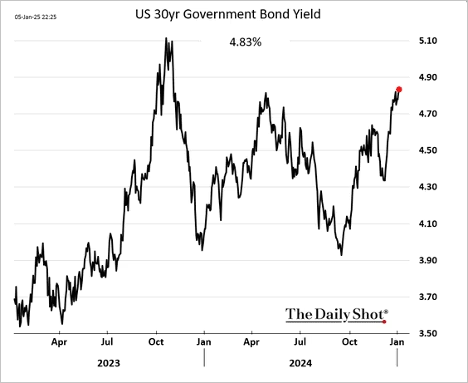

The long-bond yield continues to rise, with the Treasury curve steepening.

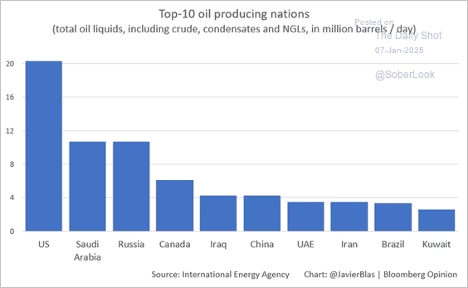

Here is a look at the top 10 oil-producing nations.

Copper is holding support.

Market breadth has been weakening.

The S&P 500 has been holding support.

The rebound in the global stock/bond ratio suggests markets are starting to discount improving economic growth. Companies are increasingly delaying earnings announcements, signaling rising corporate uncertainty.

Economy:

According to the ISM PMI report, the US manufacturing downturn eased in December as demand strengthened. Export orders stabilized. US factories continue to cut jobs. Leading indicators point to future improvement in US factory activity. December vehicle sales exceeded estimates, fueled by stronger demand for hybrids, but gains are not expected to last into 2025.

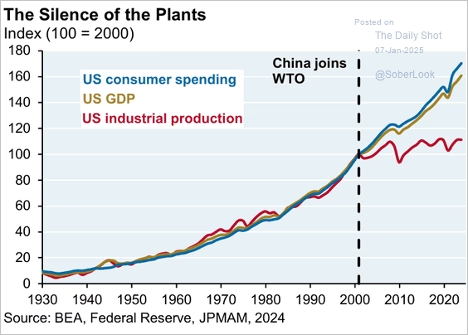

US factory orders fell in November, weighed down by a decline in aircraft orders. Manufacturing orders, excluding transportation, increased for the third consecutive month. Despite steady growth in consumer spending and GDP, industrial production began to lag noticeably following China’s entry into the WTO in 2001. This lag highlighted structural shifts in global manufacturing and trade dynamics, reflecting the decoupling of industrial output from overall economic growth.

Job openings rose again in November, surpassing forecasts. The upside surprise was largely due to a sharp increase in vacancies in the Business Services sector. Quits and hires both declined, indicating the labor market may not be as robust as the headline job openings index suggests. The ISM Services PMI echoed S&P Global’s findings, showing continued expansion in the US service sector in December. The biggest surprise in the ISM Services PMI was the prices paid index, which revealed a sharp acceleration in cost inflation. The unexpected rise in the ISM Services cost index pushed Treasury yields higher, with further yield curve steepening and the stock market dropping. Inflation expectations climbed, while stocks sold off. Mortgage rates moved higher. Did the sharp rise in imports result from frontloading ahead of tariffs?

Consumer credit unexpectedly fell in November, marked by the steepest drop in credit card debt since the 2020 COVID shock. Credit card debt as a percentage of disposable personal income has plateaued well below pre-COVID levels. Total consumer credit as a percentage of disposable personal income continues to decline, indicating ongoing consumer deleveraging.

Mortgage applications began the year at depressed levels as rates continue to rise to almost 7.25% on the 30-year.

Initial jobless claims started 2025 at a multiyear low. Although weekly seasonally adjusted data can be unreliable, the sharp drop at the beginning of the year is noteworthy. The December ADP private employment report was weaker than expected. The healthcare sector continued to add jobs, while several other sectors faced weak employment conditions. Job growth is expected to cool further this year…..which is good for the Fed cutting rates and the stock market’s expectations. BofA customer data shows an increase in wages, particularly for low-income households, which helped slow the growth of household debt as a share of income.

The Fed

The FOMC minutes indicated that Fed officials are growing increasingly cautious about rate cuts.

Source: @economics Read full article

FOMC: – In discussing the outlook for monetary policy, participants indicated that the Committee was at or near the point at which it would be appropriate to slow the pace of policy easing. Many participants suggested that a variety of factors underlined the need for a careful approach to monetary policy decisions over coming quarters. These factors included recent elevated inflation readings, the continuing strength of spending, reduced downside risks to the outlook for the labor market and economic activity, and increased upside risks to the outlook for inflation.

Bloomberg’s Fed minutes indicator shifted into hawkish territory. FOMC participants sharply shifted their views on inflation risks (to the upside). The committee does not see current monetary policy as very restrictive.

Energy

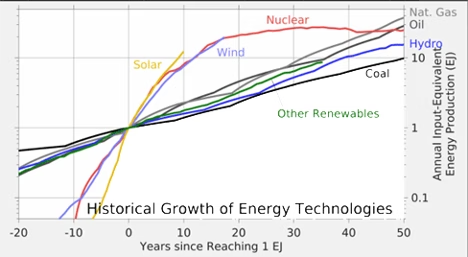

In the 1800s, we switched from wood to coal, and the Industrial Revolution roared to life. In the early 1900s, we upgraded to oil. Cars replaced horses, planes took flight, and modern life as we know it took shape.

Nuclear power should have been the next great leap, but we turned our backs on it in the 1970s. 2024 marked the beginning of the second atomic age and the next giant leap in human progress.

Nuclear has been reawakened by an unexpected force: Big tech companies have gone “all in” on atomic energy. These companies need clean, safe, abundant energy for their ambitious AI plans. They know nuclear is their best option by far.

Microsoft announced it would help revive Three Mile Island—yes, that Three Mile Island. Amazon is pouring $500 million into pocket-sized nuclear reactors to power its data centers. Google and Meta are also racing to split atoms to feed their AI beasts.

For decades, nuclear’s biggest challenge (aside from regulators) wasn’t technology. It was finding customers willing to sign long-term agreements. Now, it has the backing of the richest, most successful companies on Earth. Big tech’s deep pockets and connections in Washington will accelerate the nuclear renaissance by at least a decade. You can already see glimmers:

- Bill Gates’s TerraPower broke ground on America’s first “mini reactor” in Wyoming. Think IKEA for nuclear power, with standardized parts made in factories and assembled on site.

- In Austin, I visited Aalo Atomics, which is building reactors small enough to fit in a New York City apartment but powerful enough to power a neighborhood. Its goal is to churn out 100 mini reactors per year by the end of the decade.

- Radiant Nuclear is developing reactors so compact and safe, you can transport them on the back of a truck.

Nuclear is just the start of our energy acceleration. Last year, more solar power was installed worldwide than between 1956 and 2017. Solar is the fastest-growing power source in human history:

Source: Dr. Robert Rohde on X

In 2004, it took a whole year to install 1 gigawatt of solar power. Now, we’re deploying that much every 12 hours!

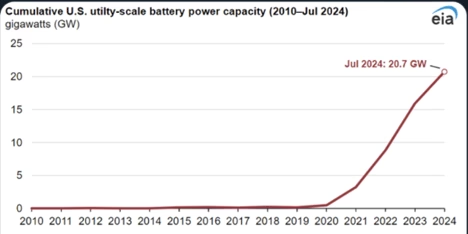

Solar has a big drawback: It only works when the sun shines. We are on our way to solving this problem with batteries. In 2024, America added more battery capacity than the previous six years combined:

Source: EIA

Imagine driving an electric car from New York to Miami on a single charge. Or every appliance in your home being cordless. That’s the future that smaller, cheaper, more powerful batteries can give us.

Rapidly improving batteries are also the key enabler of humanoid household robots. It’s not like you can run a gas-powered robot housekeeper in your home. But a battery-powered one? No problem.

And don’t forget geothermal energy’s untapped potential. If we drill deep enough, we could power the planet for millennia using the Earth’s natural heat.

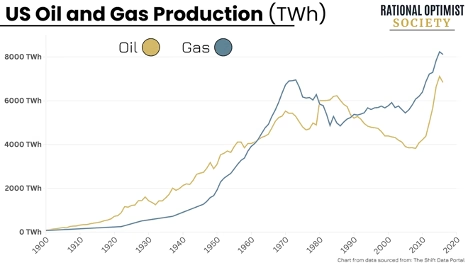

And I haven’t even mentioned fracking, which gets my vote for the most underappreciated innovation of the past decade.

It took America from being dependent on Middle Eastern oil to the world’s biggest-ever producer of oil and gas!

America is entering a new age of energy abundance. This isn’t just about cheaper electric bills. As I showed in Part 1, a lack of energy is what’s been holding back physical innovation.

Energy abundance will give us robot helpers in every home. It will automate factories. It could revive America’s manufacturing might.

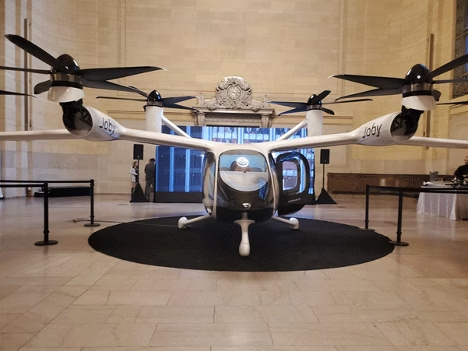

And yes, it will also be a critical component in creating the flying cars we’ve been promised for decades. Here’s Joby Aviation’s prototype. It aims to take you from downtown Manhattan to JFK Airport in seven minutes:

Source: AmNewYork

Clean, abundant energy unlocks the other four frontiers.

Great Quotes

“Do not follow where the path may lead. Go instead where there is no path and leave a trail.”

-Ralph Waldo Emerson

Picture of the Week

All content is the opinion of Brian J. Decker