This week, dollar dominance and Fed policy are under the spotlight. Geopolitical tensions and economic data have investors reevaluating the Fed’s stance, while speculation swirls around the dollar’s role in global markets.

Economy

The preliminary University of Michigan Consumer Sentiment index for June jumped 8.3 points to 60.5, well above the 53.5 consensus. According to the University of Michigan’s analysis, the improvement suggests that “Consumers appear to have settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed.” Both the current conditions (63.7 vs. 59.4 consensus) and expectations (58.4 vs. 49.0 consensus) subindices posted strong beats.

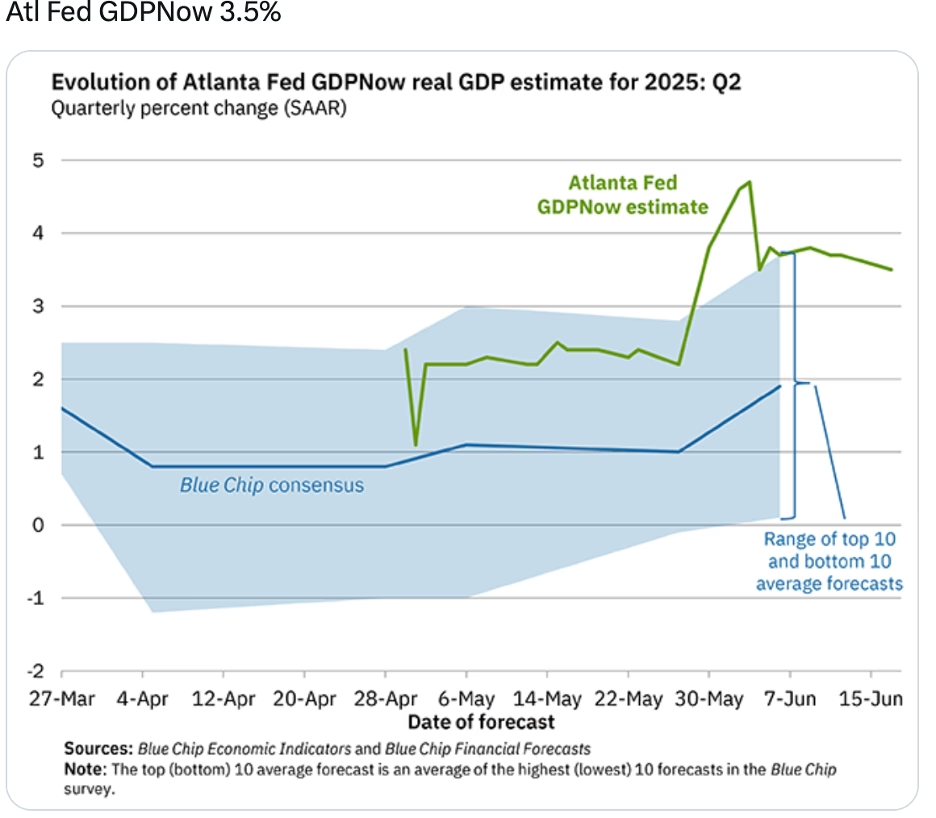

GDPNow holds near 3.5%, signaling steady growth despite policy uncertainty.

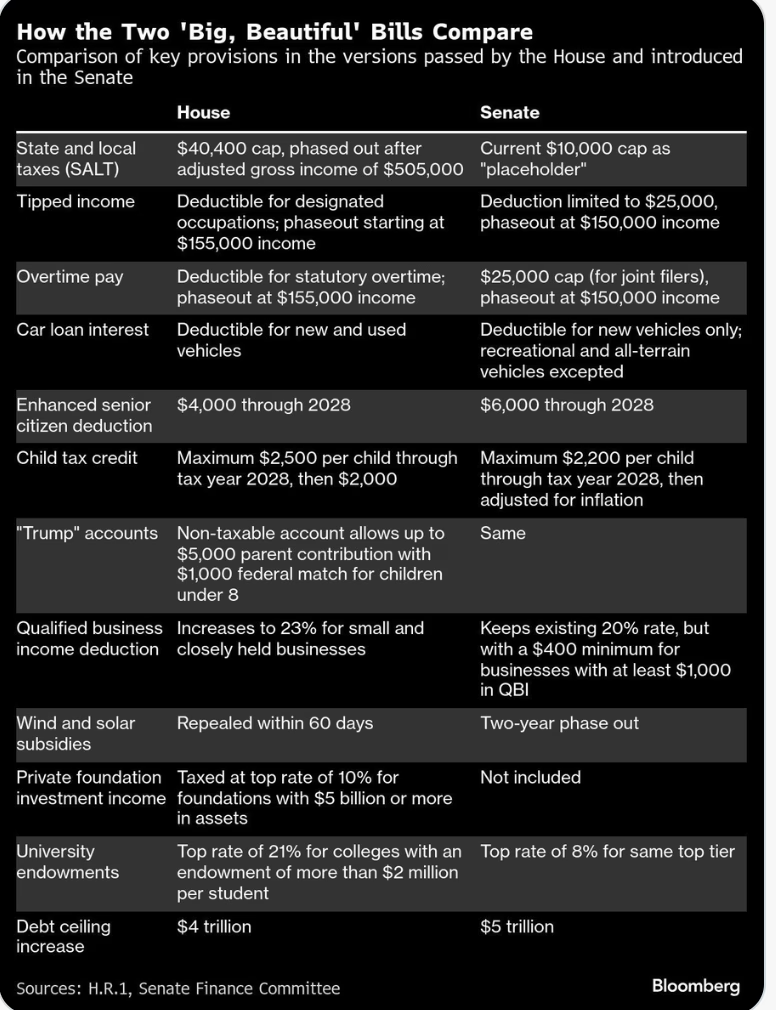

How the two Big Beautiful Bills compare:

A side-by-side look at major tax proposals and how they shape fiscal direction.

Housing starts, a sector that has a significant impact on the economy. The latest data, reported this week, is not so good.

U.S. housing starts declined to a five-year low amid rising mortgage rates, weaker demand, and a decline in builder sentiment.

The data shows a clear slowdown:

- According to the National Association of Realtors (NAR), existing-home sales dropped to a 4.00 million annualized pace in April 2025, down 0.5% from March and 2% year-over-year. Source

- NAR forecasts a modest rebound to 4.3 million in 2025, but that’s down from previous expectations of 4.9 million. Source

- Zillow projects 4.14 million existing-home sales this year, reflecting only a 1.9% rise over 2024. Source

Meanwhile, Redfin and other trackers report:

- A historic imbalance: as many as 500,000 more sellers than buyers in April. Source

- Homes are taking longer to sell: median days on market rose from ~40 days in March 2024 to 54 days in March 2025. Source

Together, these patterns indicate a slowdown in the existing-home sales market.

What’s behind the slowdown?

Key factors include:

- High mortgage rates (~6.8–7%) are suppressing demand. A jump from 3% to 6% adds about 34% to monthly payments. Source

- Affordability challenges: even though home prices have slowed, they remain elevated (median ~$414k in April 2025). Source

- Rising inventory: active listings jumped ~27.5% year-over-year. Source

- Economic uncertainty, including inflation, tariffs, and the Fed’s policy, has further dampened buying activity. Source

Why housing matters to the economy:

Although housing directly represents around 4% of GDP, its economic significance runs deeper –

- Wealth effects: Home values influence consumer spending. A slump in housing dampens household wealth, particularly for those who are selling.

- Job impacts: The housing sector supports a diverse range of jobs, including construction, real estate, lending, and remodeling. A slowdown stresses employment in these areas.

- Financial markets & banking: Home sales generate mortgage borrowing and refinancing. Reduced activity can decrease bank revenue and tighten lending conditions.

- Leading indicator: Housing often signals broader economic trends. A prolonged slump can signal slowing consumer demand, potential softening, or increased recession risks. Source

- Fed policy implications: If housing stalls significantly, the Fed might respond with rate cuts or interventions (e.g., bond or mortgage-backed securities purchases). Souce

In summary:

- Existing-home sales are decelerating, hovering well below pre-pandemic norms.

- Rising mortgage rates, persistent affordability pressure, and growing inventory are key headwinds.

- Slow housing affects the economy through its impact on wealth, employment, banking activity, local tax collections, and policy decisions.

- The Fed is watching. While inflationary pressures are on their mind, as you’ll see in the Trade Signals section below, a deeper slump could lead to monetary easing later this year. I still consider recession risk in 2025 to be more than 50%.

Markets

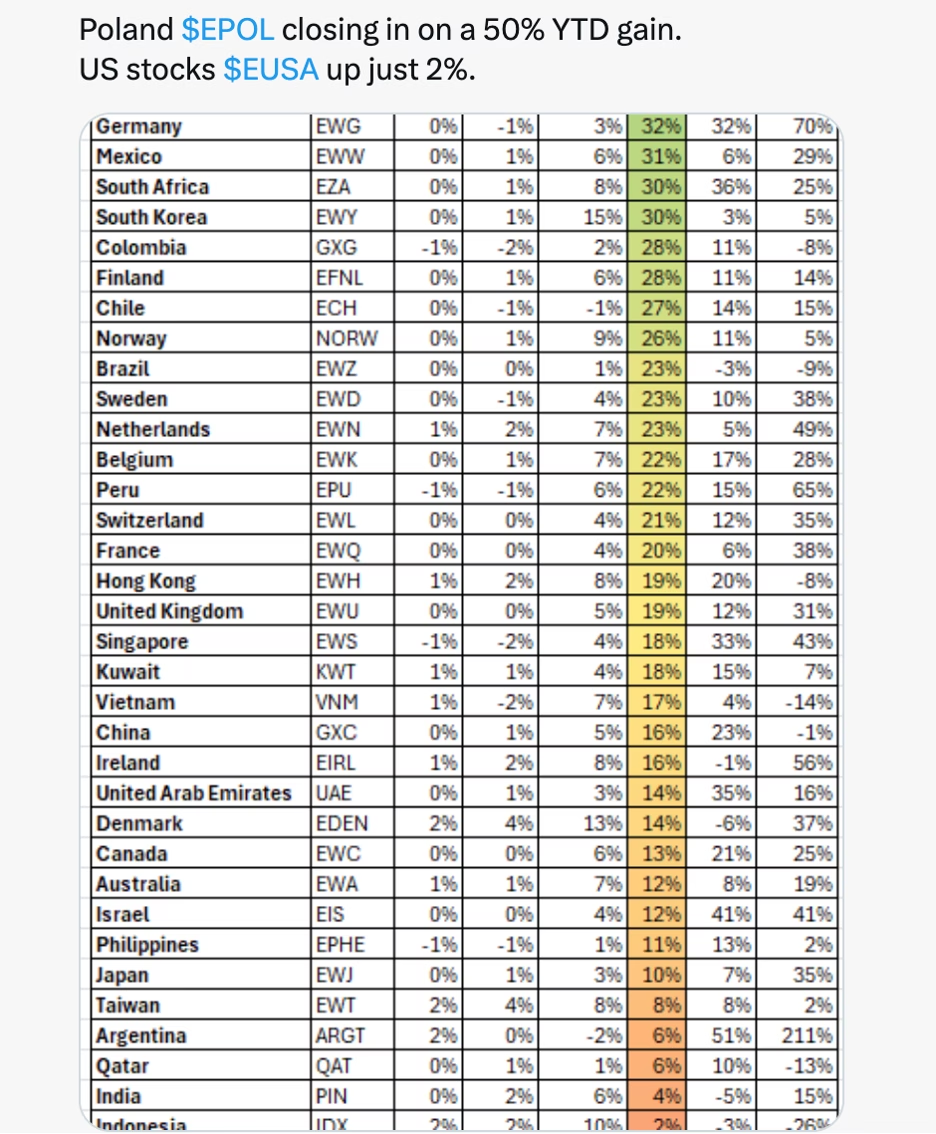

Comparing the world markets year to date performance:

Poland’s stock surge outpaces U.S. equities, highlighting global capital shifts.

The Fed

The Fed should absolutely stop talking about being “data dependent”. That’s so far from the truth. If they were data dependent, we’d have either seen a rate cut today or Fed Chief Powell would have been discussing one for the next meeting. Inflation reports since the last Fed meeting have been benign. Economic reports, on the other hand, have shown weakness and are pointing to the need for lower interest rates.

Powell was having none of it. During Wednesday’s press conference, one reporter asked the Fed Chief why the Fed was able to lower rates in December, despite knowing that tariffs and their potential impacts were on the way. I thought it was a great question, because Powell was using future tariff impacts on inflation as the primary reason for holding rates steady today. It was a perfect illustration of Powell at his best. When another reporter asked Powell about his frequent comments that the Fed is data dependent and that all current data points to the need for an interest rate cut, Powell noted the Fed needs to “look ahead”. So which is it? Is interest rate policy being guided by current data or by looking ahead?

This is a repeat of 2021 and 2022. Remember all the inflation news and how Powell said inflation was transitory. I guess he was looking ahead when he made those comments. He and his band of wafflers looked ahead and got it wrong. Then, inflation data poured in higher than expected for months and he finally started his data dependency talk.

The Fed has been late to every single party for 7 years now and running. They’re running late again. Eventually, Powell will get it right and our major indices will all move to all-time highs. For now, though, the reason for any period of consolidation or, worse yet, selling can be laid at the doorstep of none other than Powell.

Personally, I’m exhausted by the constant “listen to what I say until I change it” approach to interest rate policy. Yes, we’ve had a 100-year pandemic and a resulting inflation problem that’s been worse than any since the 1970s. We’ve had two trade wars. I get it. But I firmly believe that the extreme volatility and the four (FOUR!!!!!!!) cyclical bear markets that we’ve endured since Powell became the Fed Chief is, in large part, his fault. He was sworn in on February 5th, 2018 and the stock market has been a roller coaster ever since:

Bear markets show consistent correlation with Fed leadership and interest rate pivots.

And now where are we? Holding rates steady while the European Central Bank (ECB) has cut rates for 8 straight meetings. Powell will eventually get it right.

Tariffs

Now, with tariff pauses and trade negotiations happening with China and other countries, expectations have changed to “not as bad as it could have been” when it comes to decreased economic growth because of trade policy. But there are still lingering questions about what impact tariff policy will have.

At a minimum, a 10% across-the-board tariff on all U.S. imports could stick, with higher rates on some countries, depending on negotiations and the legality of these tariffs, which is still to be decided in the courts. The answers could shake up growth expectations.

So the bond market could get “queasy” again. But things look more like business as usual for now. That’s for better (less short-term fear) and worse (more long-term debt problems). On it goes.

Five Reasons the Dollar’s Death Narrative Is Overstated

- Lack of a Viable Alternative Currency – The dollar’s reserve status persists because no credible rival exists. The euro, holding 20% of global reserves compared to the dollar’s ~58% (IMF, Q2 2024), is constrained by the eurozone’s fragmented bond markets and political volatility. Despite increasing use (2–3% of reserves), China’s renminbi is limited by capital controls and restricted convertibility, rendering it unfit for global reserve status. Other currencies, such as the Japanese yen (6%) or smaller ones like the Canadian or Australian dollar, lack the economic scale or liquidity to challenge the dollar. Without a currency matching the dollar’s deep, liquid markets and global trust, the dollar’s death remains improbable in the near term.

- Strength of the U.S. Economy– The U.S. economy, accounting for 26% of global GDP, anchors the dollar’s dominance. Its large, dynamic economy, supported by the rule of law and robust capital markets, positions the dollar as a haven, particularly during global instability. While critics highlight rising U.S. debt ($35 trillion, ~120% of GDP), the dollar’s reserve status enables borrowing at lower rates, sustaining deficits without immediate crisis. Compared to other economies—Japan’s slow growth, China’s restricted markets, or Europe’s fragmentation—the U.S. offers stability, making the dollar’s death unlikely in the foreseeable future.

- Network Effects and Global Financial Inertia– Network effects perpetuate the dollar’s dominance: its widespread use enhances its value. It constitutes ~88% of global foreign exchange transactions (SWIFT data) and ~60% of international debt and trade invoicing. Transitioning to another currency would demand extensive coordination among central banks, governments, and markets, incurring significant costs and risks. Historical currency transitions, such as from the pound to the dollar, spanned decades and required major geopolitical shifts, which are absent today. This inertia renders the dollar’s death a distant prospect.

- Limited Scope of De-Dollarization Efforts– Although countries like China, Russia, and BRICS nations advocate for trade in local currencies (e.g., China’s renminbi in 56% of its bilateral trade), these efforts have limited global impact. The dollar’s share of reserves has dipped gradually (from 67% to 58% over two decades). However, this reflects diversification, not the dollar’s death, often into allied currencies like the Canadian or Australian dollar. China holds ~$2 trillion in dollar-denominated assets, underscoring its reliance. Geopolitical moves, such as Russia’s shift to gold or renminbi, are constrained by the small scale of non-dollar systems (e.g., China’s CIPS vs. SWIFT). These fragmented efforts fall short of triggering the dollar’s death.

- Resilience Amid Policy Challenges– Critics argue that U.S. policies—like tariffs, sanctions, or Federal Reserve actions—undermine confidence in the dollar. For instance, Trump’s tariffs in 2025 caused a ~9% dollar decline, fueling dollar death fears. However, economists note such fluctuations are cyclical, not structural, with the dollar still robust compared to its 2011–2022 peak (up ~40% against a currency basket). Sanctions, such as those on Russia in 2022, have not significantly reduced global dollar holdings, as most reserve currencies are held by U.S. allies who joined sanctions. The Federal Reserve’s swap lines and liquidity support further reinforce the dollar’s role in crises

Great Quotes

“Success is no accident. It is hard work, perseverance, learning, studying, sacrifice, and most of all, love of what you are doing or learning to do.”

— Pelé

Picture of the Week

City of Dubai at night

Picture of the Week: A nighttime view of the Dubai skyline and waterfront district.

All content is the opinion of Brian Decker

Leave A Comment