Markets are rebounding, but the foundation is shaky. This week’s update explores the growing disconnect between earnings results and forward guidance, the Fed’s cautious stance on rate cuts, and how easing tariff pressure is affecting investor sentiment. Plus, surprising data shows U.S. manufacturing isn’t dying—it’s thriving.

Economy

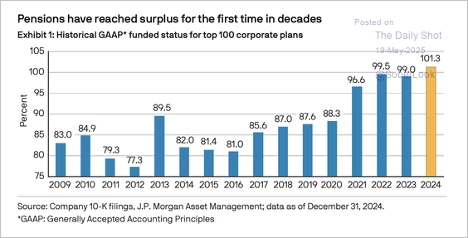

US pension funding has improved in recent years, with the top 100 plans now in surplus for the first time in decades.

Source: J.P. Morgan Asset Management

With improved funded status, pension allocators have de-risked by tilting toward fixed income and away from equities.

Trucking activity has picked up. US single-family housing starts were well below 2024 levels in April. But multi-family construction was robust last month. Borrowers with credit scores above 760 account for a large majority of recent mortgage originations. This contrasts with originations seen before the financial crisis. The share of newly built homes under 1,500 square feet has rebounded to 22.3%, the highest since 2015, after a decade-long decline. Redfin’s home price index points to the first monthly price decline since 2023.

Libertarian economist Don Boudreaux highlights some data many people seem to have missed. US manufacturing output has been climbing faster than inflation, rather than declining, for at least the last 20 years.

Key Points:

- In the 20 years from 2005-2024, US real manufacturing output rose by 30%.

- Looking only at the “Rust Belt” states, real manufacturing output rose 14% in those two decades.

- Output also climbed 25% in the South during this time.

- The biggest gains were in the West, up 114% in Arizona, 70% in Oregon and 39% in Colorado.

- The narrative that foreign trade has “hollowed out” American manufacturing is the opposite of truth.

While 30% real output growth over 20 years may not be a boom, it’s not a collapse, either. The data suggests a lot of manufacturing activity went South and West within the US, not overseas. Technology-driven productivity gains allowed this growth to happen with fewer workers, helping US consumers pay lower prices.

Markets

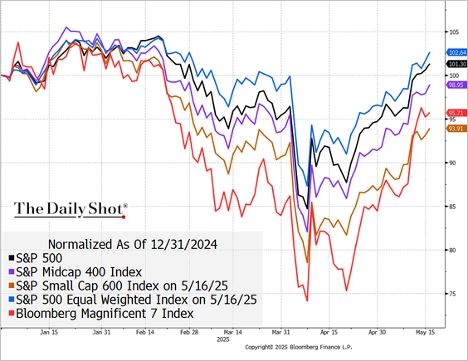

The market rebound has been impressive (2 charts).

Source: Deutsche Bank Research

Despite strong Q1 earnings, EPS guidance momentum for the S&P 500 has collapsed to its lowest level in years—underscoring investor concerns that topline growth and forward outlooks aren’t keeping pace with market valuations. The disconnect between solid backward-looking results and deteriorating forward guidance adds fragility to the recent equity rebound.

The sharp rebound in cyclicals relative to defensives signals a market re-rating of US growth prospects, despite consensus GDP forecasts continuing to drift lower.

Fund flows in 2025 reveal a sharp divergence: US large-cap stocks are experiencing record inflows, while small caps are seeing their largest outflows on record.

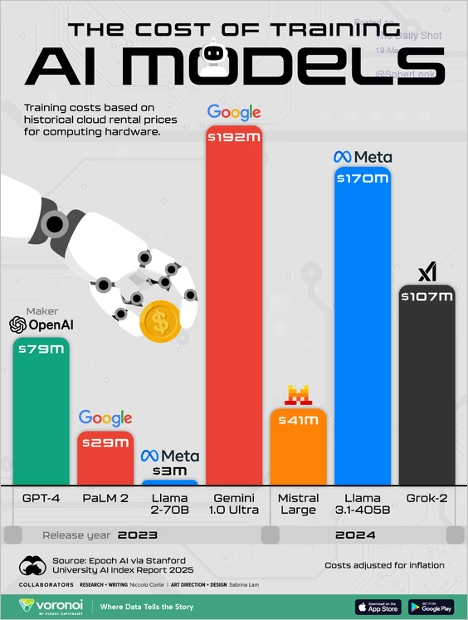

Training costs for major AI models released in 2023 and 2024:

Source: Visual Capitalist Read full article

The 30-year Treasury yield is approaching 5% amid concerns over US debt.

The US dollar is drifting lower again.

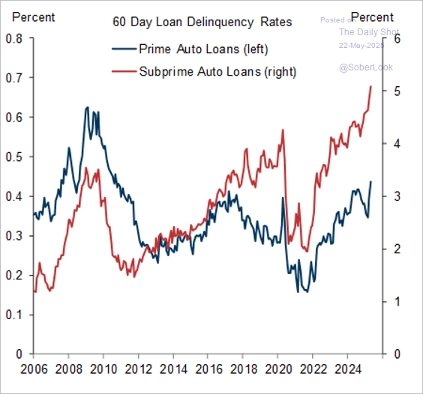

US subprime auto loan delinquencies have surged to new highs.

Manufacturing survey indicators have improved since the US/China trade war modifications.

The Fed

Fed officials remain cautious about rate cuts, …

Source: Bloomberg Read full article

… with markets assigning low odds to any move before September.

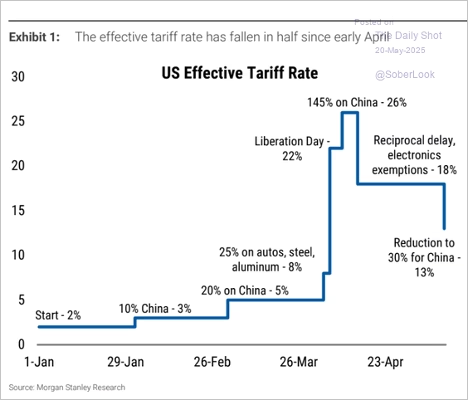

Tariffs

US effective tariff rate in 2025:

Source: Morgan Stanley Research

Great Quotes

“Life is short… until you extend it.” – Dr Peter Diamandis

Picture of the Week

The fjords of Norway

All content is the opinion of Brian Decker