While disclaimers always warn investors not to expect future returns to look like the past, many still assume they do. This report says everyone should break that habit. We are entering a period that will be much different.

Those surprised at the economy’s resilience may have underestimated the benefits of plentiful liquidity and accommodative policy since 2008. With these tailwinds diminishing, we are now shifting from a period of abundance to one of austerity.

Inflation, savings depletion and fiscal limits will likely prevent the Fed from riding the rescue as investors have grown to expect. Higher rates will reduce asset prices, in turn reducing tax revenues and further aggravating the debt problem. Commodity prices will likely remain elevated as demand keeps rising for both fossil fuel and renewable energy.

Demographics are unfavorable for both growth and inflation in all but a select few emerging markets. Current debt levels are simply too high to effectively tame inflation, which will favor real assets with ample liquidity.

In this new environment, the “risky” emerging markets may actually be safer than those of some developed countries. EM economies seem to have learned from their past mistakes and demonstrated much better fiscal and monetary restraint. The report suggests investors consider opportunities in such places.

US Economy

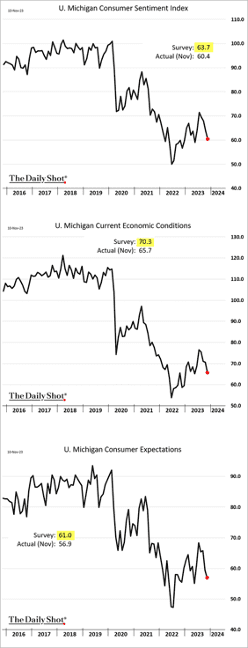

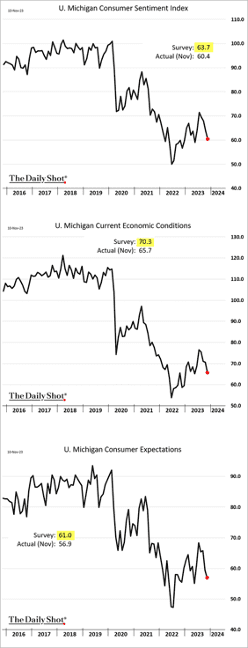

- US consumer sentiment declined again this month.

- Consumers’ outlook on vehicle buying conditions deteriorated further.

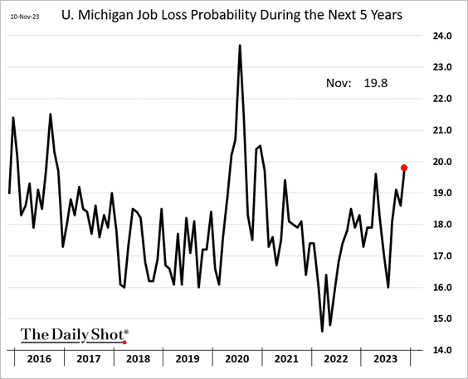

- There is more concern about job loss over the next few years.

- Despite falling gasoline prices, consumers raised their outlook for inflation (topping expectations). This is not a trend the Fed wants to see.

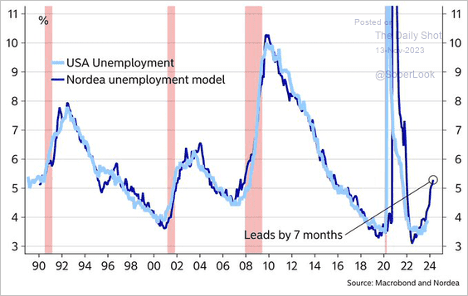

- According to Nordea’s model, the unemployment rate is projected to exceed 5% next year.

Source: @MikaelSarwe

- * More Americans are taking a hardship distribution from their 401k/IRA account.

- Interest on government debt could exceed defense spending by 2027 and non-defense discretionary spending by 2030.

- Unlike the University of Michigan’s report, the NY Fed’s consumer survey showed relatively stable inflation expectations of about 3%.

- But households’ nominal spending growth expectations are holding above 5%.

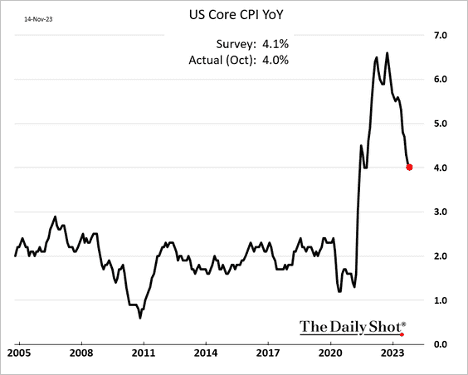

- It appears that core inflation is settling around 3%, which is a concern for the Fed.

- US hotel occupancy rates remain robust.

- The October CPI report surprised to the downside. The headline price index was almost unchanged for the month, pulled lower by softer energy prices.

- Year-over-year:

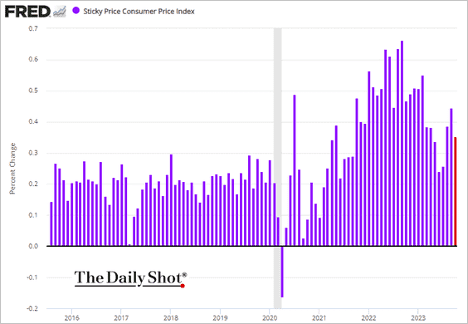

- The sticky CPI remains elevated.

- The core goods CPI declined for the 5th month in a row.

- The market has now discounted any chance of another Fed rate hike in this cycle.

- The terminal rate is now equal to the current fed funds rate, which is where rates needed to be to turn inflation lower.

- Bonds surged in response to the CPI surprise

- Stocks had a very good day, last Tuesday.

- The US dollar tumbled.

- Leading indicators continue to signal slowing business investment ahead. Here is Goldman’s CapEx tracker.

![]()

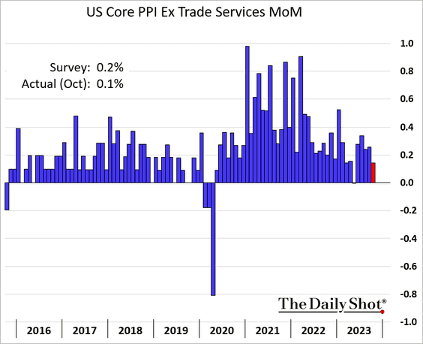

- The October PPI report was softer than expected, with the headline figure pulled lower by energy prices.

- Here is the core PPI.

- Based on the CPI and PPI data, Nomura sees the October core PCE inflation increasing by around 0.2% (below consensus).

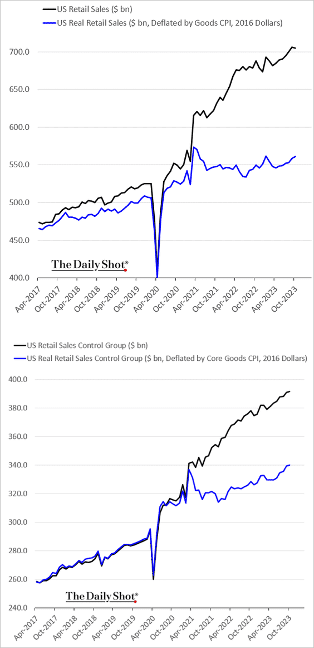

- Retail sales slowed last month, dragged lower by automobile sales.

- Here is a look at retail sales levels.

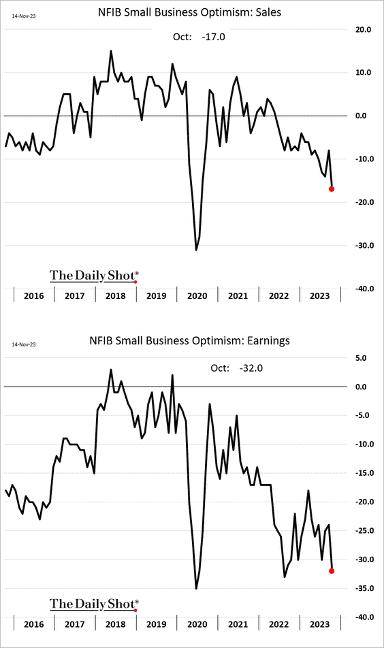

- Businesses are increasingly reporting declining sales and earnings.

- The Atalanta Fed’s GDPNow Q4 growth estimate is holding above 2% (annualized).

- Initial jobless claims are near the lowest levels in recent years.

- The decrease in continuing claims for the week of October 30th alleviated some concerns about unemployed Americans struggling to find work.

- The pullback in unemployment claims mitigates the likelihood of a recession.

- The NAHB homebuilder sentiment deteriorated this month, coming in well below expectations.

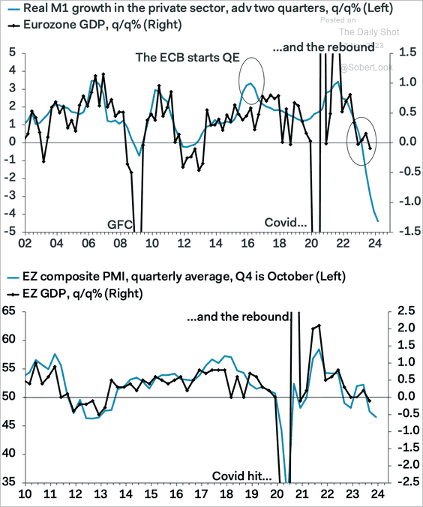

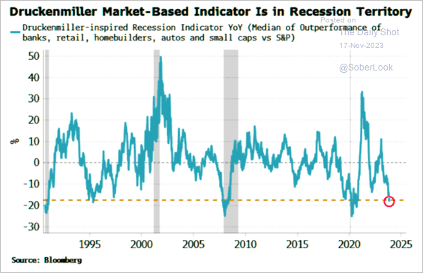

- Tight liquidity and weak PMI indicators signal a recession ahead.

Market Data

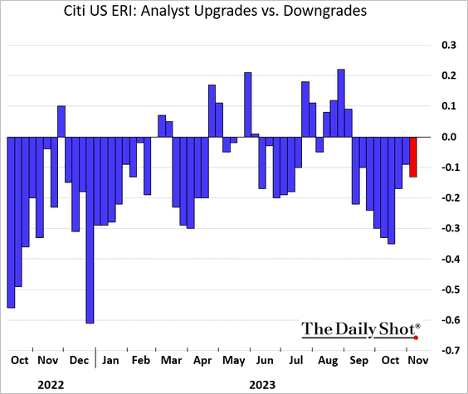

- Earnings downgrades have outnumbered upgrades for nine weeks in a row.

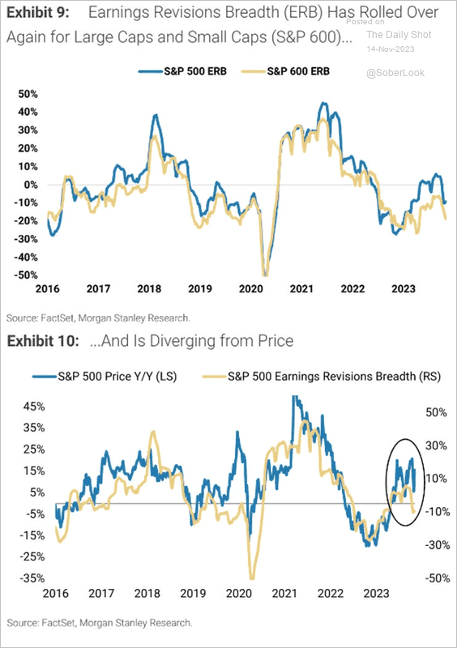

- The earnings revision breadth has worsened for both large and small caps.

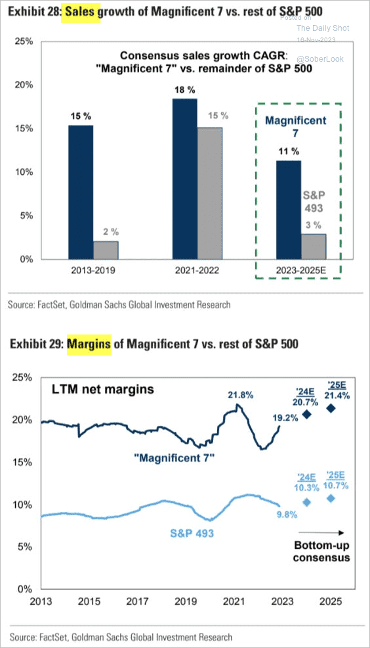

- Analysts are upbeat on the growth prospects of tech mega-caps.

- Analysts continue to downgrade their Q4 earnings estimates.

- Cycle-sensitive stocks’ underperformance points to weak economic growth ahead.

- Goldman expects modest price gains next year, robust earnings growth, and improving multiples.

Great Quotes

“Always forgive your enemies; nothing annoys them so much.” – Oscar Wilde

Picture of the Week

Rapa Park, Sweden

All content is the opinion of Brian Decker