- Residential construction held up well last month amid tight inventories.

- Building permits are back to last year’s levels.

- Multi-family construction remains relatively soft.

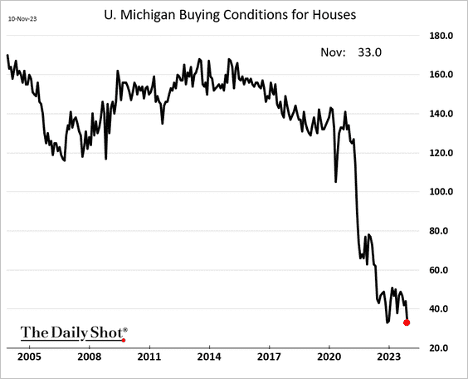

- Consumers view the current buying climate for houses as the worst in recent history.

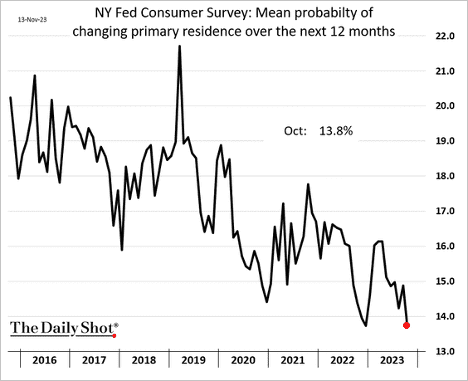

- Home inventories are further impacted by more Americans choosing to remain in their current residences due to high mortgage rates.

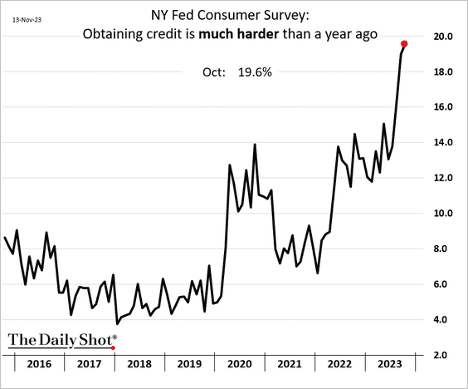

- More Americans are reporting challenges in obtaining credit.

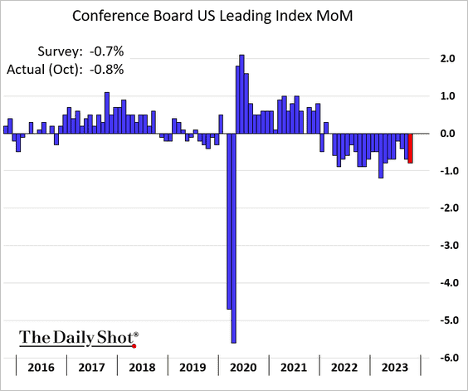

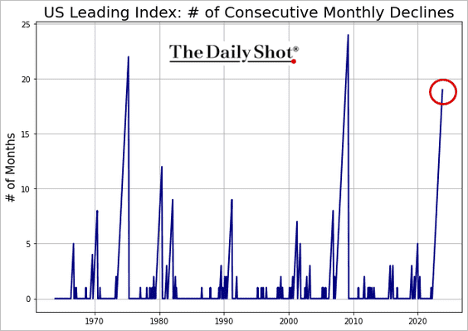

- The index of leading economic indicators (LEI) has recorded its 19th consecutive monthly decline.

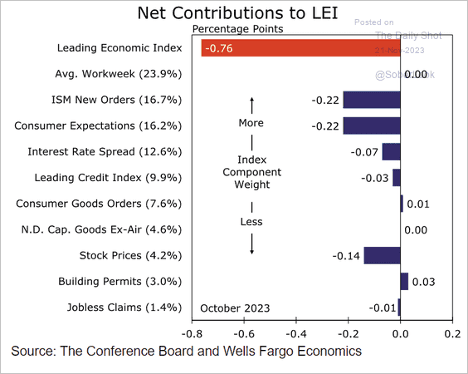

- Here are the contributions to last month’s changes.

Source: Wells Fargo Securities

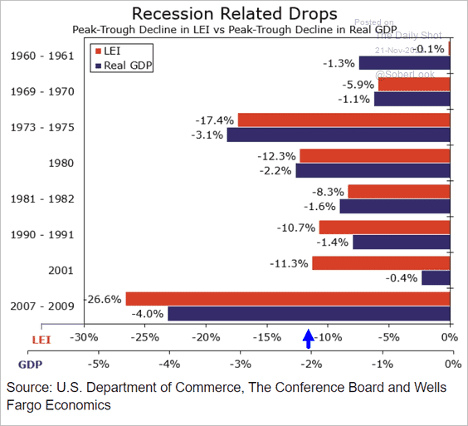

- The LEI is down 11.7% from the peak. How does the latest decline compare to previous downturns?

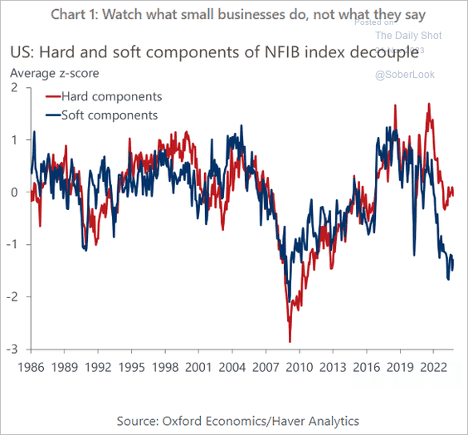

- While some sentiment measures from surveys show pessimism, hard data indicators, such as consumer spending, have been resilient.

- We also see this divergence in the NFIB small business data.

- US financial conditions continue to ease, driven by lower Treasury yields, tighter credit spreads, higher equity prices, and a lower US Dollar.

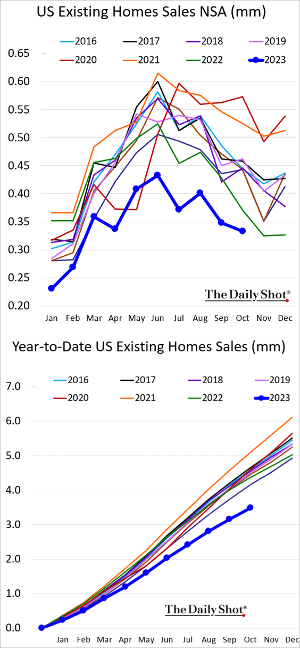

- Existing home sales remain at multi-year lows …

- … amid depressed affordability (which is not expected to improve much next year).

- The median home sales price reached a new record for this time of the year.

The Fed

- At their last meeting, the FOMC signaled a cautious approach towards additional rate hikes.

- FOMC Minutes: – In discussing the policy outlook, participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2 percent objective over time. All participants agreed that the Committee was in a position to proceed carefully and that policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks.

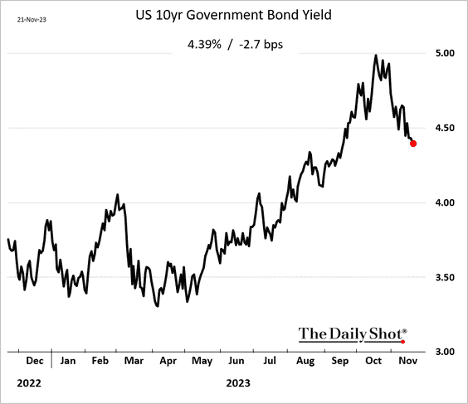

- The 10-year Treasury yield edged lower.

- It may be a while before we see the Fed’s first rate cut. The central bank has not previously cut rates with core CPI above 2.7% unless unemployment has also been comfortably above 5%.

Market Data

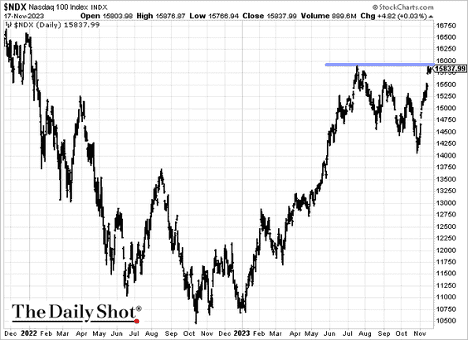

- The Nasdaq 100 is at resistance.

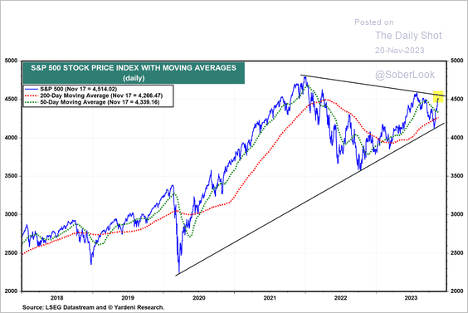

- A wedge pattern in the S&P 500?

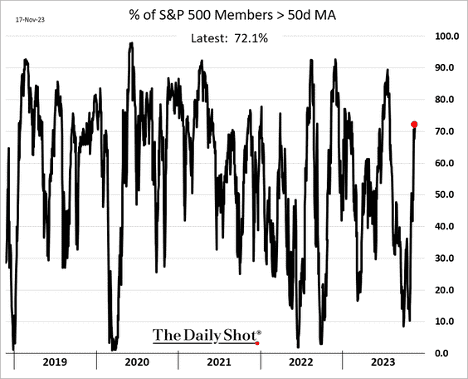

- The S&P 500 breadth has improved markedly.

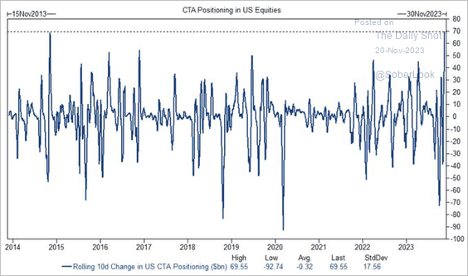

- CTAs have become upbeat on US equities.

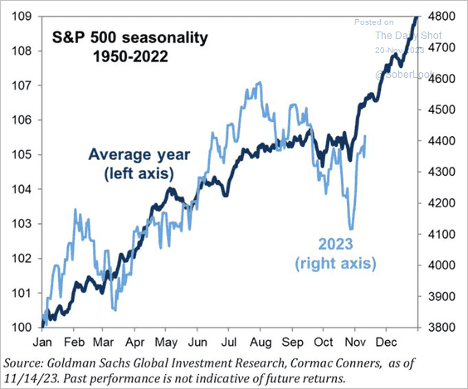

- Here is a look at the S&P 500 seasonality.

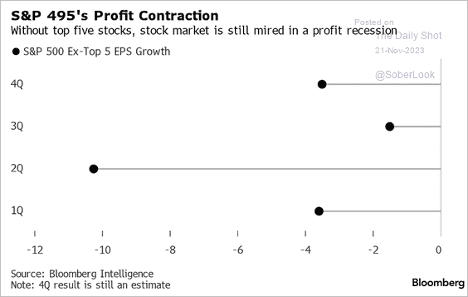

- The earnings recession persists when the five largest stocks are excluded.

Source: Simon White, Bloomberg Markets Live Blog

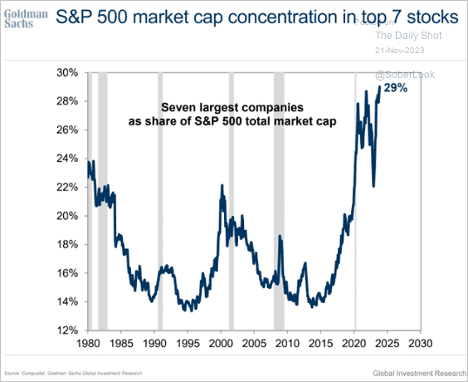

- The S&P 500 concentration is near record levels.

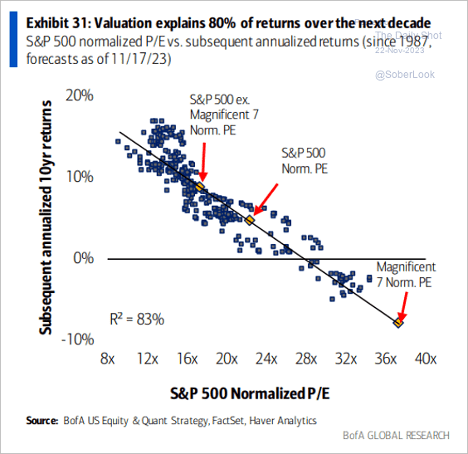

- Valuations point to low single-digit returns over the next decade.

Great Quotes

“Whenever I’m about to do something, I think, ‘Would an idiot do that?’ And if they would, I do not do that thing.”

—Dwight Schrute, The Office

Picture of the Week

Hoh Rain Forest, Olympic Peninsula WA state

All content is the opinion of Brian Decker