US stocks have had a rough start to the year compared to the rest of the world.

U.S. stocks are lagging behind international markets—posting their worst relative start to a year in more than three decades.

Source: @financialtimes Read full article

The rebound in copper futures is fading.

The rebound in copper prices is fading, raising concerns about slowing global demand and industrial activity.

Economy

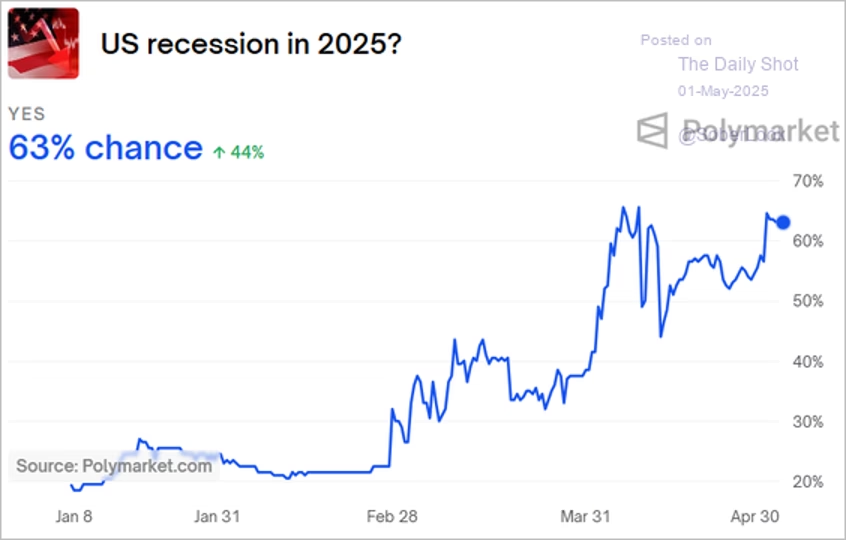

US GDP contracted in the first quarter, driven by a sharp surge in imports ahead of impending tariffs. However, private domestic demand held up well, boosted by strong business investment. Growth in consumer spending slowed in the first quarter. Businesses have been stockpiling inventories of imported goods. Prices rose more than expected in the first quarter. Recession probabilities jumped in the betting markets after the GDP report.

Markets have increased bets on a U.S. recession after Q1 GDP unexpectedly contracted.

Source: Polymarket

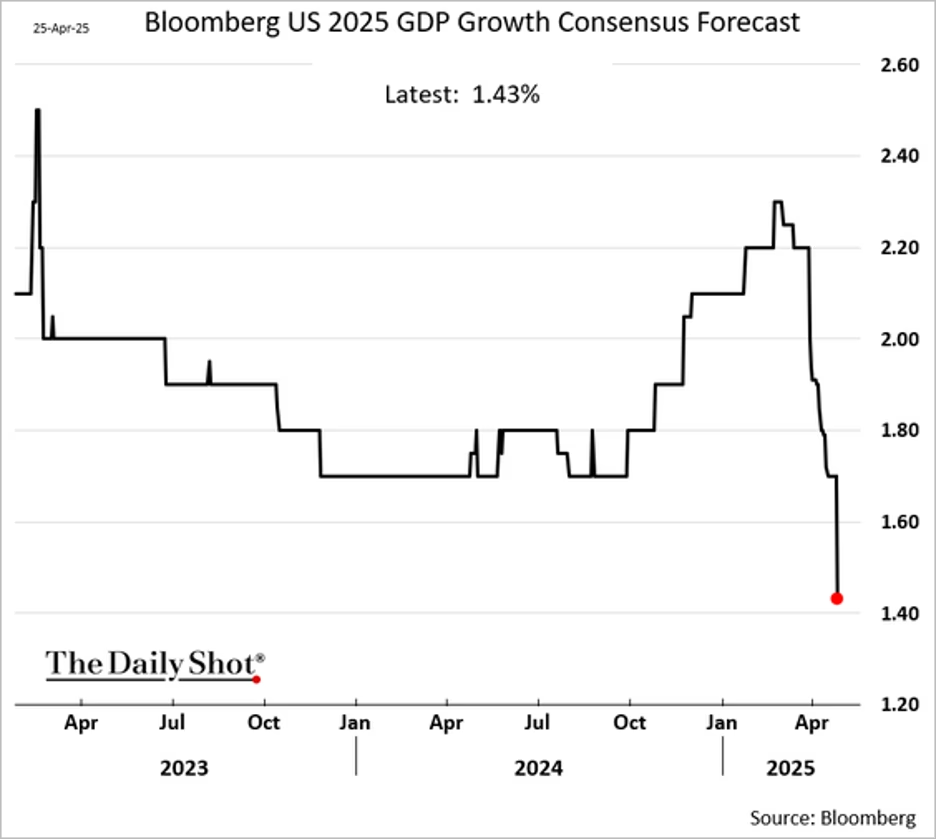

Goldman Sachs projects that tariffs will shave nearly two percentage points off US GDP growth in 2025, primarily through hits to consumer spending, tighter financial conditions, and heightened uncertainty—leaving Q4/Q4 growth at just 0.5%.

The University of Michigan consumer sentiment index edged up in the latter half of the month but remained depressed, due to elevated trade uncertainty. Economists have been actively revising down their projections for US economic growth this year.

Goldman Sachs estimates tariffs could reduce U.S. GDP growth by up to 2% in 2025.

The number of container ships departing from China to the US declined further in recent days as businesses canceled orders, while China is also canceling some US imports.

Shipping volumes from China to the U.S. have fallen as tariffs prompt order cancellations and supply chain shifts.

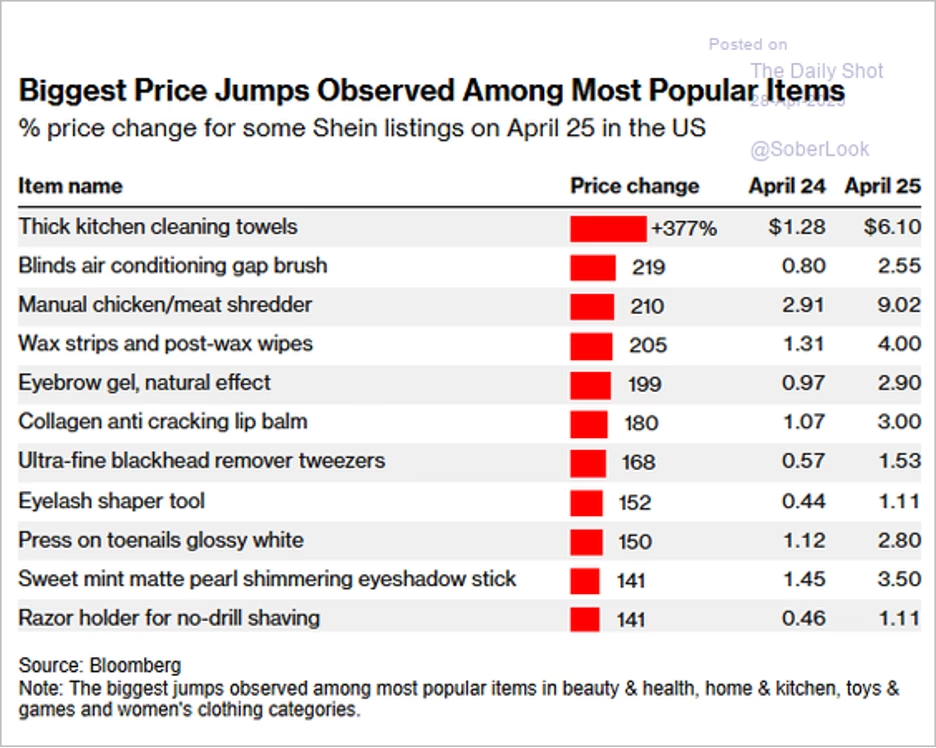

Shein Group US product price hikes in response to tariffs on China imports:

Retailers like Shein are raising U.S. prices in response to tariffs on Chinese goods.

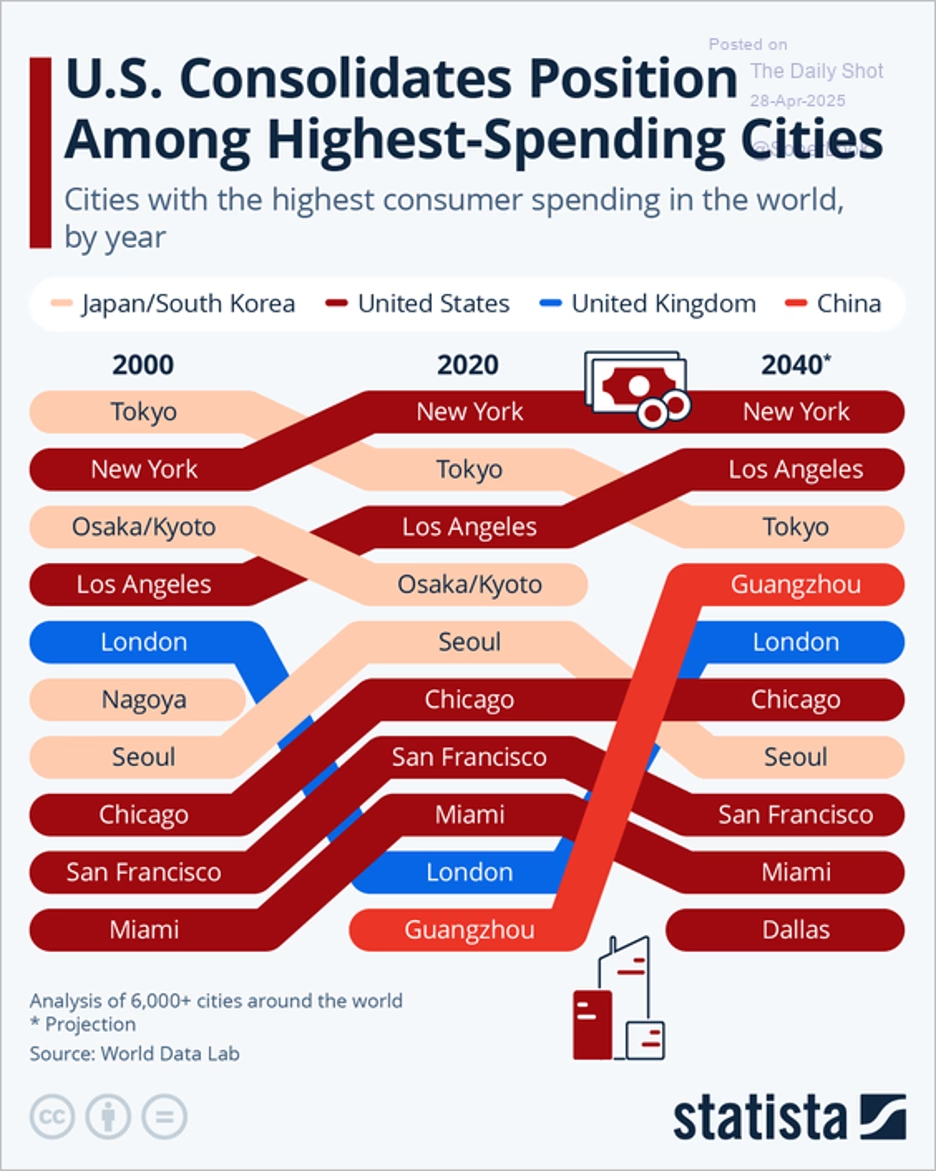

Cities with the highest consumer spending:

Spending remains concentrated in major metro areas despite broader economic caution.

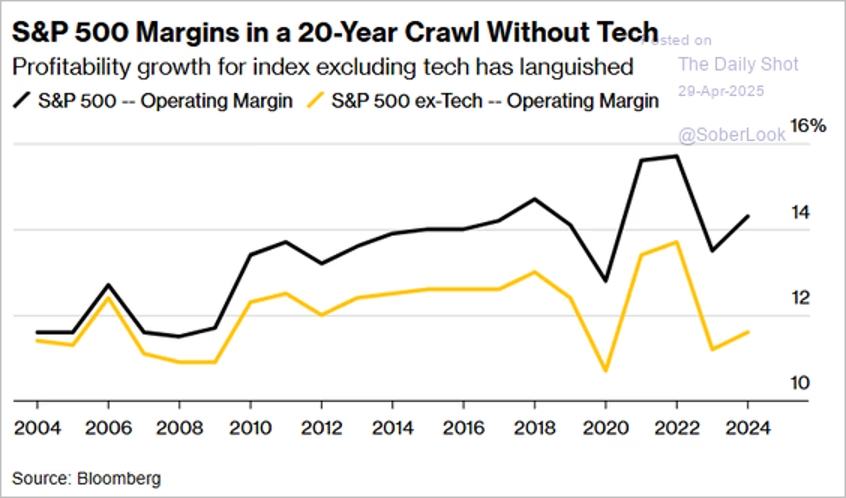

Excluding the tech sector, S&P 500 profit margins have remained flat over the past 20 years.

Profit margins are declining in most sectors, especially real estate, financials, and tech.

Source: @markets Read full article

Net margins are expected to decline sequentially in 7 of 11 S&P 500 sectors for Q1 2025, with real estate, financials, and tech facing the steepest compression.

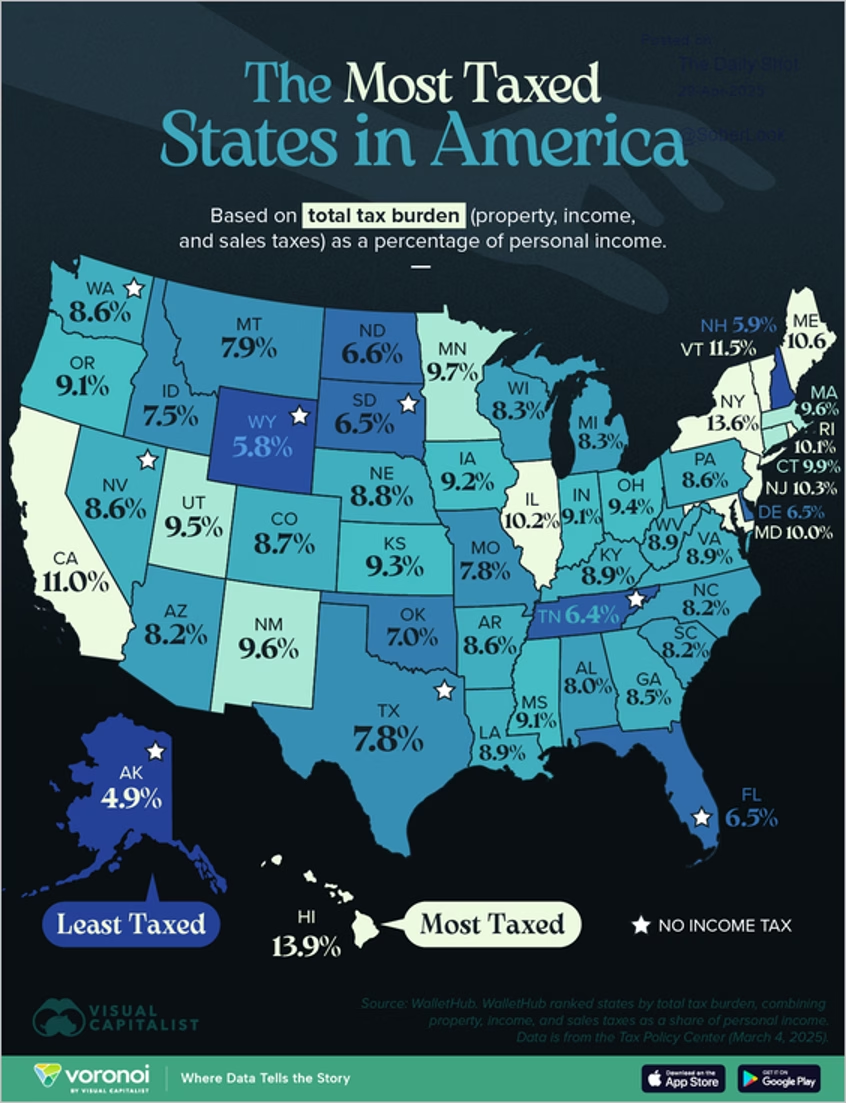

Total tax burden as a percentage of personal income by state:

State-by-state differences in tax burden remain a key factor in retirement and income planning.

Article Title: China Says It’s Assessing US Talks, Hingint at Possible Thaw

Source: @bpolitics Read full article

Article Title: Japan Sees Trade Talks Spending Up, Hopes for June Agreement

Source: @economics Read full article

The Fed

Here is a look at the latest inflation expectations.

Consumer sentiment remains depressed due to persistent inflation and uncertainty over trade policy.

Economists anticipate two Fed rate cuts this year, while the market is pricing in three to four reductions.

Tariffs

Container shipping rates from China to the U.S. have plunged since the tariff announcement, while prices via Vietnam are surging. This trend suggests a shift in trade flows as importers reroute to avoid steep duties and capitalize on temporary tariff exemptions.

Great Quotes

“True terror is to wake up one morning and realize that your high school class is running the country.” – Kurt Vonnegut

Picture of the Week

Angel Falls, Venezuala

Angel Falls, Venezuela — the tallest uninterrupted waterfall in the world and a breathtaking natural wonder.

All content is the opinion of Brian Decker