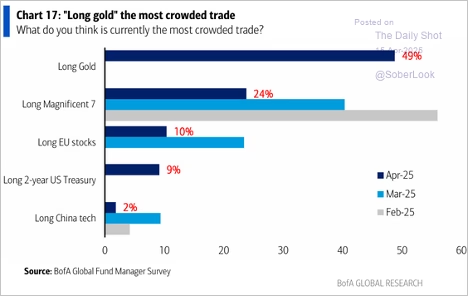

“Long gold” has overtaken “long Magnificent 7” as the most crowded trade for the first time in over two years, reflecting a sharp pivot toward defensive positioning amid rising macro and geopolitical risks.

Investor conviction in gold has surged, with 42% now expecting it to be 2025’s top-performing asset—nearly doubling from March. Meanwhile, global equities have seen a dramatic loss of favor, falling from the top spot to fourth, reflecting a pronounced flight to safety.

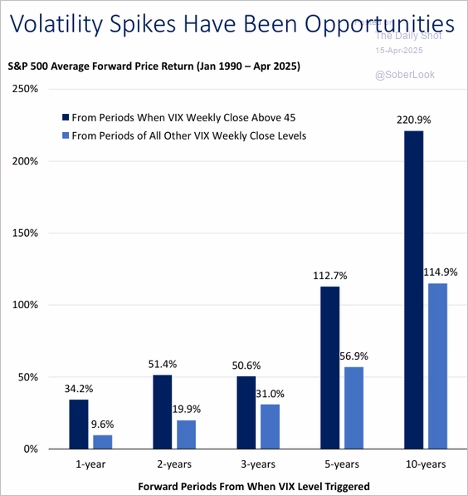

Goldman sees oil prices trending lower over the next couple of years. The VIX closing above 45 signals extreme investor fear, historically marking strong long-term buying opportunities. Following such spikes, the S&P 500 has more than doubled on average over five years—significantly outperforming periods of lower volatility. Opportunistic rebalancing during these dislocations can enhance long-term portfolio resilience.

Source: Merrill Lynch

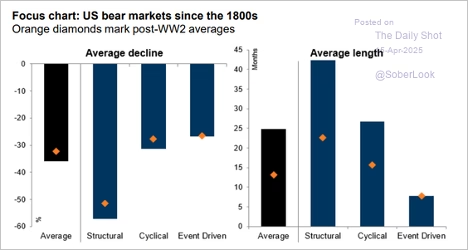

Structural bear markets have historically been the deepest and longest, averaging over 55% declines and lasting nearly four years. In contrast, event-driven bears tend to be shorter and shallower, with quicker recoveries—averaging around 30% declines and under 10 months in duration. Post-WWII averages (orange diamonds) suggest more moderate outcomes relative to the broader historical record.

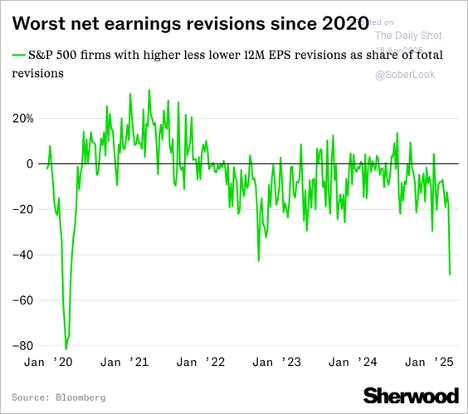

Analysts have accelerated earnings downgrades for global and US stocks, with net revisions turning sharply negative.

Investors view the US profit outlook as the most unfavorable since 2007.

Economy

The PPI report surprised to the downside, with the headline figure posting a sharp decline last month. Trade services PPI (a measure of business markups) declined for the second consecutive month, indicating shrinking margins. However, higher tariffs could lift the core PCE measure in the months ahead.

The April U. Michigan consumer sentiment index reflects outright panic among US households. The March NY Fed Survey of Consumer Expectations revealed a sharp rise in the percentage of Americans anticipating higher unemployment, aligning with findings from the April University of Michigan consumer survey. More Americans are unsure about their financial situation over the next 12 months.

Measures of expected financial situation have collapsed. Is the pessimism overdone?

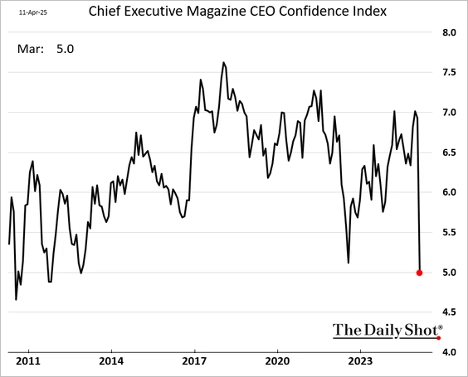

CEO sentiment has also deteriorated.

The dollar index dipped to its lowest level in over three years.

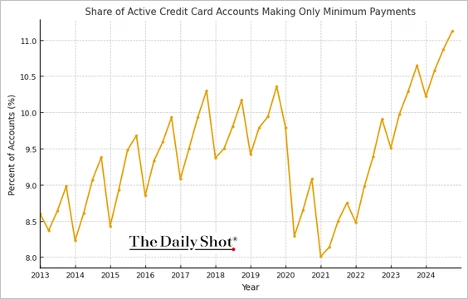

The share of Americans making only the minimum payments on their credit card accounts hit a multi-year high.

Source: @wealth Read full article

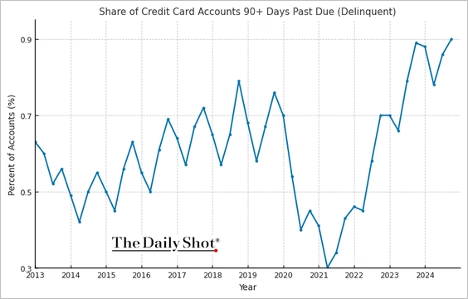

A rising share of credit card accounts are delinquent.

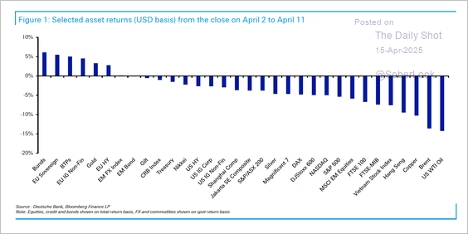

Here is a look at post-“Liberation Day” performance across key assets. Energy, copper, and equities fell the most, while European sovereign bonds and gold held up.

Source: Deutsche Bank Research

The Atlanta Fed’s GDPNow model now projects nearly flat GDP growth for Q1.

The Fed

Investor expectations for two or more Fed rate cuts in 2025 remain dominant, though the probability of deeper cuts (three or more) has risen notably since February. Meanwhile, the share expecting no change has dropped sharply.

The Fed faces a difficult position amid stagflationary concerns.

Source: @WSJ Read full article

The market is pricing in over 90 bps of rate cuts this year.

Great Quotes

“The people who are crazy enough to think they can change the world are the ones who do.” —Steve Jobs

Picture of the Week

The Interlace in Singapore

All content is the opinion of Brian Decker