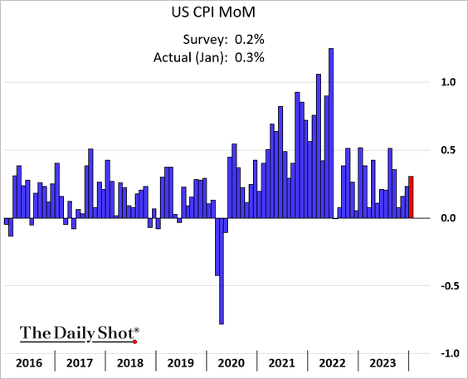

- The January CPI report exceeded forecasts, indicating a bumpy path toward the Fed’s 2% target.

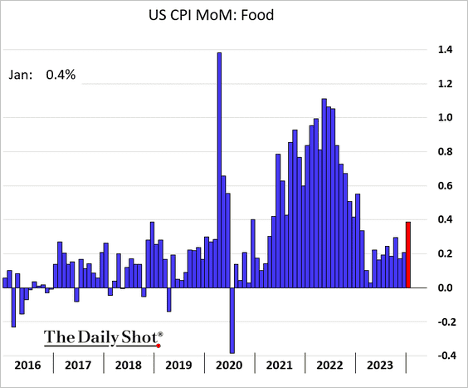

- Food price gains intensified.

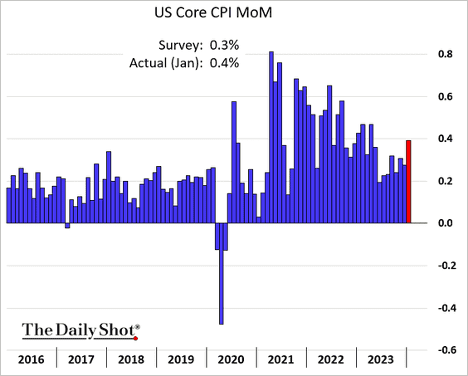

- Core inflation accelerated.

- The core goods CPI declined. Below are some examples.

- – Used cars:

- – Apparel:

- – Medications:

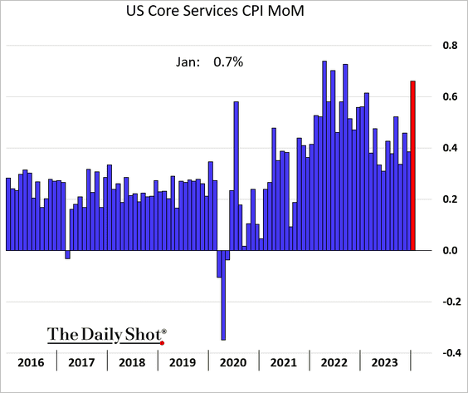

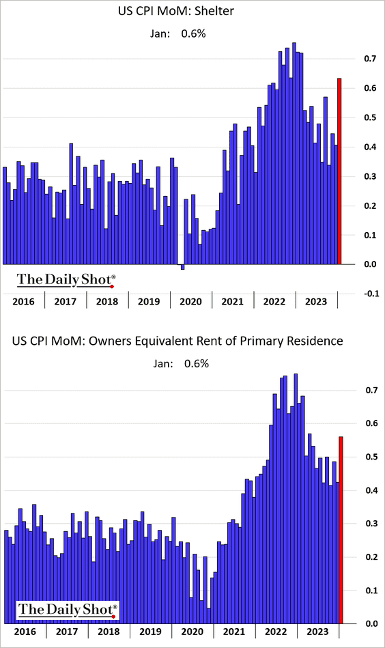

- Core services CPI climbed at the fastest pace since 2022, …

- … propelled by shelter inflation, particularly owners’ equivalent rent (OER).

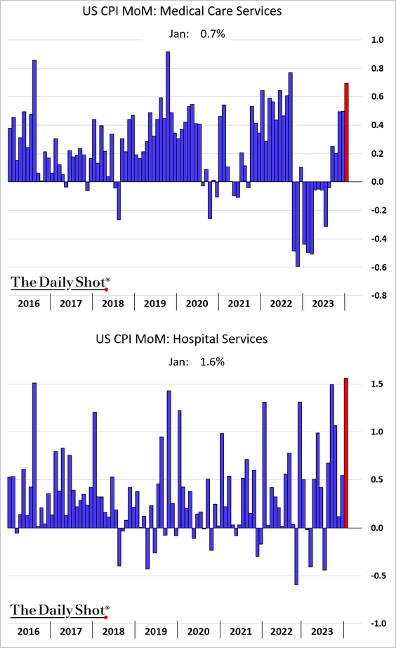

- Medical care services CPI accelerated.

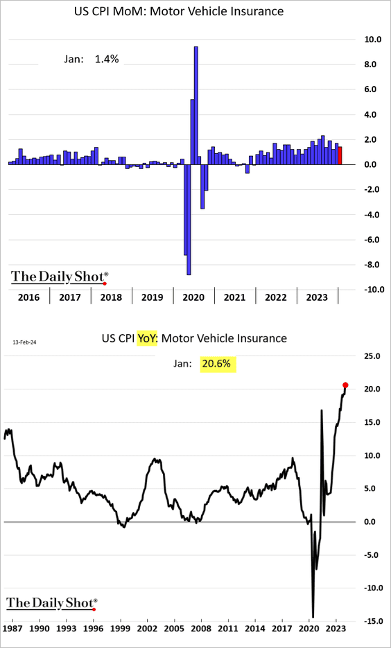

- Auto insurance costs were up almost 21% year-over-year.

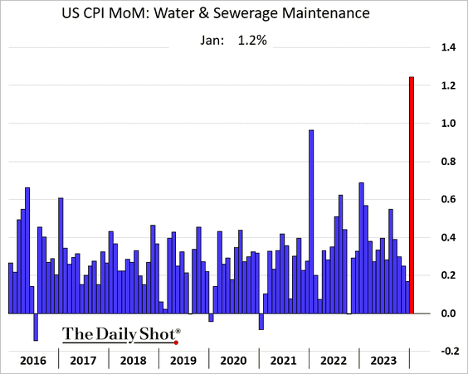

- Water and sewage maintenance CPI soared.

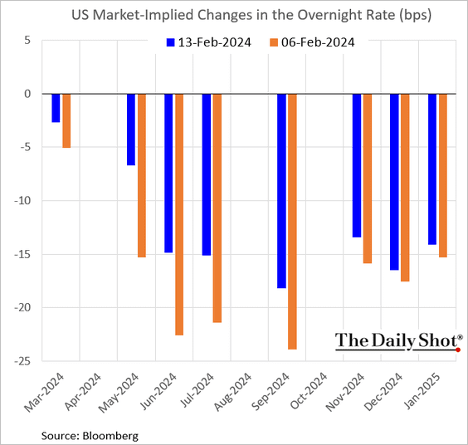

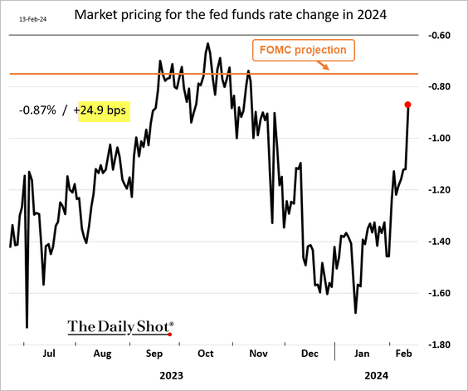

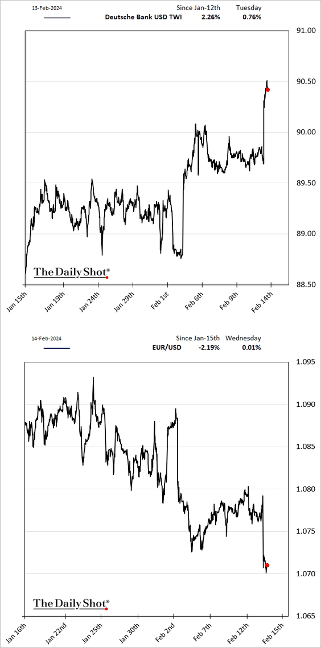

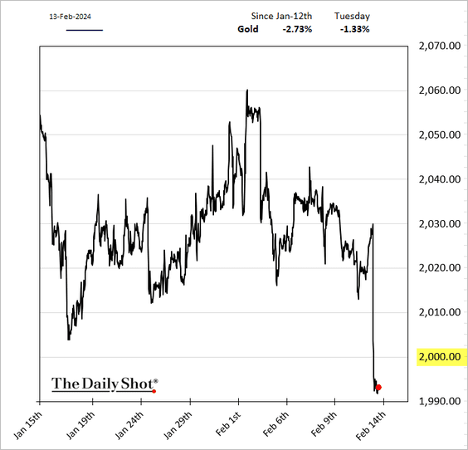

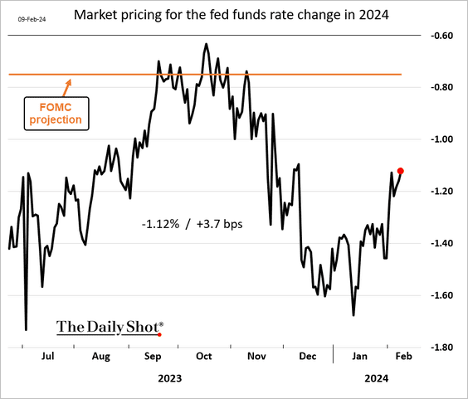

- Expectations for Fed rate cuts were scaled back substantially after the CPI report.

- A full rate cut was removed from market expectations for 2024 on Tuesday, aligning more closely with the FOMC’s dot-plot.

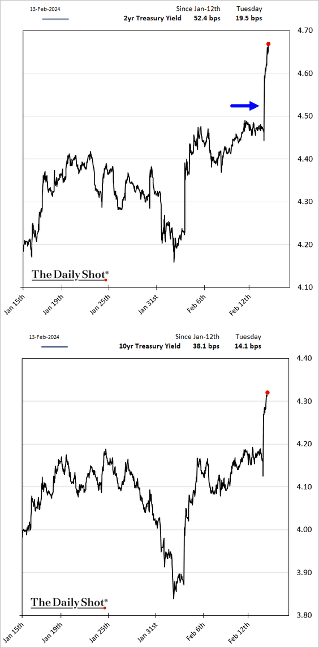

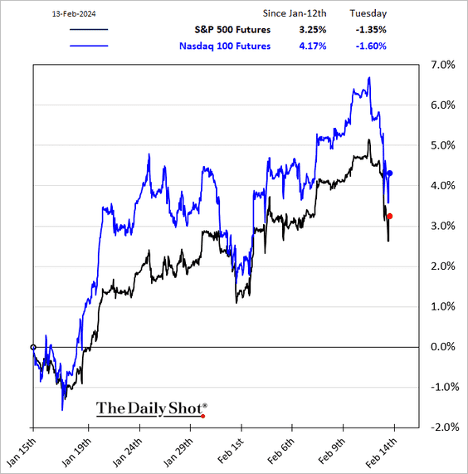

- Below are some additional market reactions to the January inflation data.

- Treasury yields:

- Equities:

- The dollar:

- Gold:

US Economy

- The market continues to scale back Fed rate cut expectations for 2024.

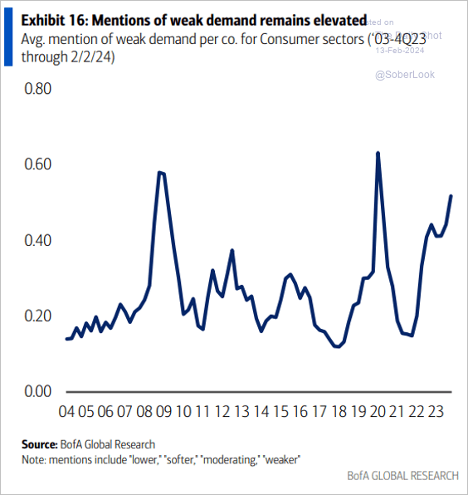

- Companies in consumer sectors increasingly mention “weak demand.”

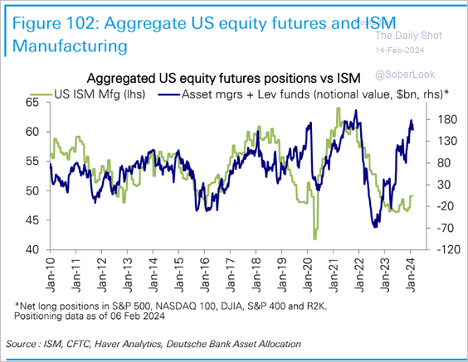

- The equity market is positioned for stronger economic activity this year.

Market Data

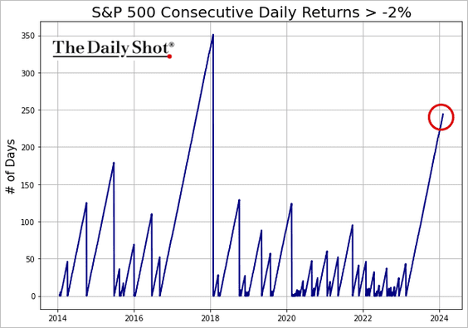

- It’s been a while since we had a 2% decline in the S&P 500.

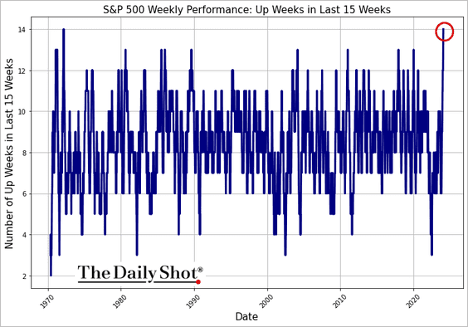

- The last time the S&P 500 was up 14 out of 15 weeks was in 1972.

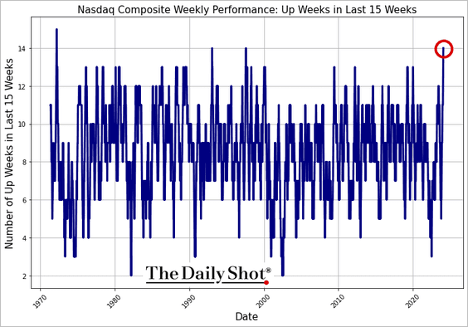

- For the Nasdaq Composite, it was in 1997.

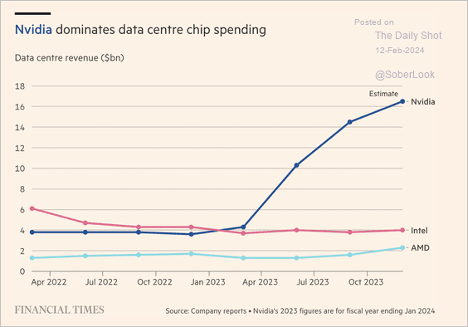

- Data center chip spending:

Source: @financialtimes Read full article

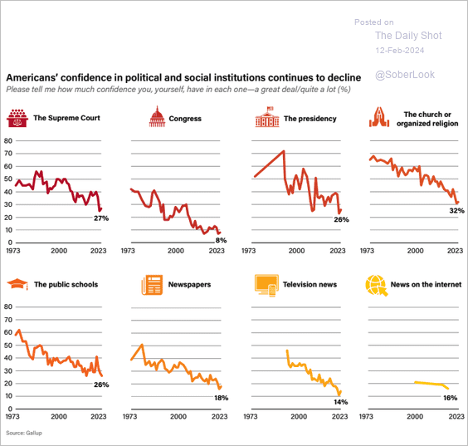

- Confidence in US institutions:

Source: Eurasia Group Read full article

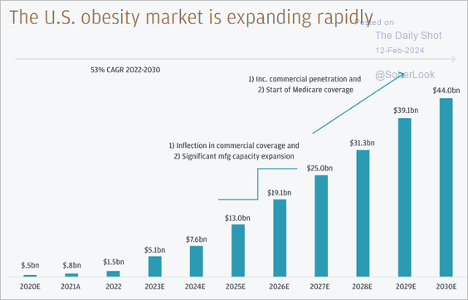

- US obesity rates:

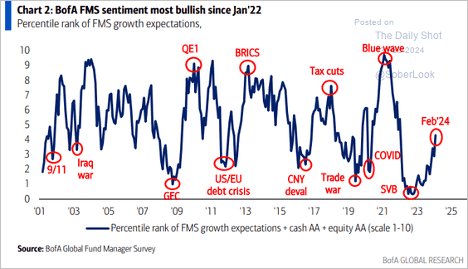

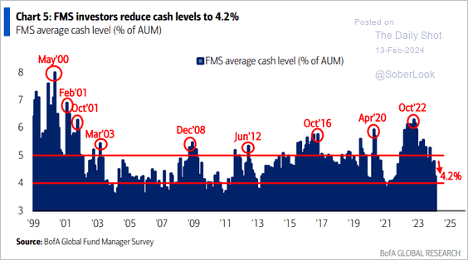

- Global investors are increasingly bullish, …

Source: BofA Global Research

- … drawing down their cash positions.

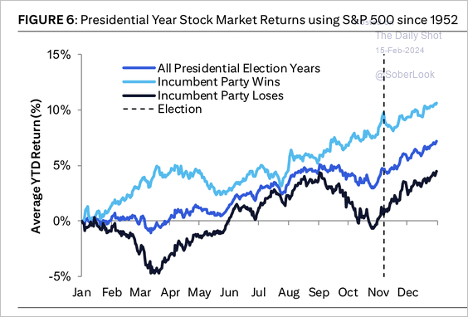

- The S&P 500 typically rises during election years, especially if the incumbent party wins.

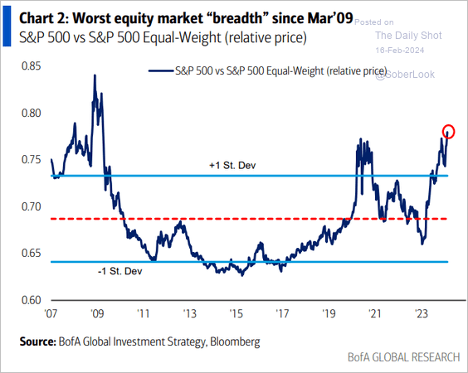

- As measured by the Cumulative Advance-Decline Line, the breadth of the Nasdaq Composite has remained depressed even as the index surged in recent months.

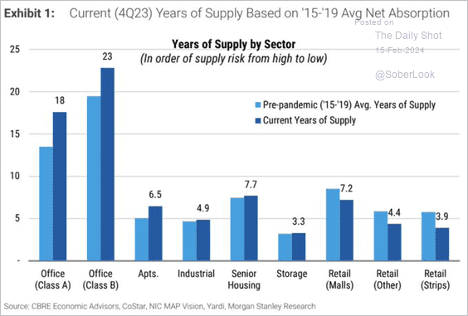

- Time it would take to absorb current CRE vacancies and under-construction inventory:

Source: Morgan Stanley Research; @AyeshaTariq

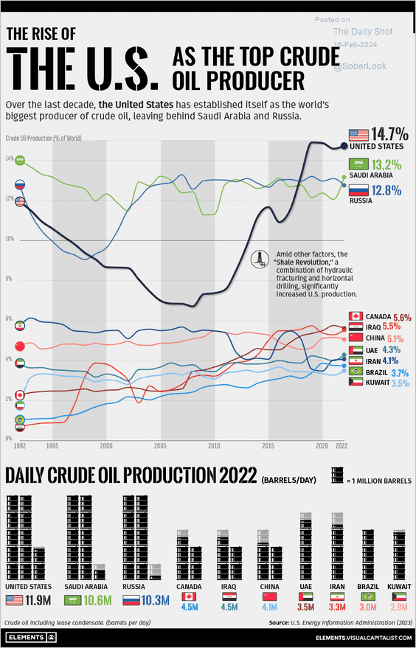

- Here is a look at crude oil production by country.

- The S&P 500’s outperformance relative to the average stock in the index has reached extreme levels.

Great Quotes

“Whether you think you can or think you cannot, you are right.” – Henry Ford

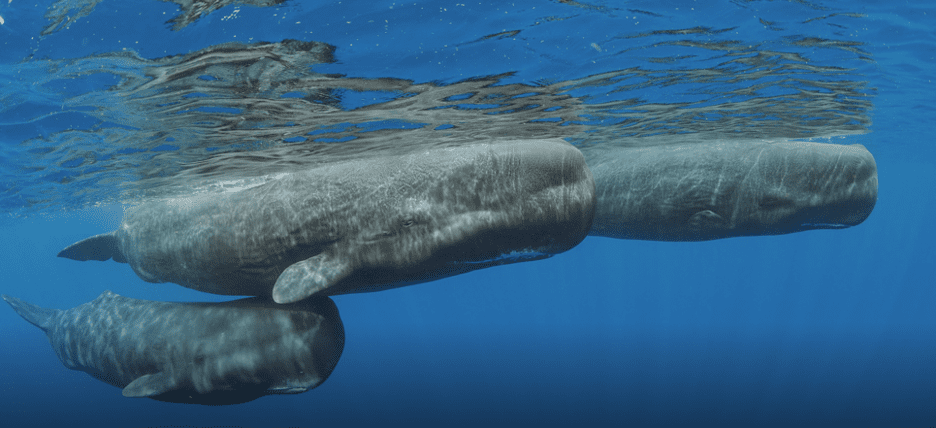

Picture of the Week

Sperm Whale pod, Dominica

All content is the opinion of Brian Decker