The US dollar has had a strong year, though the 2016 post-election pattern suggests potential headwinds ahead. Market breadth remains weak, with fewer than 30% of S&P 500 members trading above their 50-day moving average.

The US dollar continues to climb.

The Nasdaq 100 is testing support at the 50-day moving average.

The S&P 500 has grown increasingly concentrated recently, not only in terms of member weights but also across economic metrics.

Traders are increasingly betting on the US dollar, with CME futures positioning now at its highest level since early 2016.

Growth stocks have declined for four consecutive sessions. US market concentration is not extreme compared to global peers. The composition of the S&P 500 has increasingly tilted toward innovation sectors, with growth coming at the expense of manufacturing. This shift reflects the broader transformation of the US economy toward technology and services.

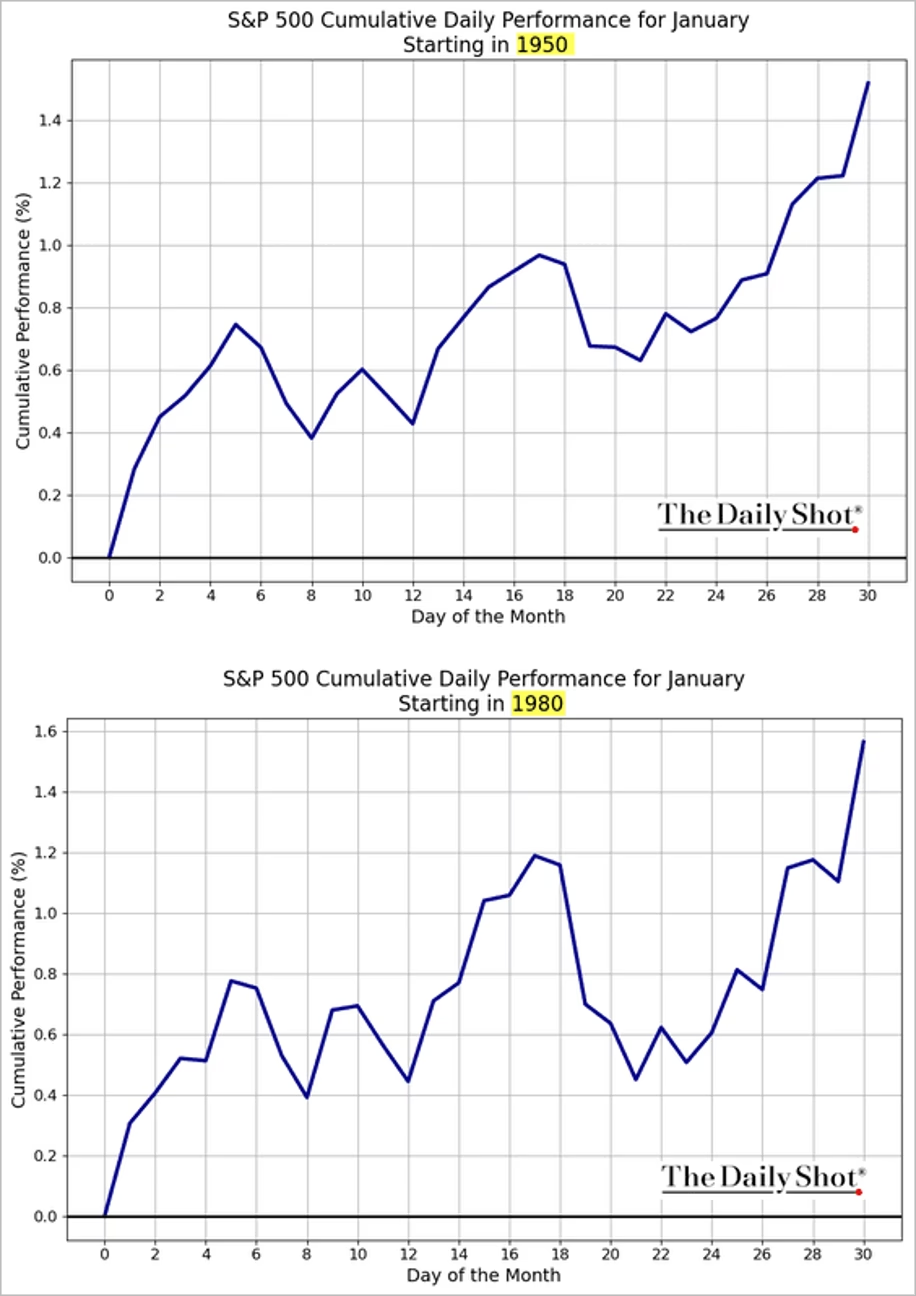

Tech mega-caps have lagged in recent days, while smaller firms have outperformed. The S&P 500 has been down for five sessions in a row. Market performance between Christmas and New Year’s was notably weak. Market breadth remains soft. January tends to be a good month for US stocks.

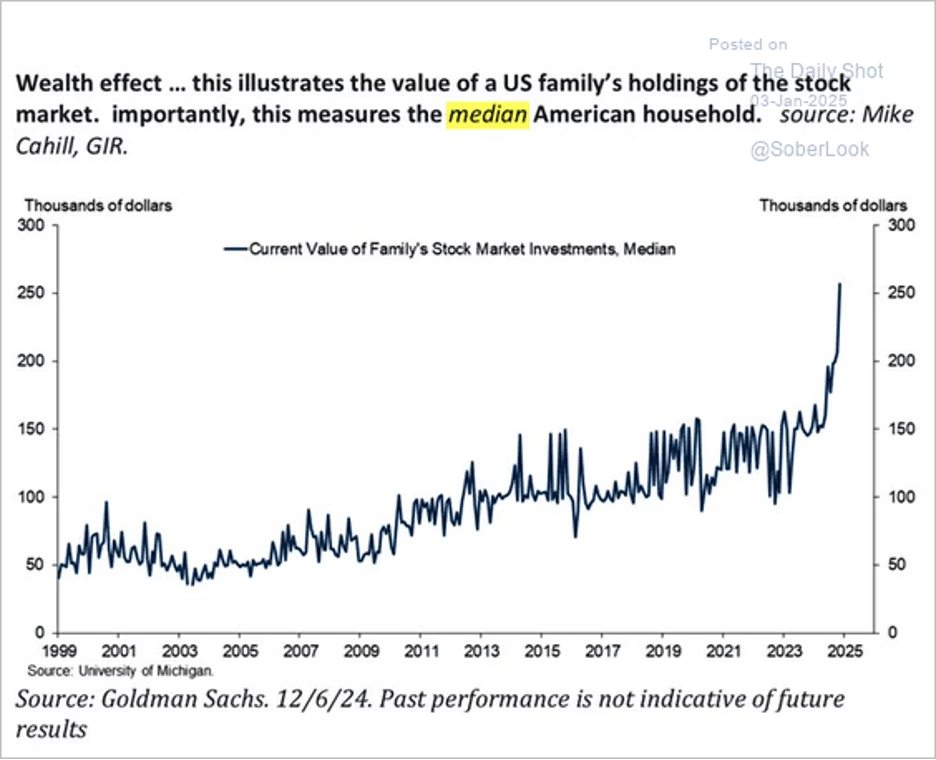

The median American family now holds more than $250k in equities, marking a record high.

Economy:

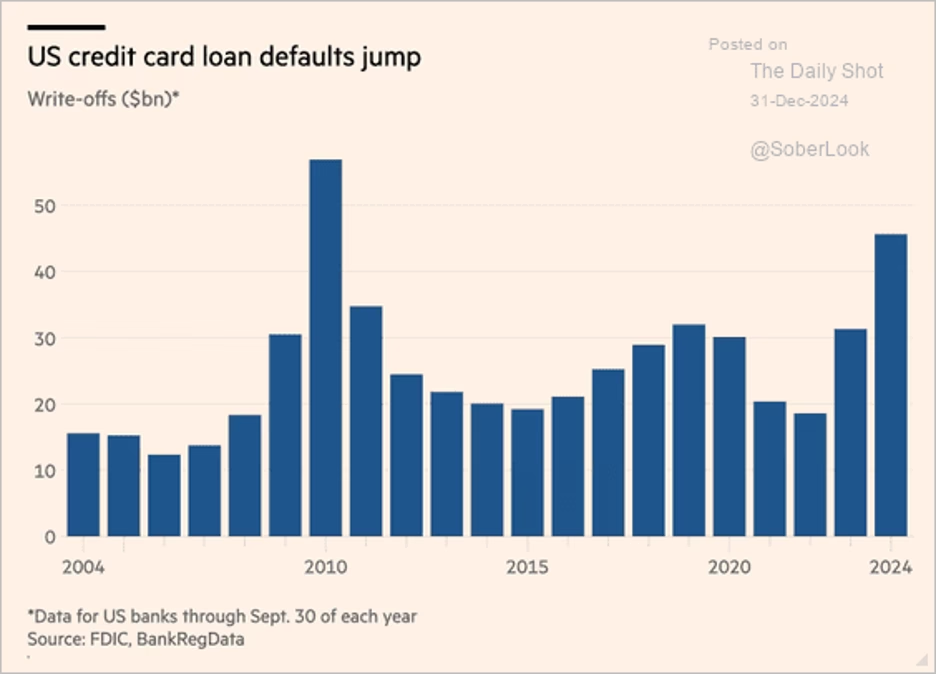

Leading indicators suggest that rent inflation continues to moderate. The trade deficit expanded in November as import growth outpaced exports. Initial jobless claims remain low, staying roughly in line with 2023 levels. Despite higher mortgage rates, US pending home sales stayed above 2023 levels in November for the third straight month as homebuyers take advantage of increased inventories. The Dallas Fed’s regional manufacturing index shifted into growth territory for the first time since early 2022. Credit card defaults surged in 2024.

Source: @financialtimes Read full article

Economists remain optimistic about US GDP growth in 2025, fueled by strong consumer spending. Construction spending was unchanged in November, weighing on Q4 GDP growth. Home improvement growth remains robust. The surge in manufacturing construction spending has stalled. Spending on data centers continues to soar. Last week’s mortgage applications reached a multi-year low for this time of year, as mortgage rates climbed.

Initial jobless claims were slightly above 2022 and 2023 levels but remained low for this time of year, while continuing claims fell below 2023 levels.

The Fed

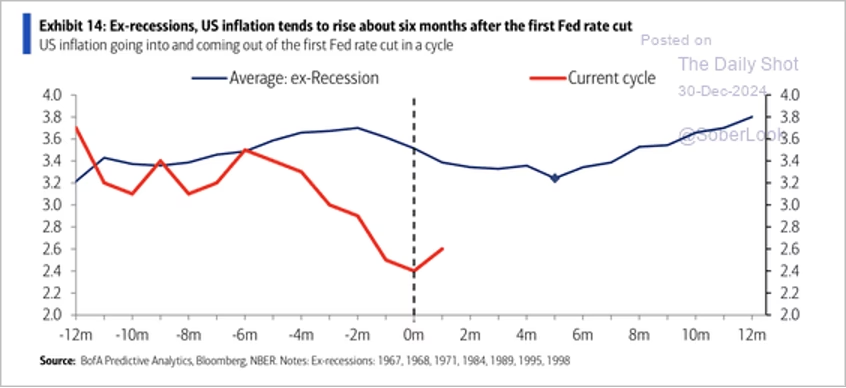

Historically, inflation has risen roughly six months after the first Fed rate cut if the economy does not fall into a recession within a year of the cut. This implies that inflation could rise by the end of Q1 2025, potentially resulting in a pause in the Fed’s rate-cut cycle.

The market now expects less than 40 bps of Fed rate cuts in 2025. Goldman anticipates central banks will adopt a more dovish stance than the market expects.

Great Quotes

“Our greatest glory is not never failing, but rising every time we fail.” – Confucius

Picture of the Week

All content is the opinion of Brian Decker