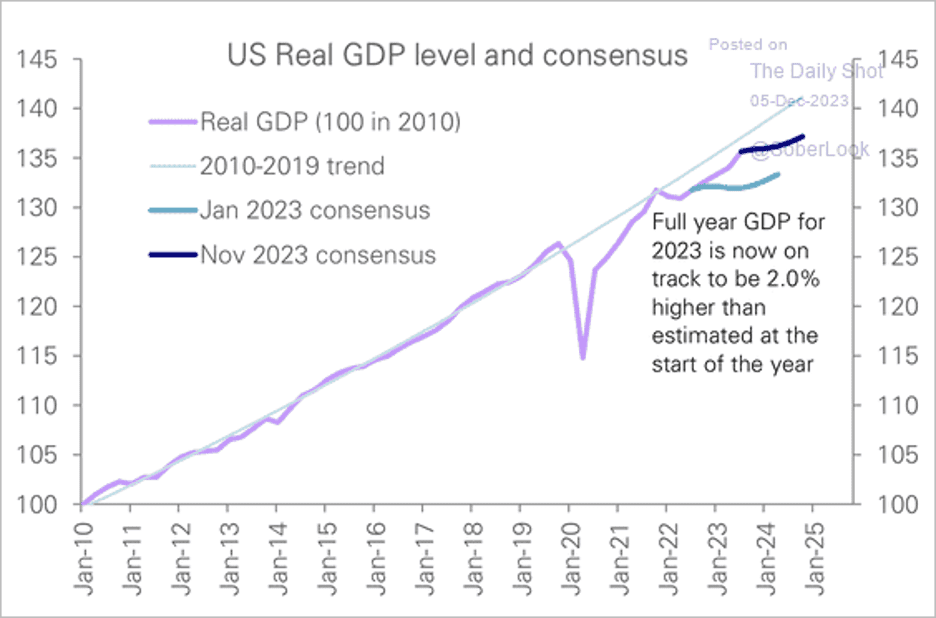

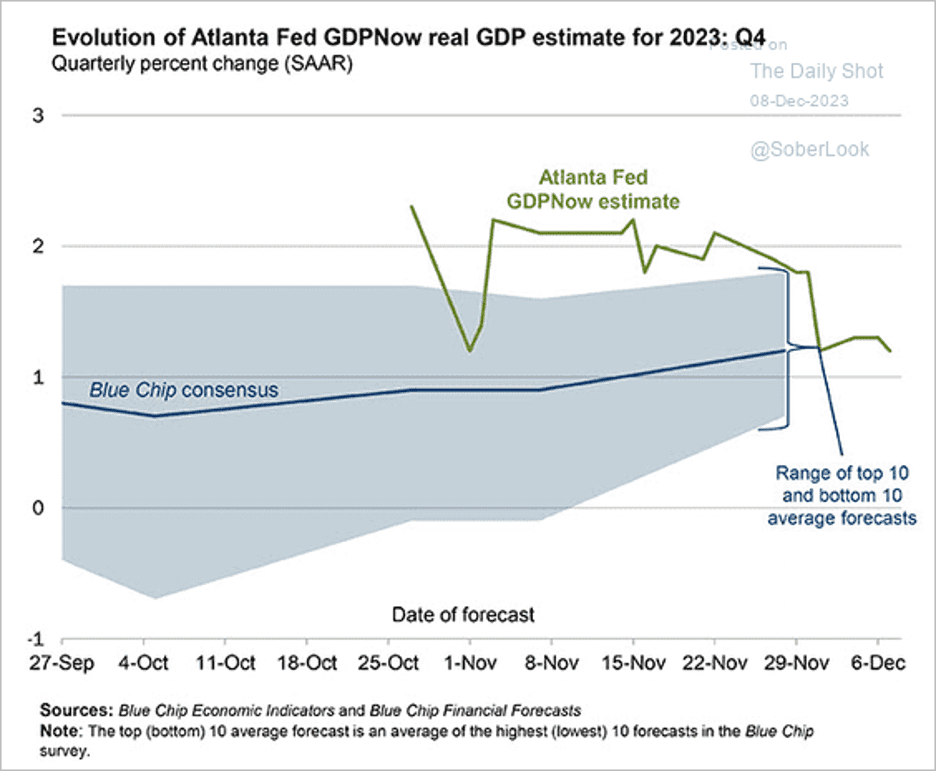

- Real GDP growth consensus estimates have been revised higher.

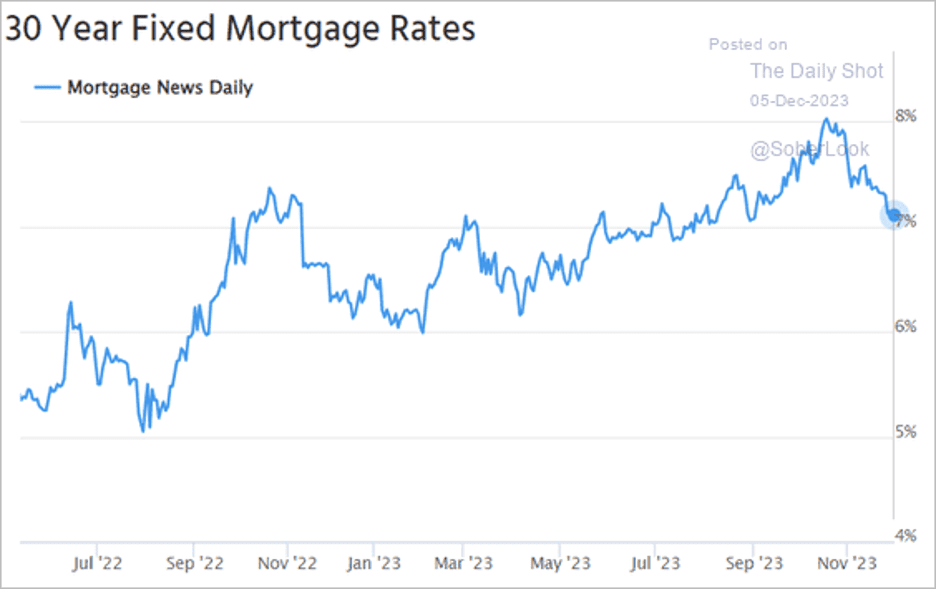

- The 30-year mortgage rate is approaching 7%.

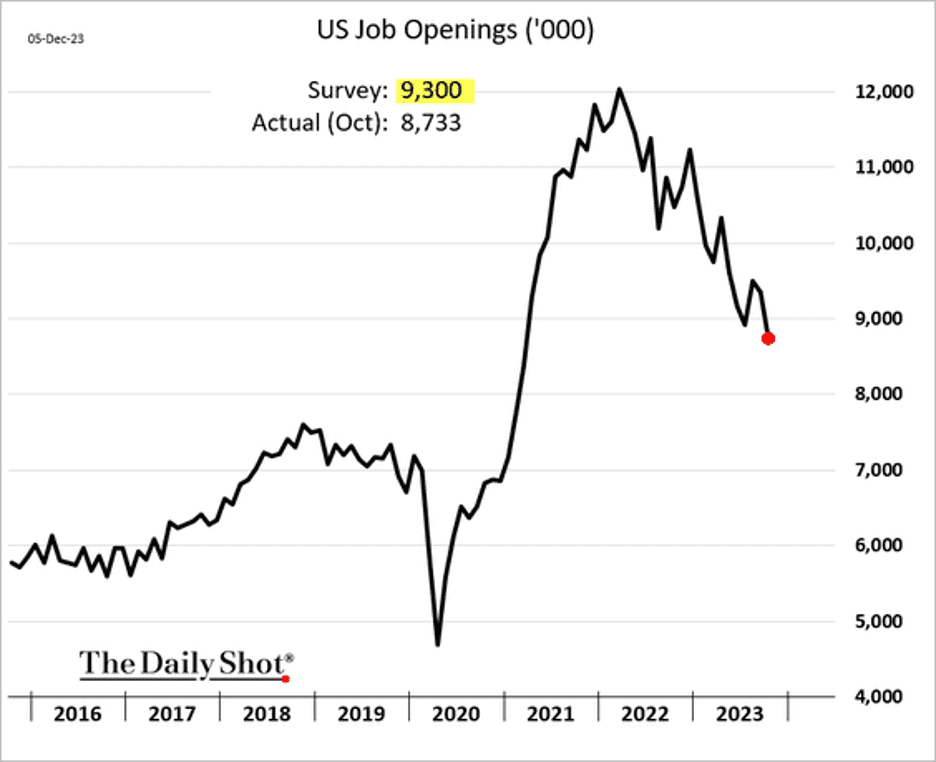

- October job openings surprised to the downside, suggesting that labor market imbalances continue to ease.

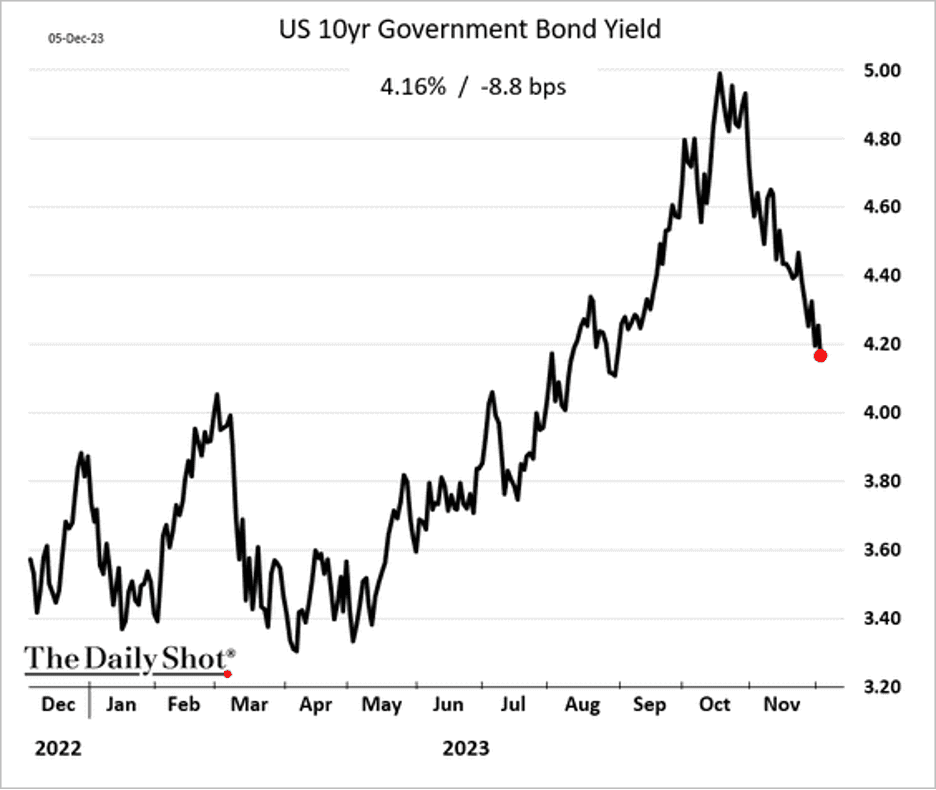

- Treasury yields dropped in response to soft job openings data.

- The ADP private payrolls report surprised to the downside, suggesting a slowdown in the labor market.

- Home prices were up 5% vs. a year ago in October.

- The Atlanta Fed’s GDPNow model estimate for the current quarter’s GDP growth is 1.2% (annualized), which is in line with economists’ forecasts.

Market Data

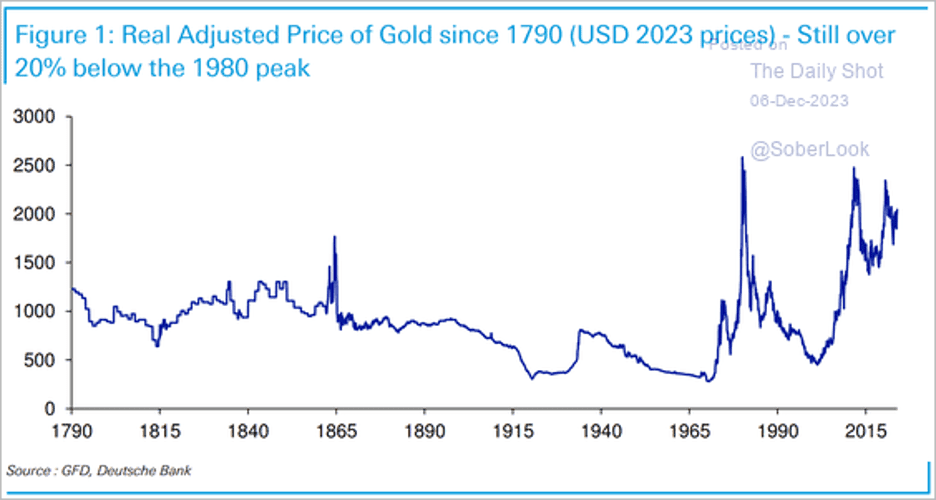

- Gold hit a record high.

- The real gold price is still roughly 20% below its peak in 1980.

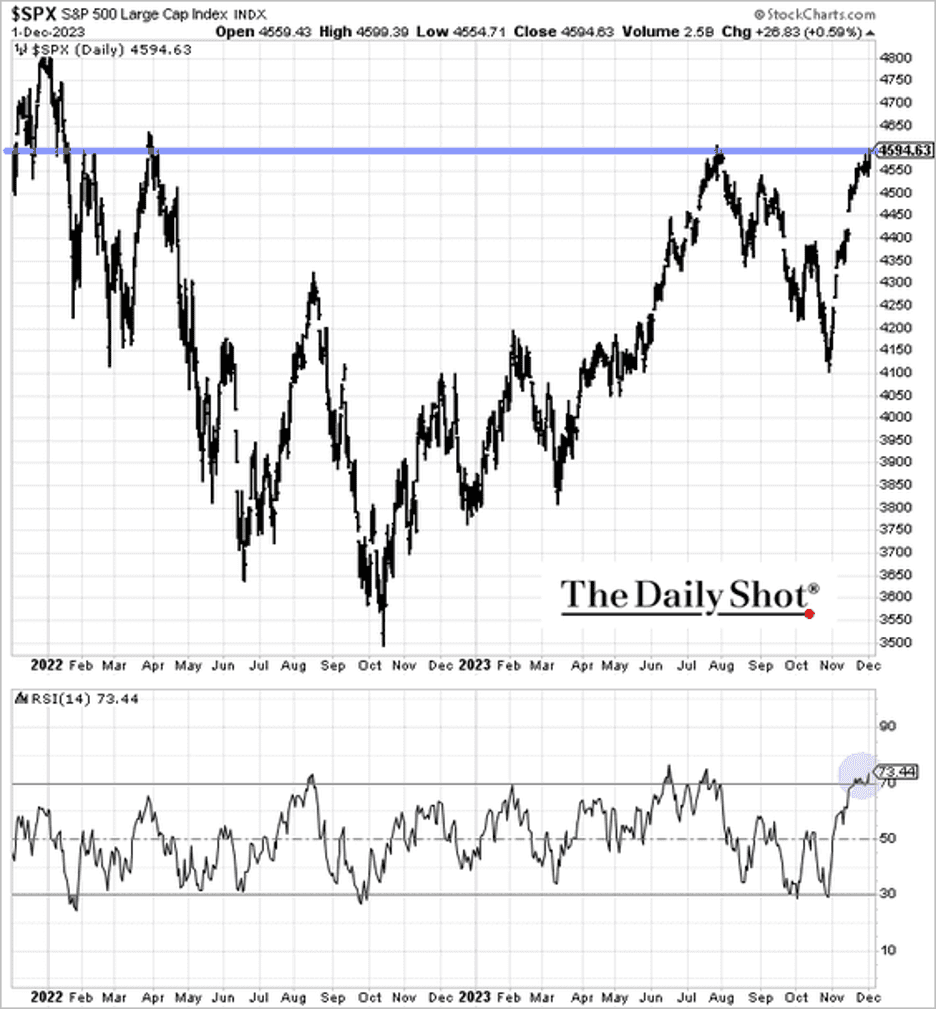

- The stock market is showing signs of froth.

- The Dow is up for five weeks in a row.

- The rally looks increasingly stretched.

- There are not a lot of bearish retail investors left.

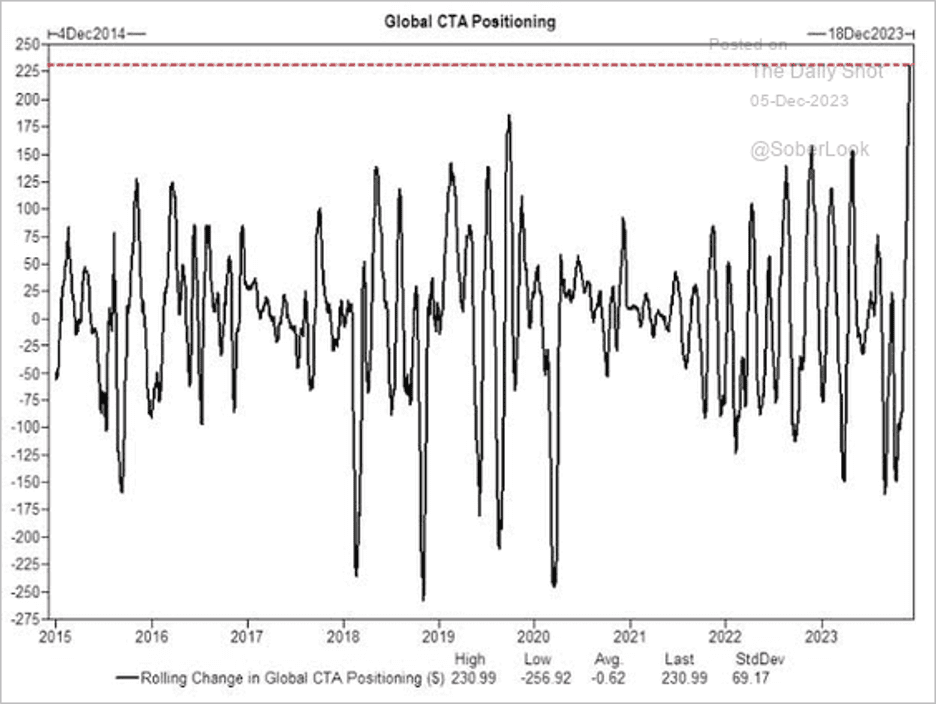

- CTAs have turned very bullish.

Source: Goldman Sachs; @dailychartbook

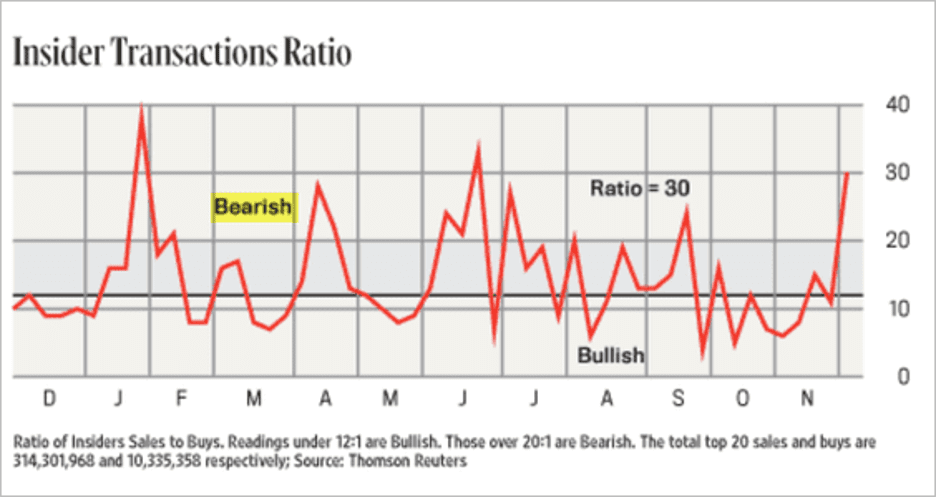

- And yet, corporate insiders are bearish.

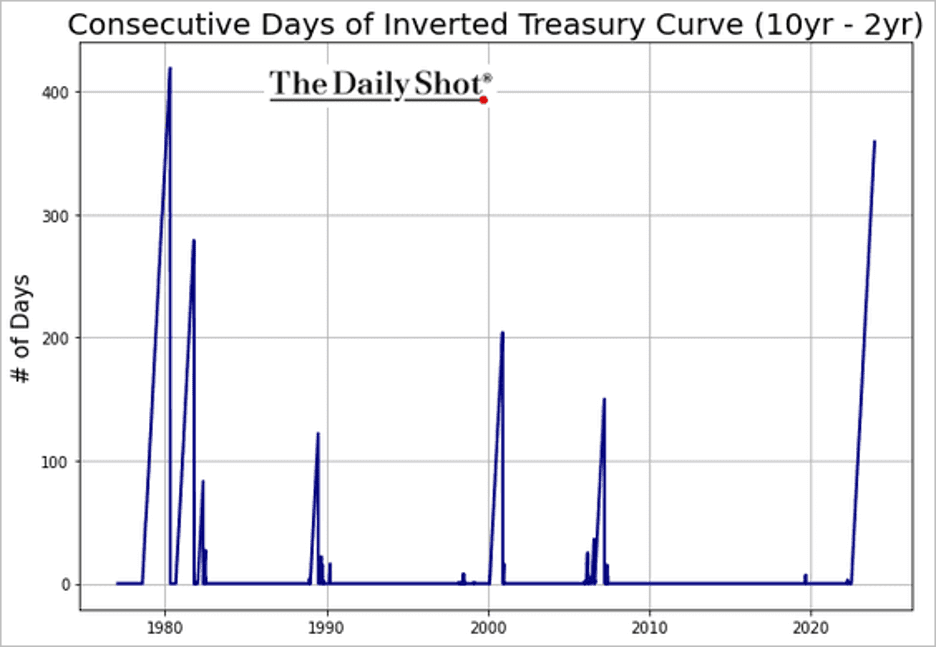

- Deeper yield-curve inversions mean larger market corrections in a recession.

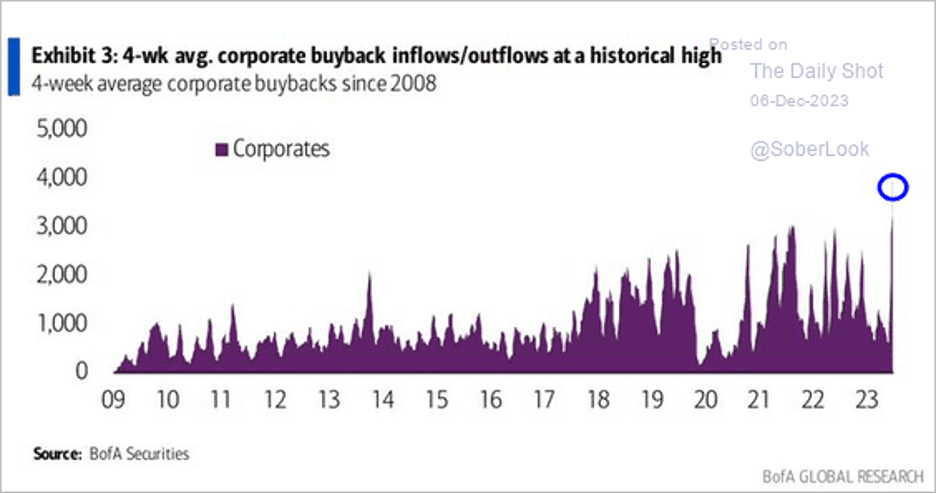

- Share buybacks have accelerated

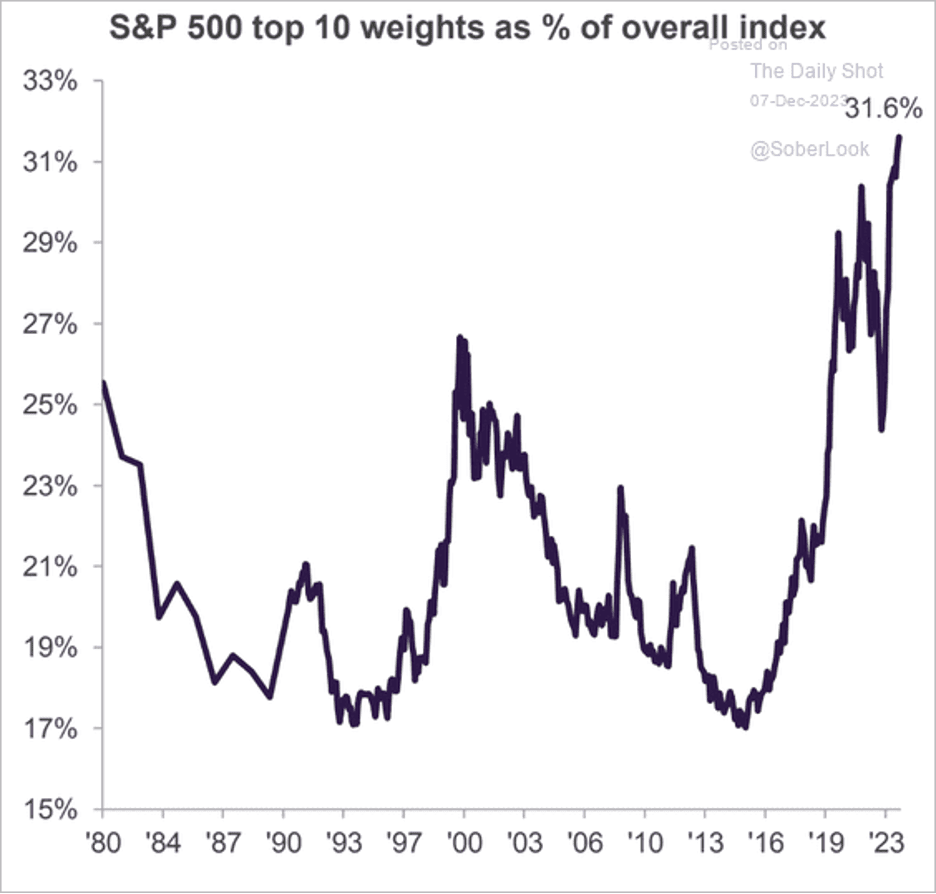

- The S&P 500 has not been this concentrated in decades.

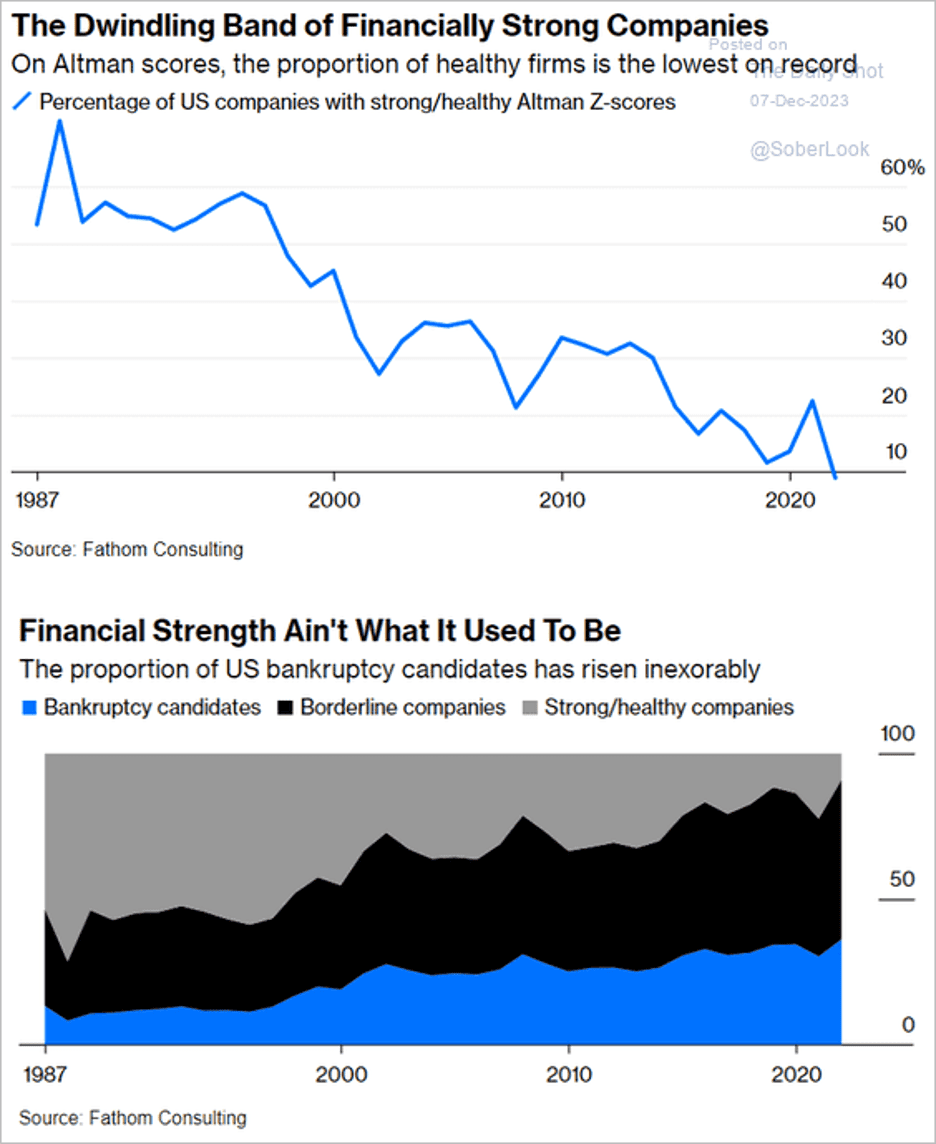

- The US corporate sector’s financial strength has been deteriorating by some measures.

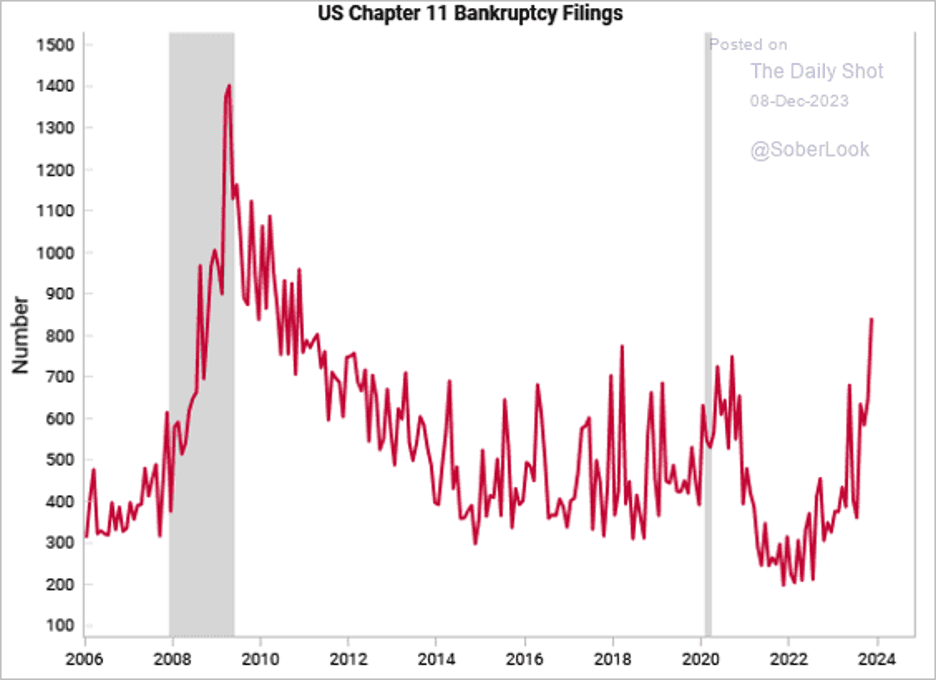

- This chart shows the number of US Chapter 11 bankruptcy filings.

- The current yield curve inversion duration has been unusually long.

Great Quotes

“(Market) Predictions Are Difficult…Especially When They Are About The Future” – Niels Bohr

Picture of the Week

Neuschwanstein and Hohenschwangau castles, Bavaria Germany

All content is the opinion of Brian Decker