This week’s update unpacks the market’s reaction to escalating conflict between Israel and Iran, cooler inflation data, and rising expectations for Fed policy decisions. We also examine key trends in sector rotation, earnings growth, and the ongoing impact of tariffs on core goods.

Economy

The May US jobs report was better than expected, with 139k new jobs added. The “usual suspects”—healthcare, hospitality, and local government—led the gains. Excluding those sectors, job growth was modest. The unemployment rate held steady at 4.2%. Treasury yields jumped following the resilient jobs report, with less than two Fed rate cuts now expected in 2025.

US home-price growth turned negative in May, with condos leading the pullback. Nearly a third of major markets are seeing price drops of at least 1%, and some Sun Belt and West Coast cities have experienced cumulative declines exceeding 10% since 2022 peaks.

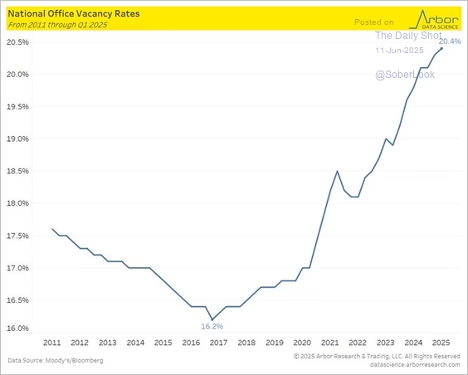

US office vacancy rates continue to climb.

U.S. office vacancy rates have surged to 20.4%, the highest level in over a decade.

According to BofA’s internal data, consumer card spending softened in May, with total seasonally adjusted growth down 0.9% annualized—marking the weakest reading in over a year. The pullback was driven by sharp declines in gasoline and retail spending, partially offset by continued resilience in services, especially restaurants. The data suggest a combination of tariff-related “buying ahead,” lower fuel prices, and poor weather dampened activity, raising concerns about momentum even as the labor market remains supportive. Spending on electronics saw a sharp pullback after consumers stockpiled ahead of tariffs.

TSA checkpoint data show year-over-year air travel has turned negative—a historically reliable early signal of economic slowing.

Despite the spike in tariff revenues ($22 billion in May), the US budget deficit remains larger than it was in fiscal year 2024, amid rising interest expenses. Jobless claims data indicated some softening in the labor market. Initial jobless claims were unchanged at 248,000 for the week ended June 7, slightly above consensus. More significantly, continuing claims for the week ended May 31 rose by 54,000 to 1,956,000, surpassing forecasts and reaching their highest level since November 2021. The four-week moving average of initial claims also ticked up to its highest point since August 2023. The labor market appears to be softening.

Markets

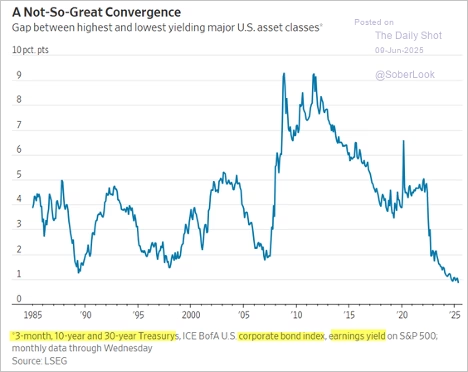

The yield gap across major US asset classes has collapsed to its narrowest in four decades, reflecting a rare convergence driven by elevated interest rates and high equity valuations. With Treasurys, corporate bonds, and stocks all yielding roughly the same, investors face diminished risk premia and must now reassess traditional compensation for duration and credit risk—or look abroad for relative value.

Yield convergence across stocks, bonds, and Treasurys has reached its narrowest level in 40 years.

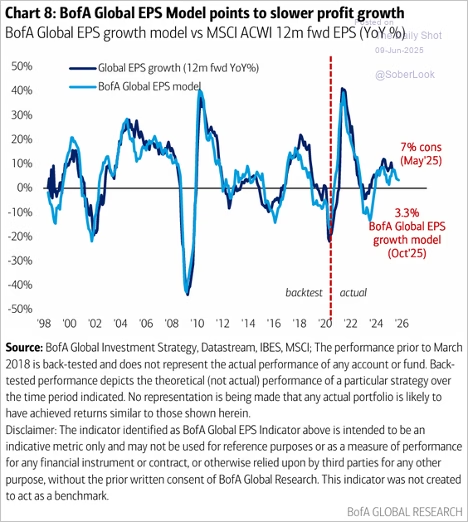

The BofA Global EPS model points to a notable deceleration in earnings growth, with forecasts dropping from 7% to just 3.3% YoY by October. This reflects weakening global macro signals—particularly in Asia exports and manufacturing PMIs—and suggests limited near-term upside for equities without a reacceleration in profit momentum.

BofA projects global earnings growth will slow to just 3.3% year-over-year by October.

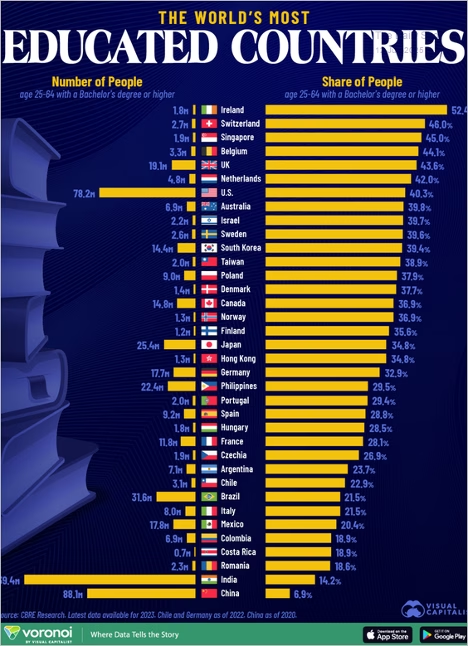

Countries with the highest number and share of adults with a bachelor’s degree or higher:

Ireland leads in education share, while the U.S. has the largest number of college-educated adults.

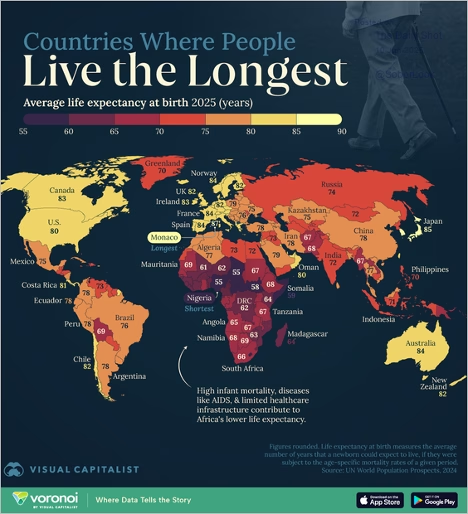

Average life expectancy at birth by country:

Monaco tops the list with the highest life expectancy; Africa continues to see the lowest rates.

The Russell 2000 is nearing resistance at the 200-day moving average.

The Russell 2000 approaches resistance at its 200-day moving average, indicating potential headwinds.

US small-caps have a higher weighting to financials, healthcare, and industrials.

Retail investor exposure to the Magnificent 7 has dropped sharply—from around 10% last summer to just over 1% as of June 2025—indicating a significant rotation away from mega-cap tech.

The Bloomberg Dollar Spot Index has extended its slide, now down nearly 10% from recent highs and reaching its lowest level since early 2023. A surge in hedging by foreign investors—particularly pension funds— is amplifying the dollar’s decline.

The U.S. dollar has declined nearly 10%, reaching its lowest level since early 2023.

Market concentration in the S&P 500 has reached extreme levels, with the Herfindahl-Hirschman Index implying effective membership has fallen to just 52 stocks—the lowest since at least 1990. This reflects unprecedented dominance by a small group of mega-cap firms.

Market concentration has surged, with only 52 stocks accounting for most of the S&P 500’s weight.

Bearish sentiment among US individual investors has dropped sharply from recent highs, now hovering near the lowest levels since late 2023. The S&P 500’s recent path stands out as one of the steepest post-peak drawdowns followed by one of the strongest recoveries in over five decades. Despite elevated tariffs, excess liquidity appears to have fueled an unusually swift rebound, lifting the index well above the historical recovery range after a >10% decline.

The Fed

The market is growing increasingly skeptical about the likelihood of two Fed rate cuts this year. The May CPI print was notably soft, with both headline and core figures coming in well below forecasts.

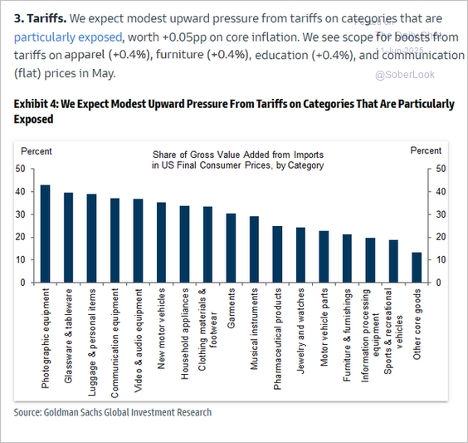

Tariffs

Tariff exposure remains concentrated in import-heavy categories like photographic equipment, glassware, and communication gear, all with over 30% value-added from imports. While the overall inflation effect is limited, specific consumer goods could see sharper price increases.

Products like photographic gear and communication devices face the highest tariff-related inflation risk.

Only 52.4% of tariff-sensitive CPI components rose in May.

In May, only 52.4% of tariff-sensitive CPI items increased, suggesting limited immediate impact.

Despite May’s softer inflation print for tariff-sensitive core goods, Nomura expects a significant pickup in price pressures ahead. The chart below suggests a lagged pass-through effect, likely due to pre-tariff inventory stockpiling and delayed implementation of new tariff rates. As inventories normalize and effective tariffs rise, upward pressure on core goods prices is expected to intensify, reversing May’s decline and contributing more noticeably to overall core inflation.

Great Quotes

“We are not humans having a spiritual experience. We are spirits having a human experience.”

– Teilhard de Chardin

Picture of the Week

Happy Father’s Day!

Picture of the Week: Celebrating Father’s Day with joy and light.

All content is the opinion of Brian Decker

Leave A Comment