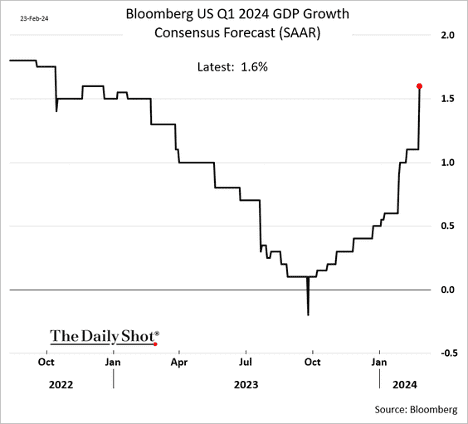

- Economists continue to boost their projections for the current quarter’s GDP growth. Forecasts for the full year also continue to rise, driven by expectations of resilient consumer spending.

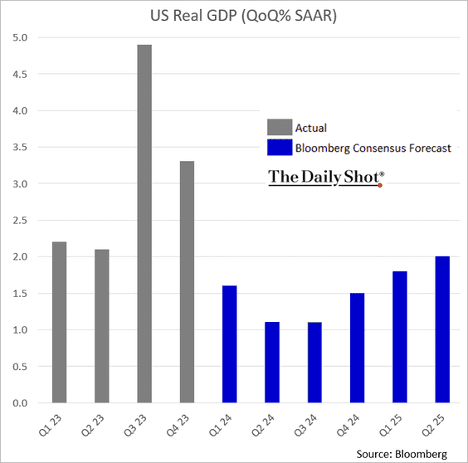

- Consensus projections show slower growth over the next couple of quarters, with momentum picking up in Q4.

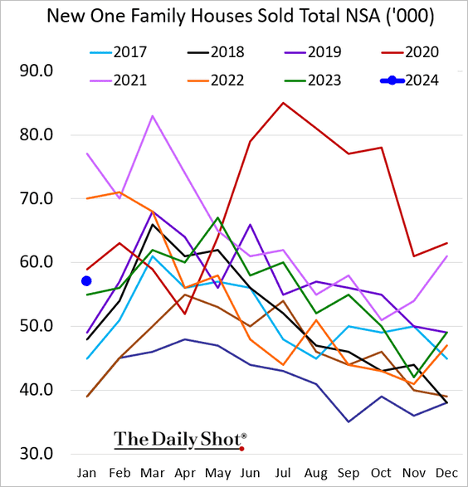

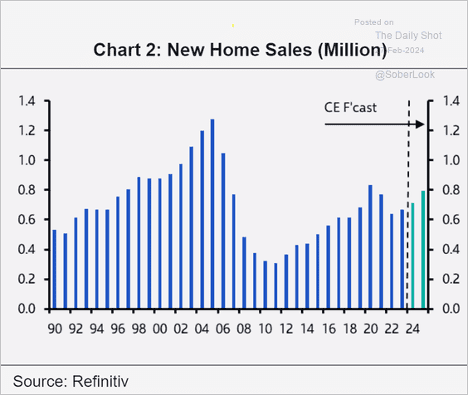

- New home sales modestly exceeded last year’s figures but fell short of projections.

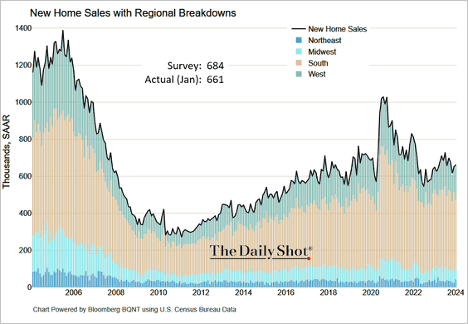

- Here is the seasonally adjusted chart with regional contributions.

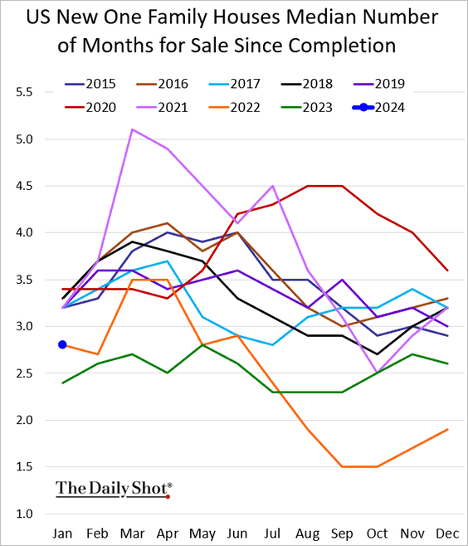

- – Inventories were roughly in line with 2022 levels.

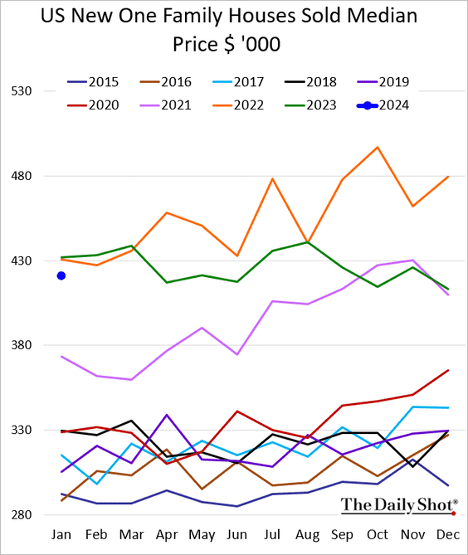

- – The median new home price was below last year’s level.

- Capital Economics expects new home sales to grow over the next couple of years.

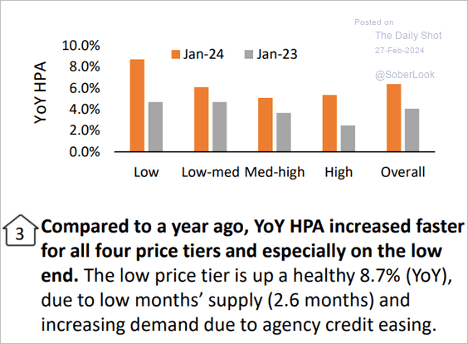

- In January, home prices registered robust year-over-year increases across all price tiers, with the most substantial gains observed in the lower-priced segment (due to tight inventories).

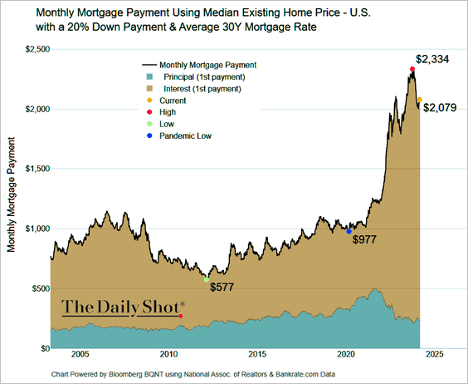

- The median mortgage payment for new homebuyers has decreased from the record highs of last year but still remains elevated.

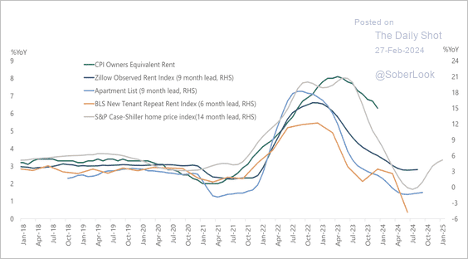

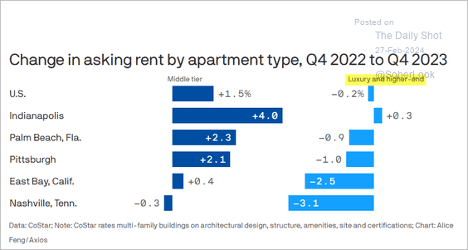

- Could we see a rebound in housing inflation?

Source: Torsten Slok, Apollo

- The share of cities with positive rent growth is rising.

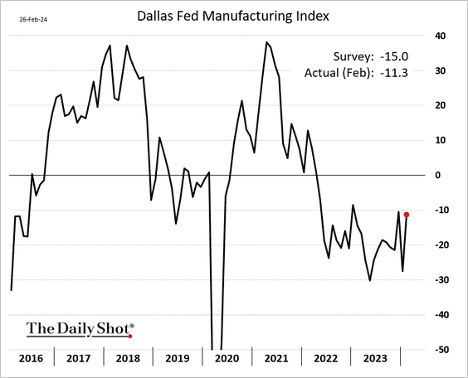

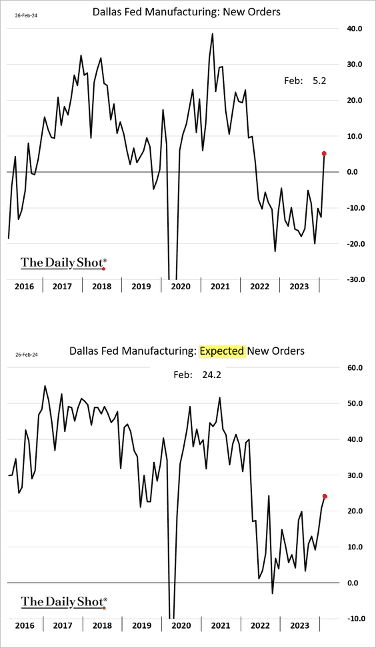

- The Dallas Fed’s regional manufacturing index showed some improvement this month but remained in contraction territory.

- However, the underlying trends point to a rebound in the Texas area factory activity.

- New orders:

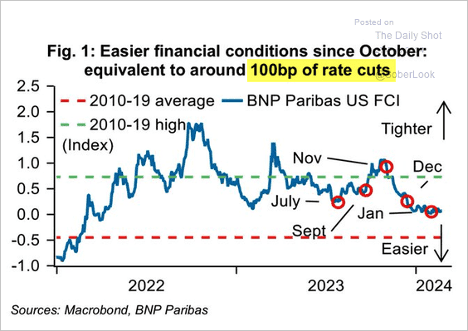

- The easing of US financial conditions equates to approximately 100 basis points of rate cuts, providing the US central bank with additional justification to delay rate reductions.

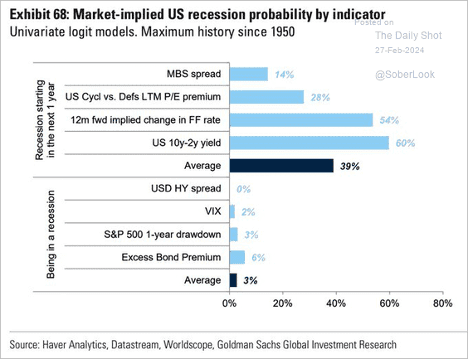

- Market signals on the probability of a recession have been mixed.

Source: Goldman Sachs; @WallStJesus

Market Data

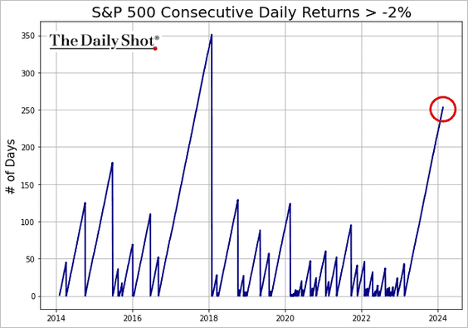

- The S&P 500 experienced 253 trading sessions without a 2% daily drop.

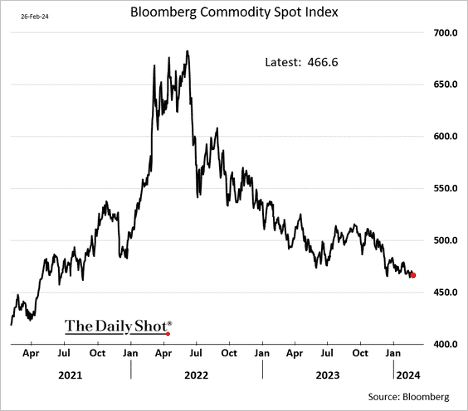

- Bloomberg’s broad commodity index has been trending down.

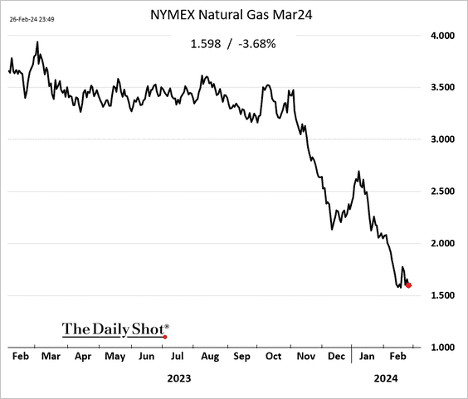

- The recent jump in US natural gas prices proved to be fleeting, with forecasts calling for unusually warm weather in the eastern United States in the coming days.

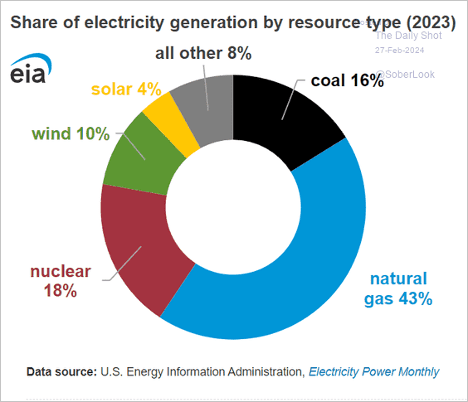

- This chart shows the share of US electricity generation by resource type.

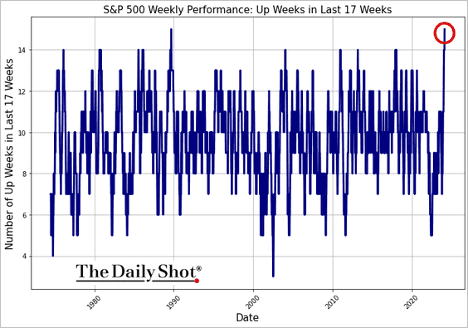

- The S&P 500 has advanced for 15 of the last 17 weeks – the longest winning streak since 1989.

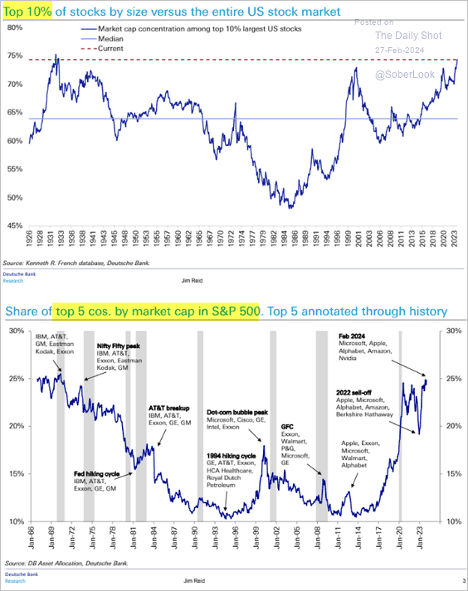

- Rising market concentration remains a concern

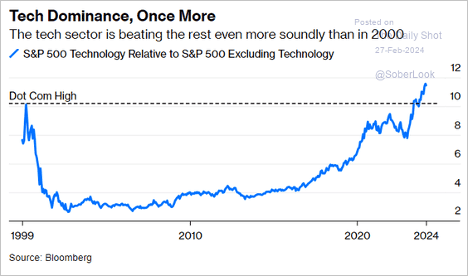

- Tech outperformance is hitting extreme levels.

Source: @johnauthers, @opinion Read full article

- The top-10 stock valuations look frothy.

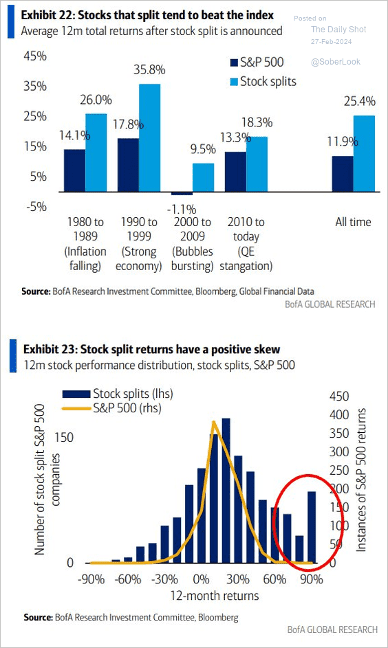

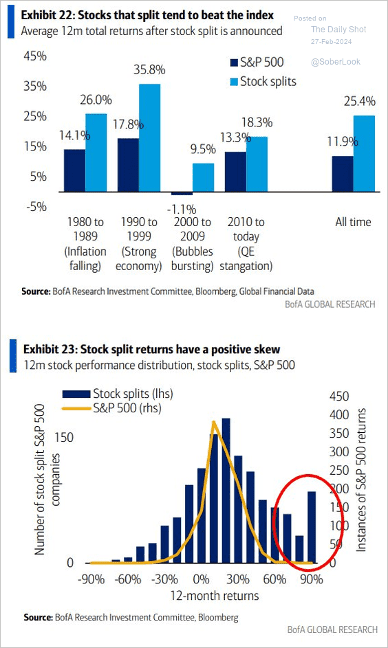

- How does a stock split impact the share price?

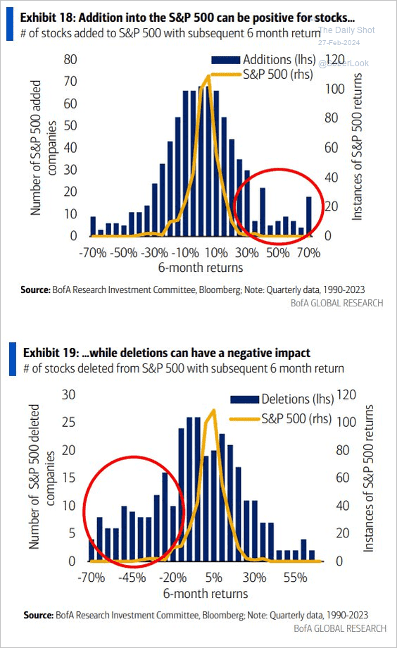

- How does being added to or removed from the S&P 500 affect a stock’s price?

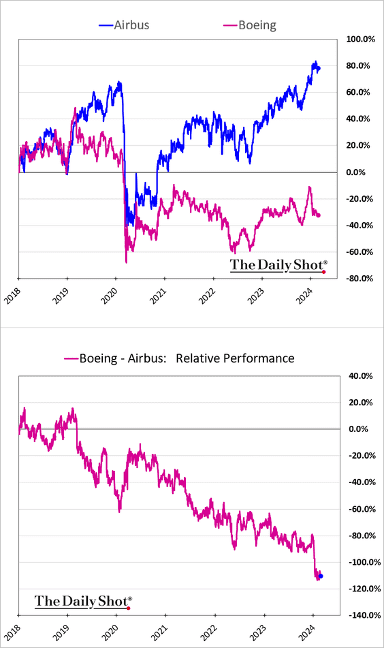

- Boeing can’t catch a break. With China venturing into commercial aircraft production, the US manufacturer may face further challenges ahead.

Source: @business Read full article

Great Quotes

“Let no one ever come to you without leaving happier”. -Mother Teresa

Picture of the Week

Grand Canyon National Park, AZ

All content is the opinion of Brian Decker