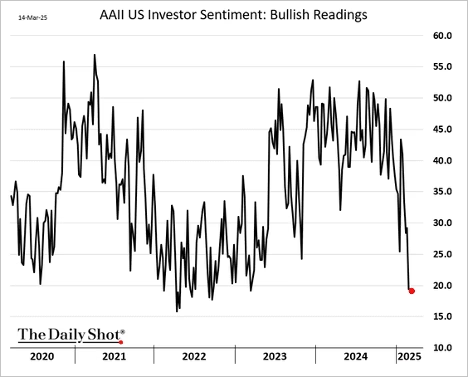

Retail investors remain nervous.

Analysts expect S&P 500 profit margins to rise further this year. Can robust profit margins cushion the tariff impact for consumers? If they do, Wall Street may have to lower its profit margin assumptions, which could put pressure on earnings. Retail sales held up well last month amid rising uncertainty. The headline index was lower than expected, but the underlying trend was robust.

The median age of homebuyers has surged to 56 in 2024, reflecting affordability challenges and tighter credit conditions that have delayed homeownership for younger generations.

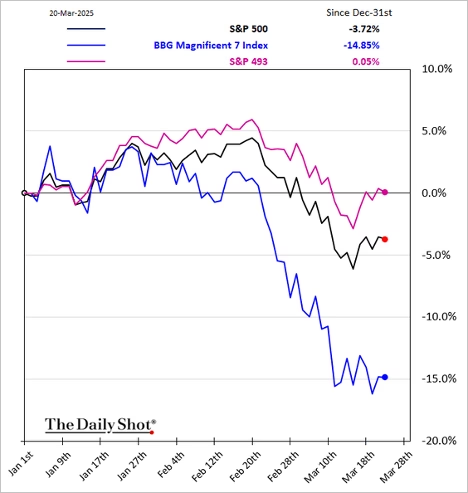

The S&P 500 has seen improving momentum, although there is a lot of overhead resistance.

Source: Aazan Habib, Paradigm Capital

The S&P 500 forward P/E ratio remains above 20x, which is still high by historical standards. US equities are entering a seasonally strong period into the month-end. Tech and consumer discretionary stocks saw the biggest drawdowns in the latest selloff. The Magnificent 7 stocks have collectively declined about 15% year-to-date.

Economy:

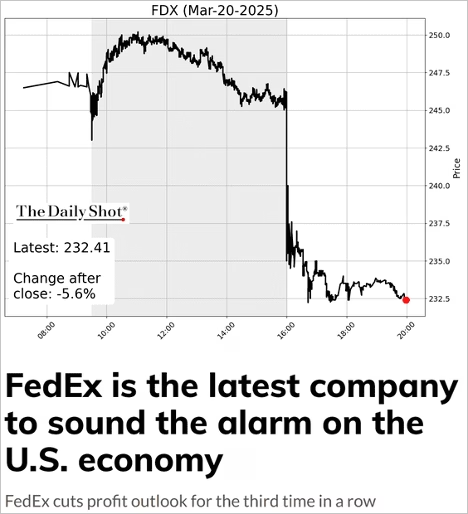

The University of Michigan’s measure of consumer sentiment deteriorated this month. Consumers are increasingly uneasy about the labor market. Inflation expectations jumped. US freight demand has been slowing, with transportation stocks underperforming this month.

US manufacturing output jumped last month, boosted by a rebound in automobile production. Capacity utilization improved. The measure of CapEx plans moved into negative territory for the first time since the COVID shock. Housing starts strengthened in February. Existing home sales exceeded expectations but still fell to a multi-year low last month. Housing inventories were well above last year’s levels in February. Prices remained above last year’s levels.

The Philly Fed’s regional manufacturing index held up better than expected this month, though the outlook has grown more uncertain. Dr Copper is a very good measure of economic strength and Copper prices are rising. COMEX copper futures continue to climb.

However, Consumer-facing firms are growing increasingly concerned about an economic slowdown. Here is FedEx.

The Fed:

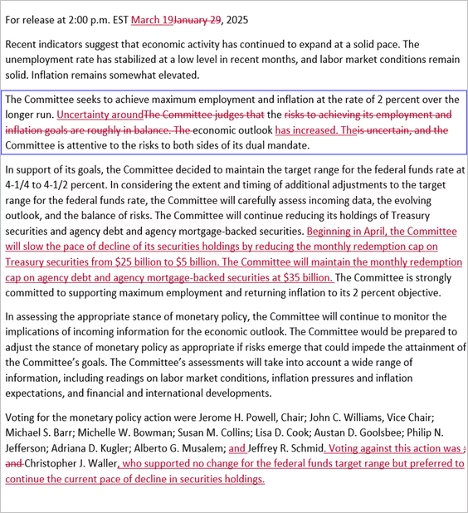

The Fed kept rates steady and acknowledged rising economic uncertainty. It also signaled a slower reduction in securities holdings starting in April, cutting Treasury redemptions to $5 billion. Below are the changes in the FOMC statement from January.

Markets were relieved that the FOMC still anticipates two rate cuts this year despite rising inflation risks. Treasury yields dropped, and stocks moved higher. The market now anticipates 66 bps of rate cuts this year, suggesting the possibility of three reductions. The FOMC revised down its GDP growth forecasts while raising inflation projections due to tariffs.

Great Quotes

“There’s no place like home.” – Wizard of Oz

Picture of the Week

Seljalandsfoss Iceland

All content is the opinion of Brian Decker