Markets

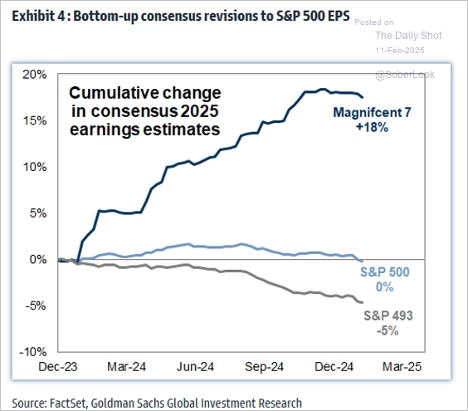

US deal activity in January fell to its lowest level in a decade, as uncertainty over tariffs and regulatory actions dampened CEO confidence and slowed M&A momentum. Magnificent 7 stocks have been underperforming this month. The Magnificent 7’s massive earnings growth advantage over the rest of the S&P 500 is narrowing. Earnings revisions have turned lower.

Retail investors have largely been buying Nasdaq 100 stocks. If gold sustains this week’s gains, it will extend its winning streak to seven weeks. Momentum stocks continue to widen their outperformance, boosted by strong forward margin revisions.

Economy:

January’s job gains fell short of expectations but remained robust.

Source: @WSJ Read full article

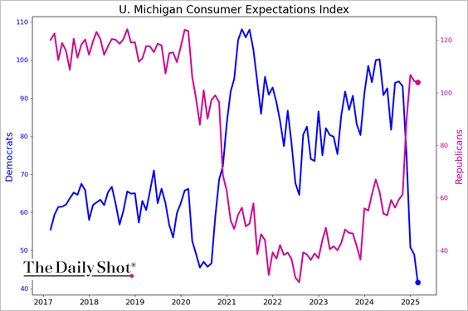

Last month’s cold weather weighed on employment. Weekly hours worked dropped to their lowest level in years. Wage growth was stronger than expected. Labor force participation improved slightly. This chart illustrates consumer expectations based on political party affiliation.

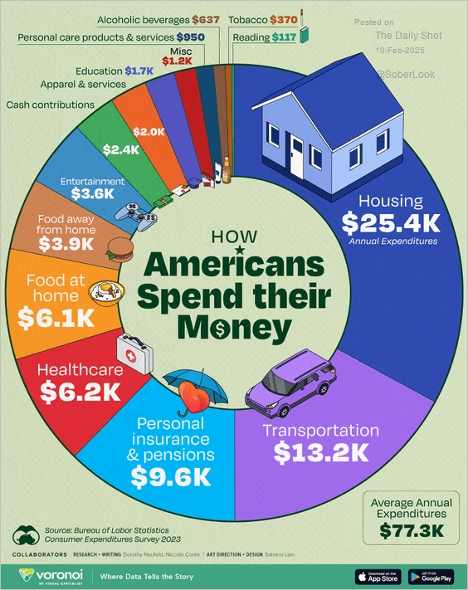

How Americans spend their money:

Overall, Americans are becoming less concerned about unemployment a year from now. However, expectations for higher unemployment vary by education level, with those holding a BA or higher expressing the most concern, while individuals with a high school education or less are becoming more optimistic. Consumers anticipate a slower growth rate in their spending.

Homes are taking longer to sell. The mortgage lock-in effect is gradually easing as more homeowners adjust to higher borrowing costs.

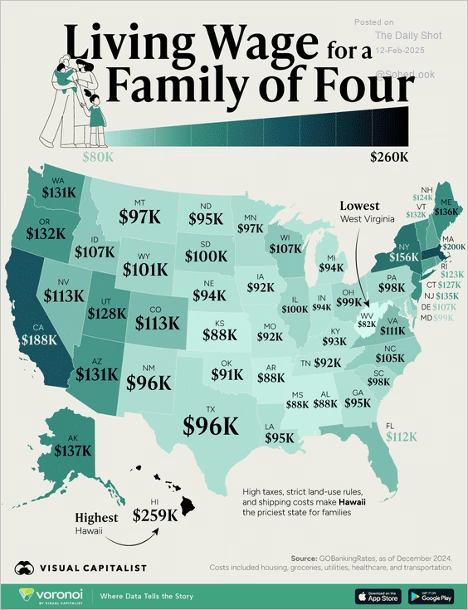

Income needed for a family of four:

Source: Visual Capitalist Read full article

The Fed:

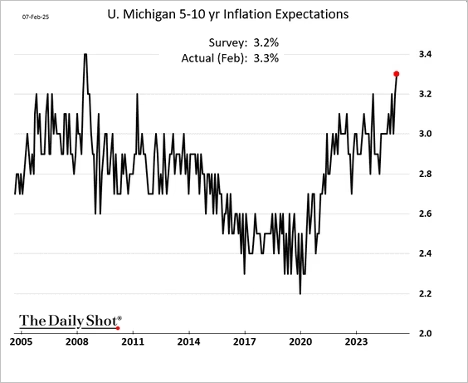

Inflation expectations surged this month. Longer-term inflation expectations jumped to their highest level since 2008.

The 10-year Treasury yield is back above 4.5%.

Chair Powell signaled that the US central bank is in no rush to cut rates.

Source: CNBC Read full article

Nonetheless, the market is still pricing in a 36 bps reduction this year. Market-based inflation expectations continue to rise, and economists are also raising their forecasts for this year’s CPI gains. Flows into the largest TIPS ETF (inflation-linked Treasuries) have turned positive this year as investors grow concerned about sticky inflation.

The CPI report exceeded expectations, with the headline and core measures accelerating in January. On a three-month basis, headline CPI is near 4.5% annualized. Grocery inflation accelerated, boosted by sharp increases in egg prices. While housing inflation remained elevated, the core CPI acceleration was driven by other components, marking a broadening of inflation. Treasury yields jumped, as the market now prices in just one Fed rate cut this year. Stocks largely brushed off the hot CPI report. According to a Goldman survey, sticky inflation is viewed as the biggest risk to the US exceptionalism theme, cited by 37% of respondents. Tariffs are second at 24%.

Source: @WSJ Read full article

The January PPI report came in stronger than expected. However, the components impacting the PCE inflation index were relatively benign. Nonetheless, Nomura expects the core PCE, the Fed’s preferred inflation gauge, to have accelerated last month, driven by components from the hotter-than-expected CPI report. The core goods CPI, no longer in deflation, along with other categories, are key contributors to this acceleration. Treasury yields fell as the details of the PPI report were milder than expected. Stocks jumped in response to declining yields and the delay of reciprocal tariffs.

Great Quotes

“To laugh often and much: To win the respect of intelligent people and the affection of children, to earn the appreciation of honest critics and endure the betrayal of false friends; to appreciate beauty, to find the best in others, to leave the world a bit better whether by a healthy child, a garden patch, or a redeemed social condition; to know even one life has breathed easier because you lived…This is to have succeeded.”

—Ralph Waldo Emerson

Picture of the Week

Marine Iguanas, Galapogos Island, Equador

All content is the opinion of Brian Decker.