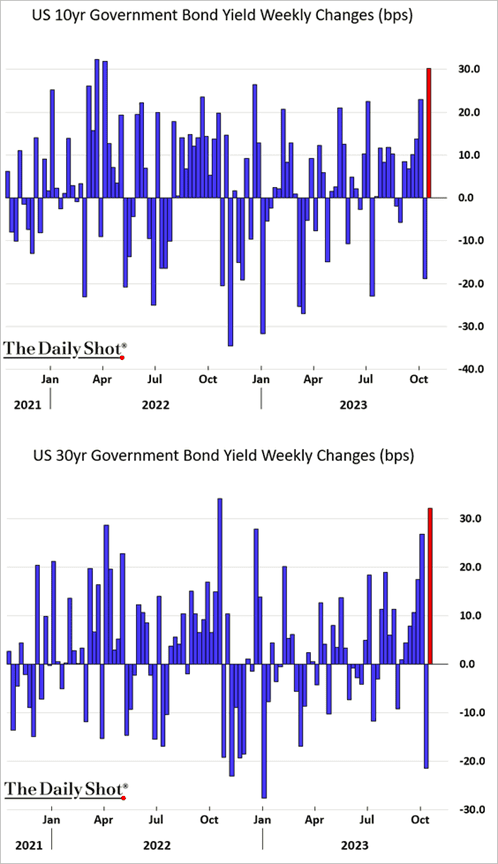

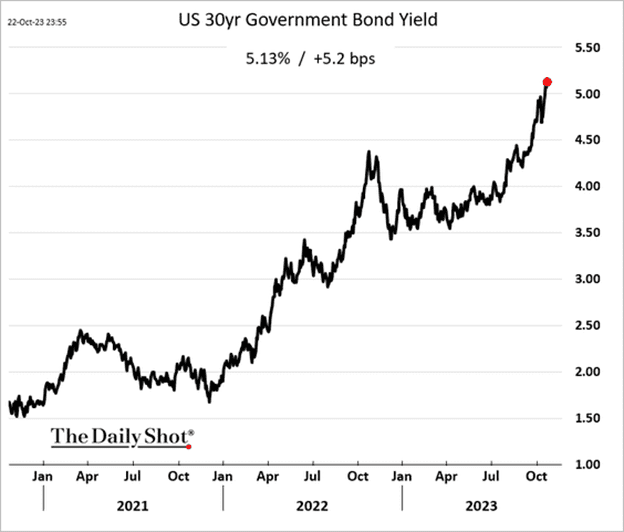

- Treasury yields rose sharply last week, …

- … climbing further last Friday morning.

- The tightening in US financial conditions since the September FOMC meeting is equivalent to some 80 basis points worth of Fed rate hikes, according to Goldman.

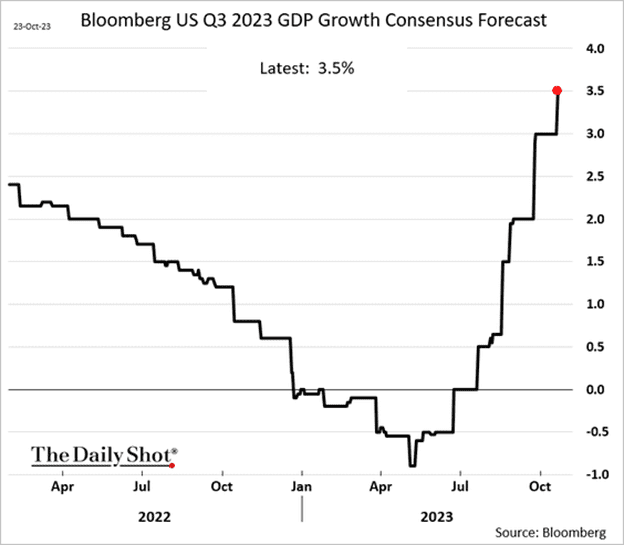

- Economic activity has been surprising to the upside. This chart shows the consensus estimate (over time) for last quarter’s GDP growth.

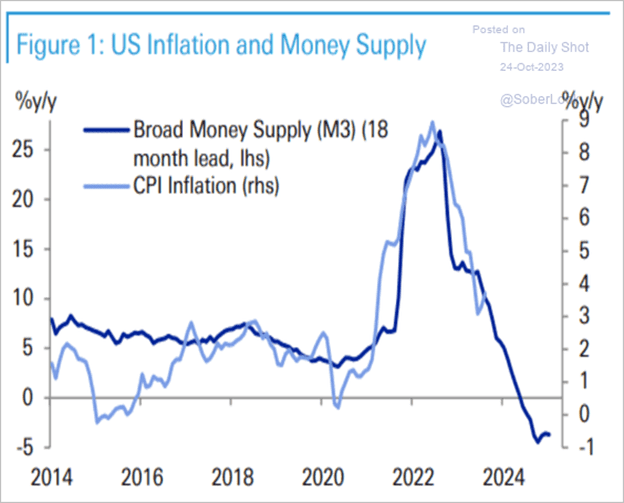

- Economists have been raising their inflation forecasts for 2024 to 2.6%

- As a result, fewer rate cuts are expected next year, with forecasters boosting their projections for Treasury yields.

- Household wealth has grown in recent years, which could support consumption.

- Subprime auto loan delinquencies hit a record high.

- The budget deficit was wider than expected in September, ending the year nearly $1.7 trillion in the red.

- While a November rate increase is off the table, the market has been pricing in some probability of a hike in January.

- The deceleration in broad money supply growth should assist the Fed in its battle against inflation.

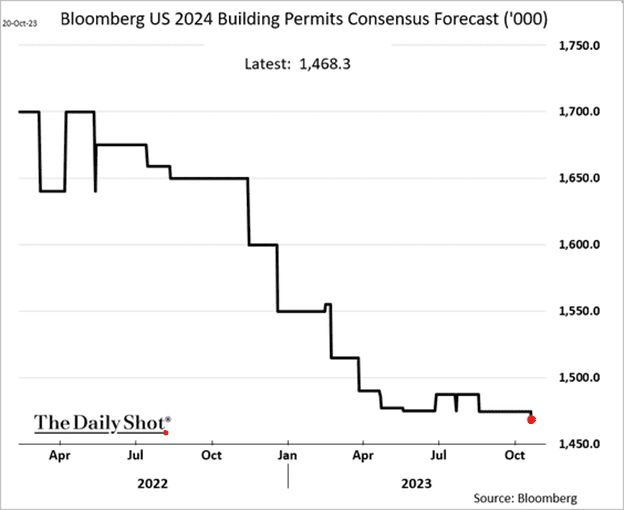

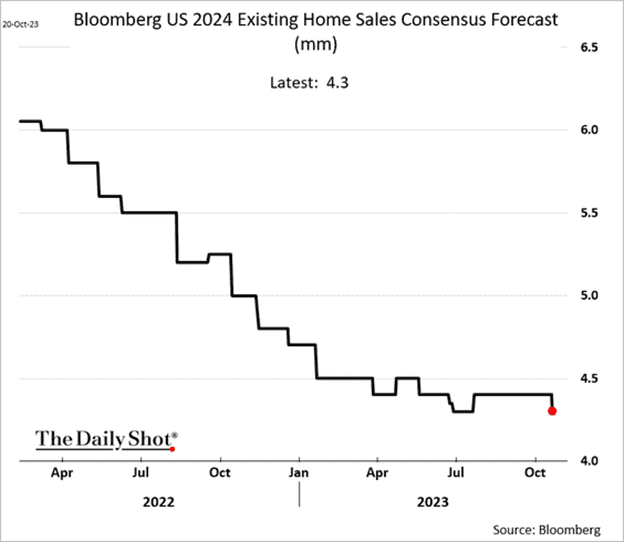

- Economists have been downgrading their forecasts for next year’s housing market activity.

- Building permits:

- Existing home sales:

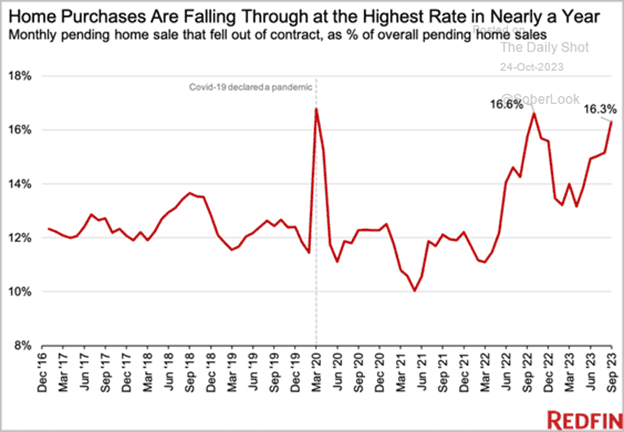

- The share of house purchases that fall through has been rising.

- Buying a home is now 52% more expensive than renting.

- The Philly Fed’s regional services sector activity is very sluggish.

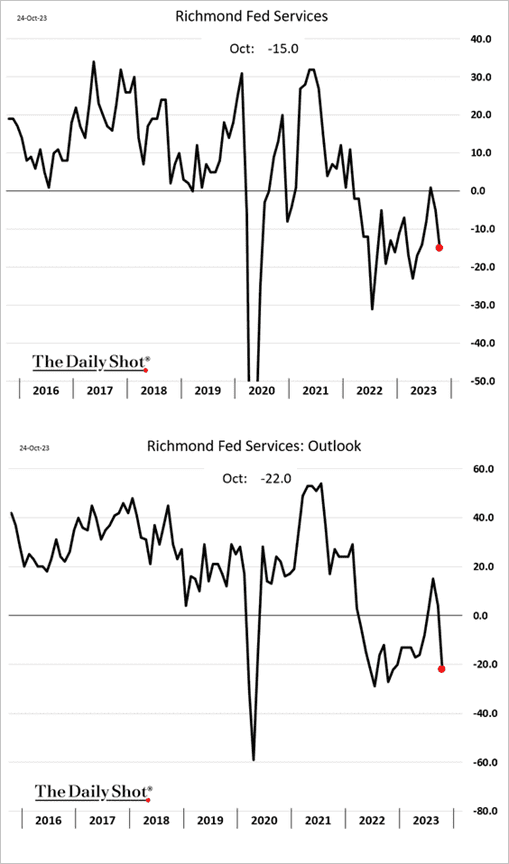

- The Richmond Fed’s services report also shows softening activity and outlook.

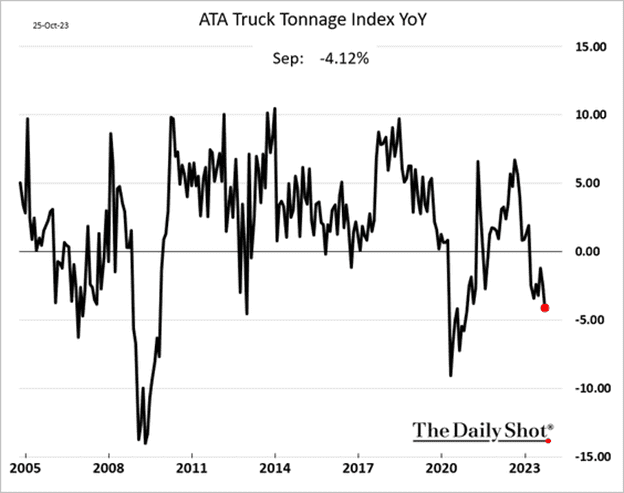

- US truck tonnage is down from a year ago.

- Mortgage rates near 8% are exerting downward pressure on demand for housing loans.

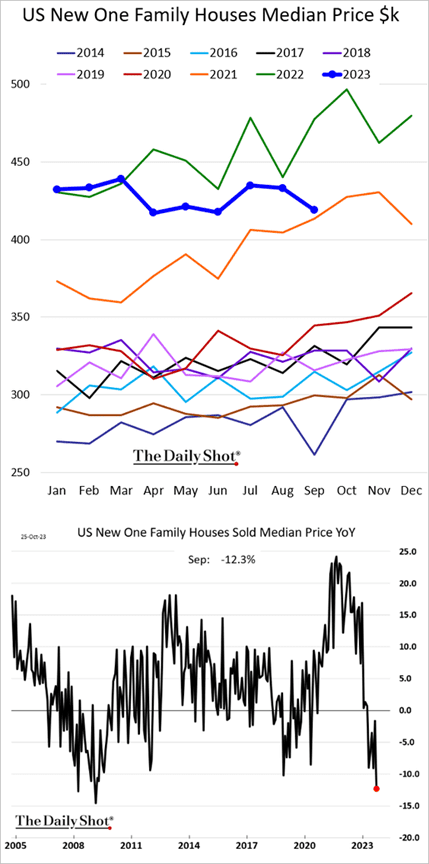

- The median new home sale price is down 12% from a year ago.

- Measured in months of supply, inventories of new homes declined.

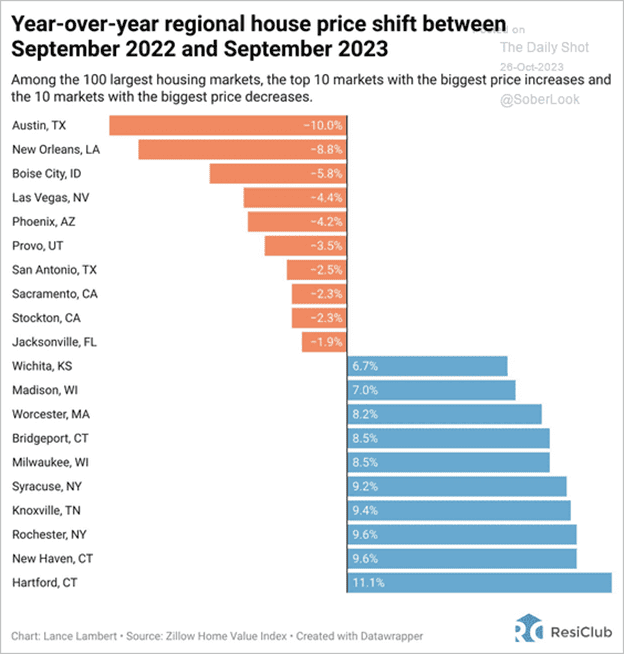

- This chart shows year-over-year home price changes by metro area.

- The latest PMI report from S&P Global signals further easing in US consumer price gains.

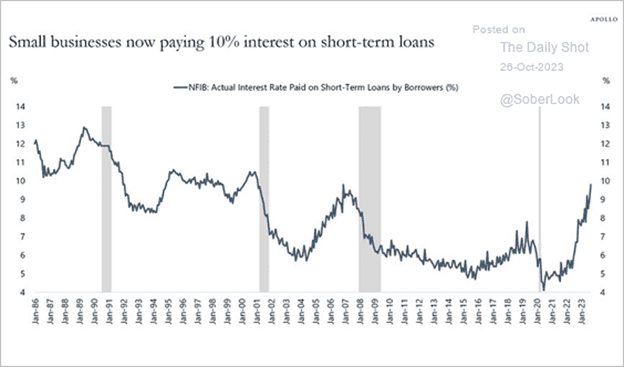

- The average interest rate paid by US small firms has reached 10%.

- US economic growth accelerated last quarter, driven by robust consumer spending. However, most economists expect a slowdown ahead.

- Inventory accumulation boosted GDP growth.

- Housing investment saw its first increase in ten quarters.

- Core inflation cooled in Q3 to 2.4%.

- Durable goods orders surged in September, boosted by aircraft orders.

- Initial jobless claims remain exceptionally low despite the massive increase in interest rates in this cycle.

- September pending home sales surprised to the upside but remained at multi-year lows.

Market Data

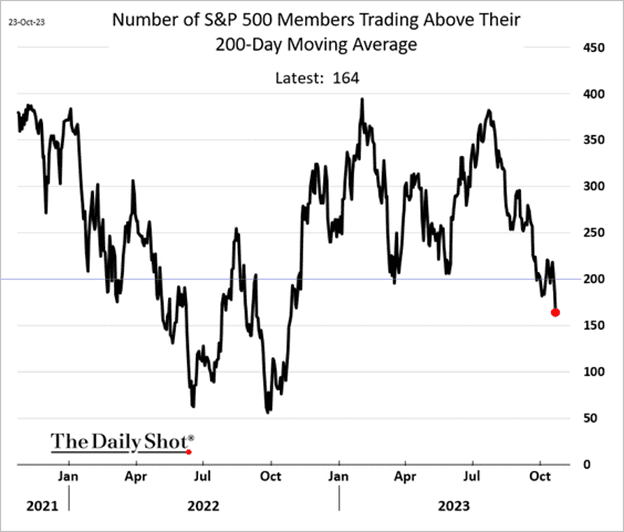

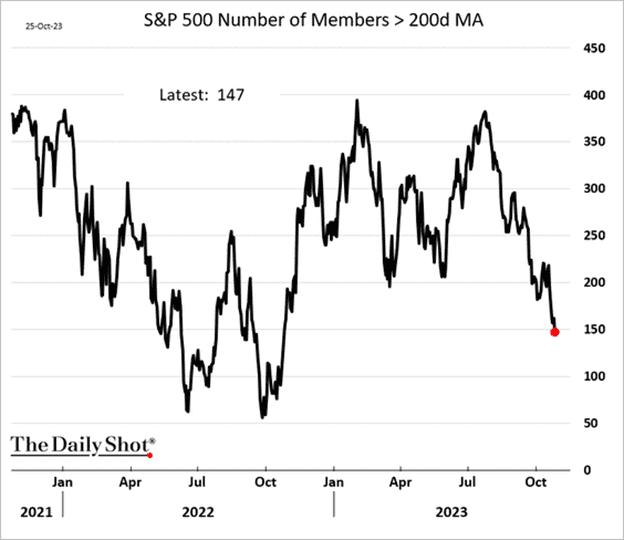

- The S&P 500 closed below its 200-day moving average.

- Seasonals suggest the S&P 500 could trade in a choppy range before a December rally.

- Market breadth continues to deteriorate.

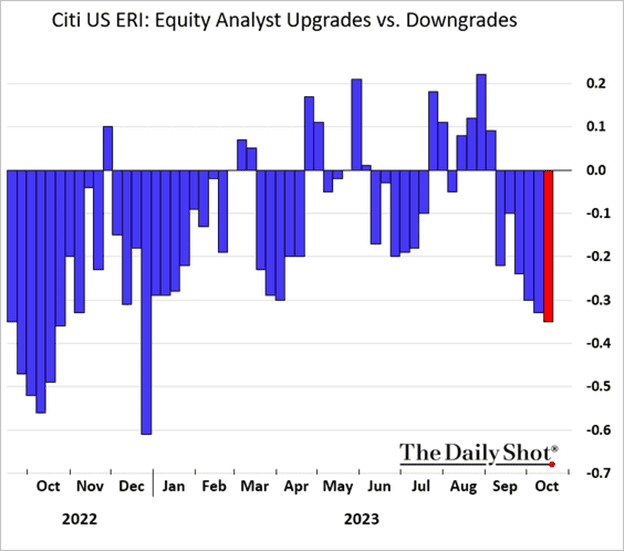

- Analysts’ earnings downgrades are outnumbering upgrades.

- Corporate guidance has also been soft.

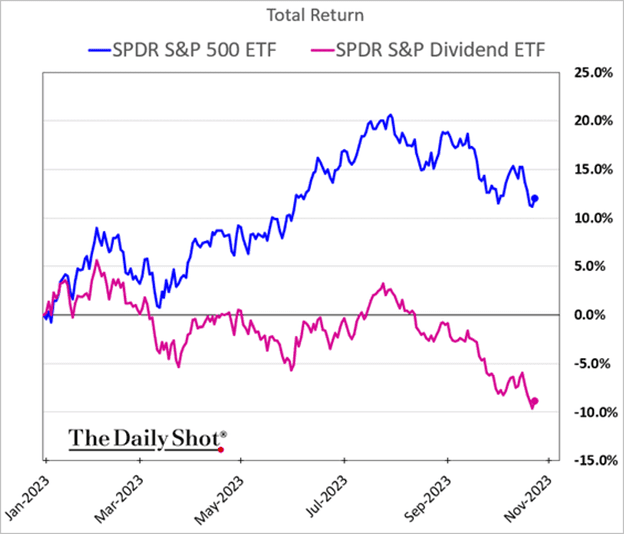

- Below are a couple of equity factor trends (year-to-date).

- High-dividend companies:

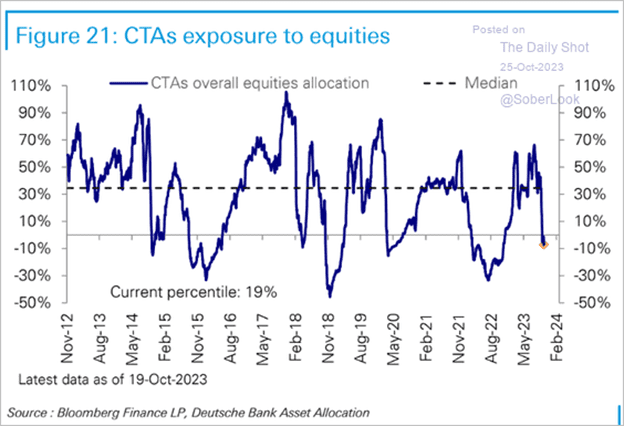

- CTAs are bearish.

Source: Deutsche Bank Research

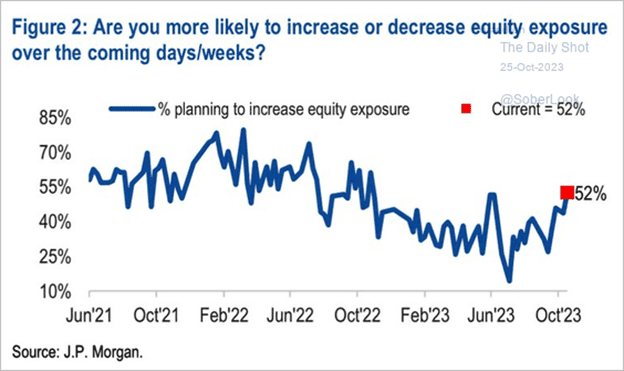

- But JP Morgan’s clients are becoming more constructive on stocks.

- The Nasdaq Composite is at the 200-day moving average.

- Breadth remains very weak as the average S&P 500 stock is down ~21% from its one-year high.

- Only 147 S&P 500 stocks are above their 200-day moving average.

Great Quotes

“All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident.” – Schopenhauer

Picture of the Week

Fuzer Castle, Hungary

All content is the opinion of Brian Decker