This headline from the Wall Street Journal last Tuesday…

OpenAI is the company behind ChatGPT, the artificial-intelligence (“AI”) app that has taken the world by storm this year.

The Journal article is incredible to me…

OpenAI is looking for a way to capitalize on the AI boom. It’s seeking a new market valuation of up to $90 billion. And yet, as the article revealed, the company expects to reach $1 billion in revenue this year.

In other words… OpenAI, an unprofitable startup, is currently valued at 80 to 90 times sales.

Meanwhile, Nvidia (NVDA) makes AI-friendly semiconductors. It trades for more than 100 times earnings and more than 32 times sales today – absurdly high valuations for any company.

The values of private, venture-capital (“VC”) investments like OpenAI are different from the values of publicly traded companies like Nvidia. But in their respective arenas, both valuations are super high.

AI is hot. And everywhere you look, it shows.

According to one report, OpenAI has generated at least $540 million in net losses since it launched ChatGPT in November 2022. And if it ever becomes profitable, it must pay a substantial portion of its future profits to its biggest investor, Microsoft (MSFT), until the tech giant gets its money back.

Microsoft first invested $1 billion in OpenAI in 2019. Then, it put another $2 billion into the business in 2021. And this past January, it threw in $10 billion more.

After Microsoft’s third investment, Fortune reported on the deal…

Microsoft is investing $10 billion in OpenAI and the transaction values the company at close to $29 billion. In exchange, Microsoft is getting the right to 75% of OpenAI’s profits until it earns back this $10 billion plus an additional $3 billion it has already invested in the company – $1 billion in 2019, and another $2 billion which it quietly put into OpenAI in 2021. After that, Microsoft will be entitled to a further 49% of OpenAI’s profits until it earns a profit of $92 billion.

Microsoft made its third investment eight months ago. And as this Fortune report shows, OpenAI’s valuation was nearly $29 billion at that time. The high end of the valuation range of 80 to 90 times sales would give Microsoft a paper profit of roughly $27 billion today.

The Journal also notes that OpenAI won’t issue new shares for the proposed sale. The company wants employees to cash out by selling their existing shares to other investors.

So naturally, it would like to get the highest possible valuation.

I don’t know if any of these proposed sales have taken place yet. But according to the Journal, the company has already spoken with potential investors.

The article implied that a “tender offer process [is] under way now.” Silicon Valley VC firms such as Sequoia Capital and Khosla Ventures have bought OpenAI shares through tender offers in the past.

If anybody can pay 80 to 90 times sales for an unprofitable startup and make money doing it, it would be Silicon Valley VC firms.

They often buy stakes in brand-new companies with no sales. And they’ve obviously still made plenty of money over the years. Otherwise, folks wouldn’t talk about them so much.

But as much as I hate to say it, that part makes sense.

Investments in these types of companies are like “out of the money” call options.

If they go “in the money” (or even head in that general direction), investors can make a fortune. But if they never do, investors can lose it all.

I’ve also noticed something else over my decades in the markets, companies that grow their sales from zero to a big number often get a huge bump in valuation. The same thing happens with companies that go from consuming cash to generating it, as well as companies that go from generating losses to reporting profits.

ChatGPT isn’t even a year old yet. And apparently, a lot of companies are licensing OpenAI’s “large language model” technology to incorporate into their businesses.

So OpenAI’s revenue is ramping up fast. Maybe that trend will continue. If that happens, the valuation of 80 to 90 times sales could eventually seem tame in hindsight.

But today is not that day.

My ultimate point is much simpler. It’s the same thing I said about the stock market two weeks ago.

Despite the bear market in stocks in 2022 and the bear market in bonds that started in 2020 (and continues to this day), stocks are still near extremely expensive levels compared with the two metrics that are highly correlated with ensuing market performance in the past.

Higher interest rates should’ve led to lower stock market valuations. But they haven’t so far.

And they should’ve crushed the valuations of private investment vehicles like VC even harder. But they haven’t so far.

VC and other private investment vehicles tend to be highly illiquid. They lock up investors’ money for years. So investors don’t get a liquidity premium like with publicly traded stocks.

Illiquidity can be great on the way up. But it’s usually a death sentence for valuations on the way down. That’s because it usually involves a lot fewer buyers offering to pay much less than sellers want.

It’s normal for profitable, growing companies to trade for 20, 25, or even 30-plus times earnings in the stock market (at least for the past couple decades). However, those same companies would trade well below that level if they weren’t publicly traded.

So when I see VC investments like OpenAI valued at 80 to 90 times sales, I cringe. And I wonder how long it will take for that part of the mega-bubble to burst.

The leap from 29 times sales to 90 times sales is large. And eight months is a short period.

But the thing is, VC didn’t have a particularly difficult 2022. As Forbes reported in March…

Seed and early-stage valuations remained resilient in 2022, rising slightly despite the later stage pricing pressure awaiting them. While values continued to modestly grow at the earliest stages, later-stage companies saw valuations drop 10% below those of 2021.

A 10% drop is nothing.

When a publicly traded stock falls 10%, no one bats an eye. Instead, everybody screams, “Buy the dip!” And just like that, life goes back to normal.

The only permanent damage in the financial markets so far (besides the bank failures earlier this year) seems to be in cryptos and the worst-of-the-worst publicly traded, cash-burning, garbage tech stocks.

So, I see why you could argue that the bear market is over, why it wasn’t so bad, and why we’re now off to the races with a new bull market. It might feel like we’ve escaped danger.

Debt Monetization

What is debt monetization? It’s when the Fed prints new money to buy either newly created or existing U.S. government debt or both. The debt sits as an asset on the Fed’s balance sheet and a liability on the Treasury’s balance sheet. Woosh, clap hands, gone… it zeros out. Legal? Not really. Is it the game plan? Yes, so said a former senior Fed insider in 2019.

For hundreds of years, leaders and governments have mostly chosen to create new money. In crisis, it appears to be the easiest thing to do and tends to be what the masses want. But it also tends to lead to inflation and the problems that come with it. Those newly printed dollars buy newly created government debt, and then the government uses the money they’ve raised to fund infrastructure projects, defense contracts, entitlement payments, bail out big institutions, and, as the U.S. has done over the last few years, print $10 trillion and helicopter much of it directly to individuals. There is no current cap on the debt limit, and a government shutdown appears likely; however, the spending problem in Washington is worsening, and the spike in interest rates is making the picture worse. A shutdown will be resolved, and the march to $50 trillion in debt will quicken. The math is the math, and the math is not looking good.

Think of it this way. If you had the power to print new money and use it to buy $100,000 of a government bond from me, you’d own the bond, and I’d have $100,000 in cash to reinvest or spend. That newly printed money, printed out of thin air, found its way into the system. If, on the other hand, you sold an asset for $100,000 and used it to buy my bonds, you simply moved money that already existed within the system from one place to another. No new money was created.

Create too much new money, and challenges mount. As Milton Friedman said, “Inflation is always and everywhere a monetary phenomenon.” Inflation is caused by too much money chasing after too few goods. We’ve seen the story before. Like a rerun of an old play, the current story is one of too much debt and money printing that leads to periods of higher inflation and persistently lower growth. There’s no straight line. It could be different this time. History advises caution.

Monitoring the actions of central banks and governments will help us confirm or change our view. At this point in time, there is no change in view.

Three Major Challenges

Three Major Challenges:

- Debt and Interest Rates

- External Geopolitical Challenges

- Internal Conflict Challenges

Debt and Interest Rates:

- In the early 1980s, Fed Chair Paul Volcker fought to whip inflation. His fight took the Fed Funds rate to an all-time high of 20% in March 1980. Since then, we’ve benefited for more than 40 years of declining interest rates. It’s been a strong wind at our backs, and was an incredible buying opportunity for long-term Treasury bonds. The winds have now shifted.

- Today, the U.S. national debt is $33.1 trillion and rising rapidly. Total Federal spending is at $6.2 trillion annually, while total tax receipts is approximately $4.34 trillion annually, making the national deficit approximately -$1.77 trillion.

- As of August 2023, the interest on our national debt is approximately $708 billion, or 12% of total spending. Much of it is financed with short-duration debt that is being refinanced at higher rates. That $708 billion will reach $1.2-1.5 trillion when the debt is refinanced at 4% or 5%. The 12% allotment of total spending may become 24% in a blink. The lawyers running the government think it doesn’t matter. We economists and financial experts—you included—know it does.

- Social Security makes up 21% of total Federal spending. Medicare and Medicaid make up 26% of Federal spending. National Defense makes up 13%. Together, the four largest budge items make up 72% of the national budget.

- There is no sign of fiscal discipline on either side of the aisle. If you’re a domestic or foreign investor buying of U.S. Treasury bonds, does the behavior of legislators in Washington instill confidence?

- And think about this: Since the founding of the Republic in 1776, it took 247 years for the U.S. to print $10 trillion dollars. In the last two years alone, the U.S. has printed another $10 trillion—that’s half of all dollars ever created in our nation’s history in 0.8% of its lifespan.

- In the book The Price of Time: The Real Story of Interest, Edward Chancellor wrote an exhaustive study of 4,000 years of interest rates. When other countries have gotten themselves into similar debt challenges, in most cases, the chosen path was to create new money and monetize the debt. After all, what politician wants to pull the punchbowl away? (And who among the masses would vote for them if they did?)

- This is an inflationary path, which puts the value of the U.S. dollar on a negative trajectory. How will this impact the decisions the stewards of capital make? Current financial misbehavior by legislators is a poor way to attract the buyers the U.S. needs to buy the bonds.

- The government is selling hundreds of billions of Treasury bills, notes, and bonds each week. China and other foreign nations—historically, major buyers of U.S. debt—are sellers of U.S. debt today.

External Geopolitical Challenges (and Energy Prices):

- We’re now in the phase of a rising power challenging an existing power. It is abundantly clear that China is preparing for war. The peace dividend that existed for the past 30+ years is gone and with it, the long-term deflationary benefits of outsourcing production to China. Friend-shoring and reshoring is the new state of play, which is arguably more expensive.

- For the economy: Inflationary!

- Rising expenses pressure corporate earnings: Stagflation!

- Oil and gas prices are rising again. We are years away from the green-energy solution most of the developed world is striving for. As such, the depletion of the Strategic Petroleum Reserve (SPR) for political purposes was a meaningful mistake. Needing to replenish this important asset, the U.S. government has put a floor under the price of oil while OPEC and Russia have cut production.

- We have a great dependence on oil, natural gas, and liquid gas. Petroleum products include transportation fuels, fuel oils for heating and electricity generation, asphalt and road oil, and feedstocks for making the chemicals, plastics, and synthetic materials that are in nearly everything: solvents, ink, boats, upholstery, sweaters, bearing grease, ballpoint pens, insecticides, tires, golf bags, perfumes, dishwasher parts, caulk, transparent tape, antiseptics, antihistamines, vitamin capsules, deodorant, cortisone, dyes, life jackets, skis, paint, refrigerant, mops, speakers, candles, trash bags, shampoos, etc. As I said: nearly everything.

- Furthermore, of the approximately 7.21 billion barrels of total U.S. petroleum consumption in 2016, 47% were of motor gasoline (includes ethanol), 20% were distillate fuel (heating oil and diesel fuel), and 8% were jet fuel. Green energy has done little to reduce this dependency.

- It’s not just at the pump. Higher oil and gas prices mean the cost to make and transport everything goes up. This is also, as you might have guessed, inflationary.

Internal Conflict Challenges:

- The U.S. is more divided, impatient, and angry with each other than at any point since the 1970s.

- Workers’ and unions’ negotiating power is on the rise. The wealth gap is extreme, with pressure mounting to bring it back in balance. From Hollywood to UPS to the UAW, strikes are proving successful, resulting in wage gains. More inflation!

- Rising costs reduce corporate earnings. More stagflation!

There are many positives, of course. Advances in healthcare, genomics, longevity health, technology that makes our lives easier and more productive, love, family, friends, theater, sport, and humanity’s ability to create. And isn’t creation great fun.

The Great Reset is a slow event that we believe will reach a point resulting in restructuring the debt, pension, and monetary systems. Reading about history shrinks events in our minds. What took a long time feels much quicker to us when reading a story. Live it, and you know it was a long time in the making. The current challenges won’t be resolved overnight.

US Economy

- The US manufacturing PMI report from S&P Global showed a modest improvement this month but held in contraction territory (PMI < 50).

- A higher share of factories reported rising input costs.

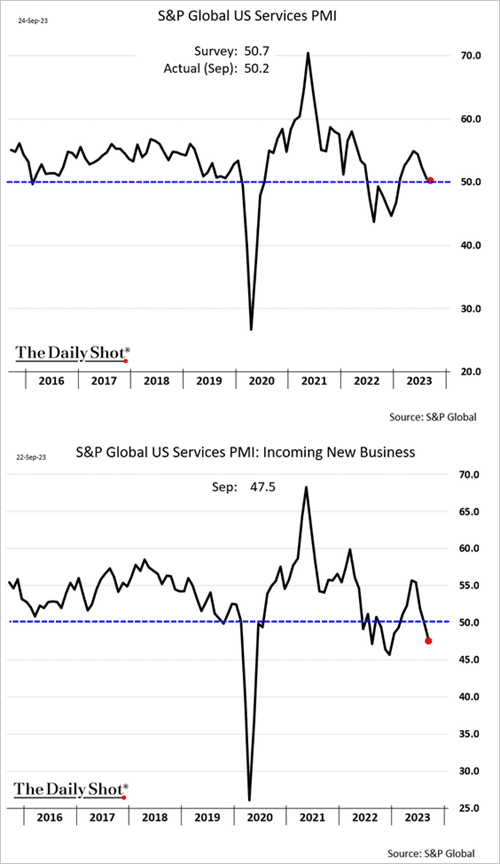

- Growth in service sector activity is stalling, with companies reporting net declines in new business (2nd panel).

- US financial conditions have been tightening, driven by a stronger US dollar, higher yields, wider credit spreads, and a pullback in stocks.

- . A survey by the Chicago Fed indicates that businesses in the Midwest region (refer to the Seventh Federal Reserve District map below) are rapidly reducing hiring.

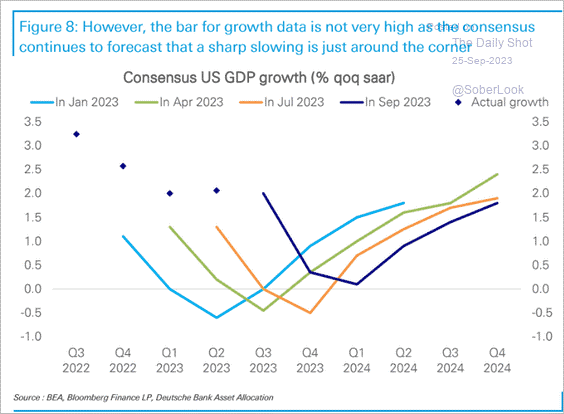

- Economists still forecast a sharp slowdown ahead but no longer expect a recession (median consensus estimate).

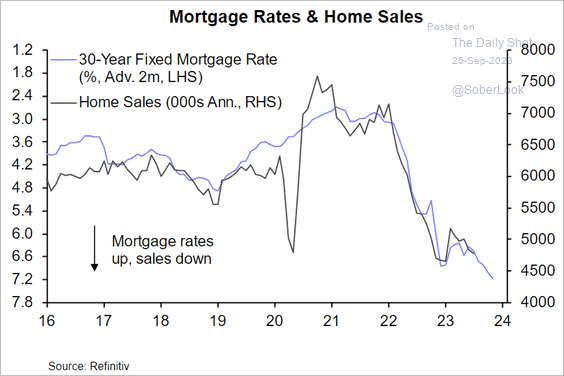

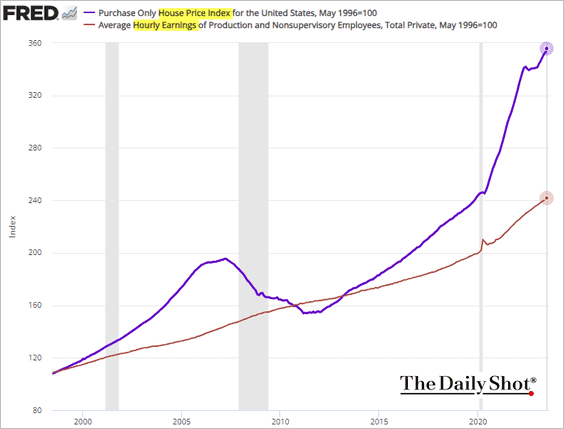

- Elevated mortgage rates at 7.55%, combined with mortgage applications at multi-year lows (2nd chart), indicate further declines in home sales.

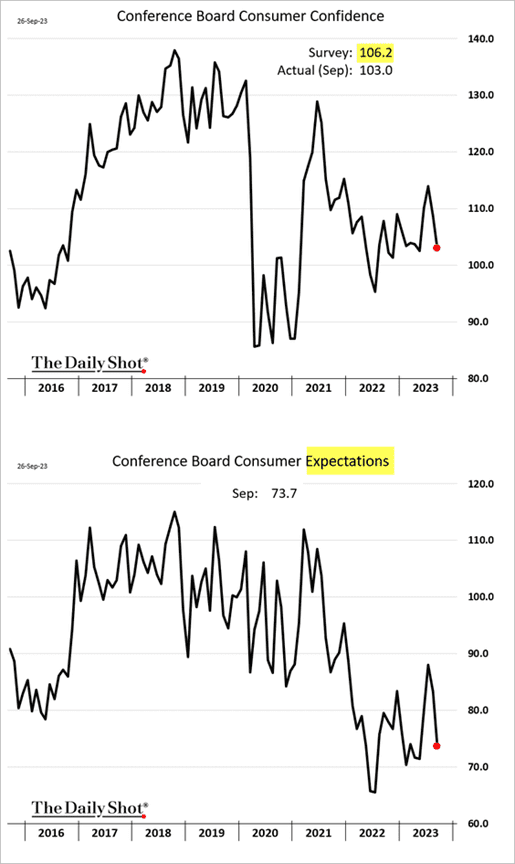

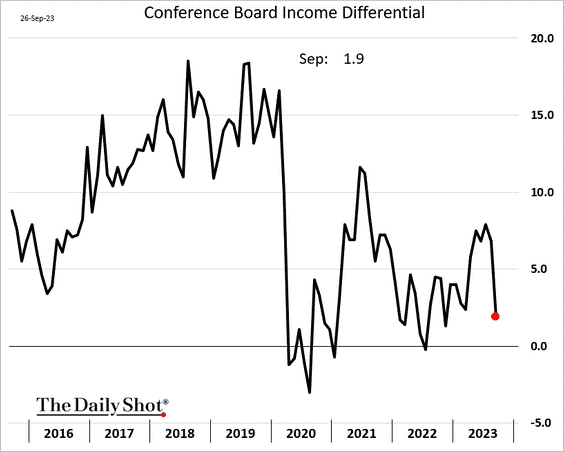

- Like the University of Michigan’s report, the Conference Board’s indicator revealed a decline in consumer sentiment this month, with a notable weakness in the expectations measure.

Source: AP News Read full article

- The income differential (participants expecting higher income less those expecting lower income) declined sharply.

- Home prices are increasingly outstripping wage growth.

- Durable goods orders topped expectations. Capital goods orders saw the largest increase since January.

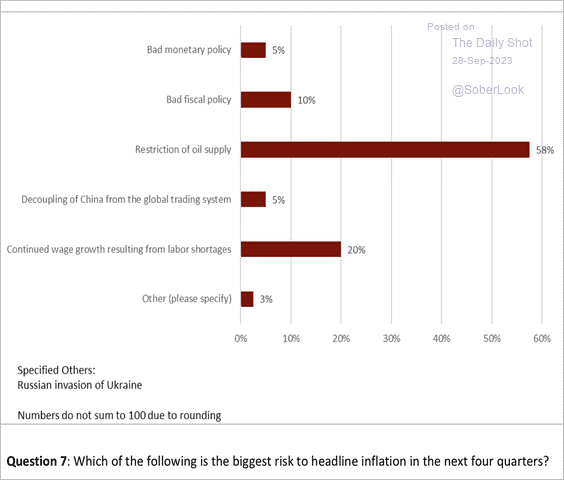

- The restriction of oil supply is viewed as the largest upside risk to headline inflation.

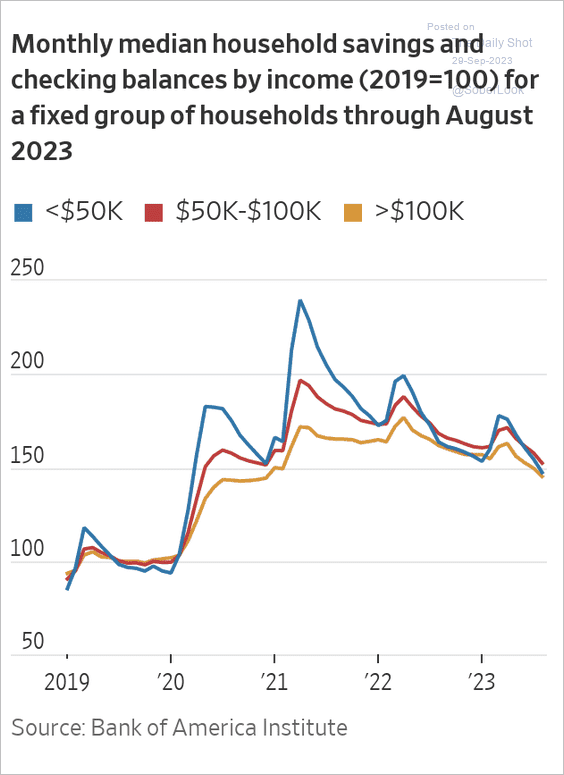

- Households’ cash balances remain elevated.

Source: @WSJ Read full article

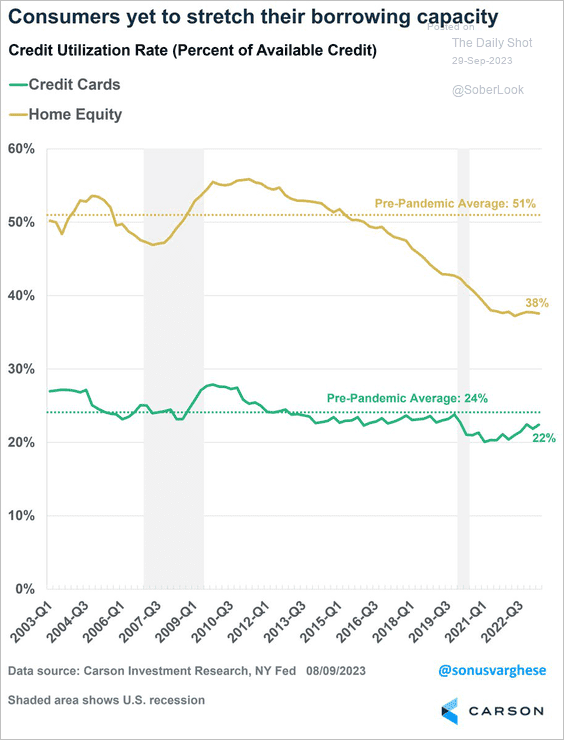

- And consumers seem to have plenty of borrowing capacity.

Source: @RyanDetrick, @sonusvarghese

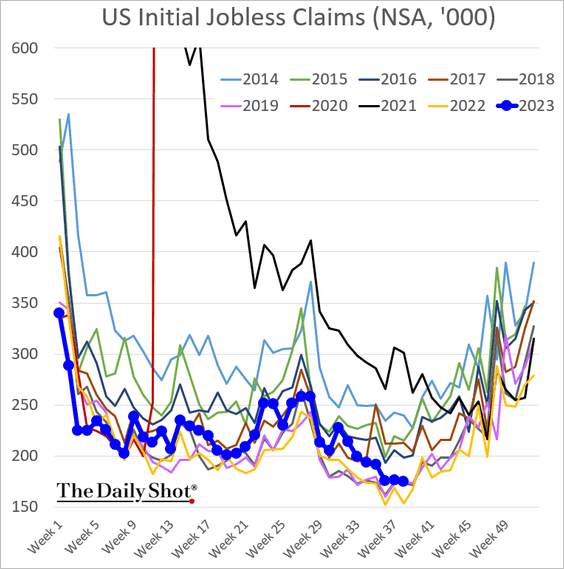

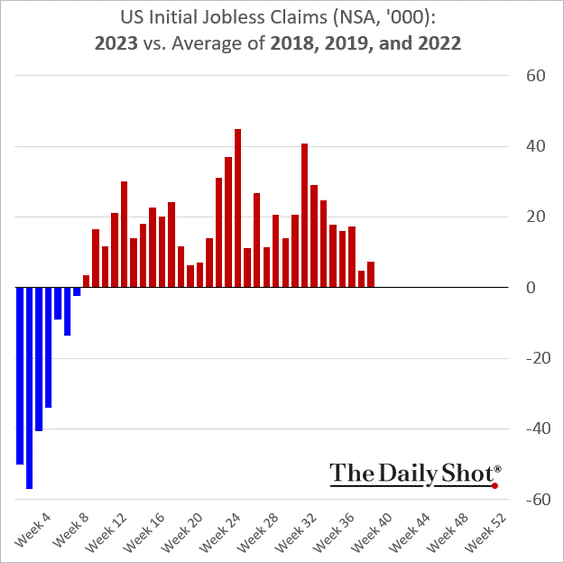

- Initial jobless claims remain low.

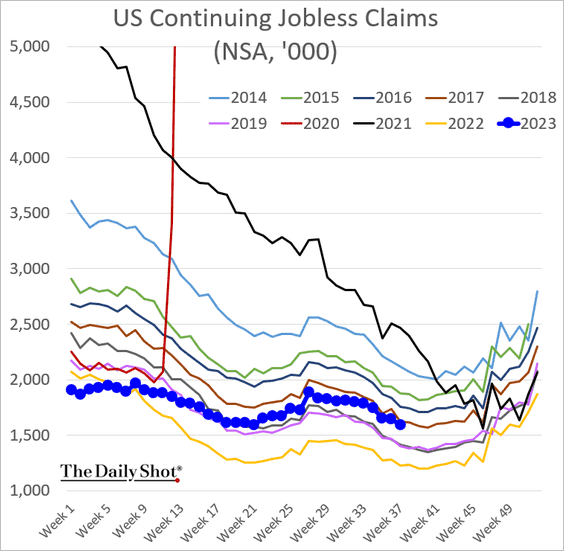

- However, the number of Americans receiving unemployment benefits is elevated relative to recent years (30% above last year’s level).

Market Data

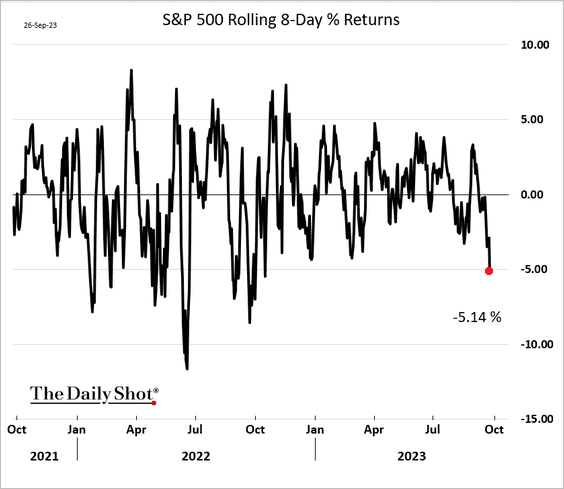

- The last eight trading sessions registered the worst decline for the S&P 500 in 2023.

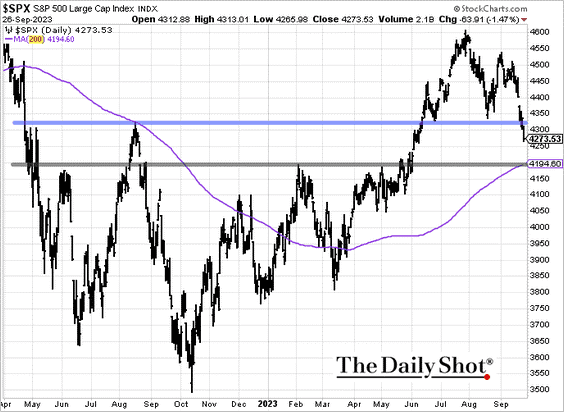

- The next support level for the S&P 500 is at around 4200.

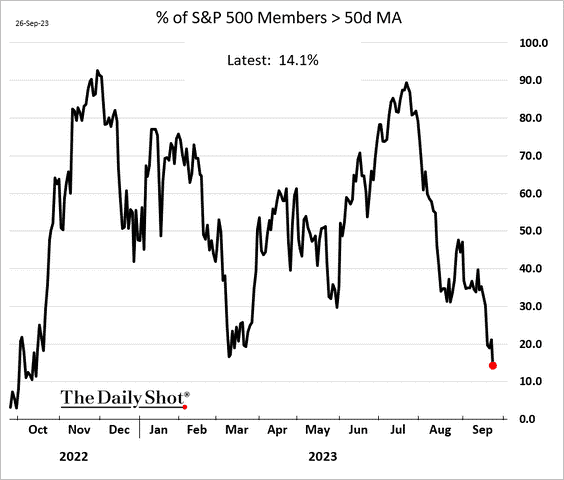

- This chart shows the percentage of S&P 500 members trading above their 50-day moving averages.

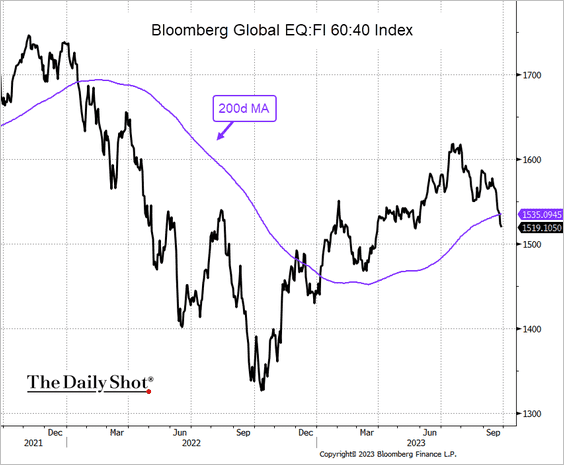

- It’s been a rough month for the 60:40 portfolio.

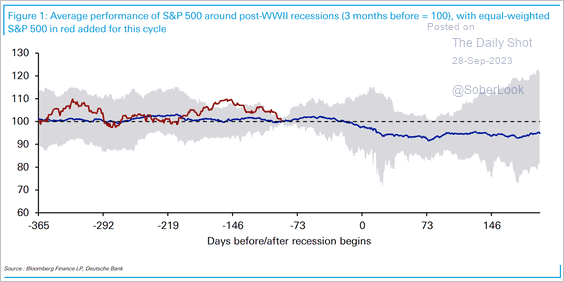

- On average, the S&P 500 typically declines in the year leading up to the start of a recession.

Source: Deutsche Bank Research

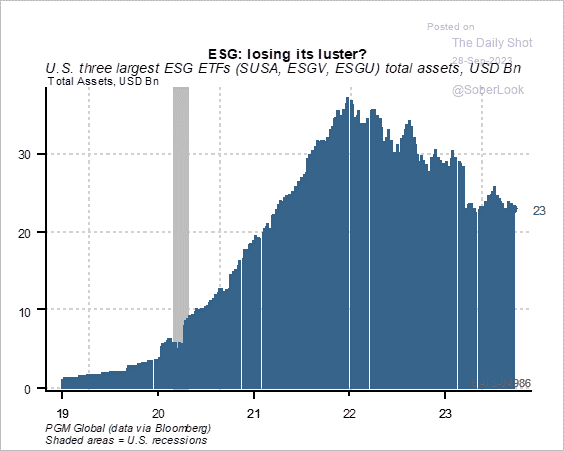

- ESG funds are losing assets.

Great Quotes

“Interest rates are the heart, the soul, and the life of the free market system. They ARE the cost of money. When costs go up, earnings go down. Real incomes go down. We are in a different investment environment than anything investors have experienced for the majority of the last 40 years.”

– Steve Blumenthal, CEO and CIO, CMG

Picture of the Week

Lake Bled at sunrise, Slovenia

All content is the opinion of Brian Decker