The last time the Fed made a policy move was when it raised rates to current levels in July 2023. The last time the central bank lowered rates was in 2020. It started hiking rates in March 2022.

Now, Fed “juice” – a lower cost of borrowing – is returning to the U.S. economy for better or worse.

Practically, this means the Fed is about to lower its target federal-funds rate range for overnight lending between banks.

The central bank doesn’t raise or lower rates with a switch, but suggests a rate range to banks that make up the “system.”

This move then trickles through the economy via changes to heavily rate-sensitive things like mortgages, credit cards, or corporate bonds usually spurring economic activity.

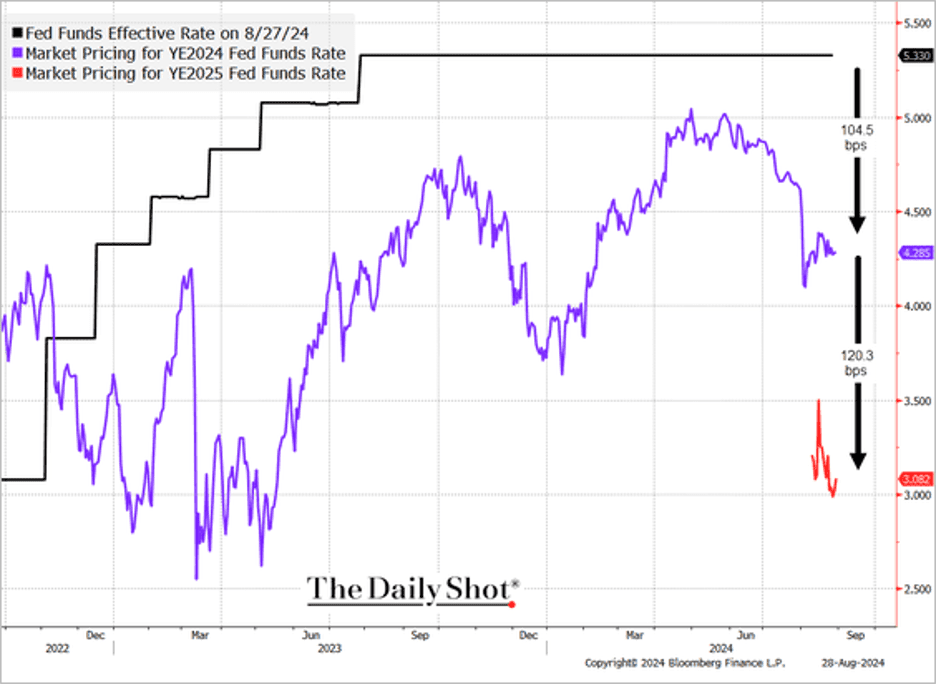

The open question now – and what could move markets in the months ahead and into 2025 – is how large the rate cuts will be.

As Powell said on Friday:

The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.\

Specifically, Mr. Market is wondering if the Fed will cut rates by a relatively small 25 basis-point amount at its upcoming meeting, or by a larger 50 basis-point amount.

Whether you think the Fed will cut rates by a smaller or larger amount likely depends on whether you think the economy is still due for a “hard” or “soft” landing following everything we’ve seen over the past few years.

I’m talking about the 2020 pandemic and response 40-year-high inflation interest rates going from near zero to above 5% in a relatively short time to “fight” inflation to today’s struggling economy.

Investors are now closely monitoring the unemployment rate and other economic indicators, with signs of recession flashing lately. The most recent unemployment rate, covering July, was 4.3%, up from 3.5% in July 2023.

A quicker or greater pace of job market weakening could lead to more significant Fed rate cuts, but also jolt the stock market. As we just saw a few weeks ago, after the last jobs number, unexpected “bad news” for the economy was viewed as bad news for stocks.

This scenario is unlike the market environment over much of the past two years, when weakening in the economy (what the Fed wanted to “fight” inflation) was viewed as a “good” thing by Wall Street because it meant the Fed would be more likely to cut rates.

Now, we’re there. Powell, right or wrong, says inflation has been licked and the Fed will now do “everything we can to support a strong labor market as we make further progress toward price stability.” We’re going to have it all, he says.

So what’s next? Barring a completely stunning unemployment rate for this month (which will be published on September 6), probably a 25 basis-point cut. Fed-funds futures traders have put 70% odds on it versus the 50 basis-point alternative.

Here’s one plausible – although unlikely – scenario:

The economic data – namely the unemployment rate – could deteriorate to a point where Powell & co. feel pressure to announce an “emergency” rate cut in between one of its regularly scheduled meetings in September, November, and December.

If such an “emergency” move happened, stocks would likely tumble, since it would signal an economy in more trouble than previously thought.

We last saw something similar in March 2020 when many investors panicked about all the uncertainties over the onset of the COVID-19 pandemic.

After the Fed announced rate cuts to near zero in early March 2020, the market plummeted before finally bottoming around mid-March when the Fed came up with a laundry list of new “lending facilities” to stop the credit market – and market in general – from freezing up.

You might remember folks on CNBC and elsewhere panicked a few weeks ago over a potential recession.

They were calling for immediate interest-rate cuts after Uncle Sam’s latest “nonfarm payrolls” report for July was published.

The reading triggered the so-called Sahm rule, a measure of employment-rate change linked to past recessions.

The next monthly jobs report covering August comes out next Friday. Take note of the date, because “everyone” seems to have forgotten the mini panic of a few weeks ago.

Much of Powell’s speech on Friday sounded like a mix of a misguided victory lap and a hollow eulogy for inflation. He said everything but “mission accomplished” and apparently thinks there’s little risk for high inflation to continue while cheering that unemployment hasn’t spiked.

Among other things, Powell said…

How did inflation fall without a sharp rise in unemployment…?

He is also sending mixed messages about unemployment. Has he not seen the unemployment rate rising uninterrupted for the past four months and trending higher since the summer of 2023? Clearly, he has.

Or does he think unemployment will just stop rising now that the Fed said it will “lower rates”? Doesn’t he still believe in “long and variable lags” of policy? Surely, he does. Otherwise, why is the Fed willing to do “everything we can” to support the job market?

Why do that if you’re not concerned?

This smells like the Fed trying to spin another story or Powell is ignorant of central-bank history, which is precisely why it has repeated itself for decades.

As we’ve written several times, the Fed has historically grossly underestimated how high unemployment can rise when recessions occur. And the unemployment rate is already greater than what the Fed members projected just two months ago.

In its most recent quarterly economic projections in June, the Fed said the unemployment rate by the end of 2024 would be 4%, and it projected a 4.2% rate by the end of 2025. With unemployment at 4.3%, it already undershot.

Powell is saying “it’s fine” when a greasy fire is burning in the basement. Maybe he thinks we can put it out with some water. “Don’t fight the Fed” is a saying for good reason, but you also don’t want to get unintentionally burned by the Fed either.

When it comes to rate cuts, it might be worth thinking about whether we’re in a “buy the rumor, sell the news” moment until the central bank adjusts to reality.

The worst part of Powell’s whole speech may be the fact that he didn’t even come close to acknowledging the central bank and Congress’ role in creating the 40-year high inflation rate in the first place amid the pandemic.

In fact, he did the opposite, justifying the Fed’s horrible “transitory” take on inflation back in 2021, which we said was wrong for nearly a year before the central bank adjusted to reality. Powell said…

The good ship Transitory was a crowded one, with most mainstream analysts and advanced-economy central bankers on board.

So be careful – and skeptical – of following the Fed. The good ship “Transitory” is somewhere at the bottom of the Atlantic Ocean and many lives were lost, but somehow the captain and crew got very well-paying jobs from the same operator of a new boat: the “Soft Landing.”

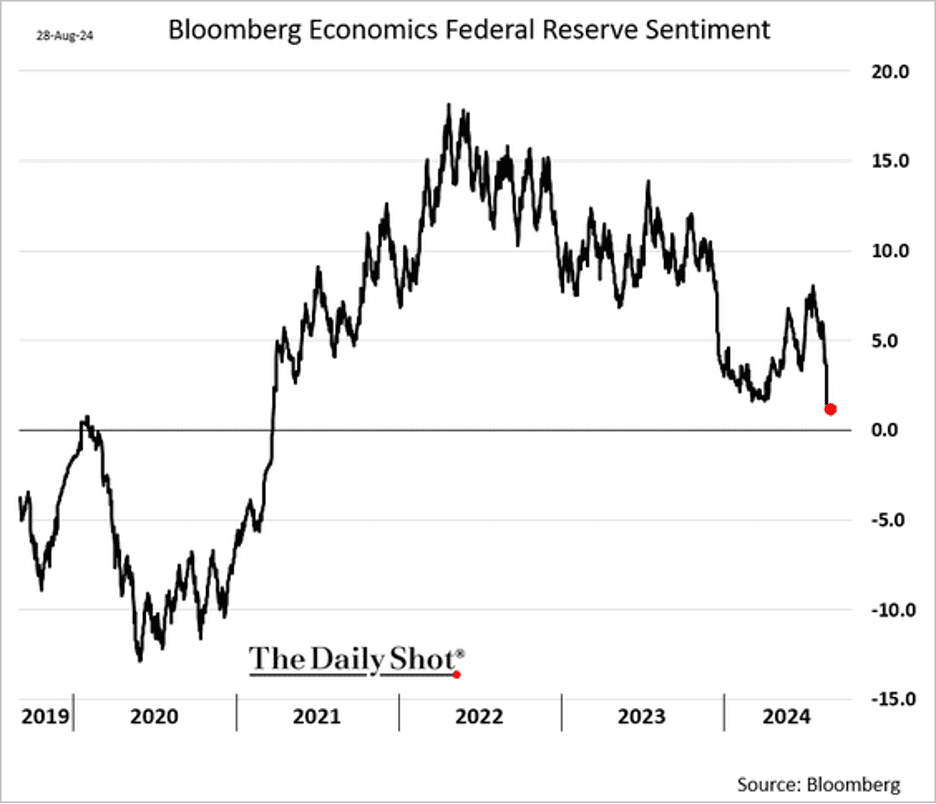

Fed officials’ comments are becoming increasingly less hawkish.

- The market is now pricing in 225 bps of Fed rate cuts by the end of 2025, …

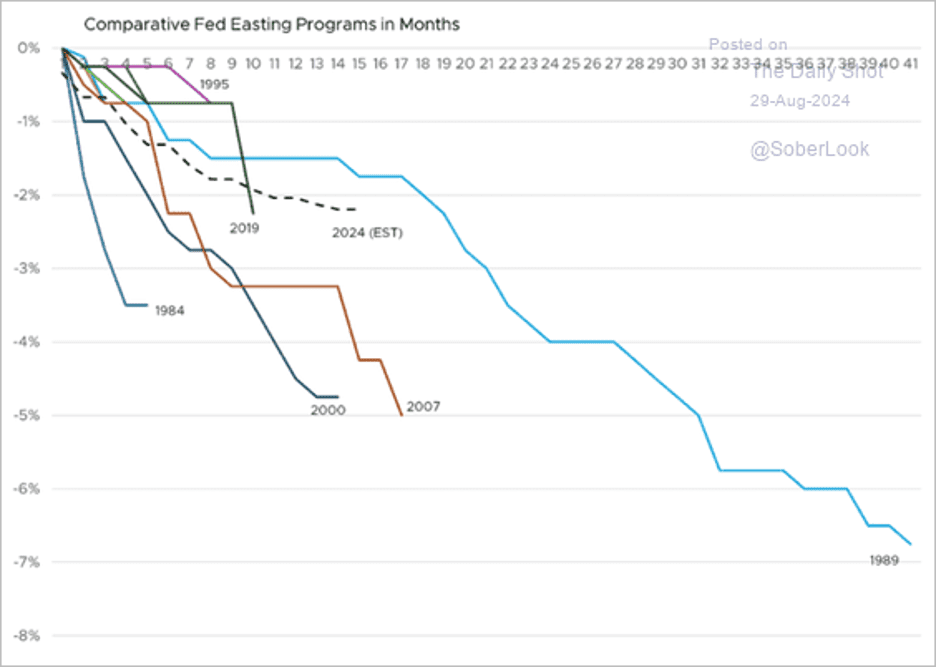

- Here is a look at previous easing cycles.

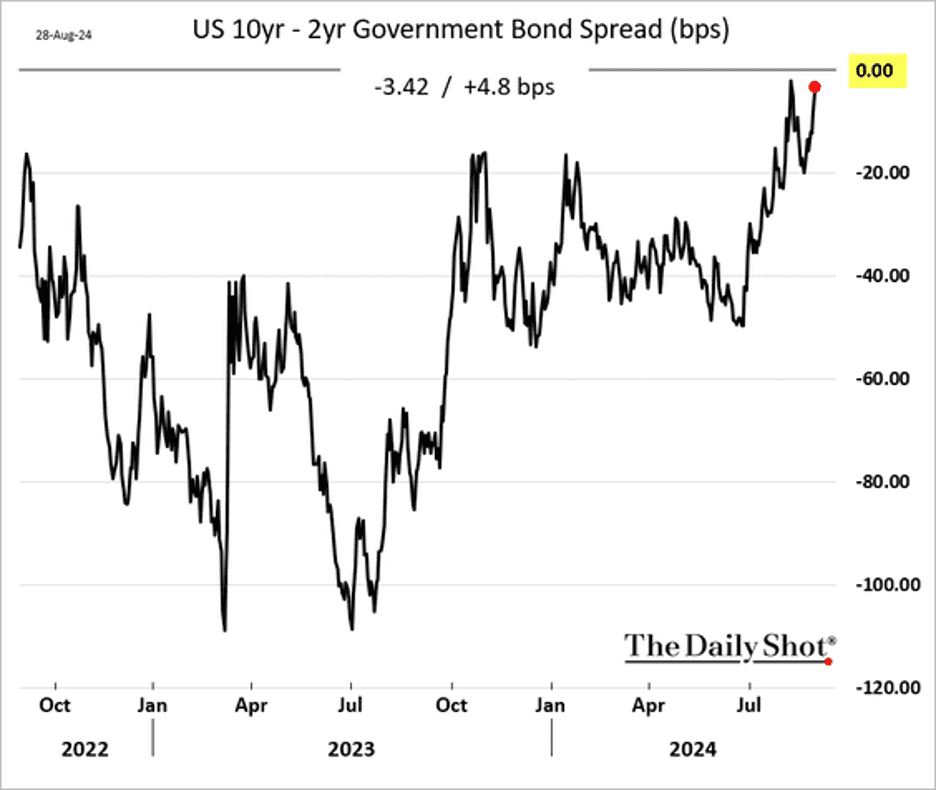

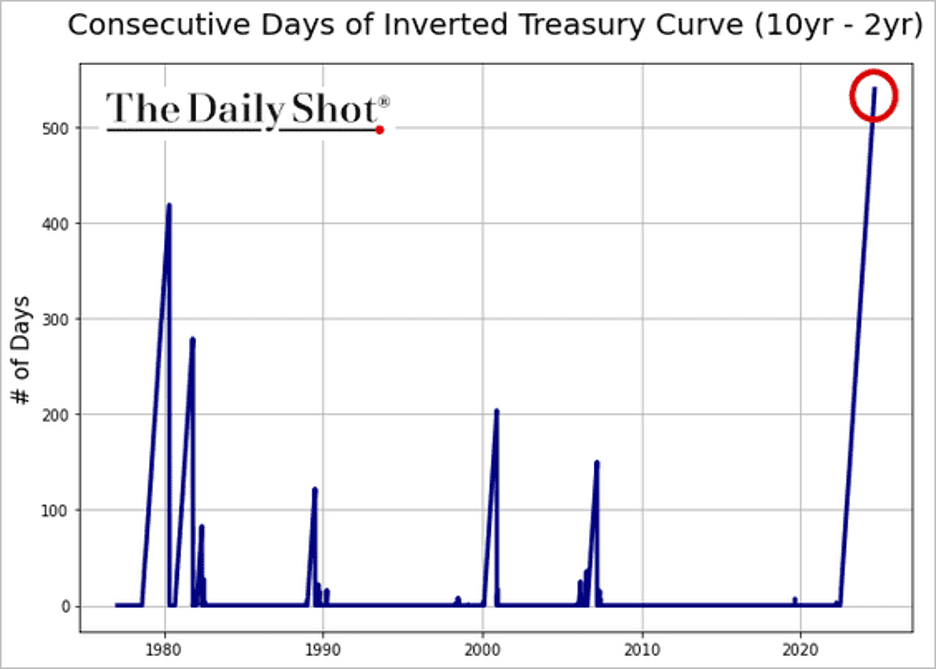

- The Treasury curve inversion is nearing its end …

- … after a record streak of negative 10s/2s, spanning 540 trading sessions..

Sector Rotation

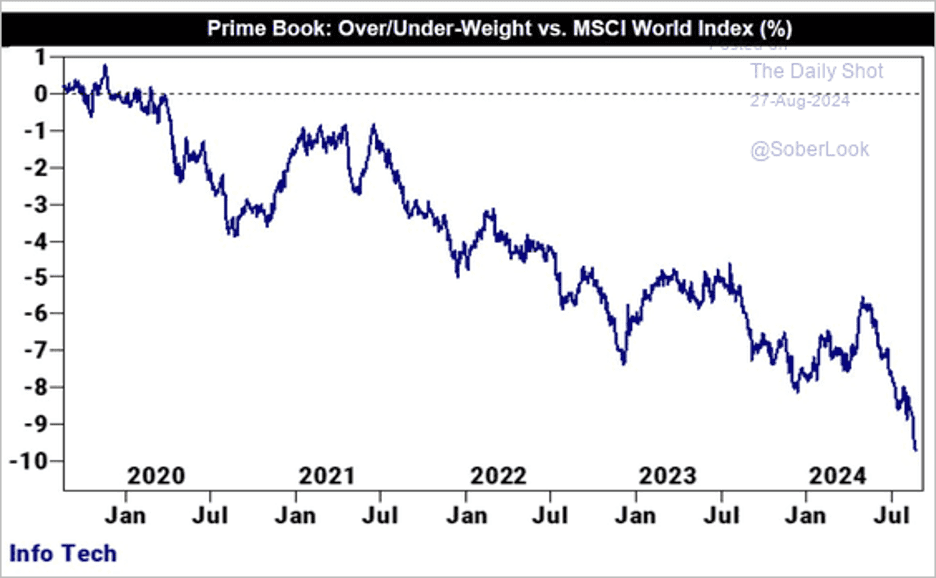

The two-sided strategy has rotated away from Technology and have recently focused on Consumer Durables, Consumer Staples and Energy. That is where the momentum has shifted:

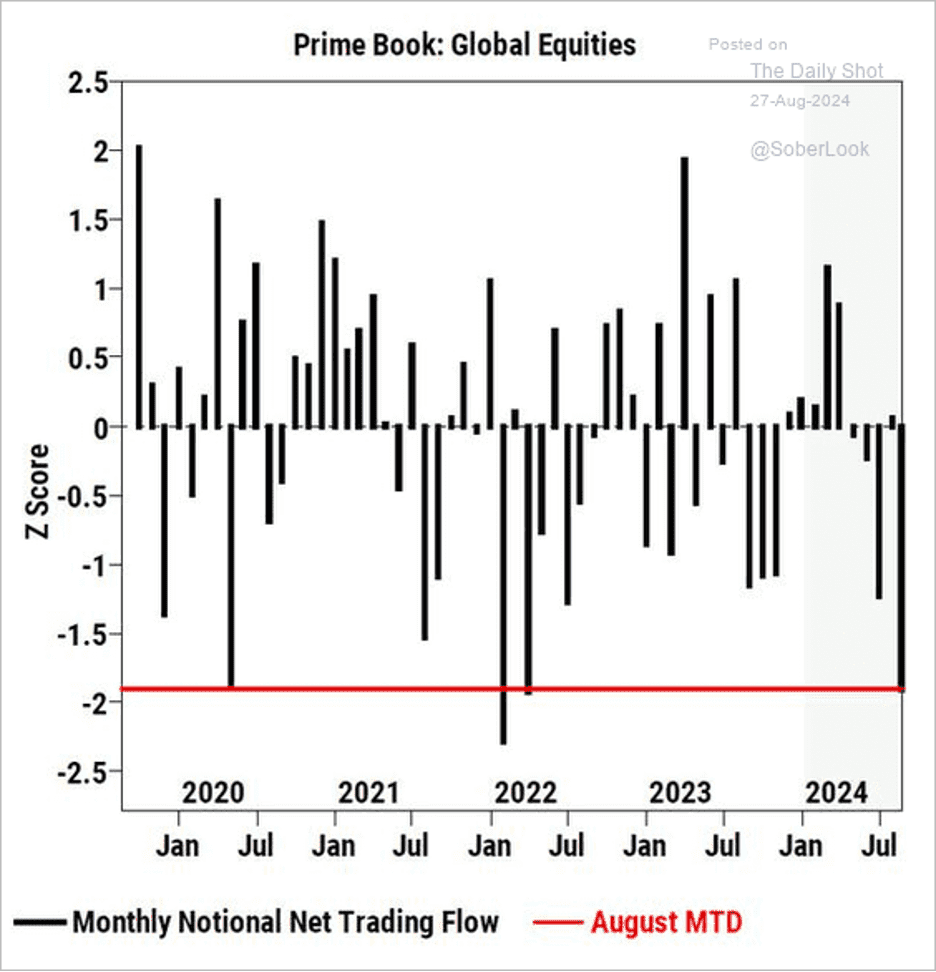

Hedge funds have been selling stocks, …

Source: Goldman Sachs

- … especially tech shares.

Source: Goldman Sachs

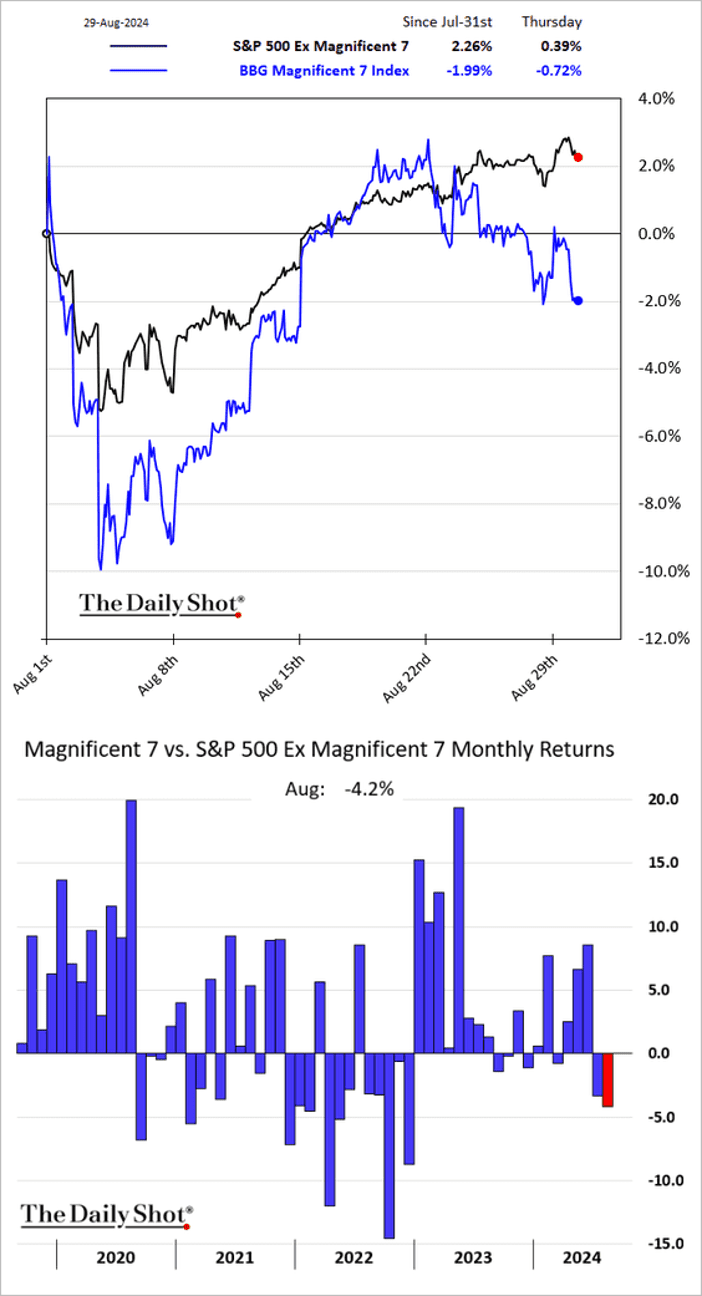

Since July 10th, the Magnificent 7 are down -10%. The S&P is flat since then and Consumer Staples is +5% since then. We have rotated into Consumer Staple stocks such as Kellogg’s, Kroger, Mohawk, 3M, Sysco as well as conservatives such as Utilities and Gold.

It’s been a rough month for tech megacaps relative to the broader market.

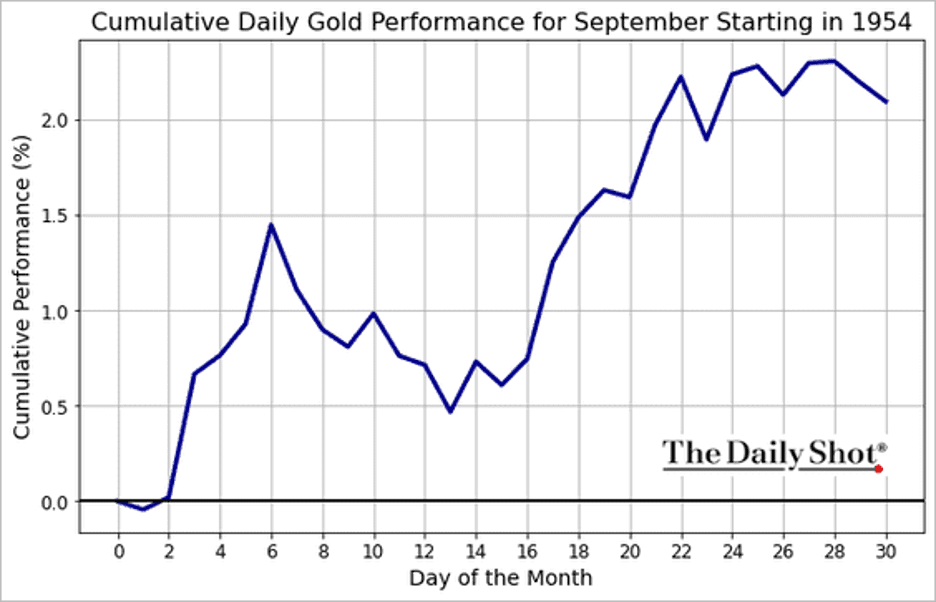

- September tends to be a strong month for gold.

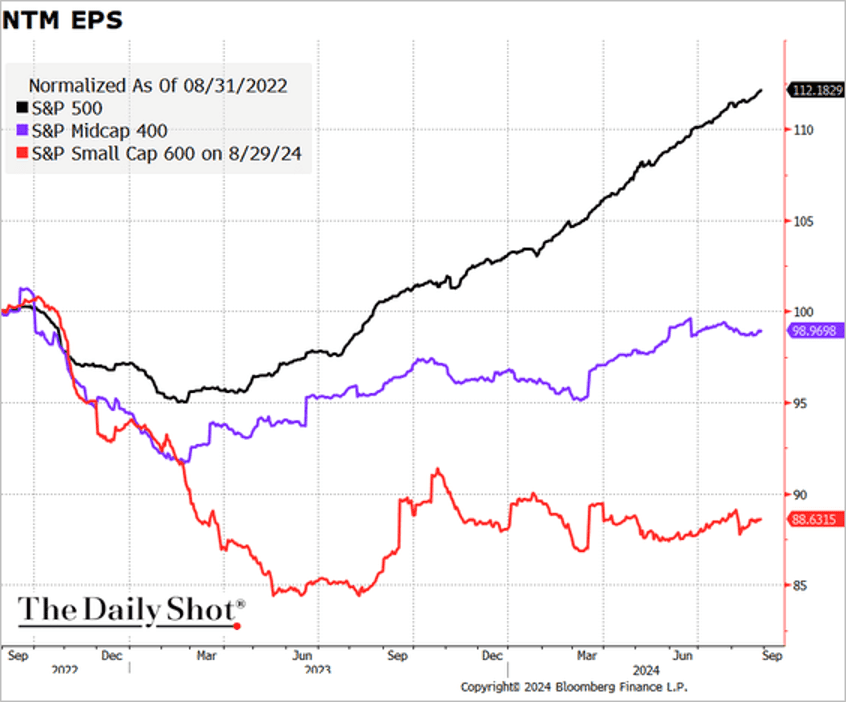

- Earnings expectations for mid and small-cap stocks are increasingly lagging behind those of the S&P 500.

Great Quotes

“Life is a splendid gift! There is nothing small about it.” – Florence Nightengale

Picture of the Week

Catalonia, Spain

All content is the opinion of Brian Decker