What if I told you the next energy revolution isn’t in the sky, but under your feet?

Deep underground, beneath layers of dirt and ancient rock, an endless furnace burns hotter than the surface of the sun.

It’s been running since Earth formed 4.6 billion years ago, generating enough heat to easily power all of humanity.

This vast energy source has always been tantalizingly out of reach. But armed with a newly repurposed technology, we are now racing to tap into Earth’s natural power plant.

Temperatures reach 10,800°F at Earth’s core. Just a few miles down, the rocks are hot enough to boil water instantly. This is the source of geothermal energy.

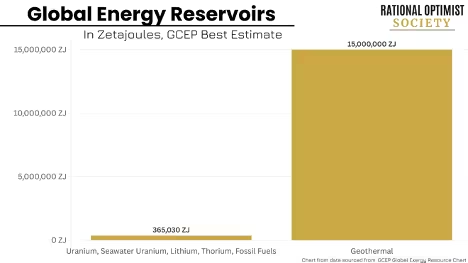

The heat locked in Earth’s crust holds more energy than all the world’s oil, coal, gas, and uranium combined—and it’s not close:

Almost every power plant today—whether nuclear, coal, or gas—is just an elaborate way to boil water into steam. That steam spins turbines, which generate electricity.

Geothermal works like nature’s steam engine. Drill holes into hot underground rocks. Pump water down. Use the heated water or steam to spin turbines and generate power.

Unlike solar panels that go dark at night or wind turbines that stagnate without a breeze, Earth’s heat never quits. It runs 24/7, emission-free, rain or shine. And we can turn it on or off by simply turning water taps. This makes it the perfect partner for “intermittent” solar.

Yet geothermal provides only 0.4% of America’s power today. Why so little?

Earth’s heat is like a vast underground ocean. Until now, we could only access it where it bubbled to the surface naturally. Iceland, where boiling mud pits and steam vents signal the heat below, gets around 30% of its power from geothermal. No hot springs nearby? No Earth power for you.

That’s because it’s really hard to dig deep enough. The Soviets dug the deepest hole ever in 1970—the Kola Superdeep Borehole in Siberia. After 20 years of drilling, they reached 7.6 miles down.

At those depths, temperatures hit 360°F. Their drills kept breaking. The 9-inch-wide hole was welded shut in 1995, marking both a record and a dead end.

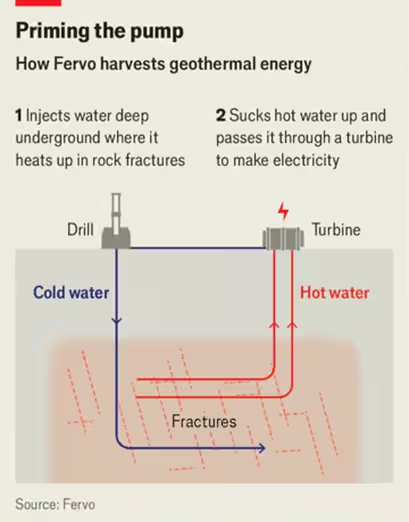

One solution:

Picture two parallel wells. The first plunges straight down thousands of feet, then hooks sideways like a hockey stick. Cold water flows down it.

The second well carries up pressurized steam hot enough to power a small city. Here’s a look:

Source: Fervo

Google already powers its massive data centers with geothermal wells in Nevada. California’s second-largest power provider also recently signed a deal to buy enough power for 350,000 homes. Geothermal fracking is here, and it’s scaling up fast.

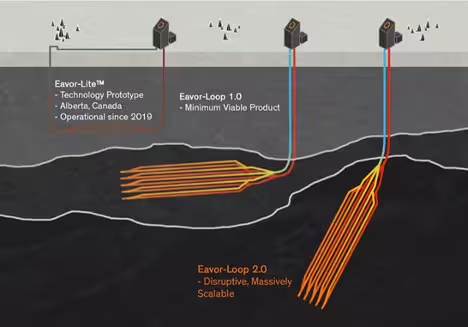

Solution #2:

Imagine the Empire State Building laid flat, two miles underground. Now picture hot water flowing through its corridors non-stop, absorbing Earth’s natural heat.

Source: Eavor Technologies

They drill two wells deep into the Earth and connects them with a network of underground pipes. Cold water flows down one well, winds through miles of heated tubes, and emerges from the second well as scalding steam.

They have working wells in Germany and Canada. Its underground radiators are proving they can pump out heat in freezing temperatures.

If progress continues, its German project could soon deliver heat cheaper than natural gas. Big if true!

Solution #3:

They want to drill deeper than we’ve ever gone before. Born in MIT’s nuclear fusion lab, it’s aiming to bore 12 miles down into Earth’s crust where rocks bake at 930°F. It would make the Soviets’ hole look like a rabbit burrow.

At extreme depths even heavy duty drills often crack and snap in half. It’s hard to drill when your drill keeps breaking. It’s hard to drill when your drill keeps breaking.

They are developing super powerful lasers to melt rock. These microwave beams vaporize granite like a blowtorch through ice.

Check out its prototype carving basketball-sized holes through solid rock

Source: Henry Phan on LinkedIn

It’s early days. But if they succeeds, we’re talking about a future where one small geothermal well can reach down to such reliably hot heat, it could power tens of thousands of homes. A hole narrower than a trash can, powering an entire town!

The race to tap Earth’s endless heat is on. Geothermal isn’t ready for prime time just yet. It still costs several times more than natural gas or nuclear to get a geothermal well up and running. But what matters is how fast this technology is evolving.

A solar panel used to cost as much as a house. Now, solar’s on track to become one of the cheapest power sources by 2030. The same forces are at work in geothermal. Every well drilled is a lesson learned. In just one-year, technology has slashed drilling times by 70% and costs by 50%.

Cheap, abundant energy is the bedrock of all innovation. When power is cheap, everything goes on sale. Factories can produce more. Businesses make more money. It’s like handing out stimulus checks to the entire economy.

Want to bring manufacturing back from China? Give American factories cheap, reliable power and throw in some robots. We can compete with anyone.

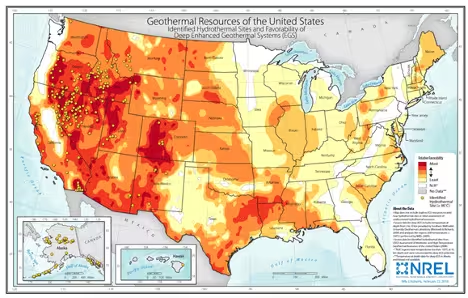

Did you know the federal government owns most of the land in Nevada, Utah, and Idaho? Look at a geothermal heat map, and you’ll see these same states glowing red with underground heat.

Source: National Renewal Energy Laboratory

This could be the birth of a new major energy source. One that combines the reliability of oil with the cleanliness of solar. Hot rocks are already powering Google’s data centers and thousands of homes in Nevada. Tomorrow, they’ll power millions more.

For the first time ever, energy abundance is now well within our reach. Solar panels carpet sunny Texas and California. Nuclear is enjoying a renaissance. Fracking keeps the oil and gas flowing. Now, geothermal could transform the American West into an energy powerhouse.

Markets:

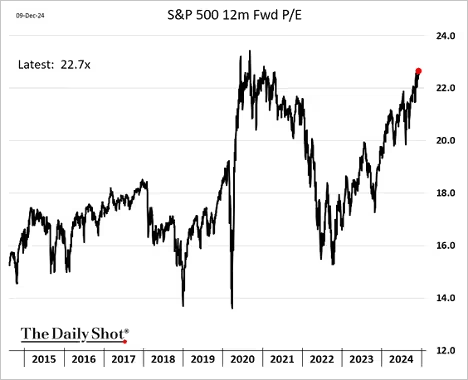

S&P 500 valuation metrics continue to climb.

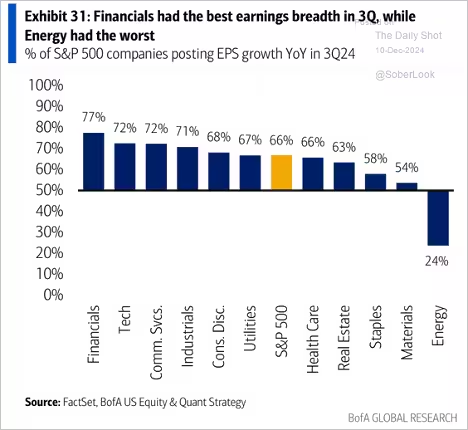

US investors have favored tech and financials over health care this year.

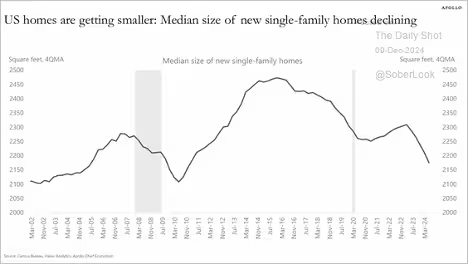

Median size of US new single-family homes:

Source: Torsten Slok, Apollo

The Nasdaq 100 has been trending within a rising wedge pattern and is testing the upper boundary, signaling potential resistance ahead.

2025 profit growth estimate:

Percent of companies with EPS growth in Q3 by sector:

Economy:

Job gains bounced back in November, aligning closely with forecasts. Healthcare, Leisure & Hospitality, and local government once again led payroll growth. The employment trajectory outside these sectors has increasingly lagged behind overall payroll growth during the post-COVID job market recovery. The Household Survey reported another sharp decline in jobs, even as the Establishment Survey (above) continues to reflect gains. The unemployment rate edged higher to 4.2%.

Many metro areas see rents rising faster than incomes. Mortgage rates have been falling.

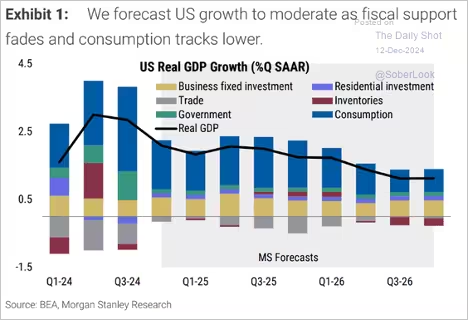

Here is Morgan Stanley’s quarterly GDP growth forecast over the next couple of years.

Source: Morgan Stanley Research

The Fed

Inflation expectations edged higher last month, but consumers expect price gains on gasoline, food, and rent to ease further. The November CPI report aligned closely with expectations, showing core inflation rising by 0.3% (annualized at 3.7%) for the fourth consecutive month. The market welcomed the CPI report, which aligned with forecasts and showed softer housing inflation. A Fed rate cut this month is now nearly a certainty.

The market interpreted the jobs report as dovish, increasing the likelihood of a Fed rate cut this month. However, the market sees the Fed pausing in January.

The PPI’s numbers were higher than mainstream economists’ consensus expectations and they’re signaling that the pace of inflation in the U.S. is reaccelerating. That was a catalyst for the major U.S. stock indexes pulling back last week.

Even last week, when stocks rose amid a higher CPI reading for November (probably because the reading was still “in line with expectations”), longer-term bonds sold off while yields were up

U.S. central bankers have said they are intent on cutting rates to a more “neutral” stance, but with 75 basis points of cuts in the second half of this year, the Fed may already be juicing the economy (and triggering future inflation) more than it cares to admit.

So the current rate-cutting cycle could come to an end sooner than “everyone” thinks or at least go on pause sometime in early 2025, meaning a higher cost of capital than many people previously imagined. That’s what the Treasury market is signaling, at least.

Great Quotes

“ The mind is like water. When it’s turbulent, it is difficult to see. When it’s calm, everything becomes clear.” – Buddha

Picture of the Week

St Michael’s Mount, Cornwall, England

All content is the opinion of Brian Decker