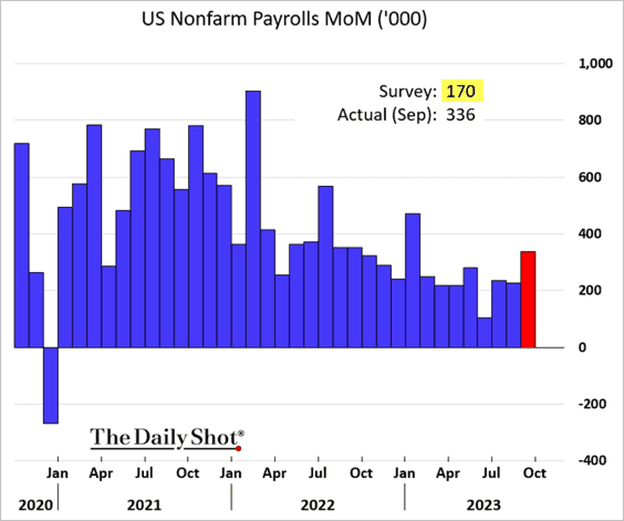

- The September jobs growth figure was almost double the expectations.

- Gains were broad, with hotels and restaurants, logistics, retail, healthcare, business services, and government (mostly educators) all registering payroll increases.

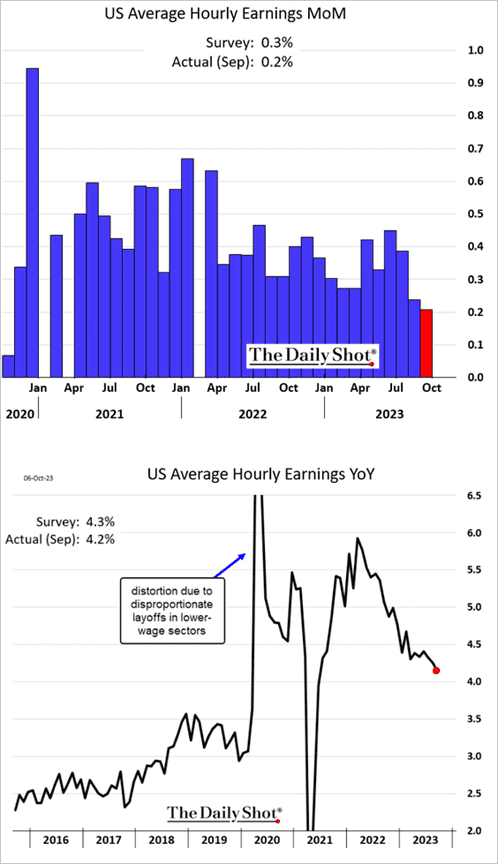

- Wage growth surprised to the downside.

- The unemployment rate held steady, and underemployment edged lower.

- The declines in temp services continued but at a slower pace.

- Labor force participation held steady.

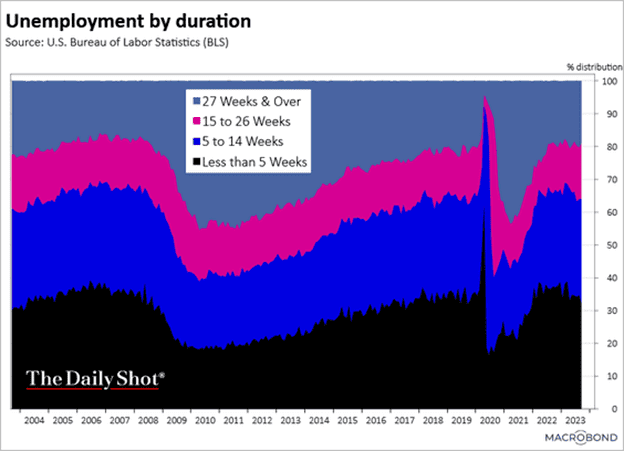

- Here is a look at unemployment by duration.

- Banks (lenders continue to reduce staff)

- Construction (resilient)

- Risk assets sold off initially but then took solace in slowing wage growth. However, all bets are off with escalating violence in the Middle East.

- 10-Year Treasury yields managed to hit new 1-year highs at 4.8%, and the yield curve steepened further.

- The market still sees about a 50% chance of another Fed rate hike.

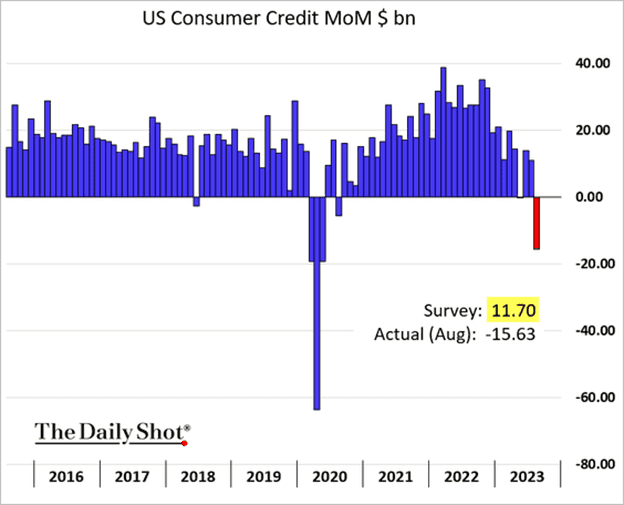

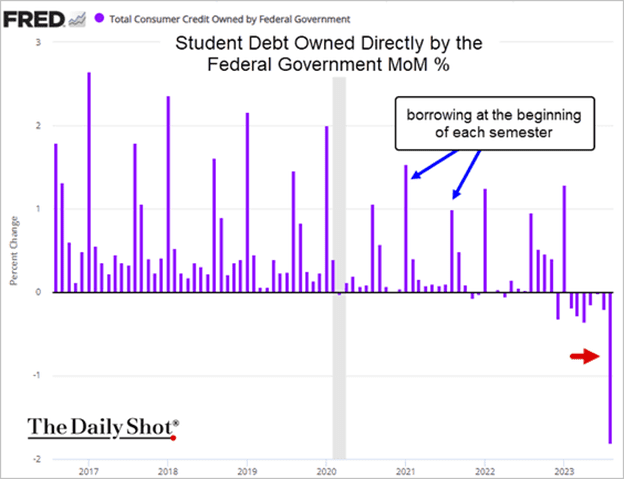

- Consumer credit tumbled in August, …

… as borrowers paid down some of their student debt.

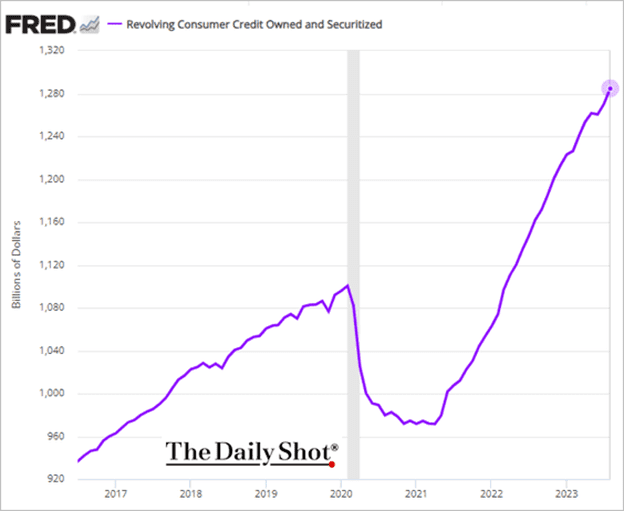

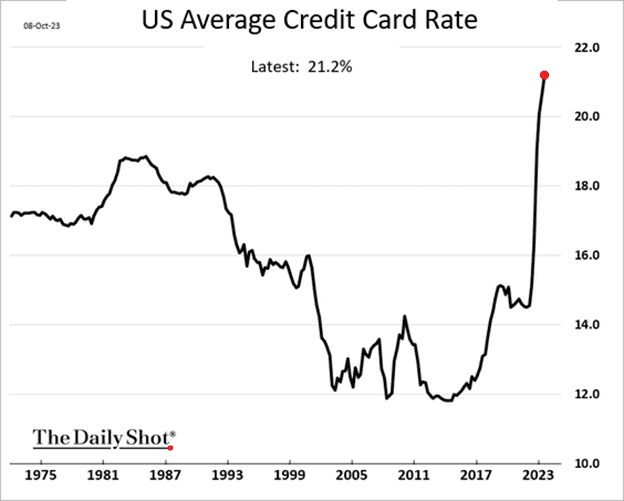

- Credit card balances continued to climb, …

- despite record rates.

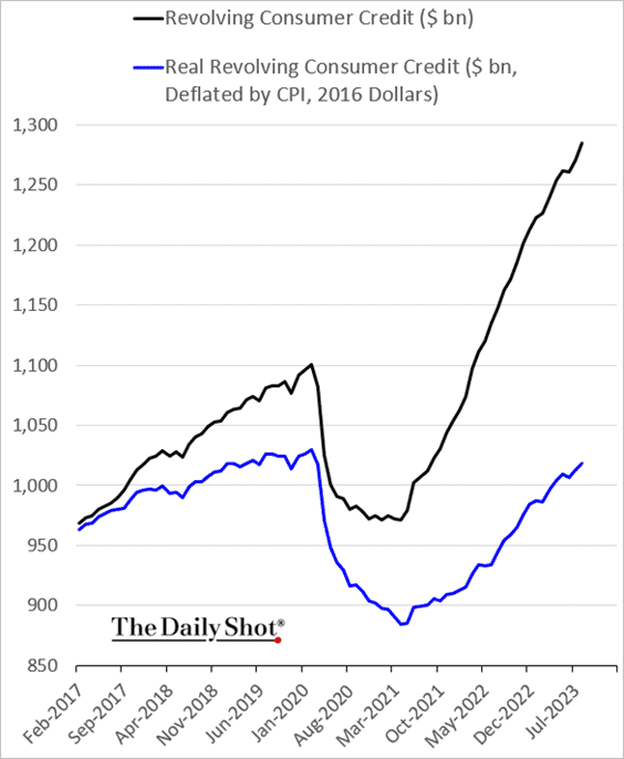

- Inflation-adjusted credit card loan balances:

Market Data

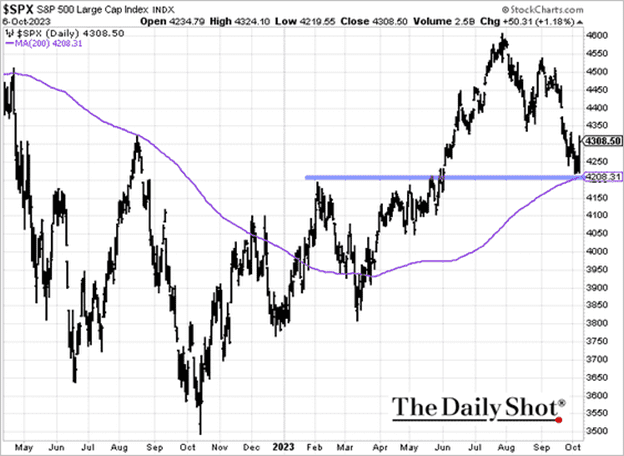

- The S&P 500 held support as US wage growth slowed.

- The S&P 500 concentration is at the highest level since the dot-com bubble.

Great Quotes

“Winter is an etching, spring a watercolor, summer an oil painting, and autumn a mosaic of them all.” – Stanley Horowitz

Picture of the Week

Baker Lake, Canada

All content is the opinion of Brian Decker