The US dollar is experiencing its worst start to the year in decades. The S&P 500 entered correction territory last Thursday, -10%. The S&P 600 (small caps) is nearing bear market territory, -20%. Government spending has been a key driver of corporate profits. Earnings revisions for both the Magnificent 7 and the broader S&P 493 have turned negative, signaling a broad-based deterioration in earnings expectations.

However….. markets are now oversold. BofA’s private clients have been buying the dip.

Economy:

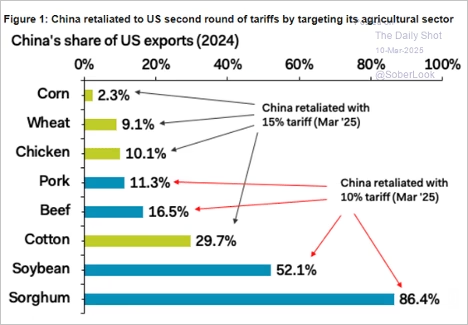

The February employment report fell slightly short of forecasts but remained relatively strong, bolstered by gains in healthcare. Layoffs in the federal government are starting to be reflected in the employment data. How much does the US rely on China for exports?

Source: Pantheon Macroeconomics

Job openings rose more than anticipated in January, signaling labor market stability early in the year. However, high-frequency data from LinkUp indicates a decline in job openings in recent weeks. Goldman Sachs has lowered its 2025 GDP growth forecast from 2.2% to 1.7%, citing the impact of new tariffs. Investors are growing increasingly anxious about weakening consumer spending.

The February CPI report came in softer than expected.

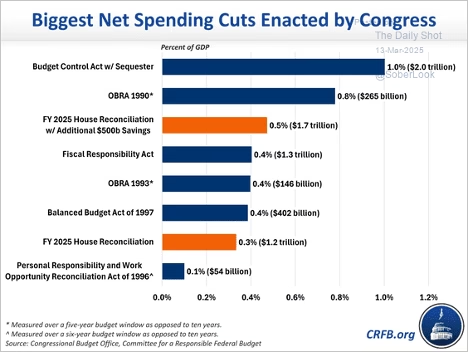

The House’s proposed $1.7 trillion of spending cuts would be one of the largest going back to 1990. However, according to CRFB, all other instances of recent large spending cuts have been associated with deficit reduction deals.

Source: CRFB Read full article

Current budget reconciliations face significantly higher debt levels compared to past spending cuts.

The Fed:

Economists expect milder inflation in February compared to January’s rise.

Great Quotes

“Better to remain silent and be thought a fool than to speak out and remove all doubt.” – Abraham Lincoln

Picture of the Week

St Patrick’s Day Today!

All content is the opinion of Brian Decker