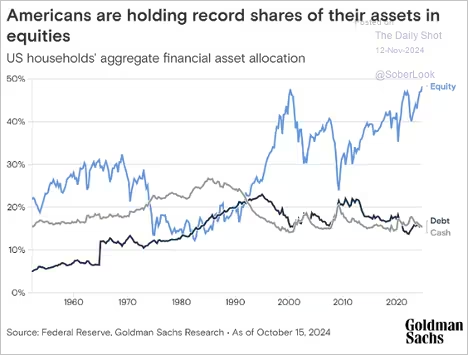

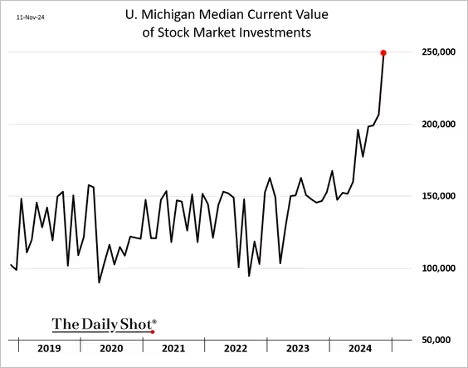

Dr Copper is selling off amid a surging US dollar and concerns over Chinese demand. US households are very exposed to stocks (2 charts).

US shares have significantly widened their outperformance over global peers. Muni bonds have bounced, but risks remain.

Source: @markets Read full article

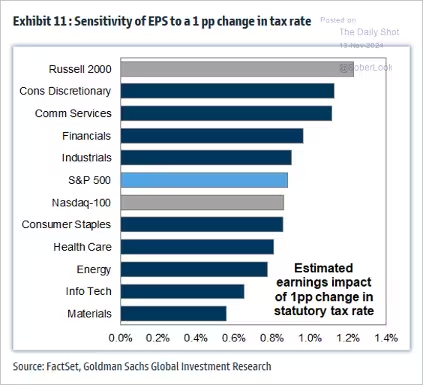

How sensitive are corporate earnings to changes in the tax rate?

Short-term Treasury yields declined as the market breathed a sigh of relief that the CPI report wasn’t more alarming. The US dollar continues to surge, which hurts Gold and most other commodities.

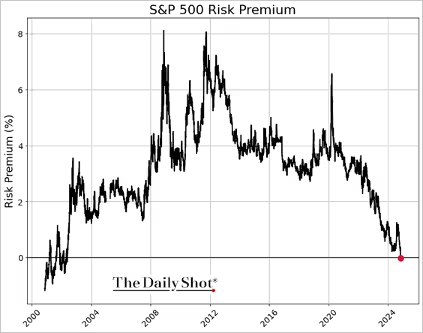

The S&P 500 risk premium (forward earnings yield minus the 10-year Treasury yield) has turned negative for the first time since 2002, indicating frothy valuations in the US stock market.

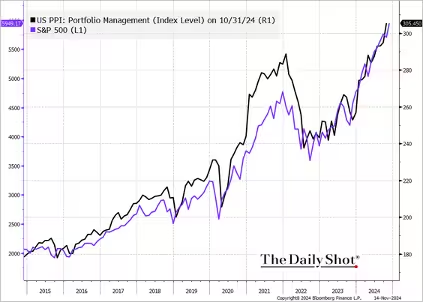

The portfolio management PPI component is highly correlated to stock market performance.

Economy:

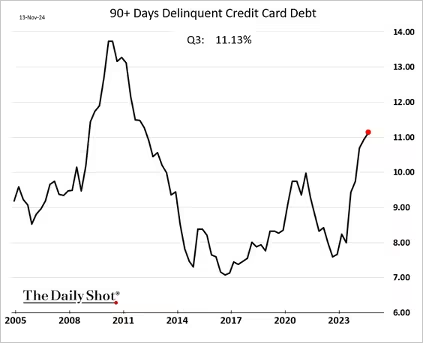

The US dollar continues to climb. Goldman expects robust CapEx growth next year. The percentage of US credit card debt that is delinquent reached its highest level in over a decade last quarter.

The Fed

Investors’ inflation expectations increased sharply last week. Consumers’ perceptions of inflation uncertainty have been increasing. Stocks that tend to benefit from higher inflation have been outperforming. With inflation projected to run hotter, the 2-year Treasury yield continues to rise.

The Treasury curve has flattened again as the market scales back expectations for Fed rate cuts. A December rate cut is no longer assured, with further reductions appearing even more uncertain.

Inflation remains sticky. Excluding used vehicles, however, the core goods CPI contracted. The core services CPI remained elevated, as housing inflation strengthened.

Market expectations for a December Fed rate cut have risen, with the probability approaching 90%. However, longer-term yields rose, with the 10-year yield approaching 4.5%.

Chair Powell struck a hawkish tone on Thursday, tempering market expectations for rate cuts. He emphasized the strength of economic activity, signaling caution toward policy easing.

Chair Powell: – The recent performance of our economy has been remarkably good, by far the best of any major economy in the world. … The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.

Other Fed officials have also been cautious on the trajectory of rate reductions.

The market is now pricing in only 54 bps of rate reductions next year.

Contrasting Economic Outlooks: Inflation vs. Disinflation

Blumenthal’s View: “All Roads Lead to Inflation”

- Core Thesis: The reliance on fiscal stimulus and monetary expansion to fund government spending, deficits, and entitlements is inherently inflationary.

- Waves of Inflation:

- Wave 1 (post-COVID) is behind us.

- Every whisper of a slowdown will find additional support from the fiscal and monetary authorities (the government and Federal Reserve, respectively). In other words, the sugar makers.

- Wave 2 (ahead) will be more substantial than Wave 1, driving inflation and interest rates higher.

- Structural Changes Ahead: By the latter half of the 2020s, inflationary pain will necessitate restructuring the debt and entitlements (e.g., “Bretton Woods Part II”) to anchor currency value. For now, the dollar rules.

- Implications: Persistent inflationary pressures will push Treasury yields higher, reflecting a need for tighter monetary policy to combat rising prices.

Dr. Lacy Hunt’s View: “The Case for Disinflation”

- Core Thesis: Contraction in global money supply (M) and low money velocity (V) create disinflationary forces.

- Monetary Contraction:

- Money supply growth surged during 2020–2022 but has since reversed sharply, signaling a prolonged downturn.

- The current contraction in money supply is more severe than during the Great Financial Crisis.

- Policy Lag: Changes in interest rates take time to affect economic activity, further delaying inflationary responses.

- Implications: Disinflation will dominate, with falling inflation and declining long-term Treasury yields, as central banks continue to ease policy to support sluggish growth.

Druckenmiller: I’m worried the Fed declared victory on inflation too early.

Stanley Druckenmiller, a renowned investor, has recently expressed concerns regarding the Federal Reserve’s approach to inflation and interest rates:

Inflation Concerns:

- Premature Victory Declaration: Druckenmiller believes the Federal Reserve may have declared victory over inflation too soon. He points to tight credit spreads, record-high gold prices, and a robust equity market as indicators that inflation could resurge. Morningstar

- Historical Parallels: Drawing comparisons to the 1970s, he notes that inflation initially declined before rebounding, suggesting a similar pattern could emerge today. Yahoo Finance

Interest Rate Policy:

- Critique of Rate Cuts: Druckenmiller has criticized the Federal Reserve’s recent decision to cut interest rates by 50 basis points, arguing that such aggressive easing is unwarranted given current economic conditions. MarketWatch

- Advocacy for Caution: He emphasizes the importance of the Fed focusing on long-term economic stability rather than attempting to fine-tune short-term outcomes, cautioning against the risks of premature rate reductions. Yahoo Finance

Investment Strategy:

- Shorting U.S. Bonds: Reflecting his inflation concerns, Druckenmiller has taken short positions on U.S. government bonds, anticipating that inflationary pressures could lead to higher yields and lower bond prices.

- Cautious Equity Positioning: While acknowledging the strength of the equity market, he remains cautious, suggesting that current valuations may not fully account for potential inflationary risks. Star Tribune

Ray Dalio, Founder and CIO Mentor Bridgewater Associates

Insights into inflation and interest rates:

Inflation Outlook:

- Persistent Inflation: Bridgewater’s co-CIO, Bob Prince, has noted that while inflation has decreased from its peak, it remains elevated and is likely to stabilize at current levels rather than decline further. Business Insider Markets

- Stagflation Concerns: Ray Dalio has expressed concerns about stagflation—a combination of stagnant economic growth and persistent inflation. He attributes this to central banks’ challenges in effectively managing economic conditions. Yahoo Finance

Interest Rate Projections:

- Potential Rate Cuts: Dalio has predicted that central banks might begin reducing interest rates by 2024 to address economic slowdowns, despite ongoing inflationary pressures. Business Insider Markets

- Impact on Markets: He has also warned that significant interest rate hikes could lead to substantial declines in stock prices, estimating a potential 20% drop if rates rise to around 4.5%. Yahoo Finance

Investment Implications:

- Cautious Stance on Bonds: Dalio has expressed skepticism about bonds, suggesting that the risks of rising rates may outweigh potential returns. The Wall Street Journal

- Equity Market Outlook: Despite concerns about inflation and interest rates, Bridgewater’s co-CIO, Karen Karniol-Tambour, has indicated that U.S. stocks remain a favorable investment, driven by expectations of robust economic growth. Reuters

Paul Tudor Jones, a prominent hedge fund manager, has recently shared his perspectives on inflation and investment strategies:

Inflation Outlook:

- Inevitable Inflation: Jones asserts that “all roads lead to inflation,” indicating his belief that rising inflation is unavoidable in the current economic climate. Cointelegraph

- Concerns Over U.S. Debt: He highlights the growing U.S. debt, which has escalated from 40% to nearly 100% of GDP over the past 25 years, as a significant factor contributing to inflationary pressures. MarketWatch

Investment Strategies:

- Hedging with Gold and Bitcoin: To protect against anticipated inflation, Jones has increased his holdings in gold and Bitcoin, viewing them as effective hedges. CryptoSlate

- Avoiding Fixed Income Assets: Expressing concerns about the fiscal trajectory of the U.S. government, he is steering clear of fixed-income investments and is shorting long-dated bonds. MarketWatch

Great Quotes

“A leader takes people where they want to go. A great leader takes people where they don’t necessarily want to go, but ought to be.” -Rosalynn Carter

Picture of the Week

Arches National Park, Utah

All content is the opinion of Brian Decker