Lacy Hunt’s quarterly letter turns darker this time. He believes the economy is far more susceptible to a downturn than is generally realized, despite what looks like positive data. He’s also not worried about inflation.

- The monetary and fiscal actions of 2020-2022 resulted in negative net national saving, which will impair economic growth even after the Fed loosens policy.

- For productivity to rise, the economy needs increased investment which requires an increase in net saving.

- The impact of pandemic stimulus programs ending

- The state of the U.S. consumer (in the form of a rising spike in Google searches for “can’t pay my credit card”)

- New jobless claims rising in more than 70% of states

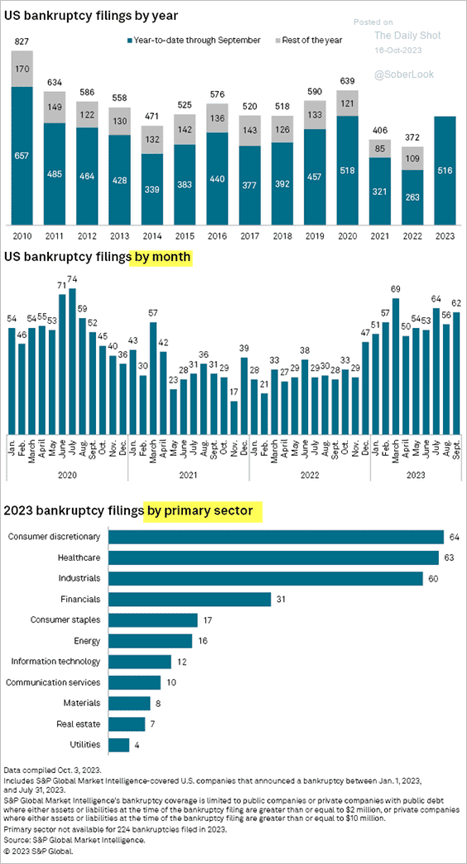

- The day after pharmacy Rite Aid said it would file for bankruptcy, that 11 companies with $50 million or more in liabilities have already filed this month alone

- Record debt at the corporate level, and the individual level, and the federal level.

- Instead, government borrowing is diverting funds from more productive use in the private sector.

- Rising real GDP combined with falling bank credit indicates underlying economic weakness.

- Bank lending standards are tightening to a degree typically associated with recessions.

- These restrictive conditions will expose those who took excessive risk in the preceding boom years.

The most ominous part of Lacy’s analysis is that he thinks monetary policy is losing effectiveness. The Fed may not be much help in the next recession.

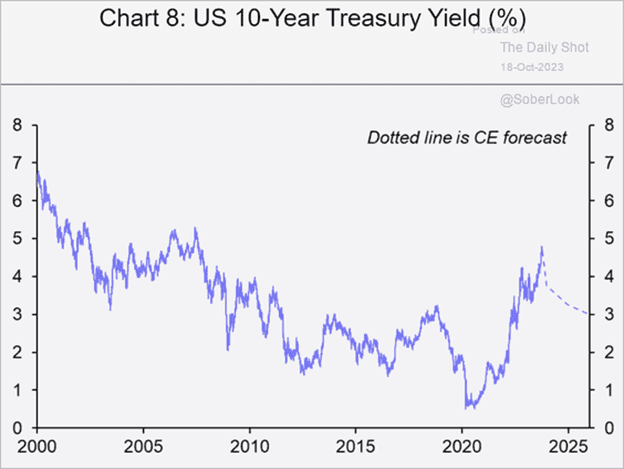

The Bond Rout

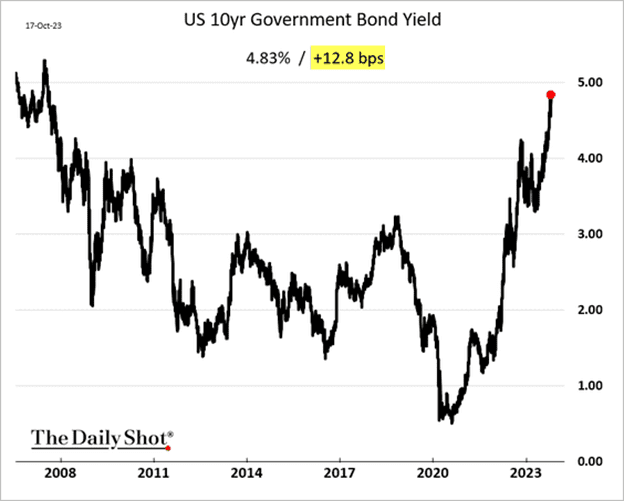

The 10-year Treasury bond has been trading at yields last seen in 2007. The Fed doesn’t directly control this but certainly has some influence. Dr. Ed Yardeni explores what is happening and whether yields will go even higher.

- One simple explanation is that the rising federal deficit means more bond supply, and yields must rise enough to stimulate demand.

- Exacerbating this is the growing realization, confirmed last month by Jerome Powell, that the Fed will keep policy restrictive well into 2024.

- Economic growth has also been stronger than expected, reducing recession fears.

- With both the Fed and commercial banks reducing their holdings, demand for Treasury bonds has dropped at the same time supply rises.

- Yardeni expects inflation will continue to moderate and bond yields stabilize in a 4.50% to 5.00% range through next year.

The risks to Yardeni’s outlook are if the rapidly steepening yield curve precipitates a credit crunch and recession, and/or inflation picks up again. The PPI and CPI data due out this week should give us more clues.

US Economy

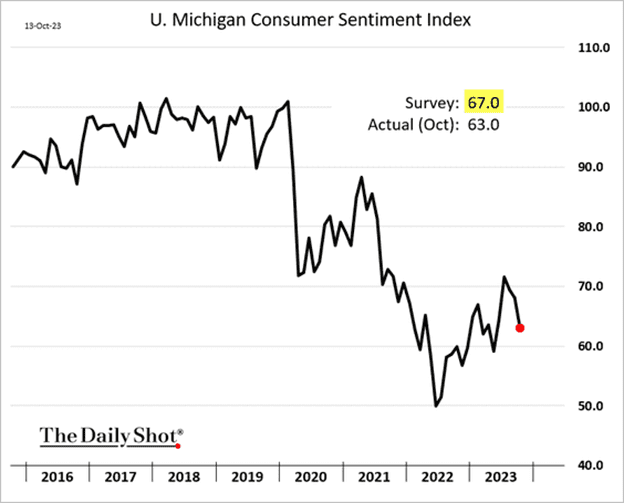

The October U. Michigan consumer sentiment indicator declined more than anticipated.

- The resumption of student loan payments, stock market volatility, and persistent inflation have left households feeling less confident about their financial situation

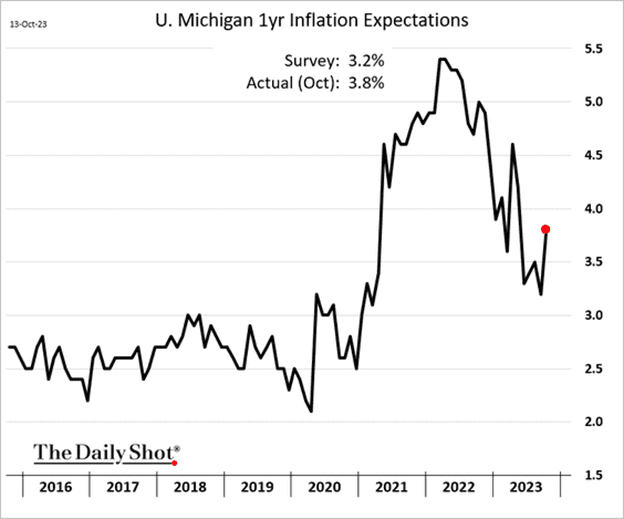

- Inflation expectations rose, topping forecasts.

- US import prices continue to ease, pulled lower by the recent US dollar strength.

- Manufacturing conditions have improved alongside a steeper Treasury curve.

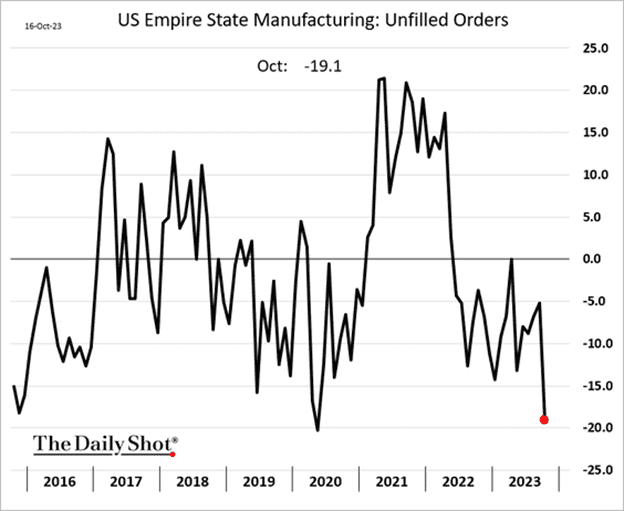

- The NY Fed’s manufacturing index (the first such report of the month) continues to show lackluster factory activity in the region.

- Manufacturers have more than cleared their order backlog.

- The labor component of Goldman’s economic activity index has been rebounding, pointing to persistent strength of the job market.

- Retail sales remained remarkably strong last month, topping forecasts.

- Automobile sales increased.

- Industrial production also surprised to the upside, with robust gains in manufacturing output.

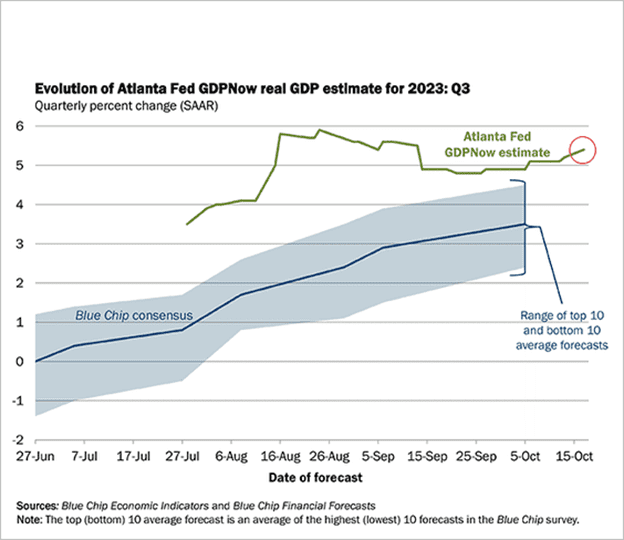

- Impressive performance in retail sales and industrial production boosted the GDPNow Q3 growth forecast (well above 4%, annualized).

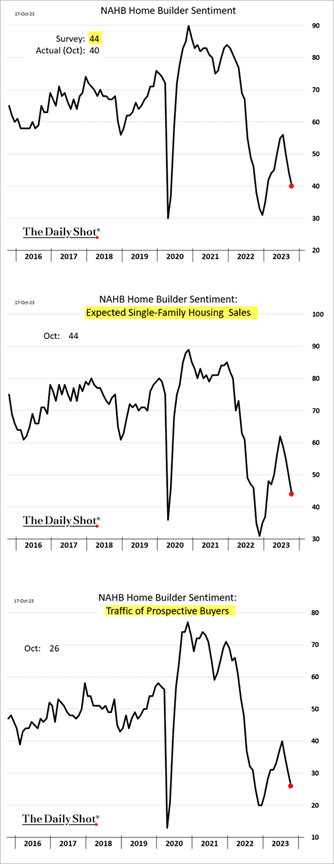

- The NAHB homebuilder optimism index deteriorated further as mortgage rates surged.

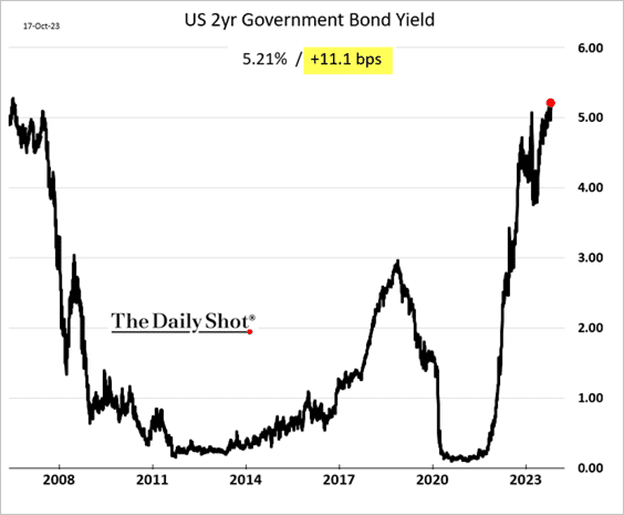

- Robust economic data sent Treasury yields to multi-year highs, …

- The 2-year Treasury yield climbed above 5.2% for the first time since 2006.

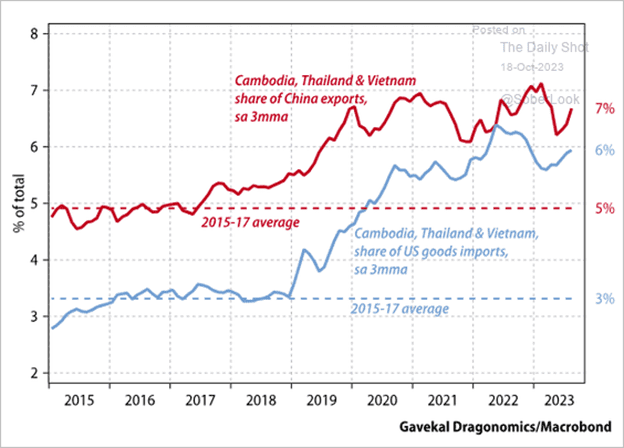

- China has been re-routing exports to the US via Southeast Asia to avoid tariffs.

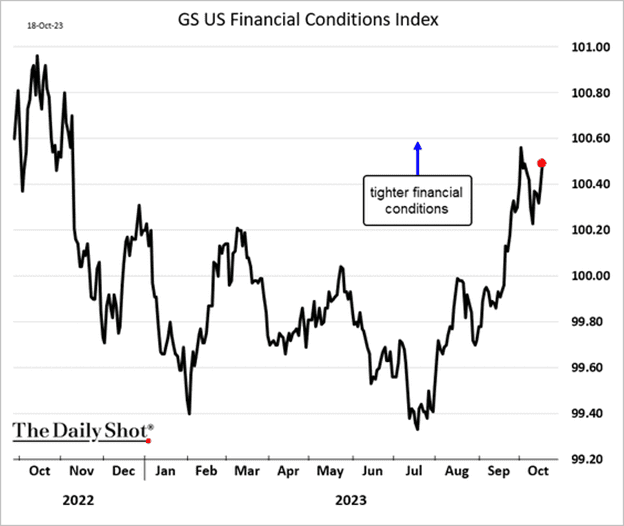

- Financial conditions are tightening.

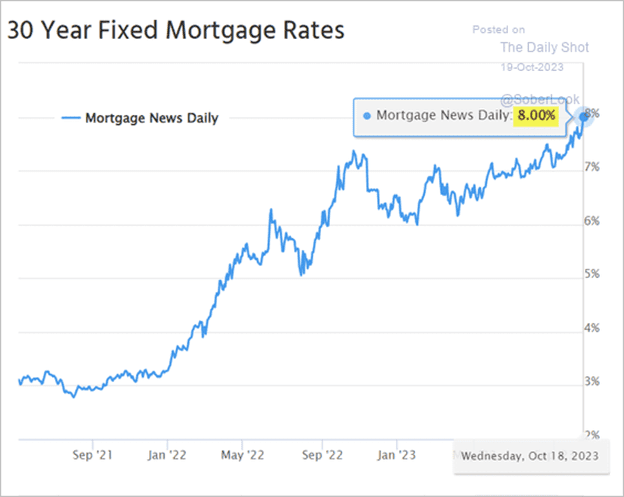

- The 30-year mortgage rate hit 8%, according to Mortgage News Daily.

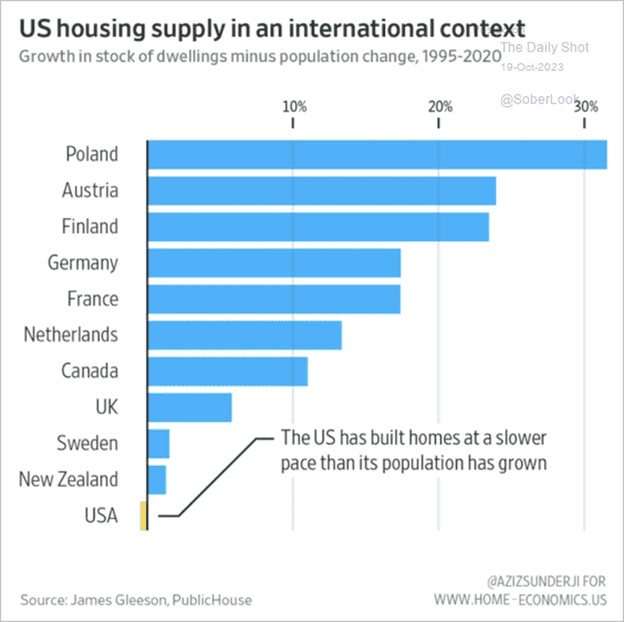

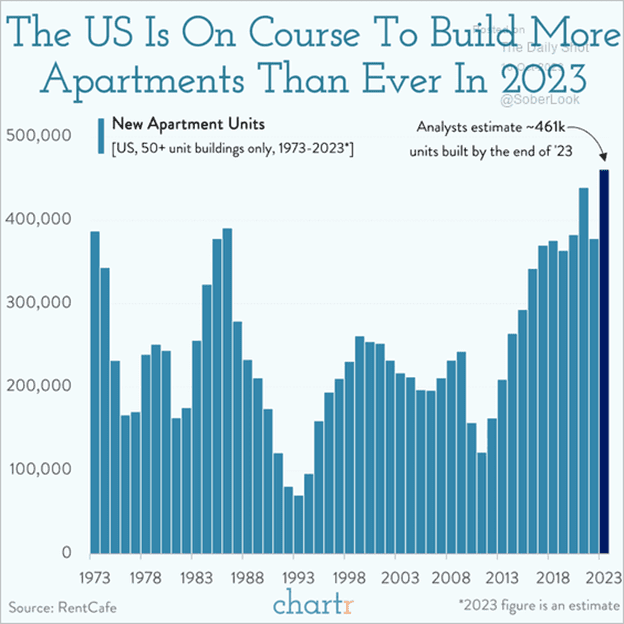

- Unlike many other advanced economies, the United States has not seen a commensurate increase in the number of homes to match its population growth.

- The Philly Fed’s manufacturing index points to persistent weakness in the region’s factory activity.

- Business outlook is also soft, with factories planning to reduce CapEx.

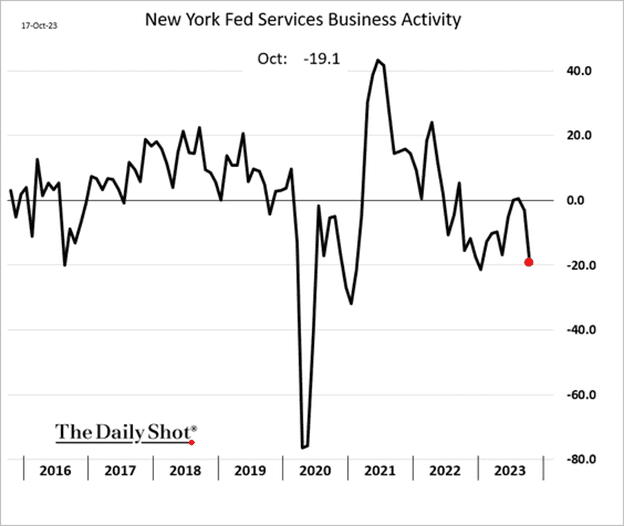

- Service-sector activity in the NY Fed’s region deteriorated further this month.

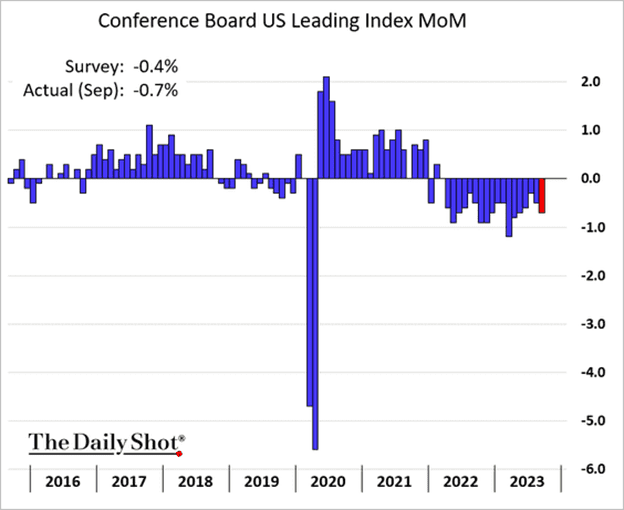

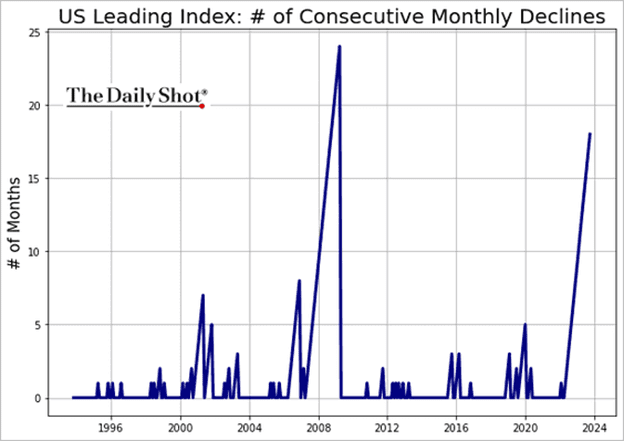

- The US index of leading economic indicators dropped for the 18th month in a row (2 charts).

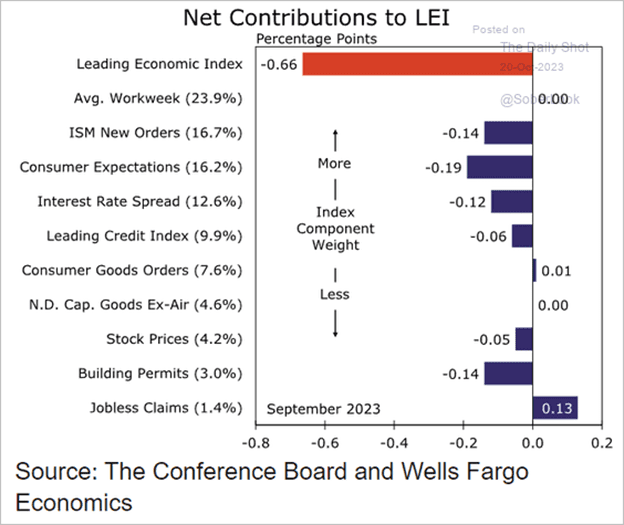

- Here are the contributions to the September decline.

Market Data

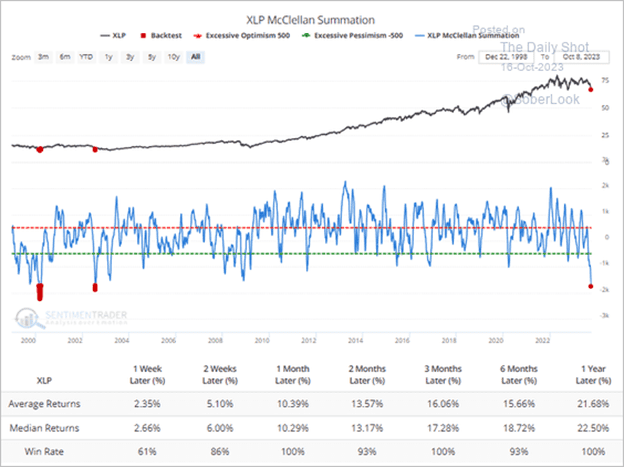

- Breadth among US consumer staples stocks is extremely weak.

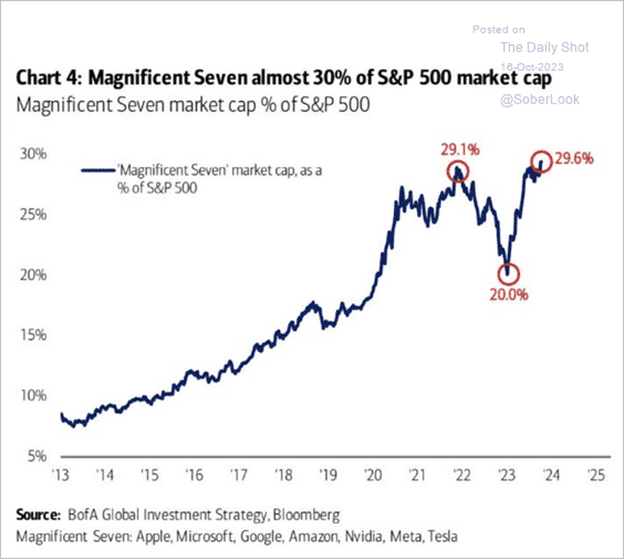

- The top seven stocks now represent almost 30% of the S&P 500 market cap.

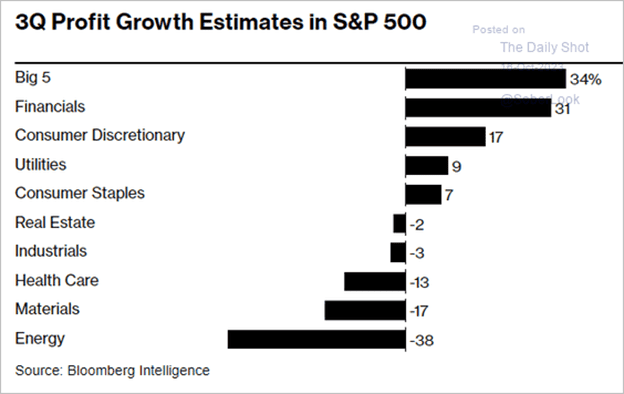

- The “big tech” concentration is powering the S&P 500 profit growth estimates.

- US bankruptcy filings remain elevated.

- New apartment units:

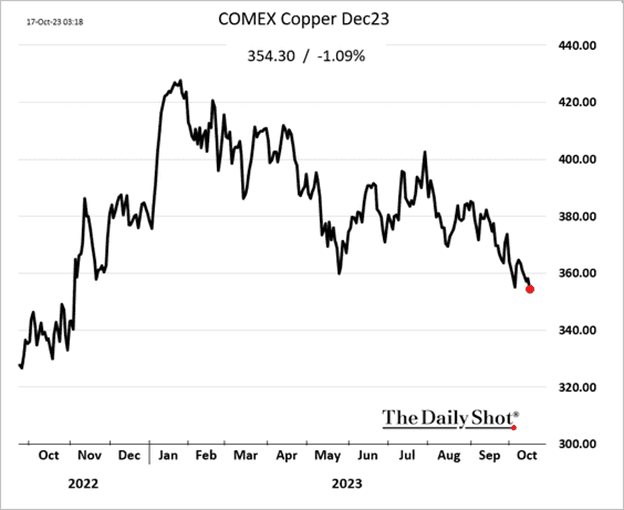

- Dr Copper:

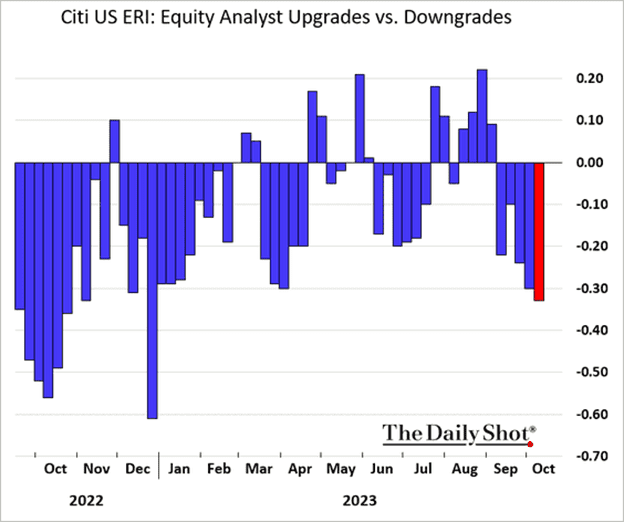

- Analysts’ earnings downgrades are increasingly outpacing upgrades.

- According to Capital Economics, Treasury yields are peaking.

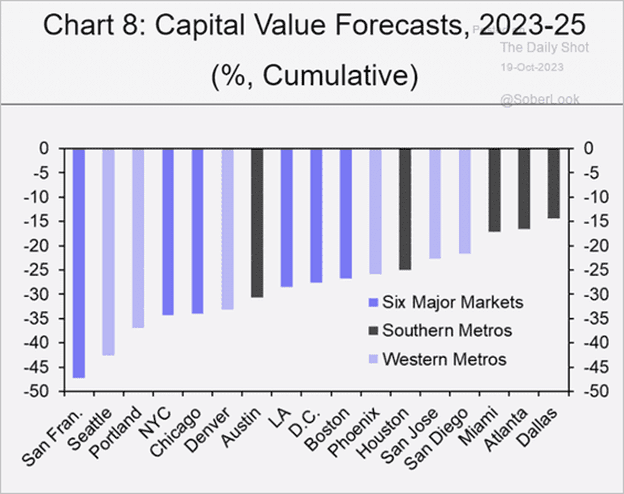

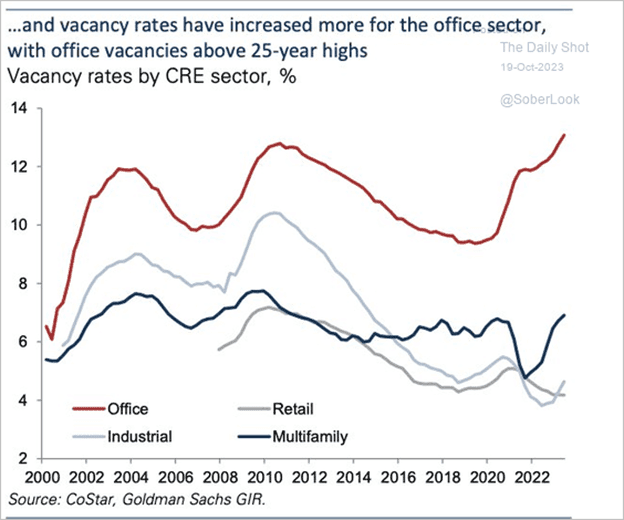

- How much will office property prices decline in major US metropolitan areas?

- Office vacancy rates are at multi-year highs.

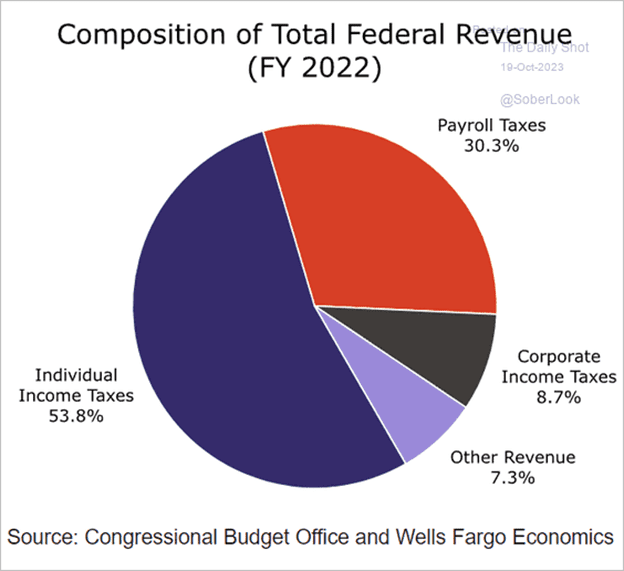

- The composition of US federal revenue:

Great Quotes

“If you are not willing to learn, no one can help you. If you are willing to learn, no one can stop you.”

Picture of the Week

Upper Falls of Provo Canyon, UT

All content is the opinion of Brian Decker