Moody’s Investors Service changed its outlook on the United States credit rating from stable to negative on Friday over large fiscal deficits and declining debt affordability.

The agency further warned of “political polarization” within the United States Congress as politicians struggle to pass any plan to fund the federal government through next year, let alone with the needed cuts.

“Recently, multiple events have illustrated the depth of political divisions in the U.S.: Renewed debt limit brinkmanship, the first ouster of a House Speaker in U.S. history, prolonged inability of Congress to select a new House Speaker, and increased threats of another partial government shutdown,” Moody’s said.

Although Moody’s is warning of the risks, it still kept the U.S.’s “AAA” rating. It’s the last of the three major U.S. government credit rating agencies to do so.

Fitch downgraded its U.S. credit rating from “AAA” to “AA+” in August, and S&P Global did the same in 2011.

The Biden administration reacted to the announcement in a mixed fashion.

Deputy Treasury Secretary Wally Adeyemo slammed the move, arguing that “The American economy remains strong, and Treasury securities are the world’s preeminent safe and liquid asset.”

White House press secretary Karine Jean-Pierre, however, blamed House Republicans for the change, alluding to their struggles over Ukraine funding, spending cuts, and finding a House speaker.

Rep. Andy Harris of Maryland, a House Committee on Appropriations member, placed the blame on “out-of-control government spending and deficits.”

“We cannot, in good conscience, continue writing blank checks to our federal government knowing that our children and grandchildren will be responsible for the largest debt in American history,” Harris argued on X.

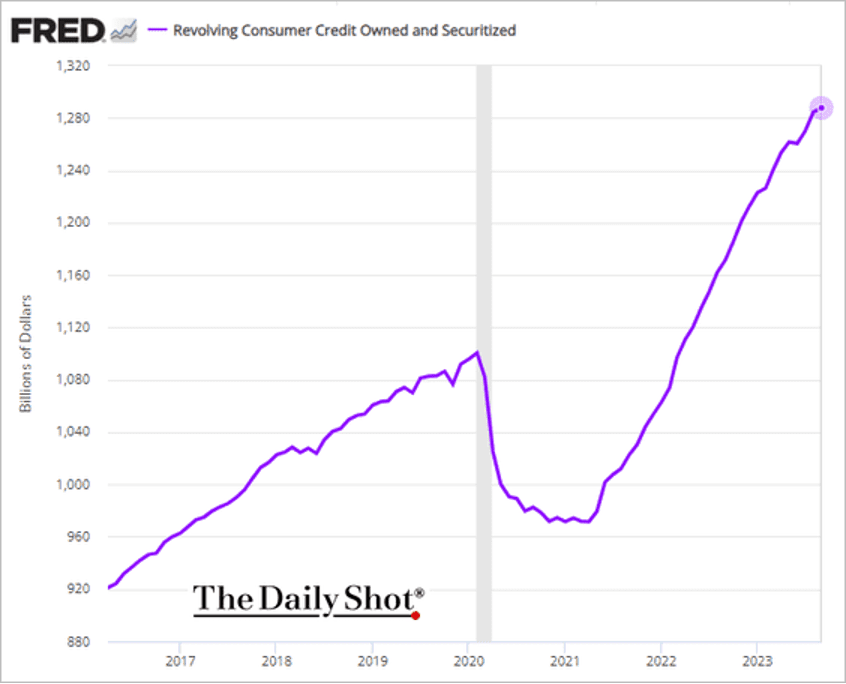

Credit Card Debt

Americans’ credit card debt swelled $154B Y/Y to a record $1.08T in Q3, according to the Federal Reserve Bank of New York, notching the largest increase since it began tracking household debt in 1999. Interestingly, millennials saw the most credit card delinquencies. “Credit card balances experienced a large jump, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, economic research advisor at the NY Fed. Bankrate analyst Ted Rossman also noted that credit card balances have been increasing faster than any other type of debt amid high inflation and record-high credit card rates, adding that “more people are using credit cards just to get by.” Credit card rates are at record highs, over 20%+.

Yield Curve Inversion

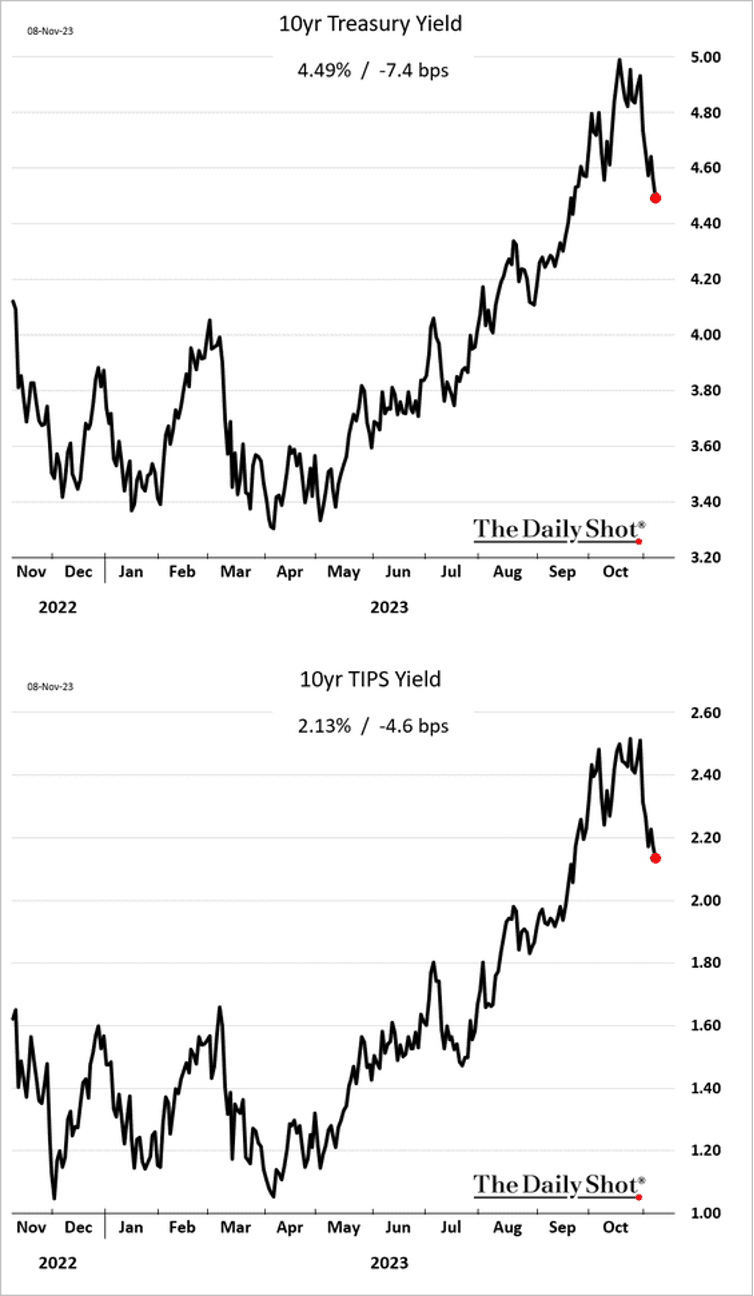

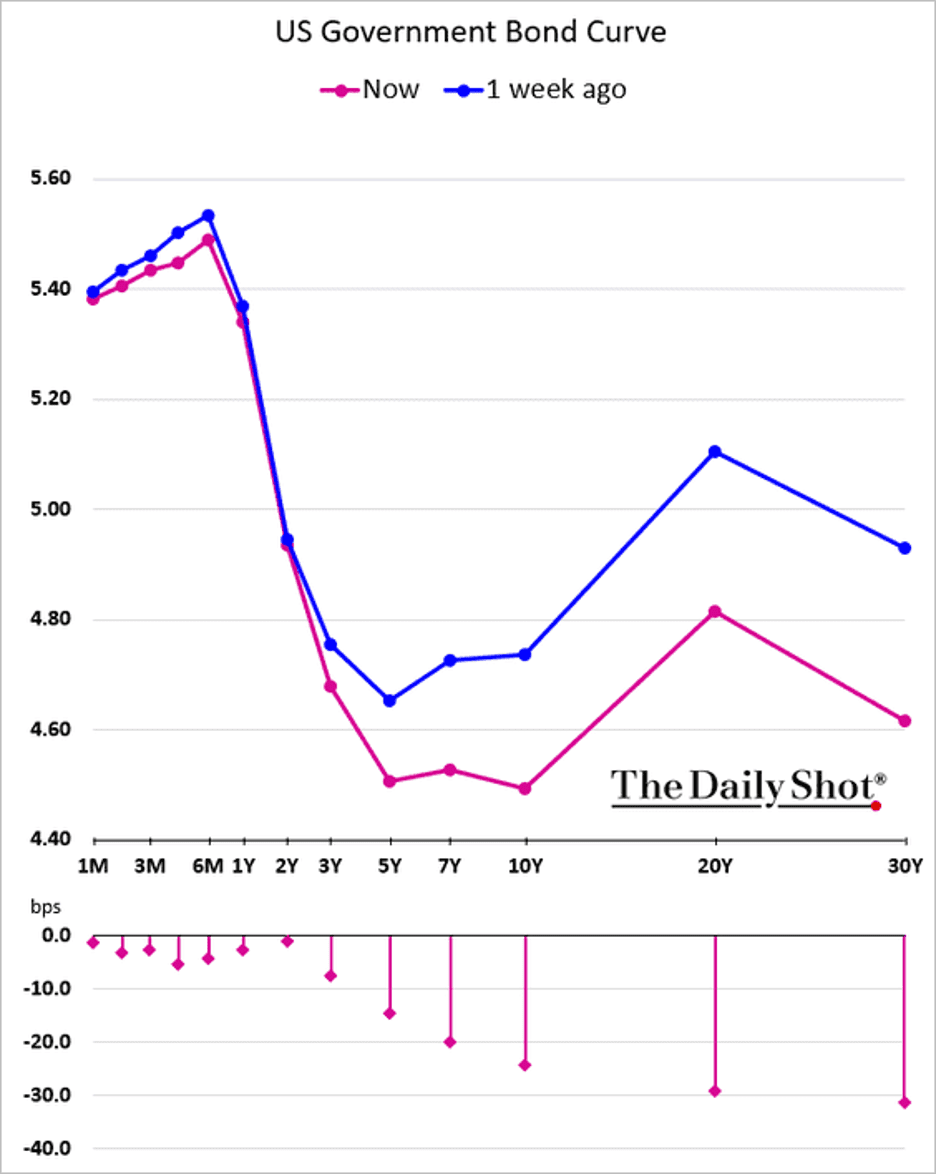

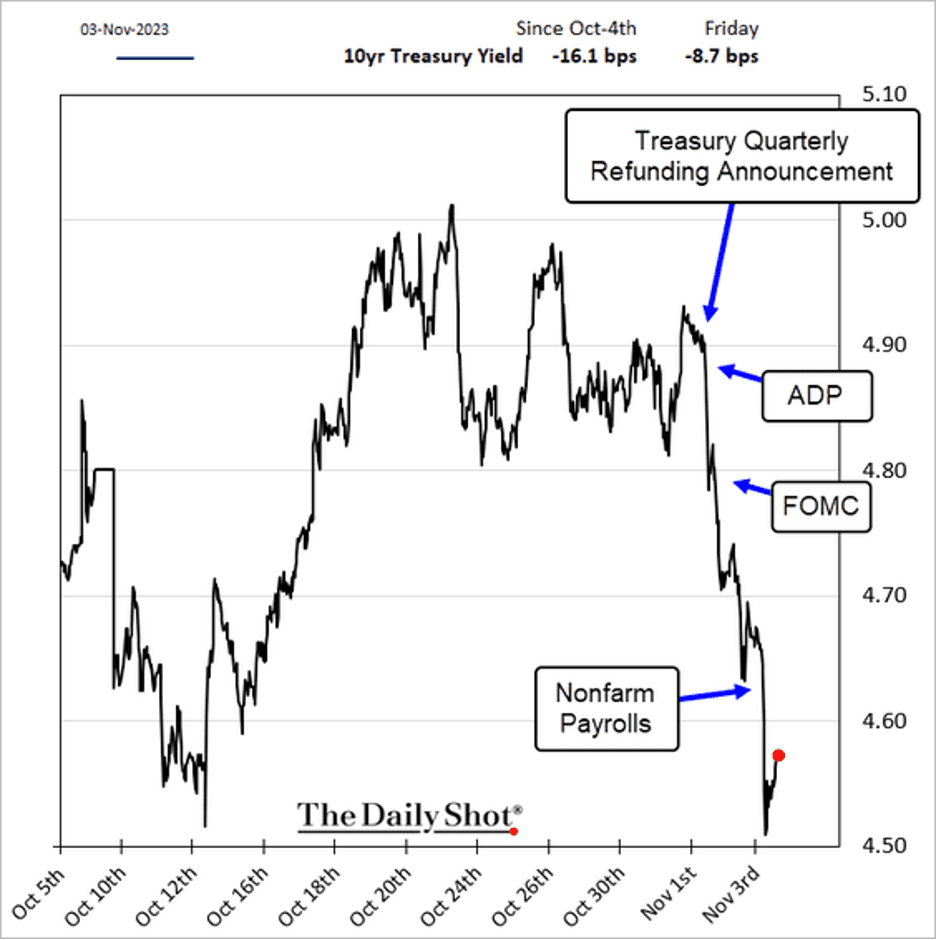

The retreat in Treasury yields, both nominal and real, continued last week.

The yield curve inversion has intensified in the past few days.

US Economy

- After consistently surpassing forecasts, last month’s US payrolls surprised to the downside, signaling a cooling labor market.

- The UAW strike was a drag on job growth.

- Markets now see very little chance of another Fed rate hike in this cycle.

- The terminal rate is closing in on the current fed funds rate of 5.33%,and the market is pricing in deeper cuts over the next couple of years.

- Treasury yields tumbled.

- 10-year yield:

- Risk assets had a great week.

- The US dollar took a hit.

- Student debt, credit cards, and auto loan payments are becoming a drag on consumer spending.

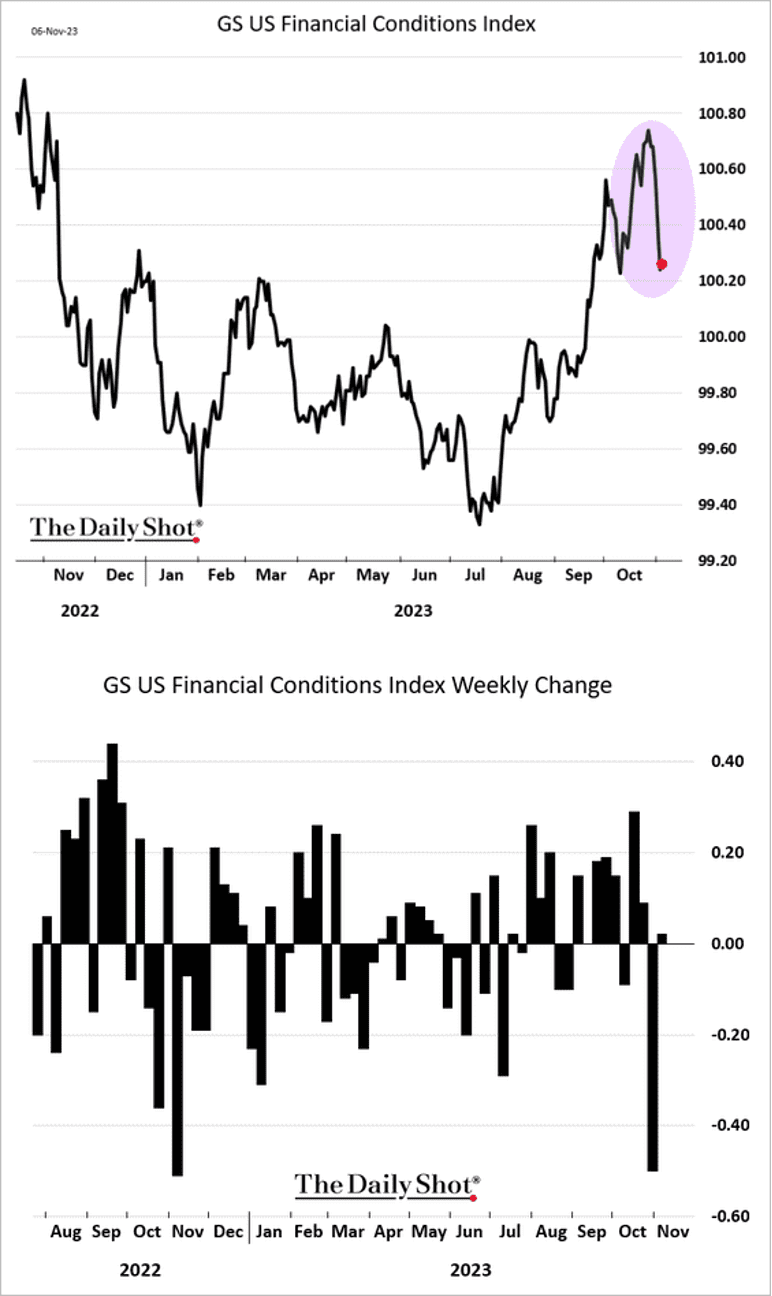

- US financial conditions eased sharply over the past few days.

- Banks continue to report tightening credit standards and softer demand.

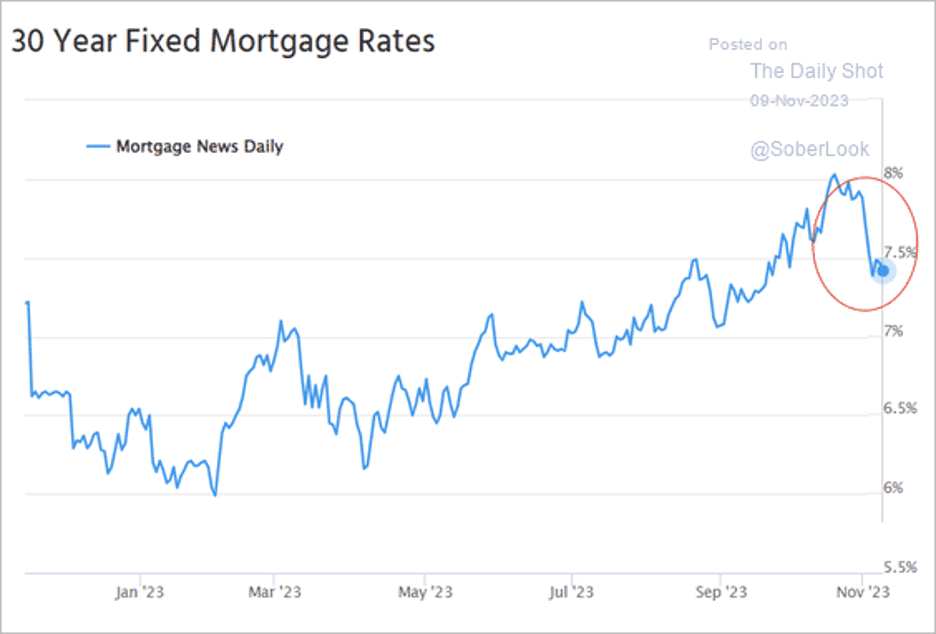

- The sharp pullback in mortgage rates …

Source: Mortgage News Daily

- … resulted in a modest gain in mortgage applications.

- Homebuilders are increasingly offering incentives.

- The Atlanta Fed’s GDPNow model is tracking the Q4 growth at above 2% (annualized), boosted by expectations of robust consumer spending.

- Goldman increasingly expects the US to avoid a recession.

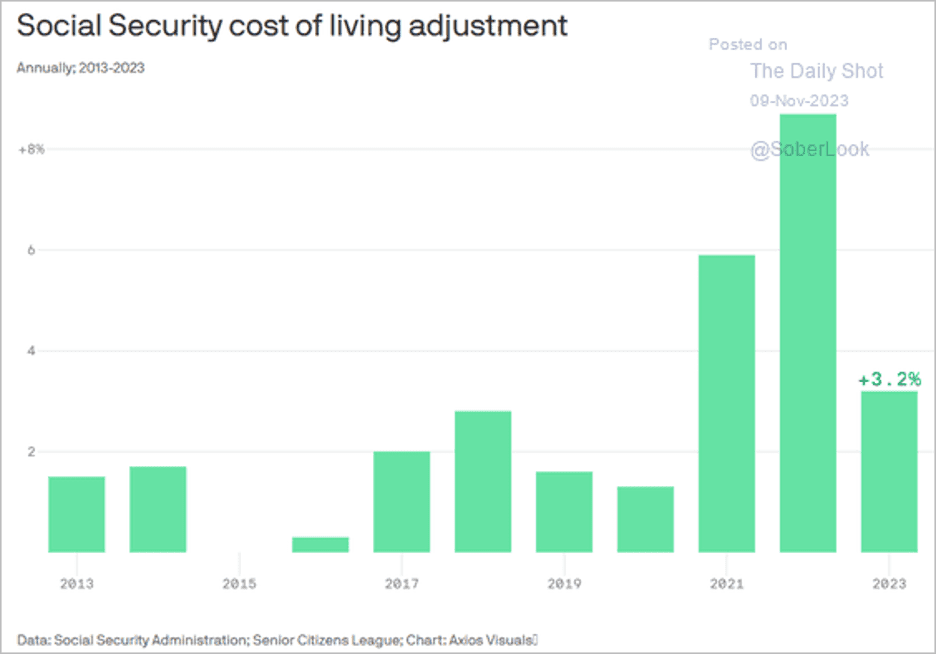

- Social Security cost-of-living adjustments:

Market Data

- Earnings downgrades have exceeded upgrades for eight weeks in a row.

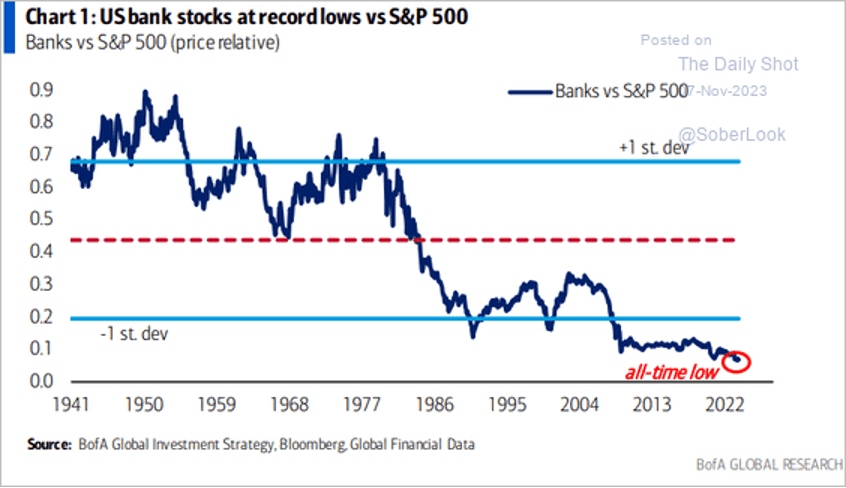

- Banks’ underperformance has been remarkable.

- US business borrowing remains sluggish while consumers have been tapping their credit cards.

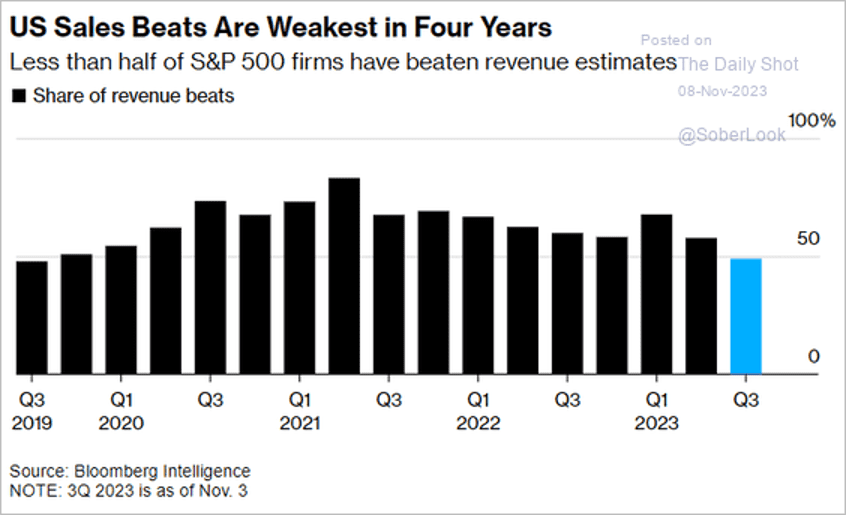

- Fewer firms have been beating sales forecasts.

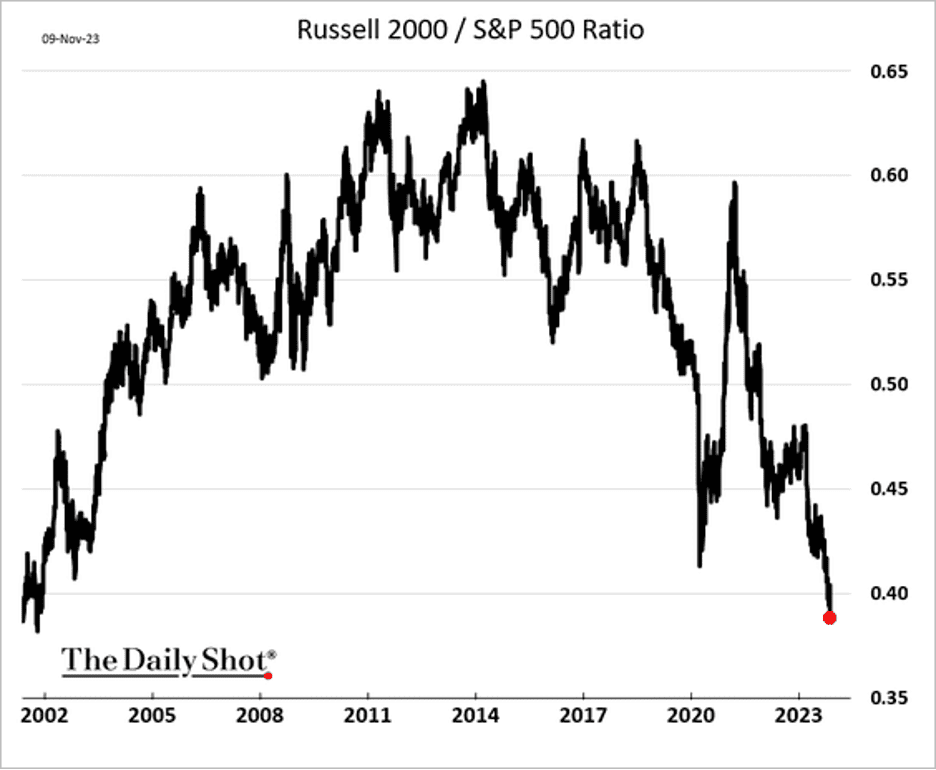

- Small-cap underperformance continues. The Russell 2000 ratio to the S&P 500 has reached its lowest point in more than two decades.

Great Quotes

“I want my children to have all the things I couldn’t afford. Then I want to move in with them.”

—Phyllis Diller

Picture of the Week

Aspen Grove

All content is the opinion of Brian Decker