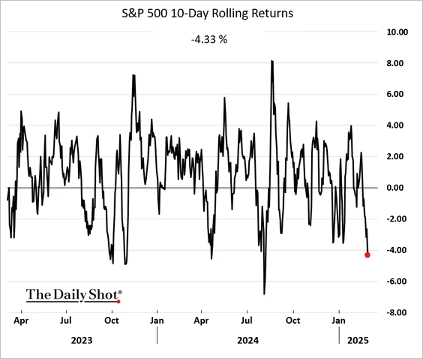

It’s been a rough couple of weeks for the S&P 500. This chart shows rolling 10-day returns.

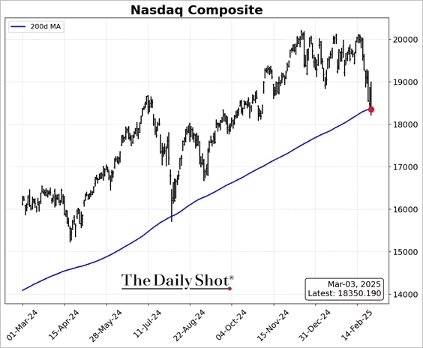

The Nasdaq Composite is testing support at the 200-day moving average.

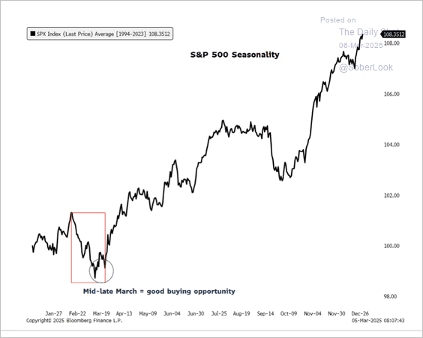

The drawdown in small caps is nearing 14%. Seasonality remains a headwind for the S&P 500 until later this month, aligning with options expiration.

The Nasdaq Composite entered correction territory on Thursday amid trade jitters.

The percentage of S&P 500 stocks trading above their 200-day moving average fell below 50% for the first time since 2023.

Economy:

The escalating trade war threatens to stifle US economic growth.

Source: @bpolitics Read full article

Source: @WSJ Read full article

Source: @bpolitics Read full article

Consumer spending fell in January, partly due to cold weather.

Source: Reuters Read full article

Durable goods spending experienced a particularly sharp decline.

On the other hand, personal income growth topped expectations. On average, goods prices have remained nearly flat for almost three years.

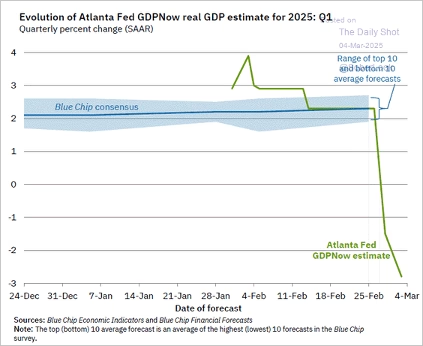

Businesses continue to report rising price pressures. The US trade deficit exploded in January as imports surged. A substantial portion of the gain in imports was driven by the movement of gold from Europe to the US to avoid tariffs. The Atlanta Fed’s GDPNow model estimate for Q1 GDP growth plunged into contraction territory following the surge in the US trade deficit.

Source: Federal Reserve Bank of Atlanta

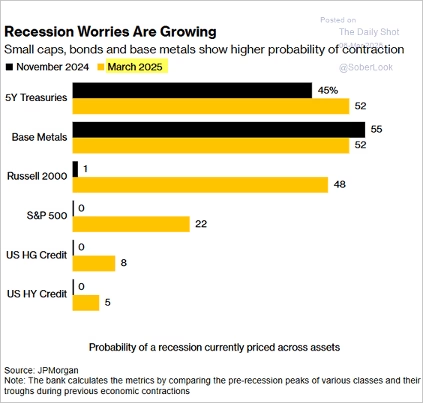

Recession probabilities priced into markets have increased, with small-cap stocks, bonds, and base metals signaling the highest risks. The Russell 2000 now reflects a 48% probability of contraction, up sharply from 1% in November. Meanwhile, five-year Treasuries and base metals indicate recession odds exceeding 50%, while broader equity and credit markets remain more subdued.

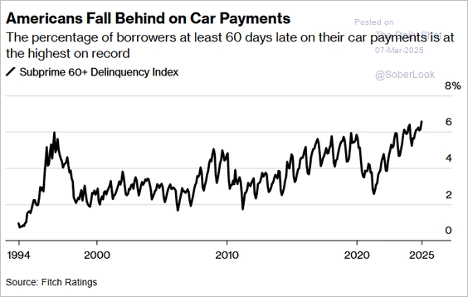

Companies are less concerned about interest rates, but worries over immigration and tariffs are rising. The percentage of auto loan borrowers with low credit scores that are late on car payments hit a record high.

Source: @wealth Read full article

This chart illustrates the recent shift in consumer behavior. Lower-income households are grappling with tighter budgets, higher costs, and economic uncertainties, including potential tariff impacts, driving a preference for retailers that emphasize cost savings.

The Fed

The market now fully pricing in three Fed rate cuts this year.

Great Quotes

“Anyone who tells you they know what is going on today, don’t believe them, no one knows.”

– John Tousley, Managing Director, Global Head of Market Strategy, Goldman Sachs

Picture of the Week

The Wave, AZ

All content is the opinion of Brian Decker