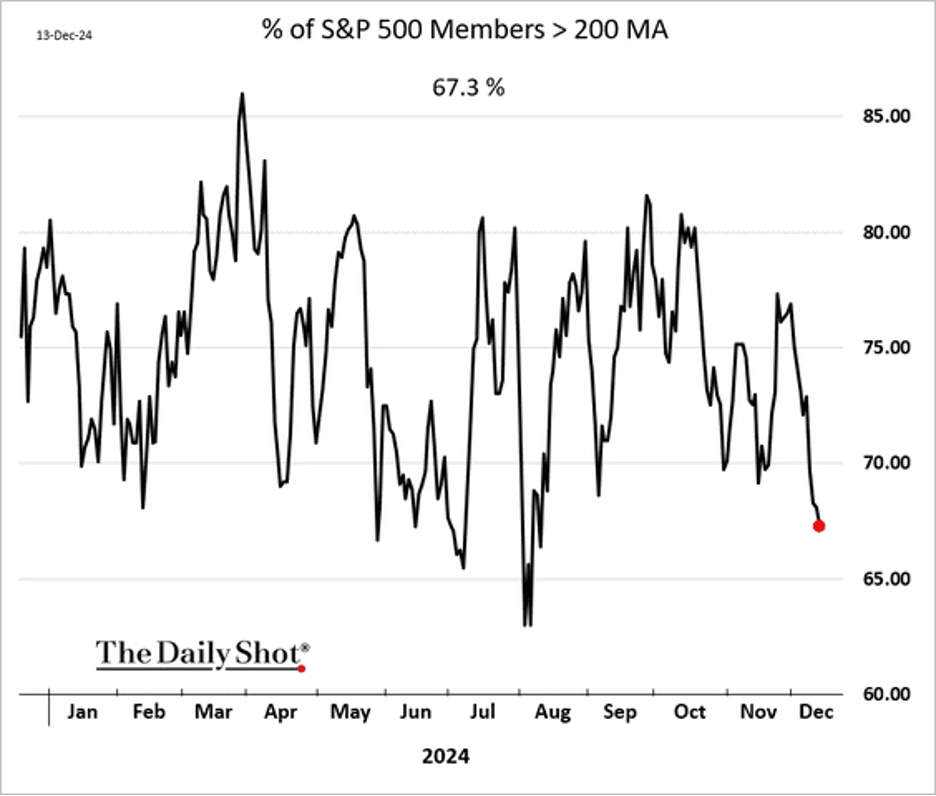

Market breadth continues to deteriorate.

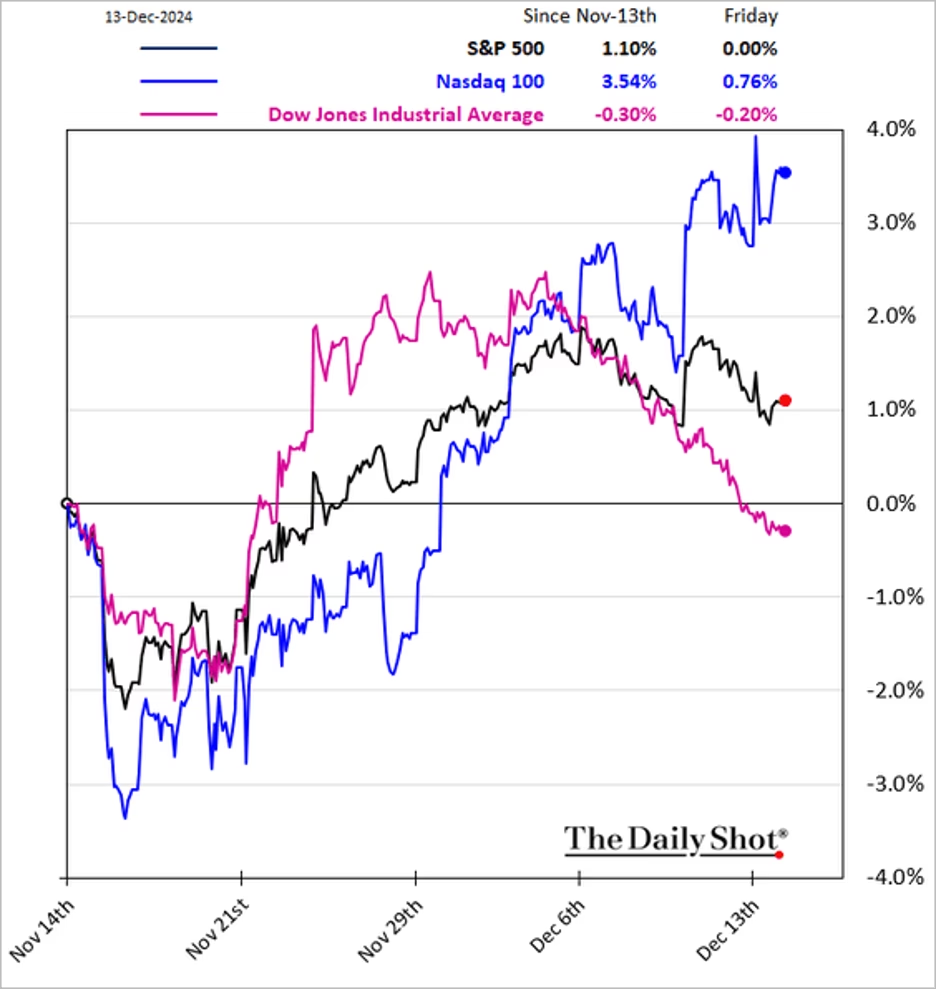

Growth stocks keep outperforming, boosted by tech.

Small and mid-cap shares are underperforming again.

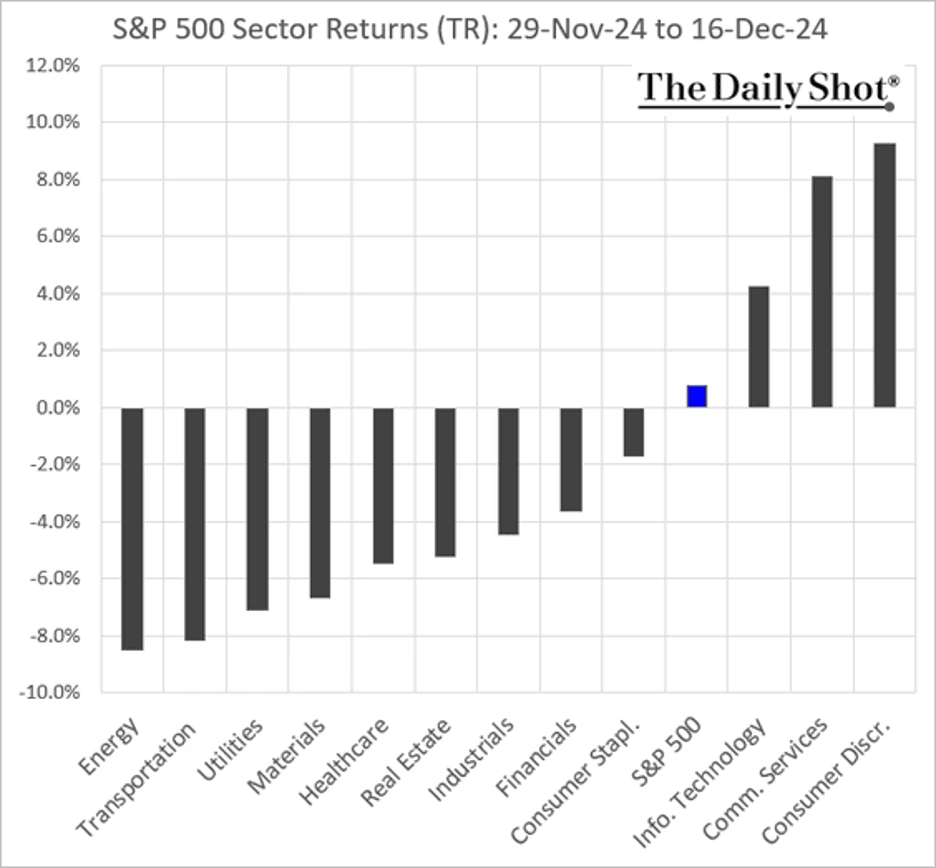

Any sector without Magnificent 7 stocks is down for the month. Notably, gains in the Consumer Discretionary sector have been driven by Tesla and Amazon.

Magnificent 7 stocks are now a third of the S&P 500 market cap.

Market breadth has deteriorated across the board.

The number of declining stocks in the S&P 500 has outpaced advancers for 11 consecutive days, marking the first such streak in recent decades.

Value stocks have underperformed growth by over 30% year-to-date. The S&P 500 Value Index has been down for 11 consecutive days. The value-growth divergence is reflected in major US indices with the Dow underperforming the Nasdaq.

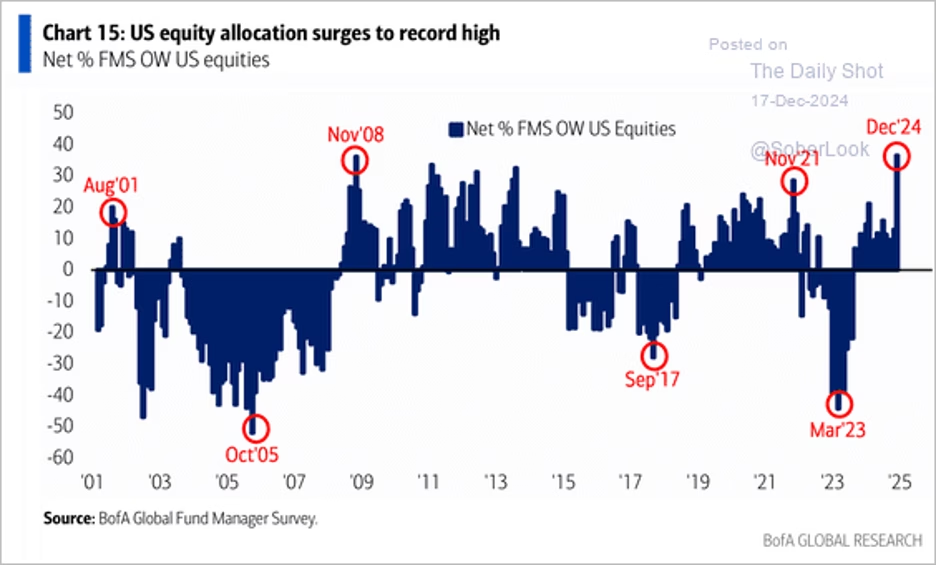

Institutional investor optimism toward stocks has reached extreme levels, as cash levels dwindle

Source: BofA Global Research

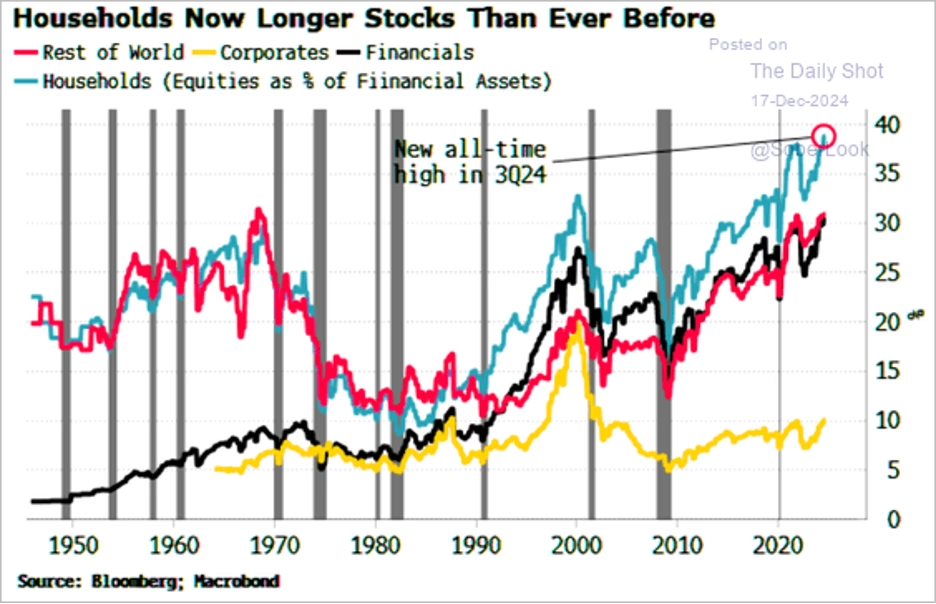

US households’ exposure to stocks continues to grow.

It’s been a while since the Dow registered nine consecutive daily losses. Speculative stocks continue to outperform.

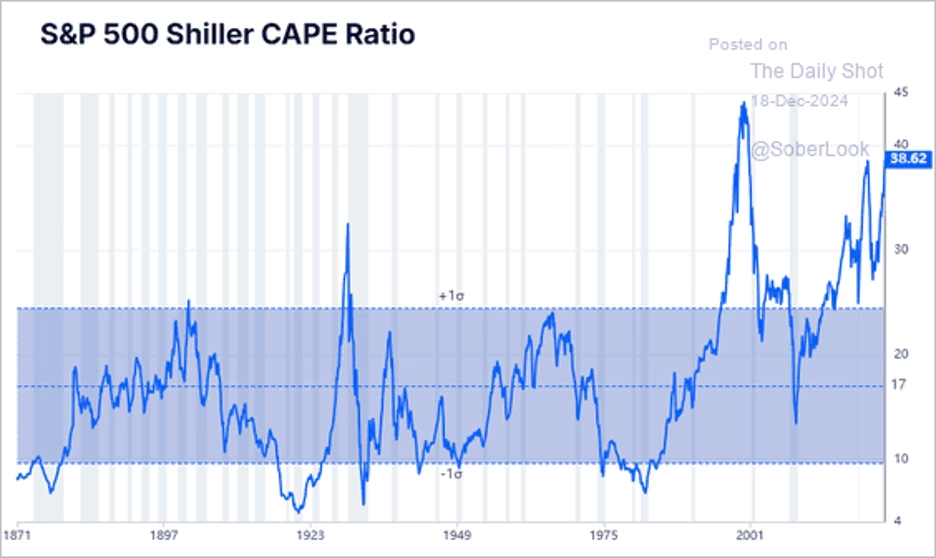

The S&P 500 Shiller CAPE ratio has reached its highest level since the dot-com bubble, highlighting lofty valuations.

Source: GuruFocus.com

It’s been a rough month for energy shares. The S&P 500 dropped 3% on FOMC day after the Fed’s hawkish tilt. The Nasdaq 100 is testing initial support, although upside momentum has weakened.

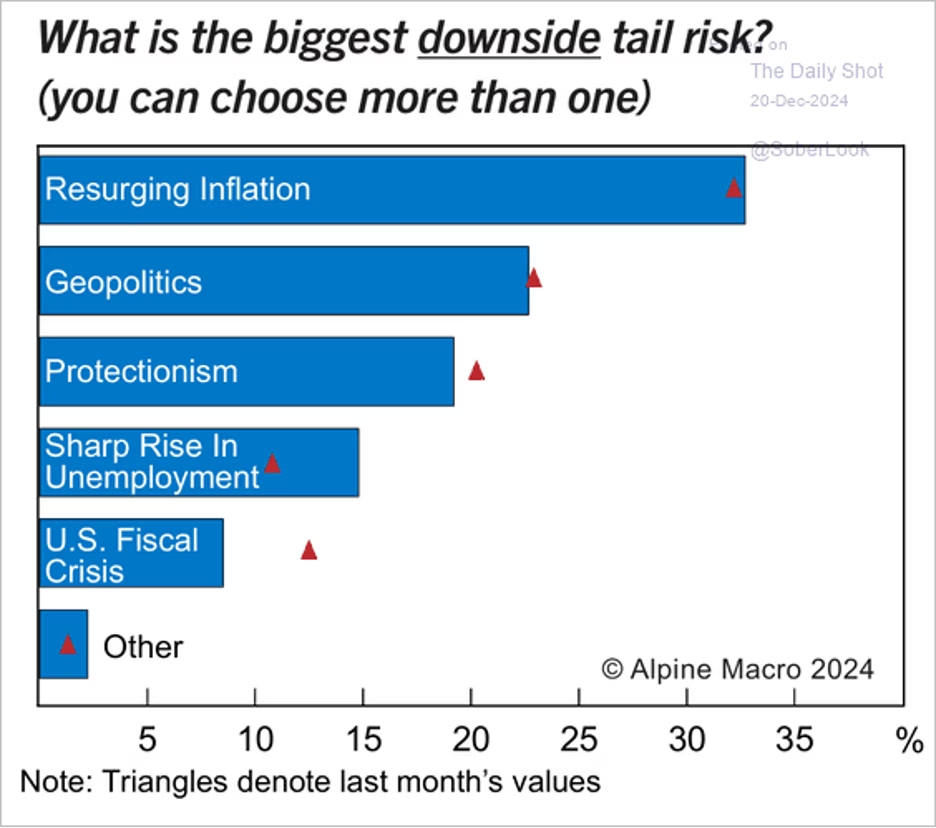

A survey by Alpine Macro shows resurging inflation as the greatest downside risk next year.

Economy:

The Magnificent 7 capex spree reflects the structural AI boom, which is key to America’s economic divergence.

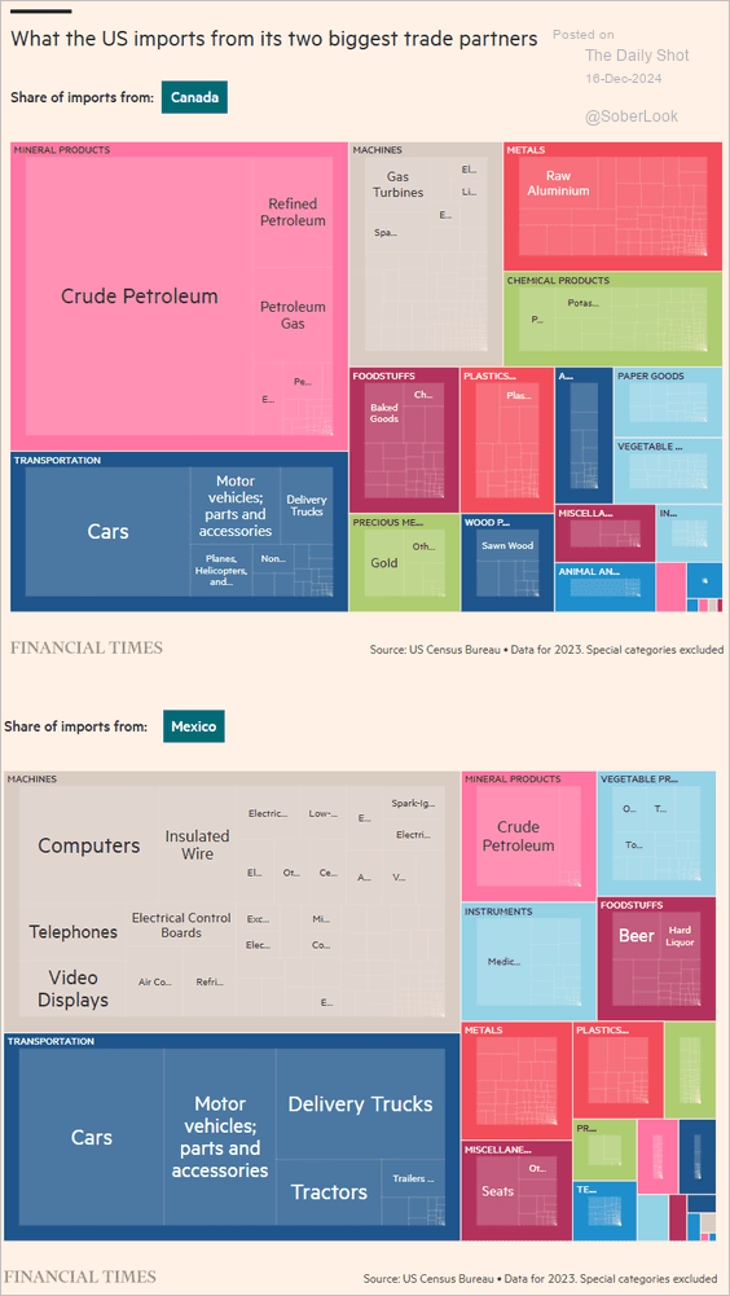

Tarriffs? Here is a look at US imports from Canada and Mexico by category.

The 10-year – 3-month portion of the Treasury curve is no longer inverted.

The PMI report from S&P Global was mixed, showing a further slowdown in factory activity while service sector growth accelerated this month. The New York Fed’s manufacturing index, the first regional indicator of the month, pulled back more than expected. This survey has been volatile, partly due to its relatively small sample size.

Last month’s retail sales exceeded expectations, driven by strong vehicle and online sales. While homebuilders are upbeat on sales next year, buyer interest remains soft. The Atlanta Fed’s GDPNow Q4 growth estimate has been moving lower but remains above 3% (annualized). Third-quarter GDP growth was revised upward, supported by stronger business investment and a smaller impact from the trade deficit.

The Fed

Economists now see inflation risk skewed to the upside. Tariffs and persistent inflationary pressures could keep core PCE above the Fed’s 2% target, according to Pantheon Macroeconomics. Will the Fed be forced to tighten again?

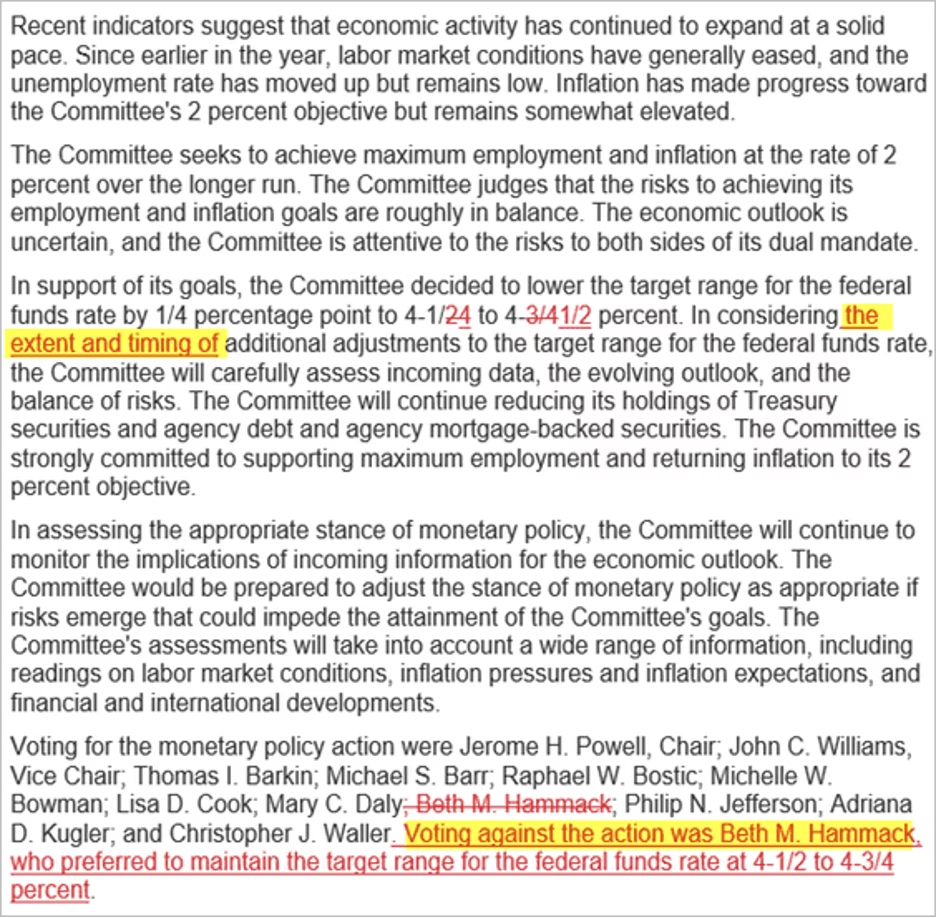

The Federal Reserve lowered its target rate as expected but adopted a hawkish tone. The FOMC statement introduced the phrase “the extent and timing of” regarding rate changes, signaling the end of consecutive rate cuts at every meeting.

Chair Powell’s remarks highlighted frustration with the Fed’s progress in tackling inflation.

– “We had a year-end projection for inflation, and it’s kind of fallen apart as we approach the end of the year.”

– “It’s been a bit frustrating because, while we’ve made progress, it has been slower than we had hoped.”

– “As we think about further cuts, we’re going to be looking for progress on inflation. …We have been moving sideways on 12-month inflation.”

Nomura forecasts just one 25 bps rate cut in March, followed by a prolonged pause extending well into 2026. The market agrees. The FOMC raised its estimate of the longer-run fed funds rate to 3%. The FOMC boosted its inflation forecasts for 2025, with inflation risks now skewed to the upside. Treasury yields surged, accompanied by a significant increase in real yields. Stocks tumbled.

The dollar jumped. Gold dropped by 2.3%. Mortgage rates are now firmly above 7%.

Great Quotes

“I want my children to have all the things I couldn’t afford. Then I want to move in with them.”

—Phyllis Diller

Picture of the Week

Salzberg Austria

All content is the opinion of Brian Decker