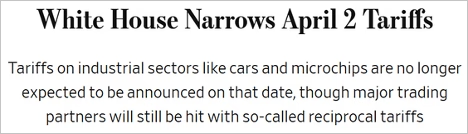

Equity futures are higher this morning, as the White House tariffs are now expected to be less extensive than initially feared.

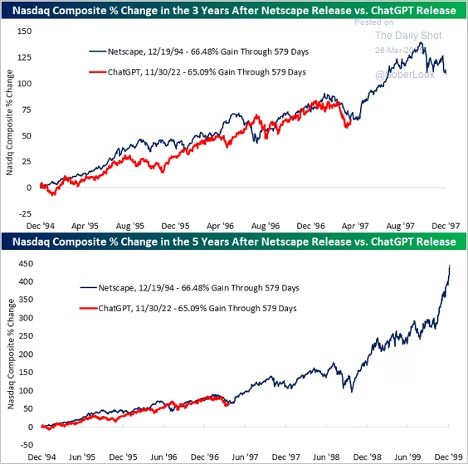

The Nasdaq’s performance in the 579 days following ChatGPT’s release closely mirrors the post-Netscape trajectory in the mid-90s, with both showing gains of around 65%. If the analogy holds, the Netscape era suggests potential for significant upside ahead—though that path was marked by increased volatility and speculative froth before the dot-com peak.

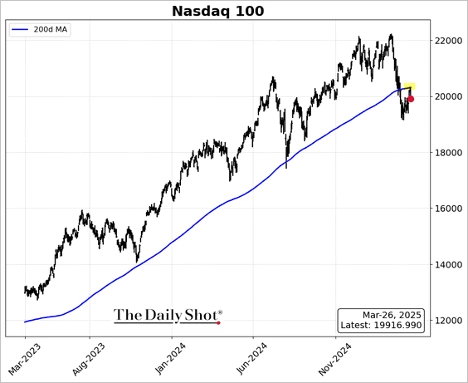

The Nasdaq 100 hit resistance at the 200-day moving average on Wednesday.

S&P 500 forward earnings expectations continue to rise, while Russell 2000 EPS has remained flat since 2022.

Markets continue to reflect persistent inflation concerns. US retail investors bought the dip during the latest selloff, concentrating on single stocks.

Economy:

Businesses are experiencing heightened uncertainty, as reflected in the Fed’s Beige Book report. The FOMC also reported greater uncertainty in their projections for economic growth. The longer trade policy uncertainty persists, the more significant the drag on real GDP is likely to be.

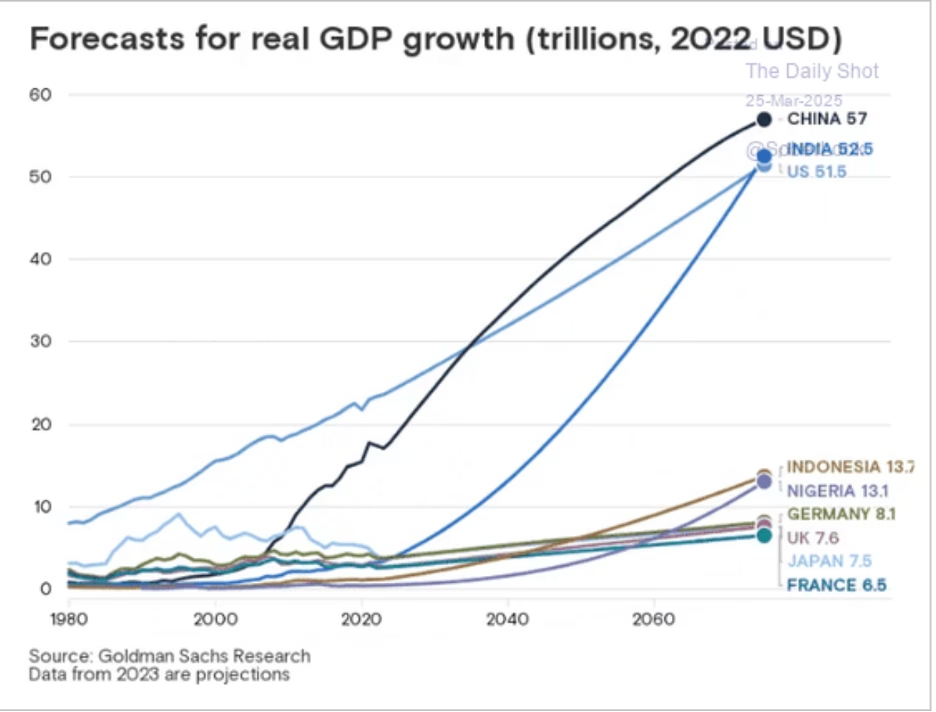

The services PMI indicator from S&P Global showed an acceleration in activity this month (fueled in part by warmer weather), easing concerns about an economic slowdown. On the other hand, factory activity was back in contraction territory. US consumer spending is increasingly dependent on the top 10% of households by income. Here is Goldman’s forecast for GDP growth trajectories in the largest economies.

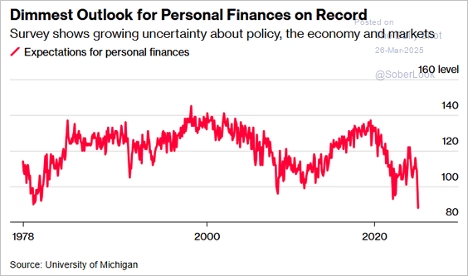

US consumer confidence deteriorated further this month, according to the Conference Board’s survey. Here is the outlook for personal finances.

Source: @economics Read full article

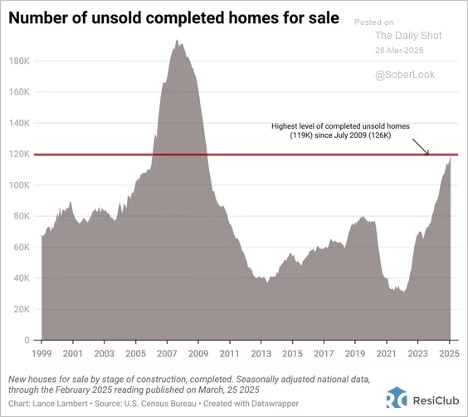

New housing inventories remain at multi-year highs.

Existing home prices rose again last month. Pending home sales remain at multi-year lows.

US durable goods orders rose more than expected in February.

Shipments of AI-related tech accelerated. February’s 0.9% jump in capital goods shipments suggests a front-loaded boost to investment activity in anticipation of incoming tariffs. However, the decline in core orders (-0.3%) points to waning momentum, reinforcing concerns that underlying CapEx demand remains fragile amid policy uncertainty.

The Fed:

Dampening market sentiment a bit was a key inflation reading that came in a tad hotter than anticipated on Friday. The Fed’s preferred inflation gauge—the core personal consumption expenditures price index—rose 0.4% M/M in February, compared to a consensus of +0.3%. On an annual basis, the index ticked up +2.8%, versus an estimate of +2.7%.

Great Quotes

“Success is not the key to happiness. Happiness is the key to success.” – Albert Schweitzer

Picture of the Week

The Xiaozhai Tiankeng, also known as the Heavenly Pit, is the world’s deepest sinkhole.

Located in Fengjie County of Chongqing Municipality in China, it is 626 meters (2,054 feet) long, 537 meters (1,762 feet) wide, and between 511 and 662 meters (1,677 and 2,172 ft) deep.

All content is the opinion of Brian Decker