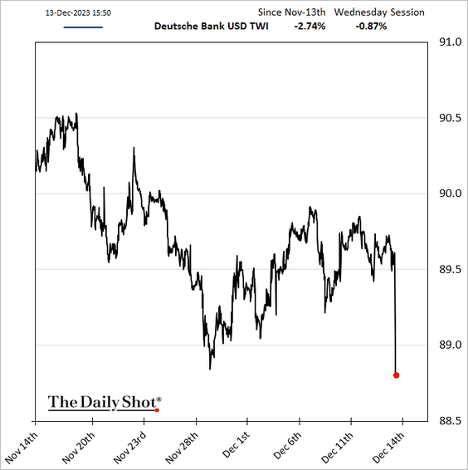

It finally looks like the Federal Reserve’s rate-hiking cycle has come to an end, as the central bank’s policymakers signaled that more rate cuts could be in store next year than they had foreseen in September. The Federal Open Market Committee maintained its key policy rate at 5.25%-5.50%, as widely expected, but it still kept the door open for additional firming. Traders cheered the Fed’s revised expectations, with all three benchmark indices ending around 1.4% higher each, while yields plummeted.

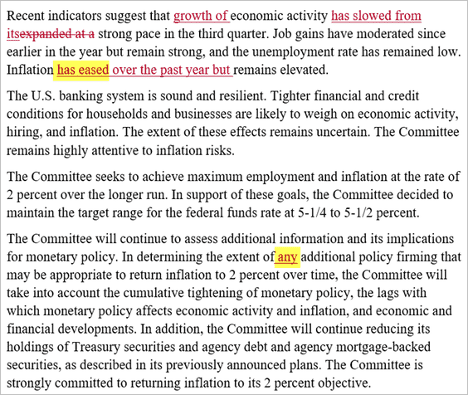

Dot plot: Fed officials now expect three rate cuts next year and four more in 2025, according to the Summary of Economic Projections. While the new projection implies fewer cuts than what the markets priced in, it means that the Fed is moving closer to easing. In the September median projections, policymakers had forecast one last rate hike for 2023, followed by two cuts in 2024. Most FOMC members expect the key rate to fall within the 4.25%-5.0% range next year.

Fed Chair Jerome Powell remained cautious in the post-decision press conference, saying the Fed is “just at the beginning” of discussing policy easing. He noted that inflation is still elevated, although it has eased from its highs without a spike in unemployment. Powell reiterated that incoming data will determine the Fed’s decision on how long it keeps rates restrictive. “He acknowledges that it is premature to declare victory, but this FOMC meeting gives off a strong sense of achievement,” said Yimin Xu on behalf of Investing Group Leader Cestrian Capital Research.

“Despite the message of caution from the press conference, the Fed has clearly taken a dovish tone here,” said SA analyst Jeremy LaKosh, adding that the economy needs to achieve significant disinflationary milestones over the next 12 months. Wolf Richter noted that the FOMC’s statement toned down the chance of additional rate hikes, but left the door cracked open, “just in case.” Meanwhile, ING Economic and Financial Analysis thinks the Fed will end up being more aggressive on rate cuts than both they and the market are currently expecting.

The Federal Reserve finally signaled the long-awaited “pivot,” acknowledging slowing inflation …

… and starting to discuss the timing for initiating interest rate cuts.

Chair Powell: – … that begins to come into view and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today.

The dot plot is signaling some 75 bps of rate cuts next year.

At the end of the day, the market was pricing in around six 25 bps rate reductions next year.

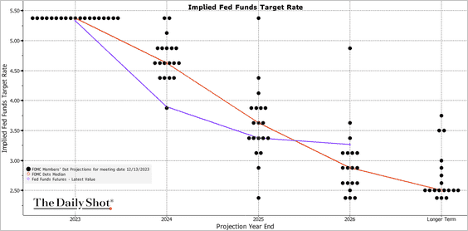

Treasury yields plunged in response to the Fed’s “pivot” signal (2 charts).

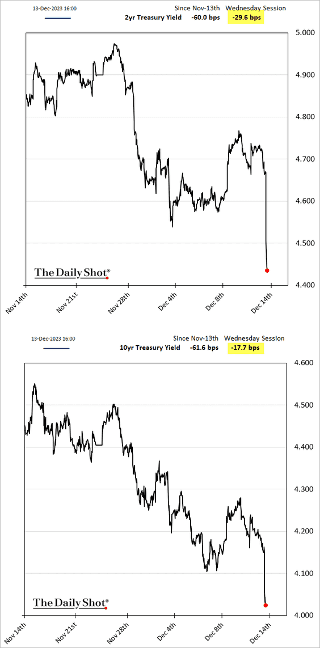

The dollar tumbled, …

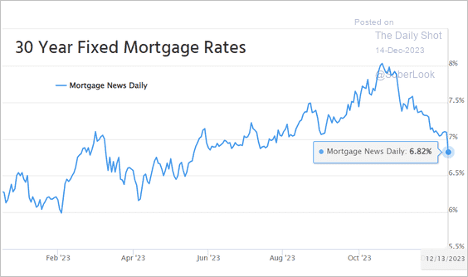

Mortgage rates dip below 7%.

US Economy

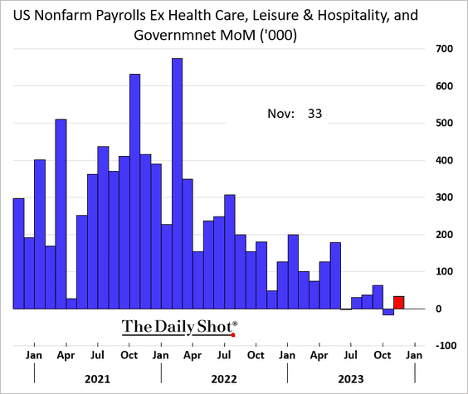

- Last month’s job gains topped expectations. However, excluding government jobs, the figure was roughly in line with economists’ estimates.

- Healthcare and Government continues to be a key driver of job growth.

- And just for completeness, here is the above trend with government jobs removed. It points to a weaker breadth in the labor market.

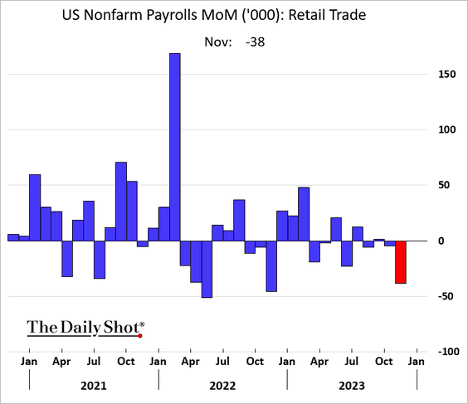

- The retail sector is shedding jobs.

- After the jobs report, the market quickly reduced its expectations for Fed rate cuts next year.

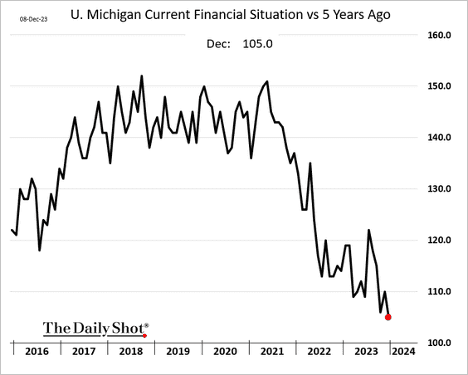

- Consumer sentiment climbed this month, exceeding expectations.

- Consumers increasingly see themselves in a worse financial situation than five years ago.

- Inflation expectations eased, as gasoline prices fell further.

- Leading indicators continue to signal slower inflation ahead.

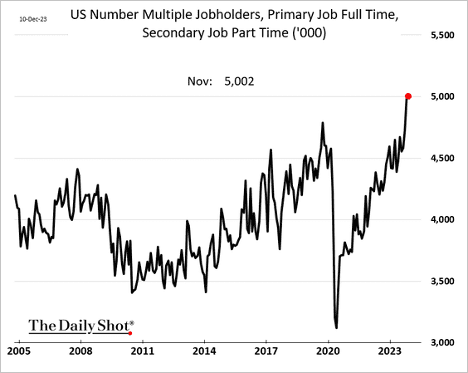

- More Americans with full-time jobs are moonlighting.

- The CPI report was roughly in line with expectations, with the core inflation strengthening in November.

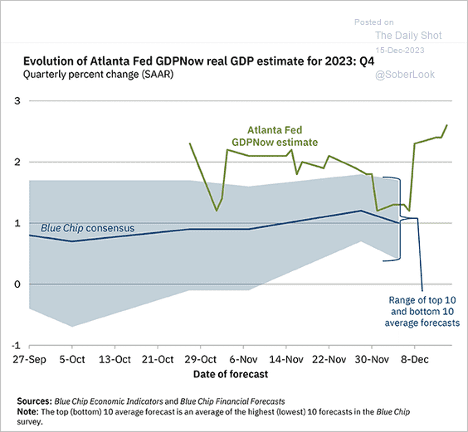

- The GDPNow nowcast estimate for the Q4 economic growth climbed to 2.6% (annualized), …

Source: Federal Reserve Bank of Atlanta

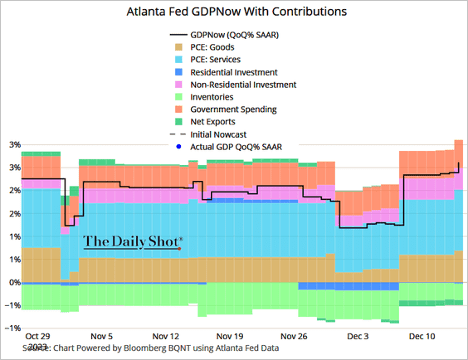

- … boosted by resilient consumer spending (“PCE Goods/Services”).

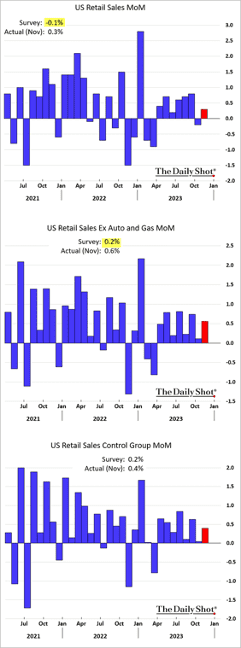

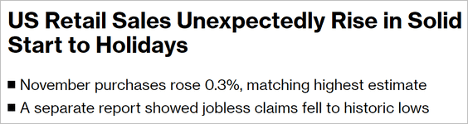

- Last month’s retail sales exceeded expectations, signaling robust economic activity.

Source: @economics Read full article

Market Data

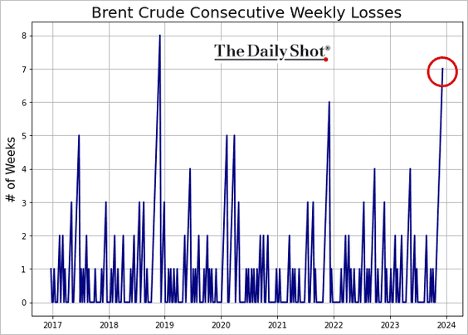

- Crude oil has declined for seven consecutive weeks.

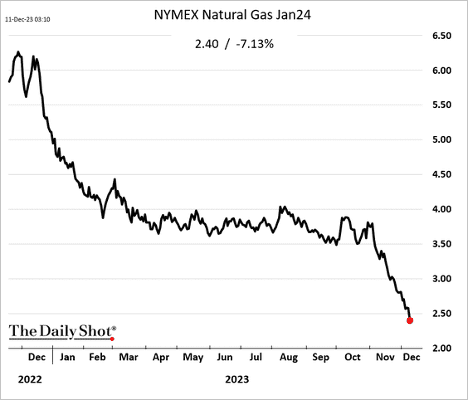

- US natural gas is crashing, amid warmer-than-usual weather.

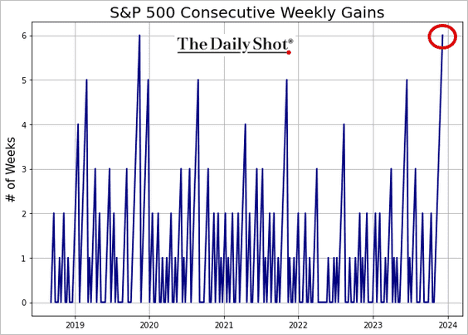

- The index has been up for six consecutive weeks.

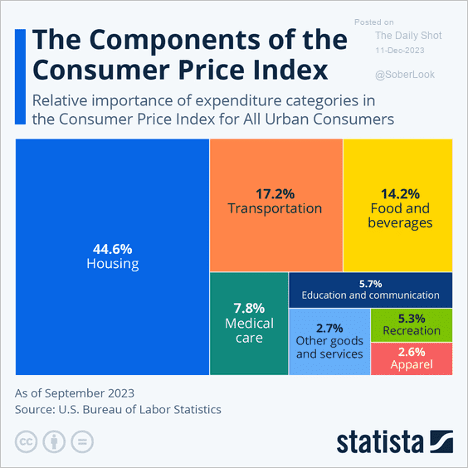

- Components of the US CPI index:

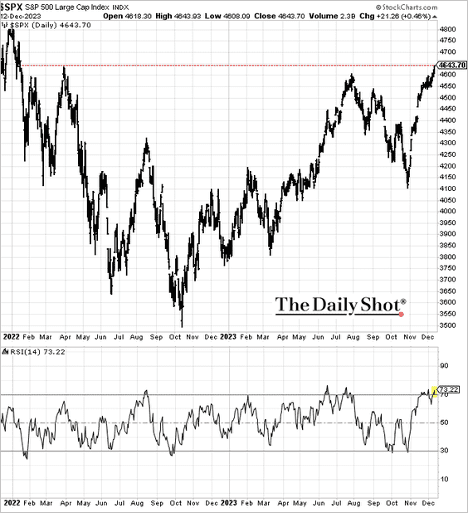

- The S&P 500 hit the highest level since January of 2022. Technicals suggest that the index is overbought.

- The S&P 500 is now less than 2% below its peak.

- 90% of S&P 500 members are above their 50-day moving average.

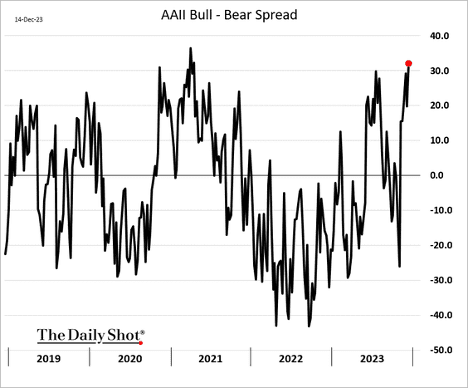

- Retail investors haven’t been this bullish since early 2021.

Great Quotes

“When you no longer need the approval from others like the air you breathe, the possibilities are endless. What an interesting little prison we build from the invisible bricks of other people’s opinions.” – Jacob Nordby

Picture of the Week

Winter in Huangshan China

All content is the opinion of Brian Decker