In the 60 Minutes interview a week ago Sunday – Powell clearly designed to spread the central bank’s latest message far and wide to anyone who might not have heard it – the Fed chair reiterated the points he made last week:

- Don’t expect rate cuts until May, at the earliest. That’s because the economy is “strong” enough, Powell says, to handle higher rates and the pace of inflation can still get closer to its 2% annual growth target, in the Fed’s estimation.

- The Fed plans to cut rates in 2024, but size and scope are to be determined. Here’s Powell from the interview last night…

Almost all of the 19 participants who sit around this table believe that it will be appropriate in their most likely case for us to cut the federal-funds rate this year [but] what we actually do is really going to depend on the evolution of the economy.

If the economy were to weaken, then we could reduce rates earlier and perhaps faster. If inflation were to prove more persistent, that could call for us to reduce rates later and perhaps slower.

Say what you want about the Federal Reserve – like how it helped fuel 40-year high inflation with near-zero rates during the pandemic… and how it often creates the kind of financial crises it was supposedly designed to prevent – but at least Powell has been a straight-shooter about future Fed policy during his tenure as Fed head.

We don’t need to read the tea leaves here, folks. Powell is telling us what he’s been telling us all along.

Investors may have taken Powell’s words to heart after hearing them on network television… The major U.S. indexes were down today, with the small-cap Russell 2000 off the most, and bond yields up all along the curve, from three-month T-bills to the 30-year Treasury bond.

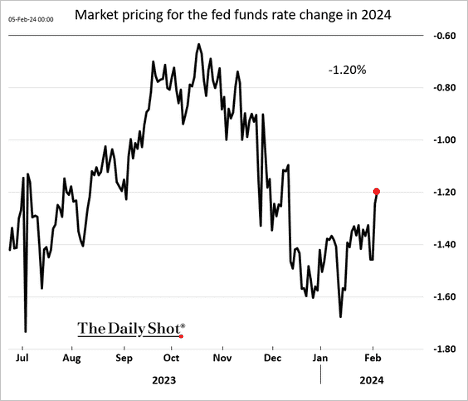

CME Group’s FedWatch Tool, which tracks bets on fed-funds futures, also showed traders upping their odds for a continued Fed “pause” at the central bank’s next meeting in March… from 80% on Friday to 85% today. And maybe most notably, these traders have pushed the entire timeline for rate cuts back by a few months.

Now, if everything is going so great with the economy, you might be wondering why the Fed doesn’t just keep rates where they are instead of cutting them.

This might be part of your answer… Consider the nearly $9 trillion in government debt (of $34 trillion total) that will mature over the next year. Corporate debt, topping $13 trillion, and consumer debt levels are part of the calculus, too, as are unrealized losses in bonds (prices trade inversely to yields) that banks are sitting on since rates went from near zero to above 5%.

Add it all up and Powell is interested in lowering debt costs at some point this year.

If anything was news-making about Powell’s 60 Minutes interview, it was his thoughts on government debt (which, to be clear, the central bank doesn’t have as much to do with as the U.S. Department of the Treasury and Congress)…

The Fed chair has gone to great lengths over the past few years to avoid “getting political,” but he appeared to drop his guard in portions of the interview, some of which didn’t make the broadcast cut but were provided in full transcript form of the interview later…

In the long run… the U.S. federal government is on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy… I don’t think that’s at all controversial. And I think we know that we have to get back on a sustainable fiscal path. And I think you’re starting to hear now from people in the elected branches who can make that happen. It’s time that we got back to that focus.

I think the pandemic was a very special event, and it caused the government to really spend to ward off what looked like very severe downside risks. It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.

Interviewer Scott Pelley said, “I have the sense this worries you very much.” Powell replied…

Over the long run, of course it does. We’re borrowing from future generations. And every generation really should pay for the things that it needs… and not hand the bills to our children and grandchildren.

I think this is, again, not controversial. But it’s difficult from a political standpoint. It’s not our business, really. But I do think it’s pretty widely understood that it’s time for us to get back to putting a priority on fiscal sustainability. And sooner’s better than later.

The Housing Market

The cost of housing remains a hot-button topic with both Millennials and Gen-Z. Plenty of articles and commentaries address the concern of supply and affordability, with the younger generations getting hit the hardest. Such was the subject of this recent CNET article:

“The housing affordability crisis means it’s taking longer for people to become homeowners — and that’s especially impacting millennials and Gen Zers, economically disadvantaged families, and minority groups. There’s not one single driver of the crisis, but several colliding elements that put homeownership out of reach: rising home prices, high mortgage interest rates and limited housing supply. That’s on top of myriad financial challenges, including sluggish wage growth and increasing student loan and credit card debt among middle-income and low-income Americans.”

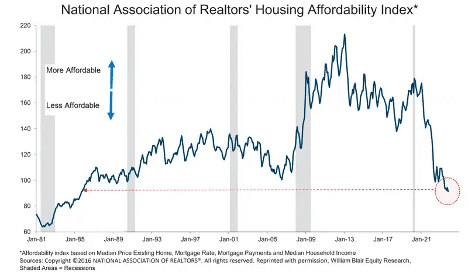

The chart below of the housing affordability index certainly supports those claims.

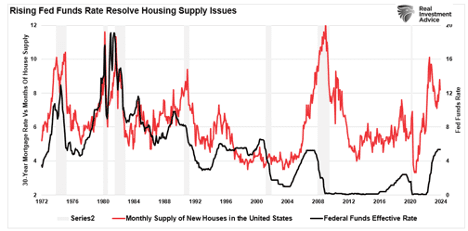

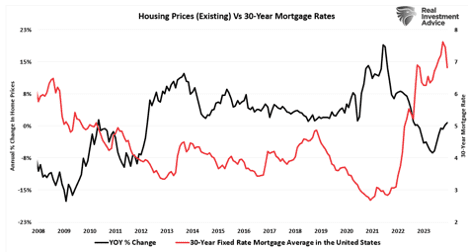

As noted by CNET, there are many apparent reasons causing housing to be unaffordable, from a lack of supply to increased mortgage rates and rising prices. Over the last couple of years, as the Fed aggressively hiked interest rates, the supply of homes on the market has grown. Such is because higher interest rates lead to higher mortgage rates and higher monthly payments for homes. It is also worth noting that previously, when the supply of homes exceeded eight months, the economy was in a recession.

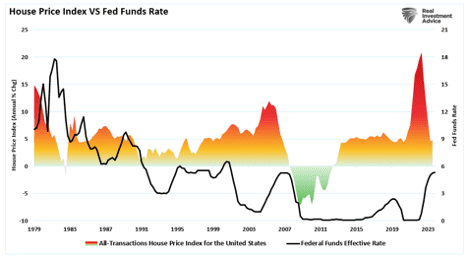

At the same time, higher interest rates and increased supply should equate to lower home prices and, therefore, create more “affordability.” As shown, such was the case in prior periods, but post-pandemic housing prices skyrocketed as “stimulus checks” fueled a rash of buyers.

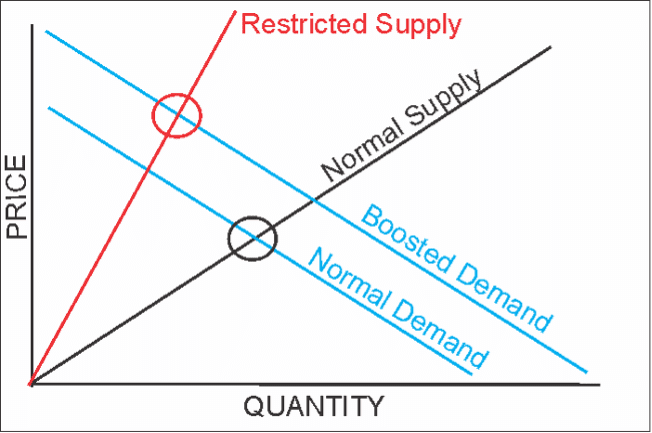

As is always the case with everything in economics, price is ALWAYS a function of supply versus demand.

The following economic illustration is taught in every “Econ 101” class. Unsurprisingly, inflation is the consequence if supply is restricted and demand increases.

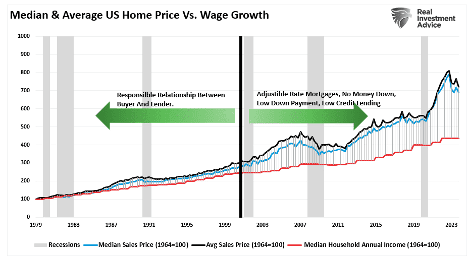

While such was the case following the economic shutdown in 2020, the current housing affordability problem is a function of bad decisions made at the turn of the century. Before 2000, the average home buyer needed good credit and a 20% down payment. Those constraints kept demand and supply in balance to some degree. While housing increased with inflation, median household incomes could keep pace.

However, in the late 90s, banks and realtors lobbied Congress heavily to change the laws to allow more people to buy homes. Alan Greenspan, then Fed Chairman, pushed adjustable-rate mortgages, mortgage companies began using split mortgages to bypass the need for mortgage insurance, and credit requirements were eased for borrowers. By 2007, mortgages were being given to subprime borrowers with no credit and no verifiable sources of income. These actions inevitably led to increased demand that outpaced available supply, pushing home prices well above what incomes could afford.

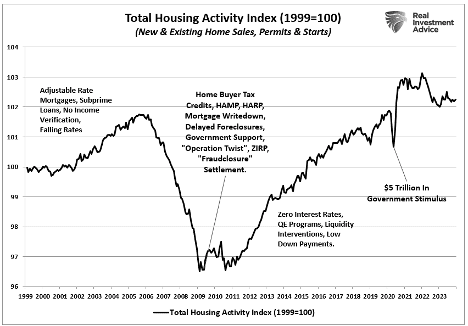

This episode in the housing market resulted from zero-interest policies by the Federal Reserve. That policy and massive liquidity injections into the financial markets brought hoards of speculators, from individuals to institutions. Institutional players like Blackstone, Blackrock, and many others purchased 44% of all single-family homes in 2023 to turn them into rentals. As prices rose, advances like AirBnB brought more demand from individuals for rentals, further reducing the available housing pool. Those influences lead to even higher prices for available inventory.

Notably, it isn’t a lack of housing construction. The Total Housing Activity Index is not far from its all-time highs following the 2020 pandemic “housing rush.” The issue is the removal of too many homes by “non-home buyers” from the available inventory.

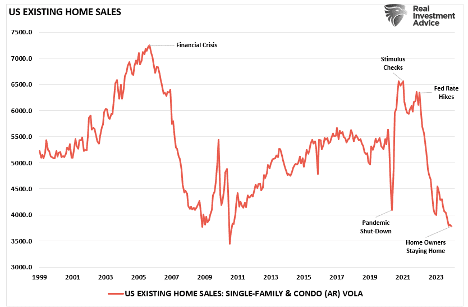

Furthermore, existing home sales are absent. Current homeowners are unwilling to sell homes with a 4% mortgage rate to buy a home with a 7% mortgage. As shown, existing home sales remain remarkably absent.

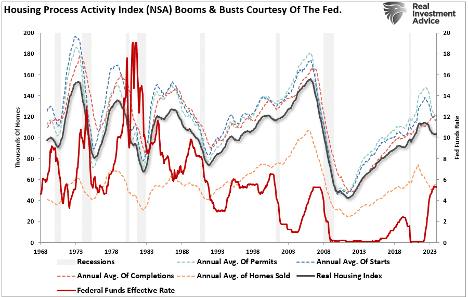

All of these actions have exacerbated the problem. At the root of it all is the Federal Reserve, keeping interest rates too low for too long. Oversupplying liquidity and creating repeated surges in home prices. It is not a far stretch to realize the bulk of the housing problem directly results from Governmental forces.

Lawmakers are pushing Jerome Powell to lower interest rates at the upcoming Fed meeting to make housing more affordable.

“As the Fed weighs its next steps in the new year, we urge you to consider the effects of your interest rate decisions on the housing market. The direct effect of these astronomical rates has been a significant increase in the overall home purchasing cost to the average consumer.” – Letter To Jerome Powell

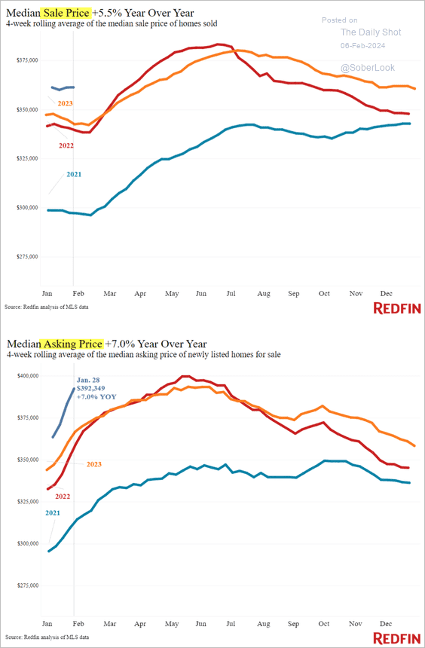

As discussed above, lowering interest rates is not the solution to lowering housing prices. Lower interest rates would bring more buyers into a market already short inventory, thereby increasing home prices. We can already see the impact of lower mortgage rates on home prices just since October. Prices rose as yields fell on hopes the Federal Reserve would cut rates in 2024. If mortgage rates revert to 4%, where they were during most of the last decade, home prices will significantly increase.

There is only one solution to return home prices to affordability for most of the population. That is to reduce the existing demand. If lawmakers are serious about doing that, passing laws today would go a long way to solving that problem.

- Restrict corporate and institutional interests from buying individual homes.

- Increase the lending standards to require a minimum 15% down payment and a good credit score. (such would also increase the stability of banks against another housing crisis.)

- Increase the debt-to-income ratios for home buyers.

- Return the mortgage market to straight fixed-rate mortgages. (No adjustable rate, split, etc.)

- Require all banks that extend mortgages to hold 25% of the mortgage on their books.

Yes, those are very tough standards to meet and initially would exclude many from home ownership. But, home ownership should be a demanding standard to meet, as the cost of home ownership is high. For the individual, such standards would ensure that home ownership is feasible and that such ownership, along with the subsequent fees, taxes, maintenance costs, etc., would still allow for financial stability. For the lenders, it would reduce the liability of another financial crisis to almost zero, as the housing market’s stability would be inevitable.

But most importantly, such strict standards would immediately cause an evaporation of housing demand. With a complete lack of demand, housing prices would fall and reverse the vast appreciation caused by a decade of fiscal and monetary largesse. Yes, it would be a very tough market until those excesses reverse, but such is the consequence of allowing banks and institutions to run amok in the housing market.

Naturally, none of this will ever happen or considered, as there is too much money in the housing market for corporations, institutions, and banks to feed on. But one thing is for sure: if the lawmakers get their wish and the Fed cuts rates again, housing prices will become even more unaffordable.

US Economy

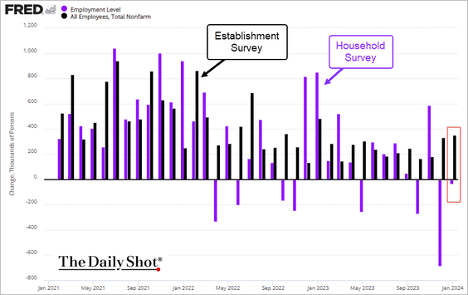

- The January jobs figure was almost twice the expected, challenging the narrative of a decelerating labor market.

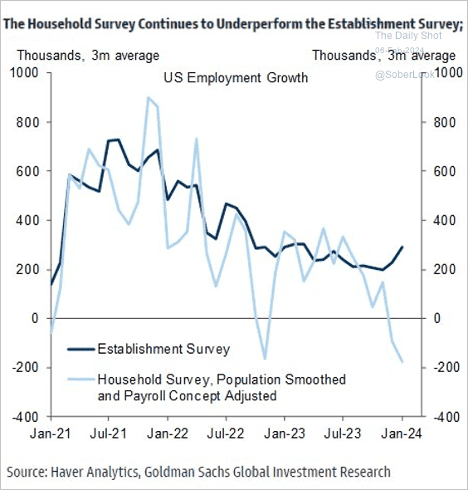

- However, the Household Survey once again showed a decline in jobs, further diverging from the Establishment Survey.

- The unemployment rate held steady last month, but underemployment edged higher.

- Fed rate cut expectations eased after the employment report.

- Probability of a March rate cut dropped below 20%.

- The total expected rate reduction in 2024:

- Railcar loadings have improved over the past six months.

- The ISM Services PMI rebounded last month from levels close to stagnation in December. Employment returned to growth mode.

- Housing asking and sale prices are at record highs for this time of the year.

- New homes continue to represent over 30% of the total housing market listings.

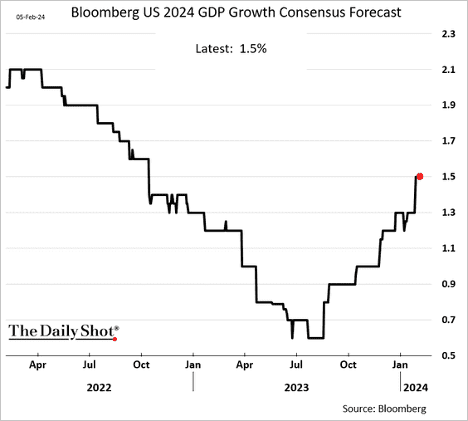

- Economists continue to boost their forecasts for this year’s GDP growth.

- Here is another illustration of the divergence between the Jobs Establishment Survey (the official payrolls report) and the Household Survey.

Source: Goldman Sachs; @MikeZaccardi

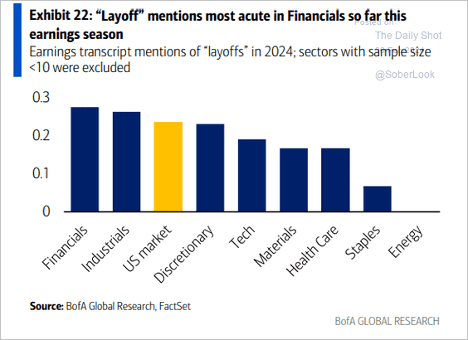

- In the current earnings season, which sectors are most frequently discussing “layoffs” during their earnings calls?

Source: BofA Global Research; @MikeZaccardi

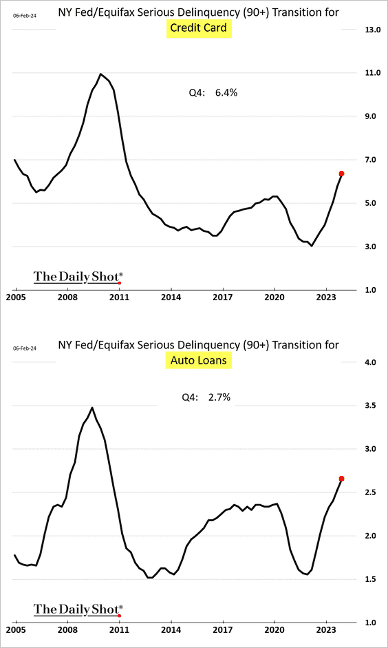

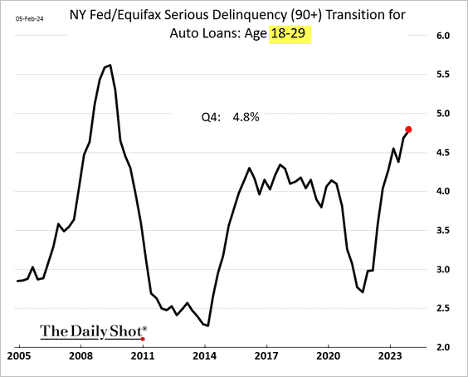

- Consumer credit delinquencies keep moving higher, …

- … especially among younger Americans.

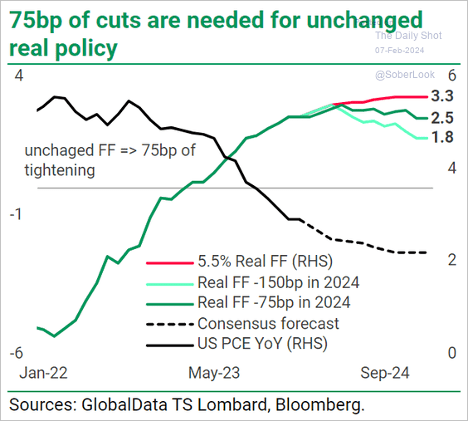

- With current expectations of reduced inflation ahead, the Fed would have to lower rates by 75 basis points merely to maintain the current tightness of monetary policy.

- And that’s exactly what the central bank is promising.

Source: Fortune Read full article

Market Data

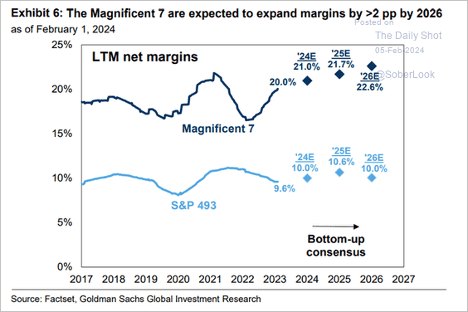

- Here is Goldman’s forecast for the Magnificent 7 margins vs. the rest of the S&P 500.

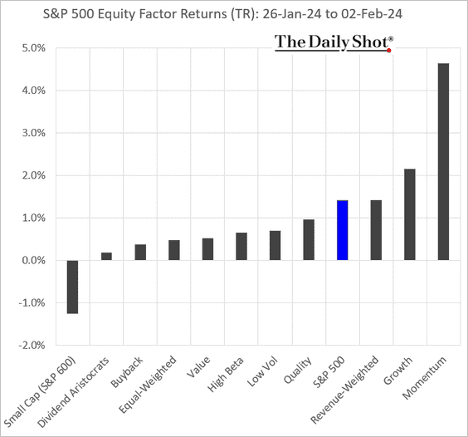

- Equity factors:

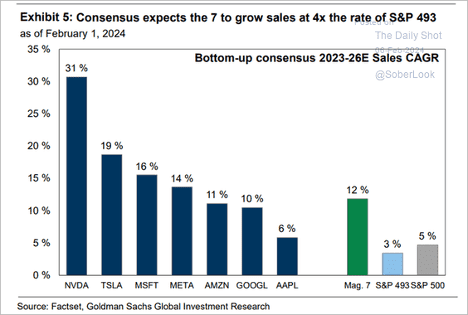

- Expected sales growth vs. the rest of the S&P 500:

Source: Goldman Sachs; @MikeZaccardi

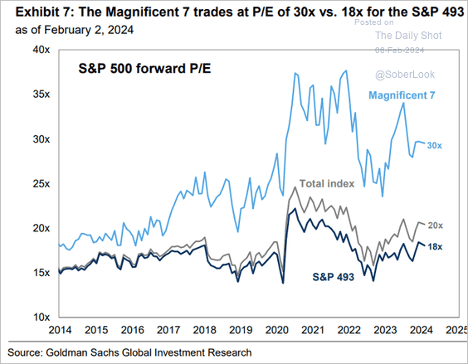

- Valuations:

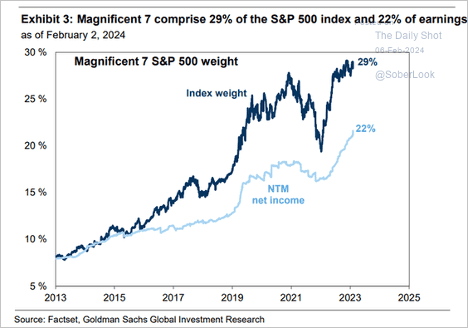

- The Magnificent 7 weight in the S&P 500 and their earnings contribution to the index:

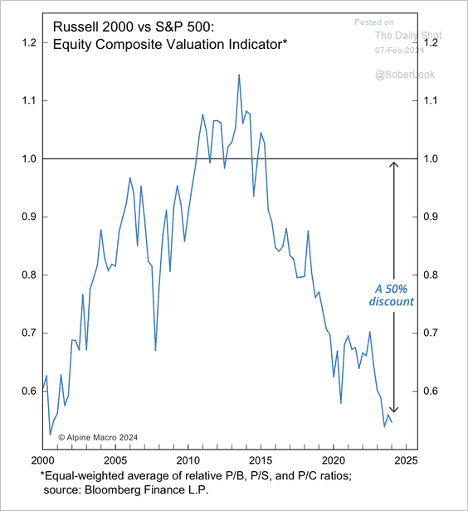

- US small-caps are extremely undervalued versus large-caps.

Great Quotes

“When I grew up I really wanted to be “somebody”! Now I realize I should have been more specific.” – Lilly Tomlin

Picture of the Week

Mt Hood, Oregon

All content is the opinion of Brian Decker