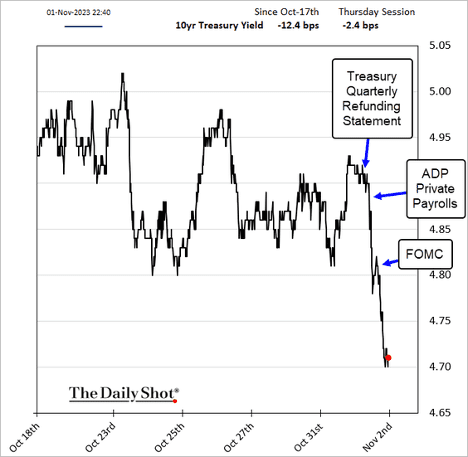

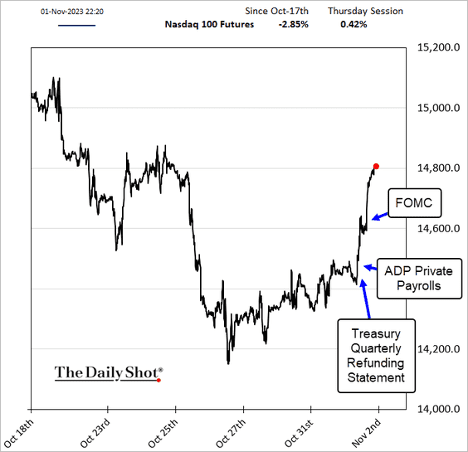

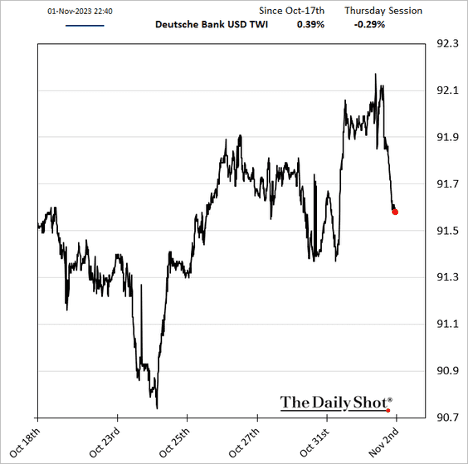

Three events brought about a shift in the Treasury market last Wednesday.

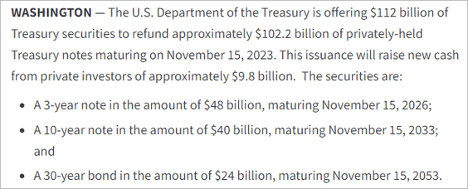

The US Treasury slowed the increases in longer-term bond sales, moving some financing to bills.

Source: @markets Read full article

Source: US Treasury Read full article

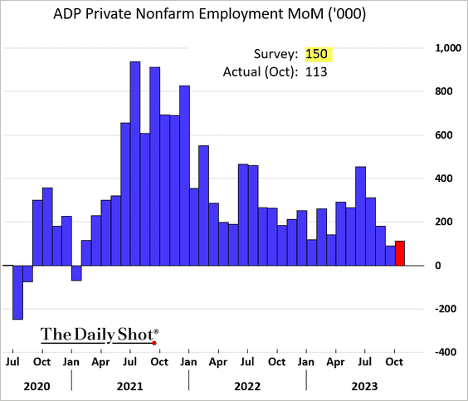

- The ADP private payrolls report showed the labor market softening (more on this below).

- Chair Powell kept up the hawkish rhetoric after the FOMC left rates unchanged, but the markets saw some dovishness between the lines. The prevailing view now is that the Fed is likely done raising rates.

The FOMC remains focused on tight financial conditions.

Financial conditions have tightened significantly in recent months, driven by higher longer-term bond yields, among other factors. Because persistent changes in financial conditions can have implications for the path of monetary policy, we monitor financial developments closely.

The monetary policy lag was mentioned again.

… the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

– The FOMC is comfortable with pausing.

Slowing down is giving us, I think, a better sense of how much more we need to do, if we need to do more ….

The market-based probability of a December rate hike declined.

The implied terminal rate dipped below 5.4%.

Treasury yields dropped sharply, …

- boosting equity prices.

- The US dollar fell.

US Economy

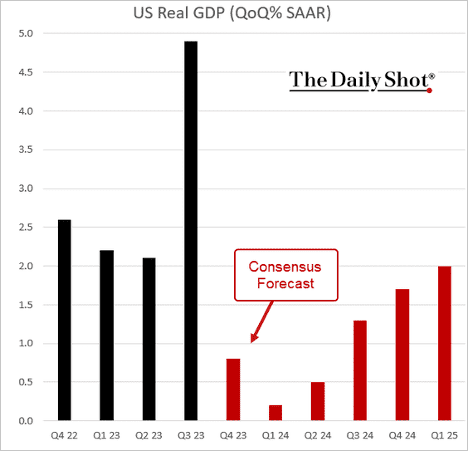

- Consumer spending exceeded expectations last month, bolstering robust GDP growth in the third quarter.

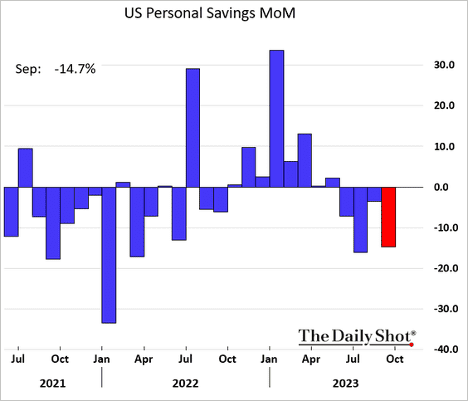

- Household incomes continue to grow, but are rising slower than consumer spending.

- As a result, savings keep dwindling.

- The core PCE inflation accelerated last month, which was expected from the CPI and PPI reports.

- Next, we have the final U. Michigan consumer sentiment index for October. The expectations index declined sharply this month.

- US financial conditions continue to tighten

- A higher share of households are struggling to pay expenses

- Forecasts indicate a significant economic slowdown following a robust quarter, and with bond yields hovering near multi-year highs, the Fed is likely on hold for the time being.

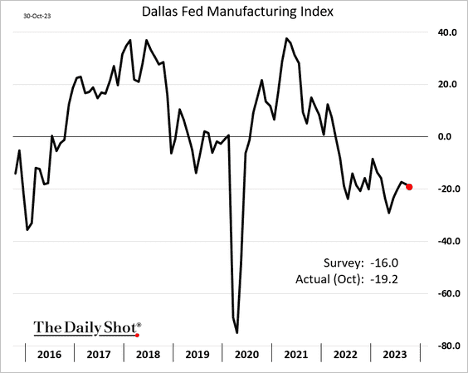

- The Dallas Fed’s regional manufacturing report continues to show contracting factory activity.

- Companies are increasingly concerned about rising financing costs.

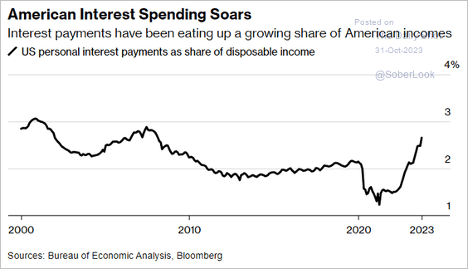

- Households are also incurring significantly higher interest expenses.

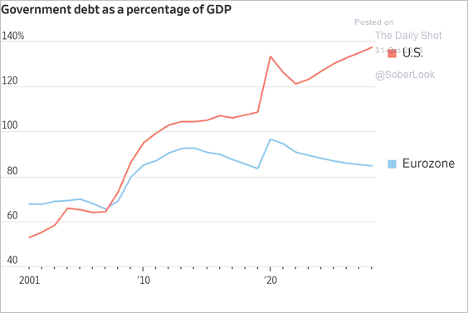

- The US debt-to-GDP ratio continues to diverge from the Eurozone.

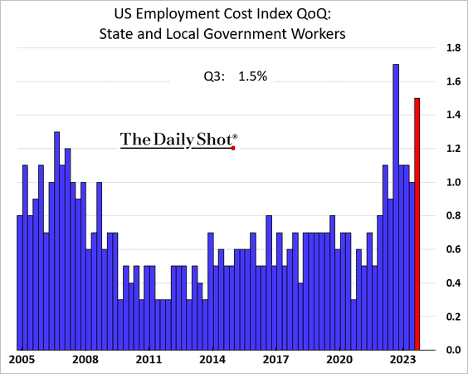

- Stronger Q3 gains were in part due to higher pay for teachers.

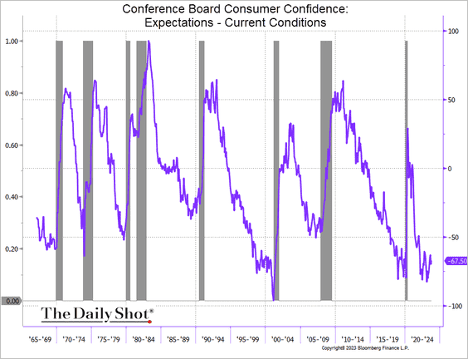

- The spread between expectations and current conditions indicators continues to signal a recession ahead.

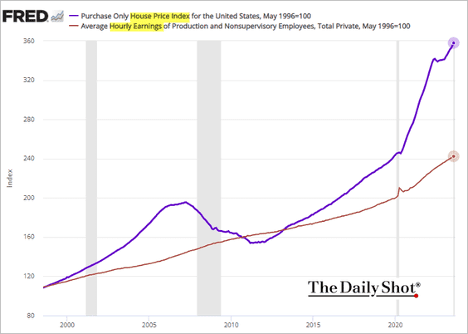

- Gains in home prices continue to outpace wages.

- The outcome of the lawsuit against NAR suggests that realtors may have to change the way they charge fees.

Source: Reuters Read full article

- Shares of real estate brokerage firms tumbled in response to the news.

- The October ADP private payrolls surprised to the downside again, …

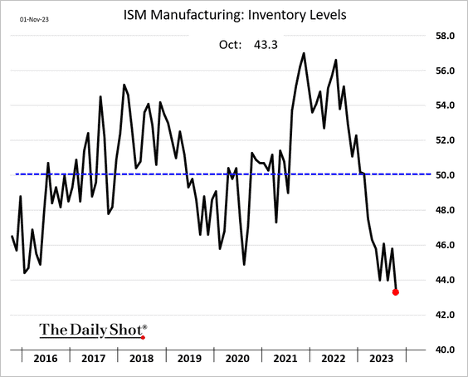

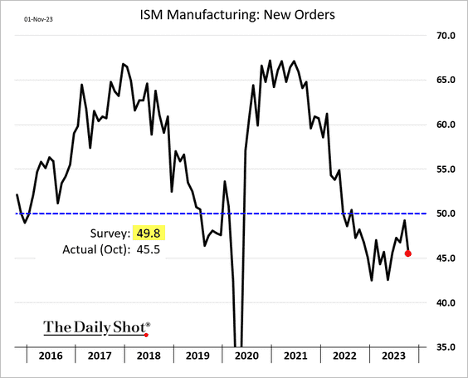

- Manufacturers have been cutting inventories, …

- … amid soft demand.

- US labor productivity increased more than expected last quarter.

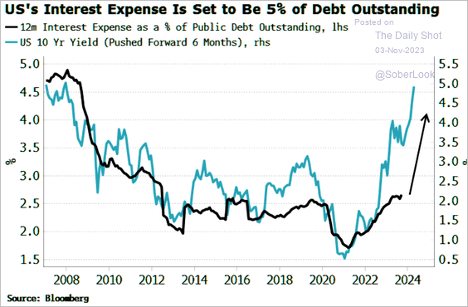

- Federal interest expense is expected to hit 5% of the total debt outstanding.

Source: Simon White, Bloomberg Markets Live Blog

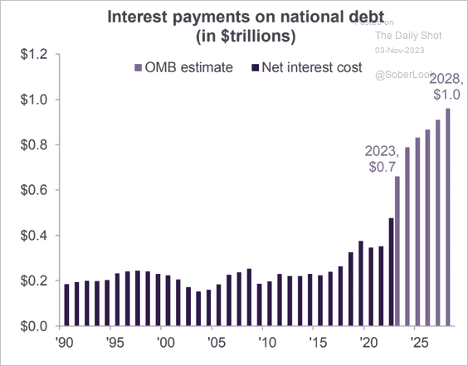

- Here are the projections in dollar terms.

Market Data

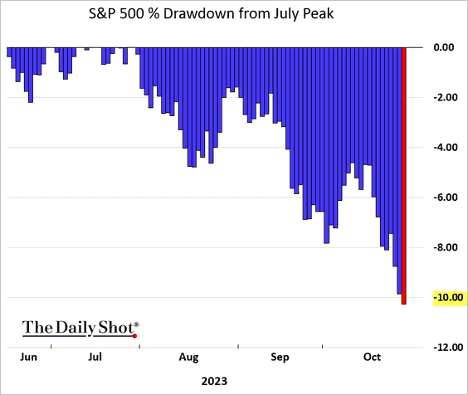

- The S&P 500 is down 10% from the July peak.

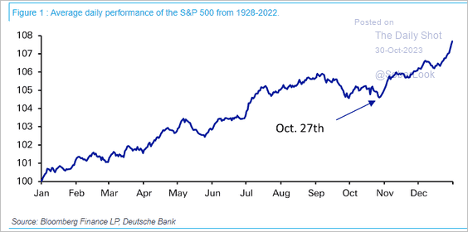

- On average, the S&P 500 has bottomed around October 27th before a seasonal rally.

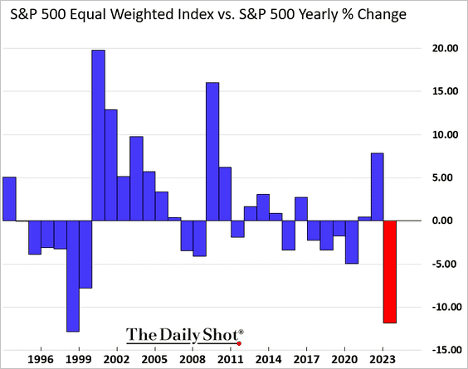

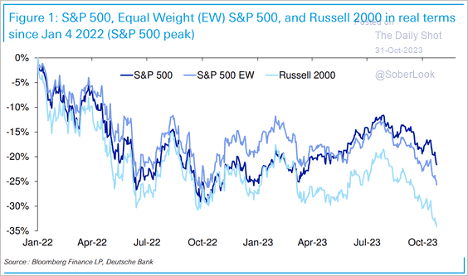

- From a relative performance perspective, the S&P 500 equal-weight index has faced a challenging year.

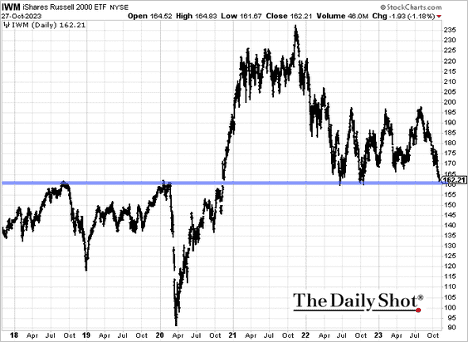

- The Russell 2000 index is at a critical level.

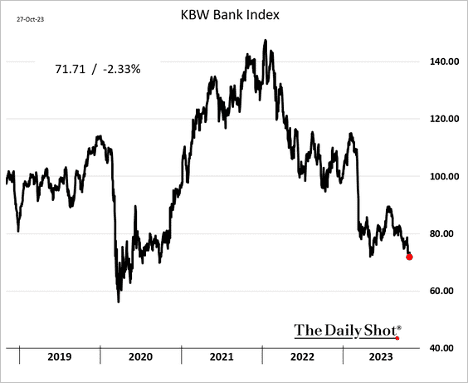

- The KBW index of bank shares hit the lowest level since the initial COVID shock.

- Most S&P 500 sectors have over half of their constituents down more than 20% from their one-year high.

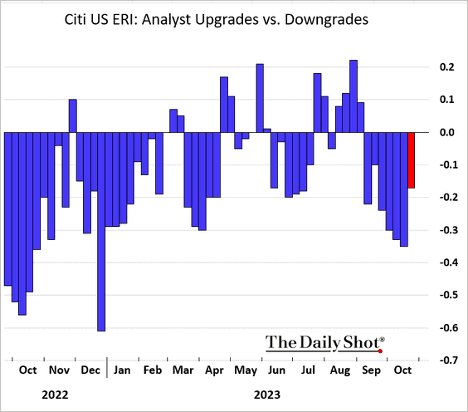

- Analysts’ earnings downgrades have exceeded upgrades for seven weeks in a row.

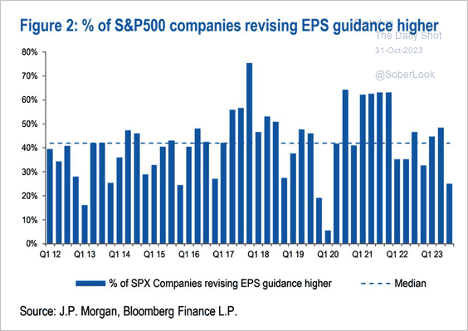

- And corporate guidance has been weak.

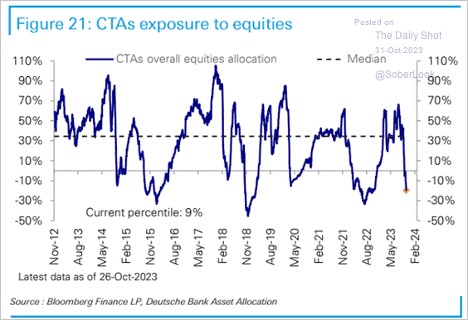

- CTAs are increasingly betting against stocks.

- The Nasdaq Composite breadth continues to deteriorate.

- The S&P 500 is still down about 20% from its highs in real terms, while equal-weight and small-cap indices continue to lag.

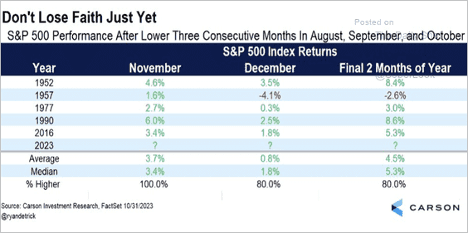

- The S&P 500 typically recovers after consecutive monthly declines during the August-October period.

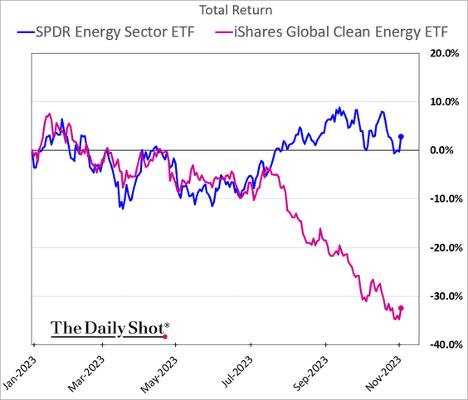

- Clean energy stocks continue to underperform.

Great Quotes

“Money will not buy you happiness, but it will let you be unhappy in nice places.” – W.C Fields

Picture of the Week

Carmel, CA

All content is the opinion of Brian Decker