November tends to be a favorable month for stocks, including during election years.

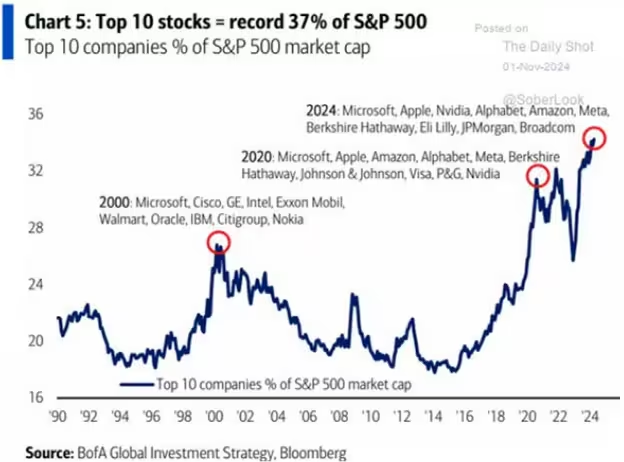

This chart below shows the percentage of the S&P 500’s value represented by the top 10 stocks. The red circles show how a top-heavy index tends to mark cyclical peaks. Today’s market is the most concentrated in 35 years.

The companies that were in the top 10 at each peak are interesting, too. The top 10 in the year 2000 were a fairly diversified group: technology, industrial, energy, retailing, financial. That is less so in 2020 and 2024. Only Microsoft (MSFT) was in the top 10 all three times.

Market reactions to Trump victory:

- Markets +2%. Stock futures surged on expectations that the 2017 Tax Cuts and Jobs Act will be extended or that corporate taxes could be lowered further under the Trump administration. Anticipation of looser regulations and reduced antitrust activity also contributed to the rally.

- Dollar stages largest gains since 2020. Trump wants to see a weaker US dollar, but markets are bracing for tariff hikes. In response, trading partners’ currencies are adjusting lower to maintain competitive pricing and offset the impact of higher tariffs. The US dollar surged against the Mexican peso, and the Chinese renminbi. The Euro and Ja[anese Yen tumbled.

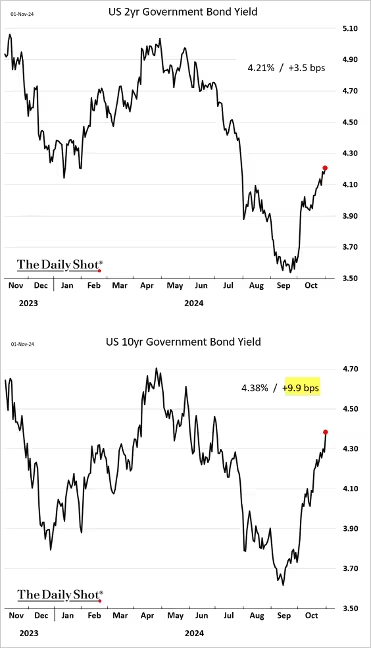

- Treasury bond yields rose in anticipation of more economic stimulus.

- Bitcoin hit record high.

- While the market fully expects a Fed rate cut this month, the situation is now less certain going forward.

- Clean energy stocks have been in a bear market since early 2021.

- Vaccine manufacturers took a hit.

- Shares of private prisons surged.

- Precious metals declined as the dollar surged on Wednesday.

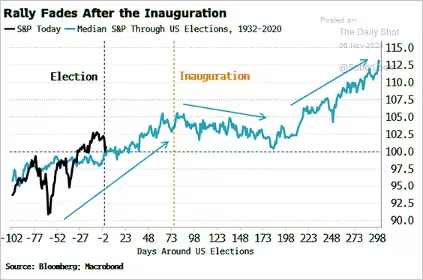

How does the market usually perform leading up to and following the presidential inauguration?

Source: Simon White, Bloomberg Markets Live Blog

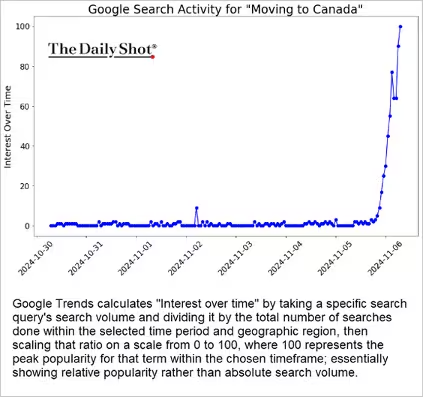

Google search activity for “moving to Canada”:

Economy:

October saw the smallest increase in US payrolls since 2020, falling well below forecasts, with private payrolls contracting. Much of this weakness, though not all, can be attributed to the impact of hurricanes and the Boeing strike. The unemployment rate held steady at 4.1%. Treasury yields initially dipped in response to the weak employment report but rebounded as the market absorbed the underlying causes of the weakness.

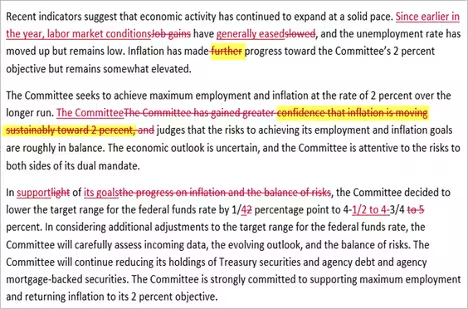

The Fed

As expected, the Fed cut its benchmark rate by 25 bps on Thursday. The FOMC statement expressed less confidence that inflation is slowing, nudging Bloomberg’s sentiment indicator slightly in a hawkish direction.

Rising wage growth could slow the Fed’s pace of rate cuts going forward. The market still expects a rate cut in December, but the situation is less certain beyond that.

Great Quotes

“Success is peace of mind, which is a direct result of self-satisfaction in knowing you did your best to become the best that you are capable of becoming.”

– The late great John Wooden, Legendary UCLA Basketball Coach

Picture of the Week

New England colors

All content is the opinion of Brian Decker