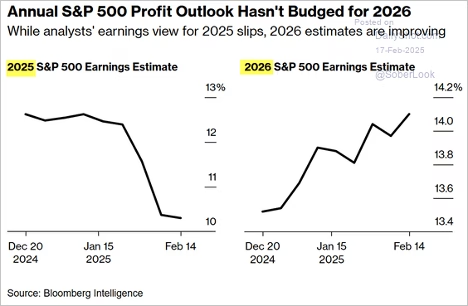

Analysts have been lowering earnings growth forecasts for this year but are more optimistic about 2026. CTAs are boosting equity exposure.

Source: @markets Read full article

Companies’ EPS guidance has been trailing consensus estimates. The equal-weight S&P 500 has significantly underperformed the aggregate index over the past decade, but projections suggest a potential reversal. If market concentration unwinds, equal-weight could outperform by eight percentage points annually over the next decade, while a mean reversion scenario implies a more modest 2% relative gain.

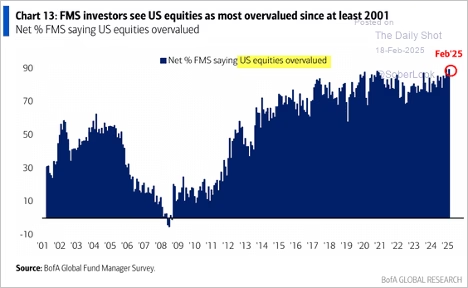

Investors have been moving silver from London to NY to avoid future tariffs. Overall sentiment in equity markets remains upbeat. However, global fund managers increasingly see US stocks as overvalued.

Source: BofA Global Research

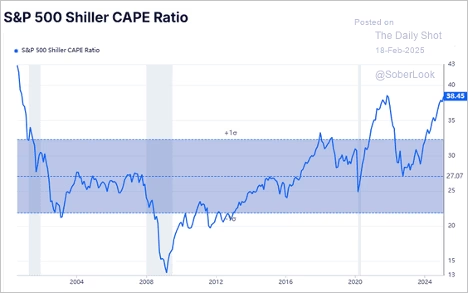

The Shiller CAPE Ratio hit its highest level since the dot-com bubble.

Source: gurufocus

Increasing divergence in stock performance creates a more favorable environment for active management. US industries with the highest profit margins:

Small caps continue to lag. The Magnificent 7 basket has been underperforming. The Nasdaq 100 is testing resistance.

Economy:

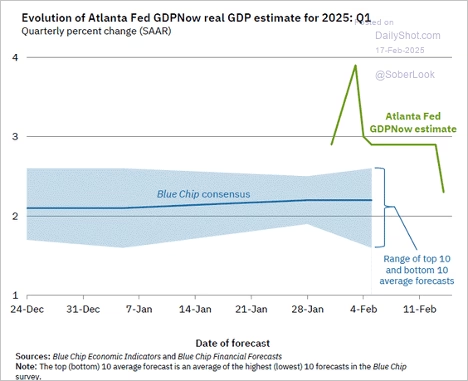

US retail sales fell more than expected in January, partly due to cold weather and the LA wildfires. Not all of the weakness can be attributed to the weather, as online sales also dropped. The Atlanta Fed’s Q2 GDPNow estimate dropped sharply last week, driven by weak retail sales and declining inventories.

Consumer loan demand remains weak, with credit card demand softening over the past two quarters. While lenders continue tightening credit card underwriting standards, they have begun easing auto loan requirements. The federal budget deficit widened more than expected in January.

Source: @economics Read full article

Federal interest expenses are exceeding last year’s levels, outpacing defense spending.

According to Deutsche Bank, the US has tolerated the erosion of domestic manufacturing in exchange for access to cheap goods. Major US banks have been cutting exposure to China.

Housing delistings are rising, signaling weaker demand as sellers pull listings amid a cooling market. Factory cost gains are accelerating, and companies are increasingly passing them on to clients.

The Fed:

The FOMC minutes suggest the Fed will remain on hold unless the labor market deteriorates while awaiting significant progress on inflation.

- Participants generally pointed to upside risks to the inflation outlook. In particular, participants cited the possible effects of potential changes in trade and immigration policy, the potential for geopolitical developments to disrupt supply chains, or stronger-than-expected household spending.

• Participants indicated that, provided the economy remained near maximum employment, they would want to see further progress on inflation before making additional adjustments to the target range for the federal funds rate.

• Many participants noted that the Committee could hold the policy rate at a restrictive level if the economy remained strong and inflation remained elevated,..

The FOMC minutes’ word count for inflation-related terms reached its highest level since 2023.

Amid renewed concerns about tighter conditions in money markets, some FOMC members favor slowing or pausing QT.

Regarding the potential for significant swings in reserves over coming months related to debt ceiling dynamics, various participants noted that it may be appropriate to consider pausing or slowing balance sheet runoff until the resolution of this event.

Treasury yields eased in response to FOMC comments about slowing or pausing QT. The market is pricing in 39 bps of rate cuts this year, with a 56% probability of two cuts, assuming at least one occurs. June and/or September look the most likely.

Russia

Dr. George Friedman of Geopolitical Futures thinks the new US-Russia negotiations aren’t only about Ukraine. It is another step in rearranging the global balance of power. Both sides have things they want.

Key Points:

- US-Russia hostility defined the global order from 1945 until the early 1990s. The USSR’s collapse deprived Russia of its historic buffer states. The war in Ukraine was an attempt to reclaim them.

- The failed war has weakened the Russian economy and imperiled the regime. Russia needs a new strategy.

- China wishes to maintain relations with the US and Europe, leaving Russia with no strategic counterweight.

- The US faces no similar threats, giving it more options in the negotiations.

- A US-Russia understanding could let the US shed its responsibility for European security while eliminating the possibility of a China-Russia alliance.

- Russia needs economic growth in which the US would likely participate.

In a later report, Dr. Friedman said that holding the negotiations in Saudi Arabia, without Ukraine or any of its neighbors present, is another sign the talks go beyond the Ukraine issues. He speculates they may relate to Gaza or broader Middle East stability. In any case, it seems big change may be brewing.

Great Quotes

“If you saw how much work it took, you wouldn’t call it genius. “ – Michelangelo

Picture of the Week

Half-Dome, Yosemite National Park

All content is the opinion of Brian Decker