- February’s job gains exceeded expectations, yet the underlying trends in the employment report indicate a softening labor market.

- Three sectors continue to propel job gains: healthcare, leisure & hospitality, and government (primarily public school teachers).

- The NY Fed’s consumer survey showed inflation expectations moving up last month, as gasoline prices climbed.

- Households expect slower inflation in food, medical care, and rent.

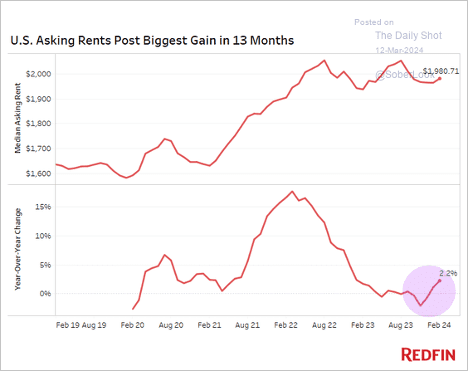

- But rent inflation is picking up again.

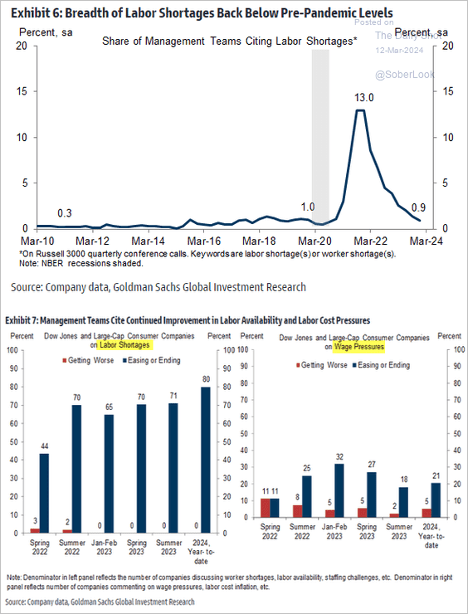

- Companies report that labor shortages are easing.

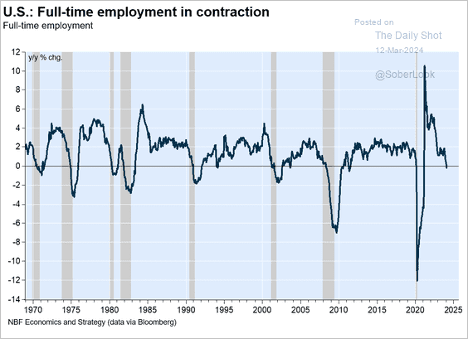

- Full-time employment is now down on a year-over-year basis. The grey is recession periods.

- Inflation strengthened in February, with the core CPI topping expectations again.

- Following eight months of declines, the core goods CPI registered an increase, boosted by a gain in used vehicle prices.

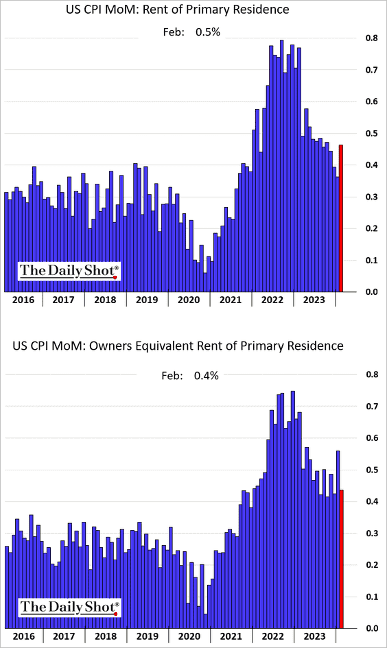

- The core services inflation continues to run hot, as rent inflation accelerated. The Owner’s Equivalent Rent CPI (second panel) moderated from January’s spike but remains elevated.

- The probability of a Fed rate cut in May tumbled in response to the hot CPI print.

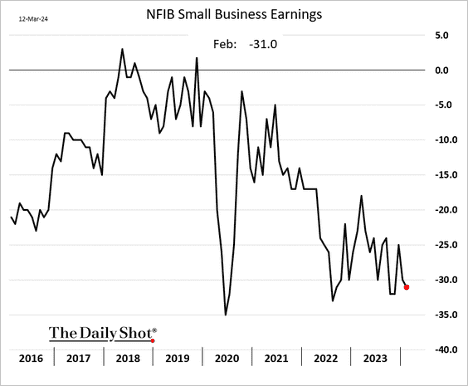

- Small businesses continue to report soft earnings.

- Last month’s producer prices topped expectations, reflecting persistent inflationary pressures.

Source: CNBC Read full article

- Even with the rise in WARN notices, initial jobless claims remained close to multi-year lows last week, suggesting that the labor market is still tight.

- Markets reacted sharply to the hot PPI report and low jobless claims, leading to further reductions in projections for Fed rate cuts this year.

- However, market participants are concerned that the dot plot will shift higher at next week’s FOMC meeting.

Source: MarketWatch Read full article

Market Data

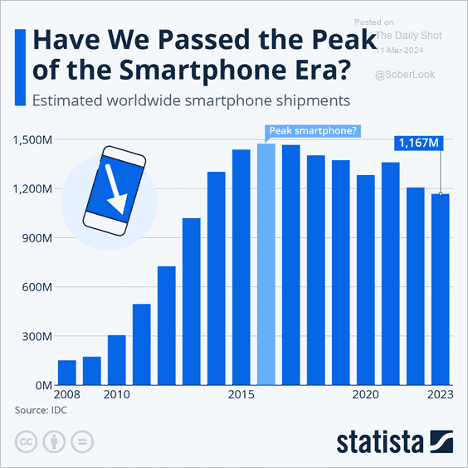

- Smartphone shipments:

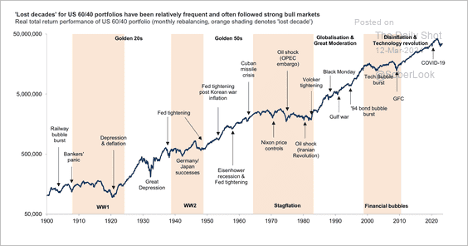

- This chart shows the historical real total return performance of a US 60% equity/40% bond portfolio with shaded “lost decades.”

Source: Goldman Sachs

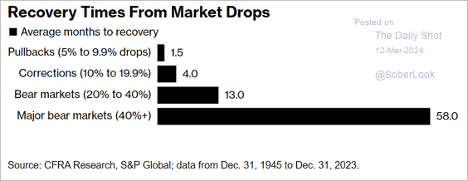

- Here is a look at recovery times after market declines.

Source: @wealth Read full article

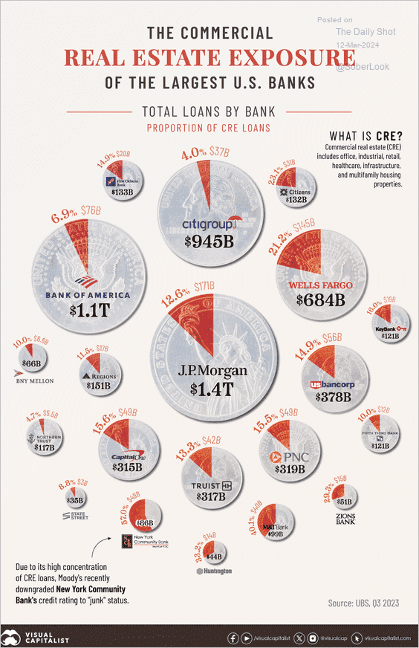

- Here is a look at US banks’ commercial real estate exposure.

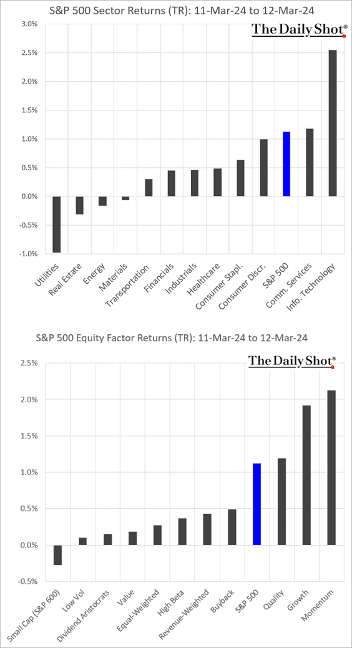

- Which sectors and equity factors contributed to market gains on the day the core CPI exceeded expectations?

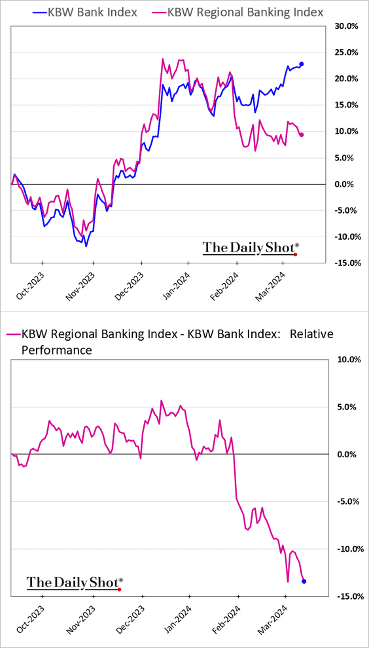

- Regional banks continue to widen their underperformance, …

- … as earnings expectations deteriorate.

- Here is a look at the tech sector’s share of the overall market cap.

Great Quotes

“When I was a kid my parents moved a lot, but I always found them.” Rodney Dangerfield

Picture of the Week

Bryce Canyon National Park

All content is the opinion of Brian Decker