Will the S&P 500 test the uptrend support again?

The S&P 500 index approaches key trendline support following sharp declines in early 2025.

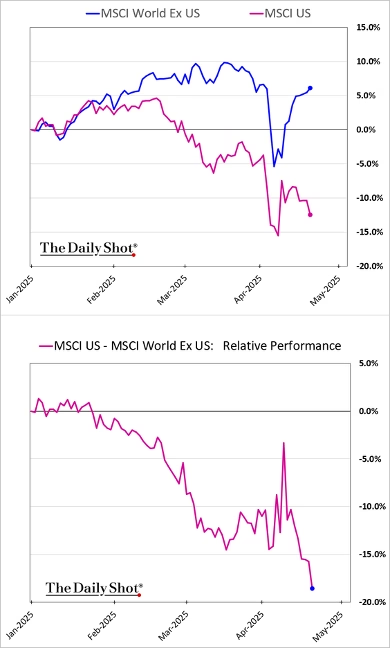

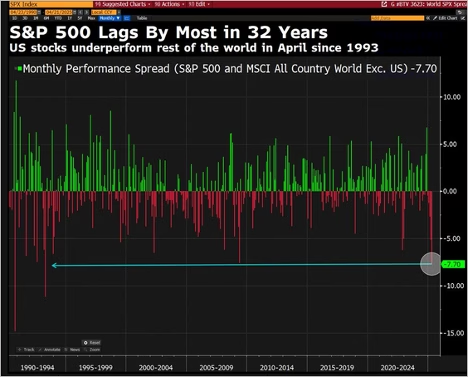

US stocks have massively underperformed global equities.

Global equities outperform US stocks by the widest margin in years.

US stocks lag global peers sharply, marking the worst relative performance in over three decades.

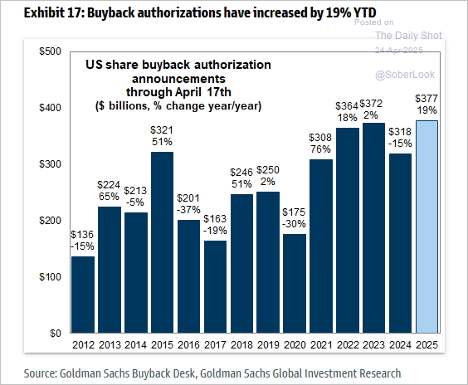

The share of S&P 500 stocks trading above their 50-day moving average has fallen back below 20%. Share buyback activity has been robust.

Corporations ramp up buyback activity, signaling continued shareholder return efforts despite market uncertainty.

Economy

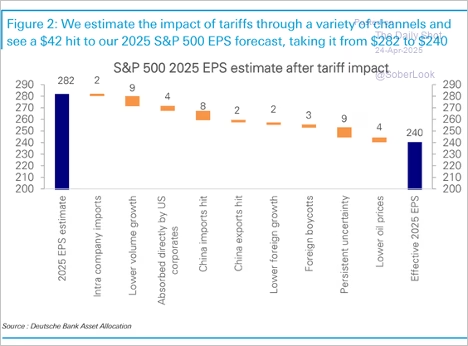

Deutsche Bank estimates that tariffs could shave $42 off 2025 S&P 500 EPS, cutting their forecast from $282 to $240. The largest hits stem from lower volume growth, persistent uncertainty, and direct absorption by US corporates, highlighting the broad-based earnings pressure tariffs can exert across supply chains and global demand.

Tariffs are expected to significantly pressure corporate earnings, with broad impacts across industries.

The PPI report surprised to the downside, with the headline figure posting a sharp decline last month. Trade services PPI (a measure of business markups) declined for the second consecutive month, indicating shrinking margins. However, higher tariffs could lift the core PCE measure in the months ahead.

March PPI report shows an unexpected drop in wholesale prices, offering temporary inflation relief.

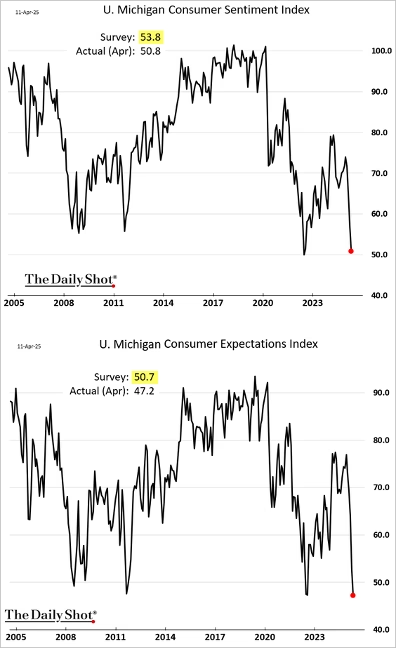

The April U. Michigan consumer sentiment index reflects outright panic among US households. The March NY Fed Survey of Consumer Expectations revealed a sharp rise in the percentage of Americans anticipating higher unemployment, aligning with findings from the April University of Michigan consumer survey. More Americans are unsure about their financial situation over the next 12 months.

Consumer confidence plunges, with both sentiment and expectations indexes reaching post-pandemic lows.

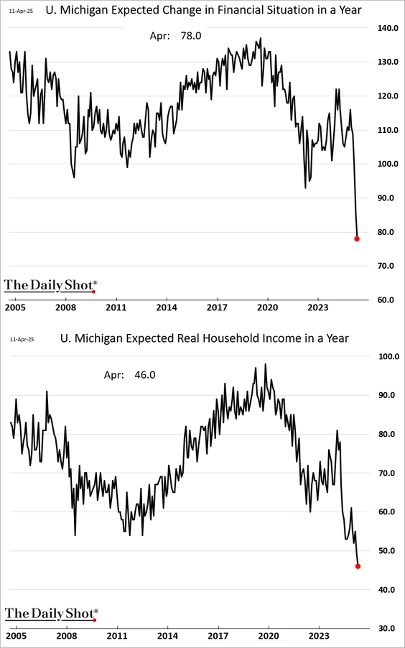

Measures of expected financial situation have collapsed. Is the pessimism overdone?

Expectations for financial well-being and household income have deteriorated significantly.

CEO sentiment has also deteriorated.

CEO confidence plummets amid mounting concerns about economic slowdown.

The dollar index dipped to its lowest level in over three years.

The dollar weakens sharply, breaking multi-year support levels.

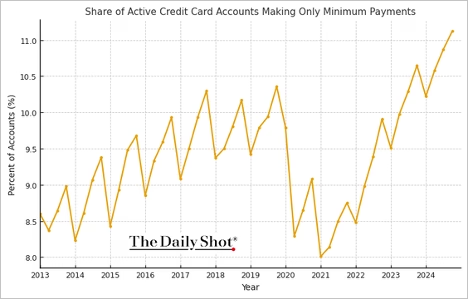

The share of Americans making only the minimum payments on their credit card accounts hit a multi-year high.

Financial strain grows as more Americans make only minimum payments on credit cards.

Rising financial distress reflected in consumer credit behavior.

Source: @wealth Read full article

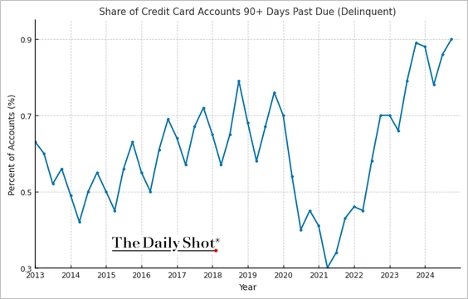

A rising share of credit card accounts are delinquent.

Delinquencies on credit cards continue to climb, signaling stress in household finances.

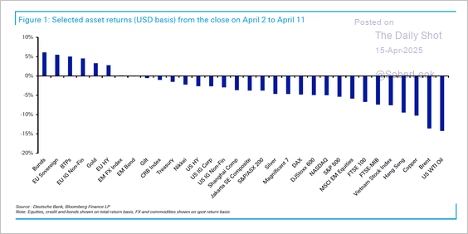

Here is a look at post-“Liberation Day” performance across key assets. Energy, copper, and equities fell the most, while European sovereign bonds and gold held up.

Risk assets sold off sharply in early April, with energy and emerging markets hardest hit.

Source: Deutsche Bank Research

The Atlanta Fed’s GDPNow model now projects nearly flat GDP growth for Q1.

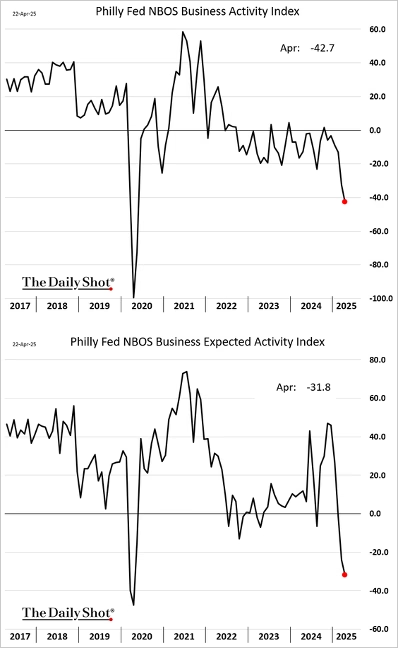

Philly Fed services index:

Regional business surveys show widespread weakness across manufacturing and services sectors.

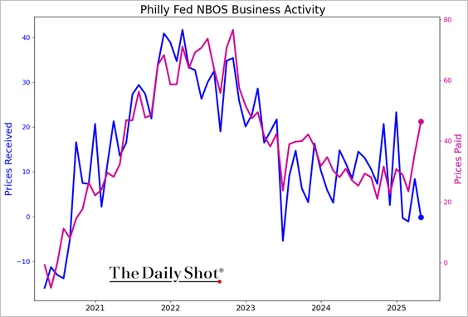

Margins could come under pressure in the months ahead.

Margin pressures persist as costs remain elevated relative to sales prices.

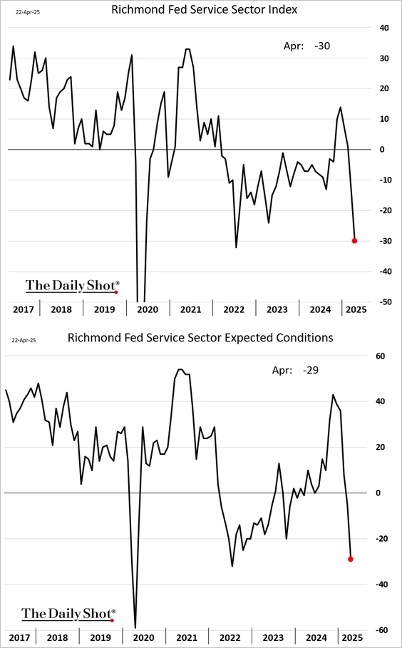

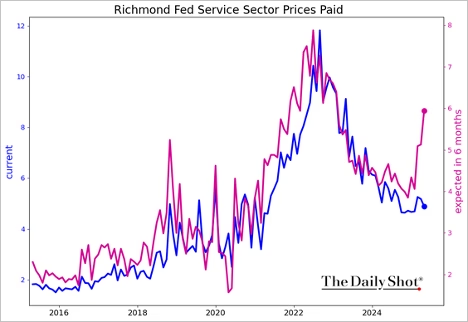

Richmond Fed services index:

The Richmond Fed’s service sector indicators signal a sharp contraction in regional economic activity.

Costs are expected to rise sharply.

Businesses report rising cost pressures, with expectations for higher prices over the next six months.

Durable goods orders surged in March, boosted by aircraft orders.

Durable goods orders rise sharply due to short-term factors that may not persist if trade tensions escalate.

The Atlanta Fed’s GDPNow model continues to signal a GDP contraction in the first quarter.

The Fed

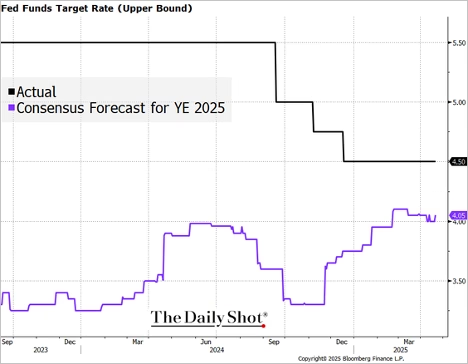

Investor expectations for two or more Fed rate cuts in 2025 remain dominant, though the probability of deeper cuts (three or more) has risen notably since February. Meanwhile, the share expecting no change has dropped sharply.

The Fed faces a difficult position amid stagflationary concerns.

Fed Chair Powell highlights economic risks from intensifying trade wars.

Source: @WSJ Read full article

The market is pricing in over 90 bps of rate cuts this year. Economists see two Fed rate cuts this year. The market expects closer to four.

Markets project significant rate cuts by the end of 2025 as economic risks mount.

Fed officials have begun discussing potential rate cuts, …

Tariff impacts on jobs could push the Fed toward monetary easing.

Source: @economics Read full article

The Fed remains flexible on rate decisions based on upcoming data releases.

Source: @economics Read full article

… with the market viewing the July and September FOMC meetings as the most likely for reductions.

Tariffs

Following a recent spike, the number of container ships departing China for the US has declined sharply, suggesting front-loading activity may be fading. Used vessel capacity has dropped more steeply than total capacity, indicating rising empty space and softening US import demand.

Great Quotes

“IMPOSSIBLE IS NOT A FACT. IT’S AN OPINION. IMPOSSIBLE IS NOT A DECLARATION. IT’S A DARE. IMPOSSIBLE IS POTENTIAL. IMPOSSIBLE IS TEMPORARY. IMPOSSIBLE IS NOTHING.”

“THE AMERICA WE DREAM OF IS NOT IMPOSSIBLE. IT BEGINS WITH US DARING TO BELIEVE, TO ACT, AND TO LEAD WITH COMPASSION.”

“EVERY HAND WE LIFT, HONORS THE GREATNESS WITHIN US ALL.”

— Muhammad Ali

Picture of the Week

Grand Prismatic Spring, Yellowstone National Park

The Grand Prismatic Spring, Yellowstone’s largest hot spring, displays stunning natural colors.

All content is the opinion of Brian Decker