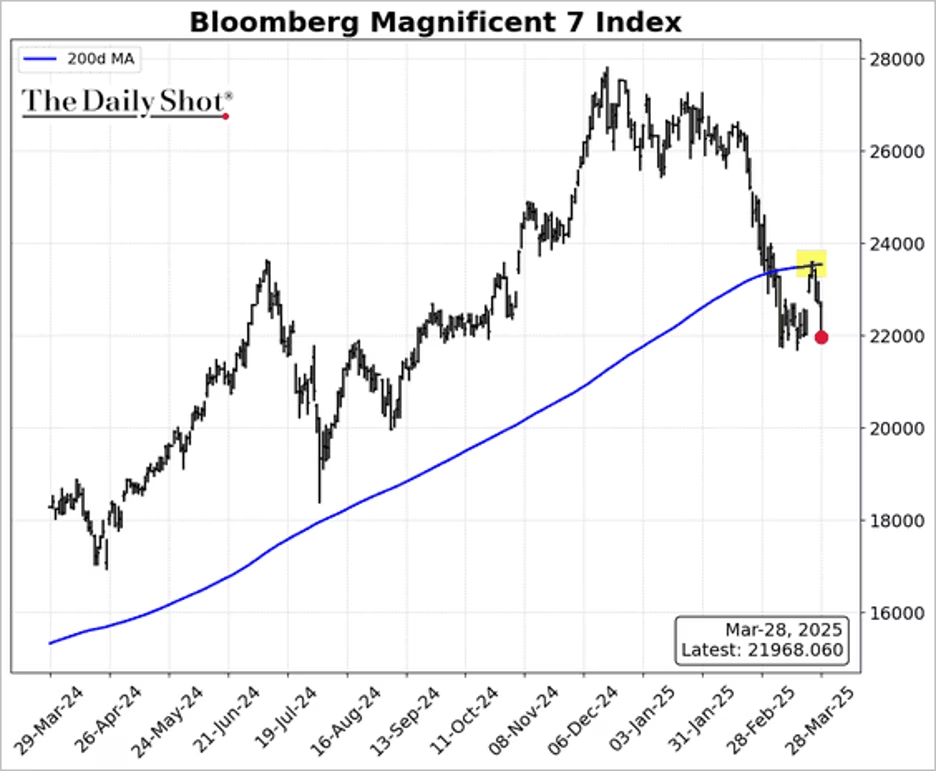

The Magnificent 7 stocks collectively held resistance at the 200-day moving average.

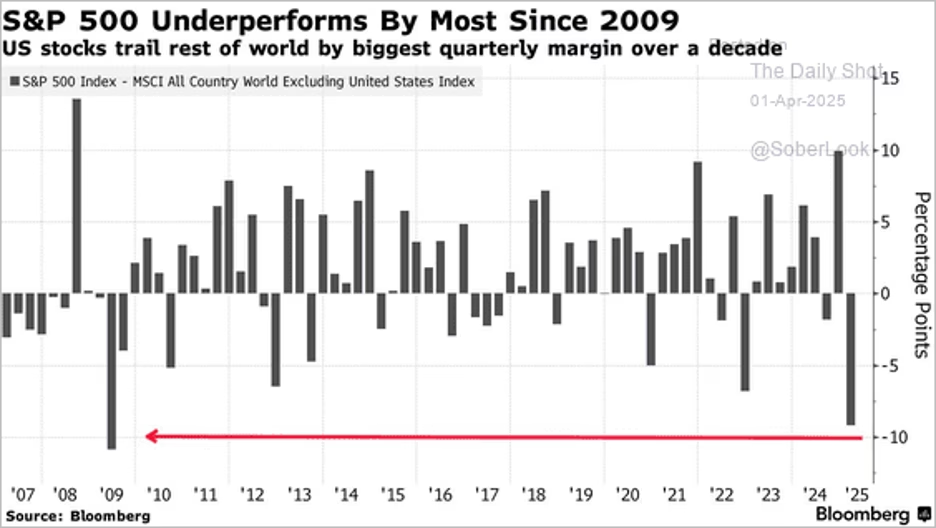

Hedge funds have been selling tech stocks. The Nasdaq has recorded five declines of over 2% in March. US equities lagged the rest of the world by the widest margin since 2009.

Source: @markets Read full article

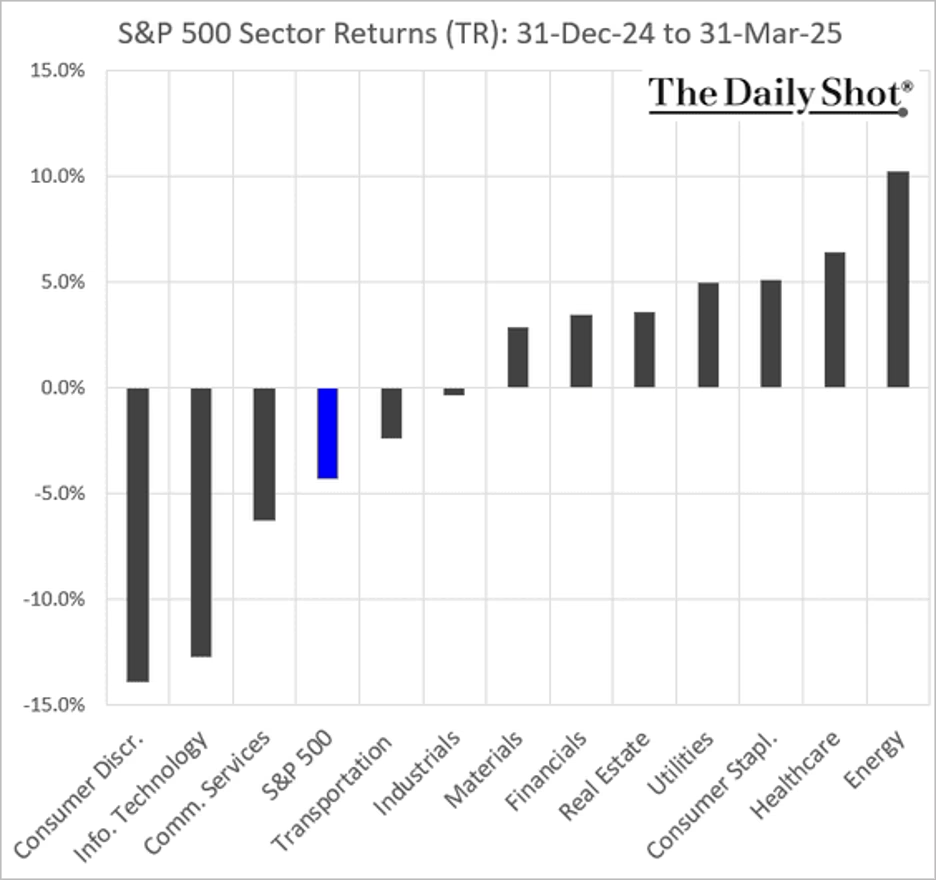

Despite underperforming sharply in Q1, US equities continue to command a substantial valuation premium over European stocks. Finally, we have some year-to-date performance data.

- Sectors:

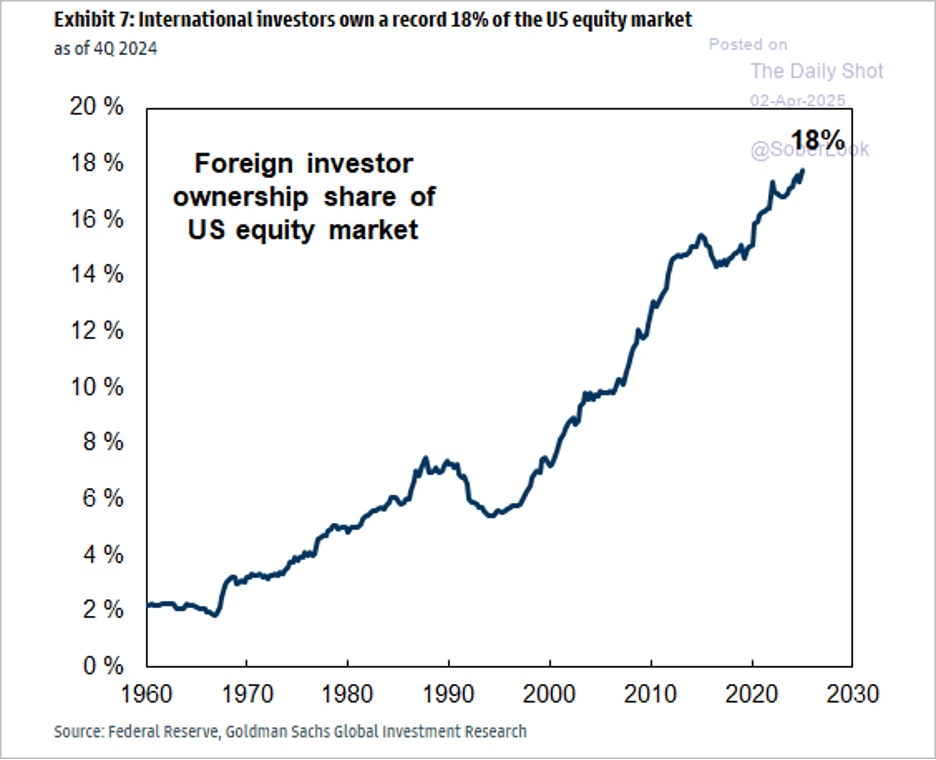

Goldman holds a short-term bearish view on US stocks but expects gains over the next 12 months. This chart shows foreign ownership of US stocks.

Source: Goldman Sachs

ENERGY – Brent crude plunged nearly 7%—its sharpest drop in two years—after OPEC+ stunned markets with a supply hike triple the planned amount, aiming to punish overproducing members and possibly appease US pressure. The move sharply reversed recent gains and pushed prices below the $70 threshold, marking a significant shift from the group’s traditionally cautious stance.

Economy:

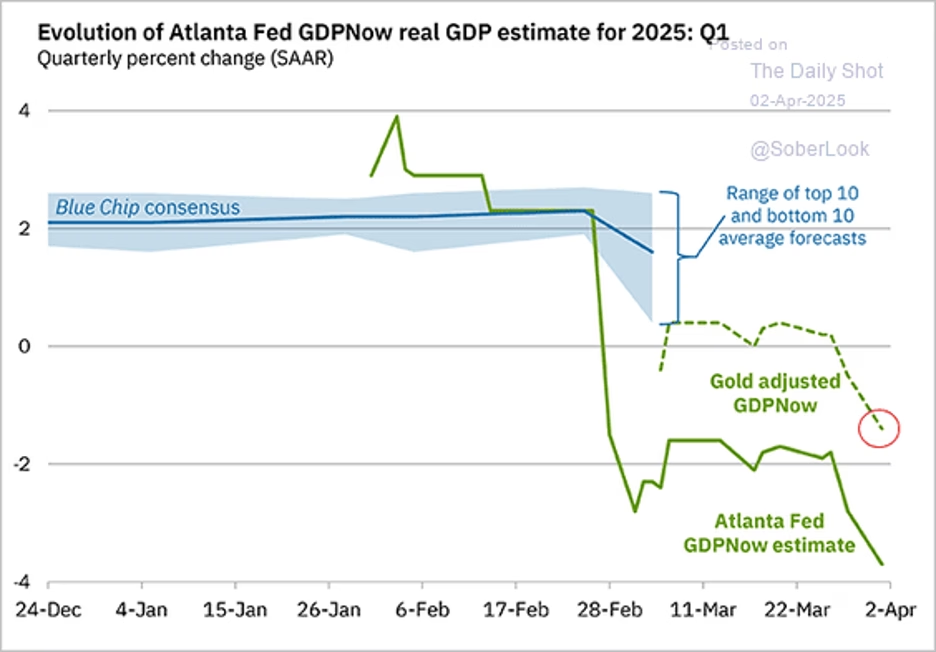

Last month’s rebound in US consumer spending from January’s weather-related slump was tepid, falling short of expectations. The stock market continues to reflect weakening consumer demand. The Atlanta Fed’s GDPNow estimate now projects a 1.4% annualized GDP contraction in Q1, even when adjusted for massive gold imports.

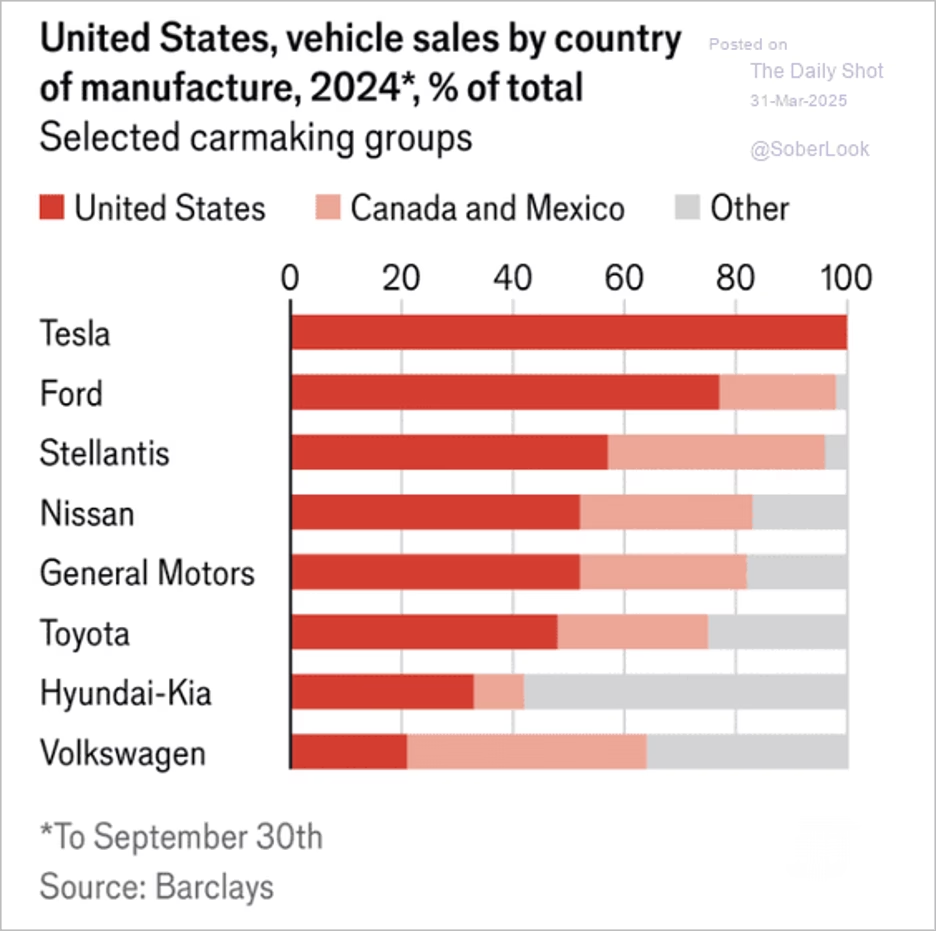

US vehicle sales by country of manufacture:

Estimated GDP impact of a trade war:

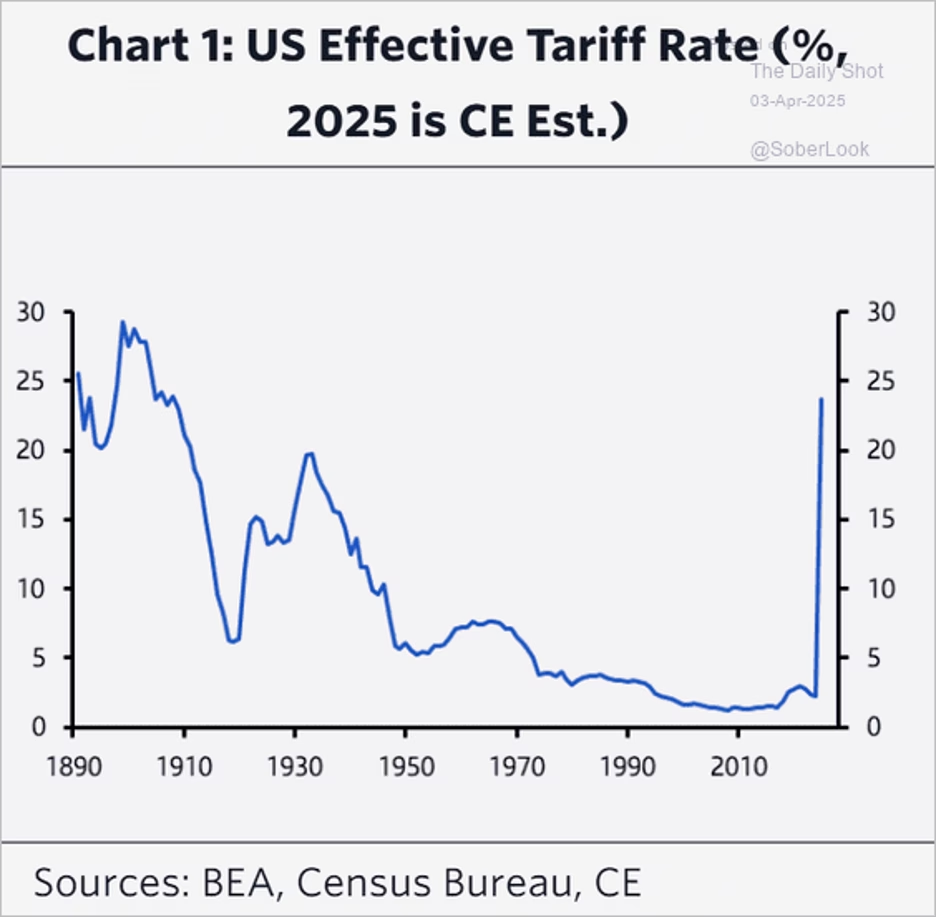

Economists have lowered their 2025 US growth forecast, cutting estimates for export growth and business investment. Goldman sees almost no GDP growth this quarter, increasing the likelihood of a recession. With autos making up 12% of US imports and a wide supplier base led by Mexico, sweeping auto tariffs could significantly elevate overall import costs. Even in a moderated scenario, the effective tariff rate is poised to reach its highest level since the 1930s, underscoring the scale of the potential trade shock.

Job openings edged lower in February. Cost pressures intensified more than expected, aligning with other indicators and pointing to higher goods inflation ahead.

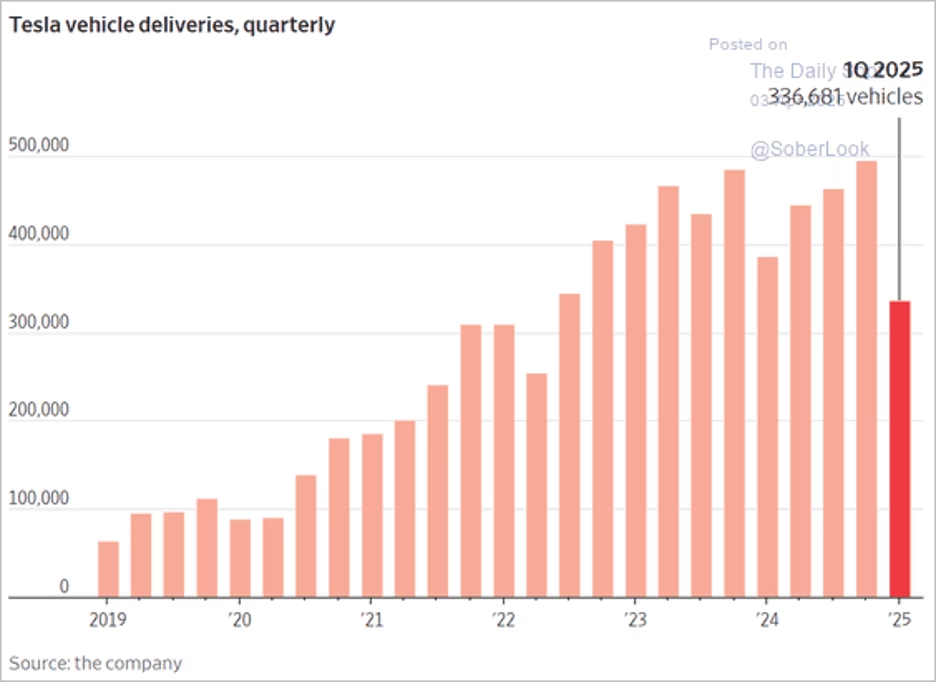

Tesla vehicle deliveries:

Source: @WSJ Read full article

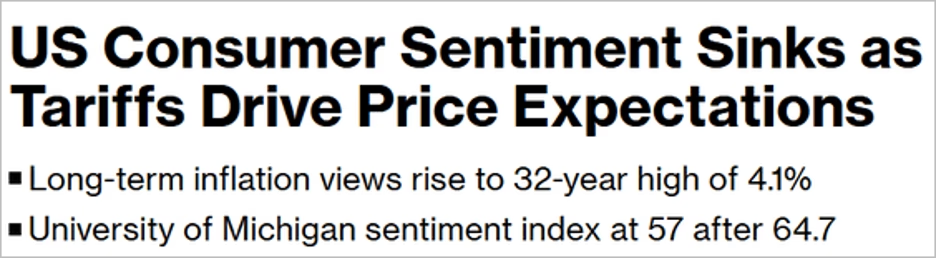

Tariffs

Good news: Tariffs will not make the world end. American businesses will do what they do best, which is adapt. While the probability of a recession has increased, we always get through it and the best businesses thrive. Unless directly affected by tariffs, don’t change your personal plans that much. Much of this may change over the next few weeks or months. At least four services that I follow have raised their recession odds overnight. Ed Yardeni is raising his recessions odds to 45%. I think that if these tariffs are still in place in two months, that is a guaranteed recession. He agreed. Which means neither of us believes they will still be in place.

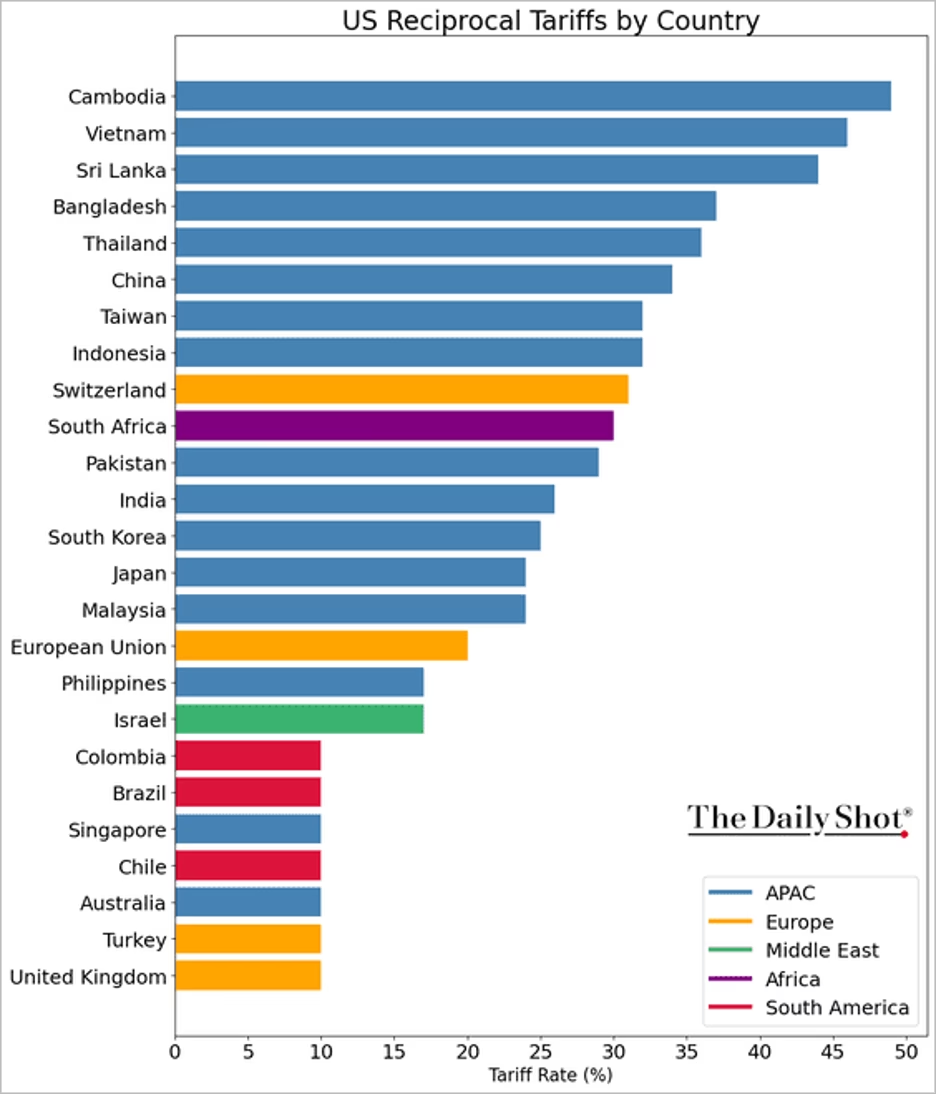

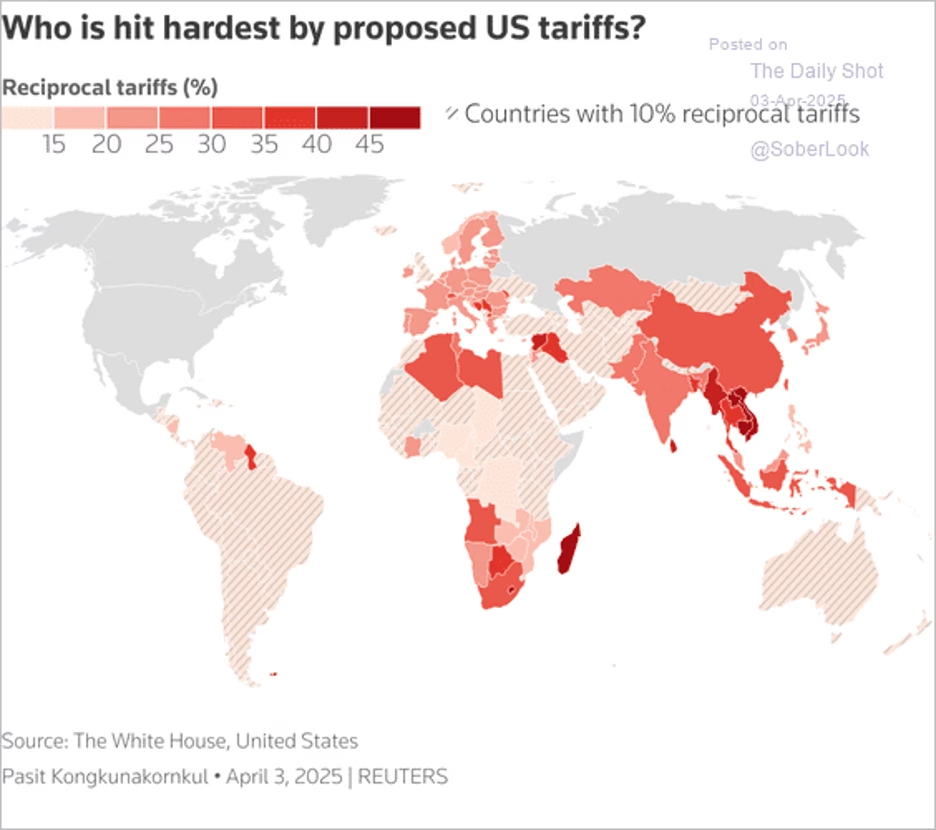

The newly announced US tariffs introduce a universal 10% duty on all imports, effective April 5, 2025, with higher “reciprocal” tariffs targeting specific countries starting April 9, 2025. Asia and Europe were hit the hardest.

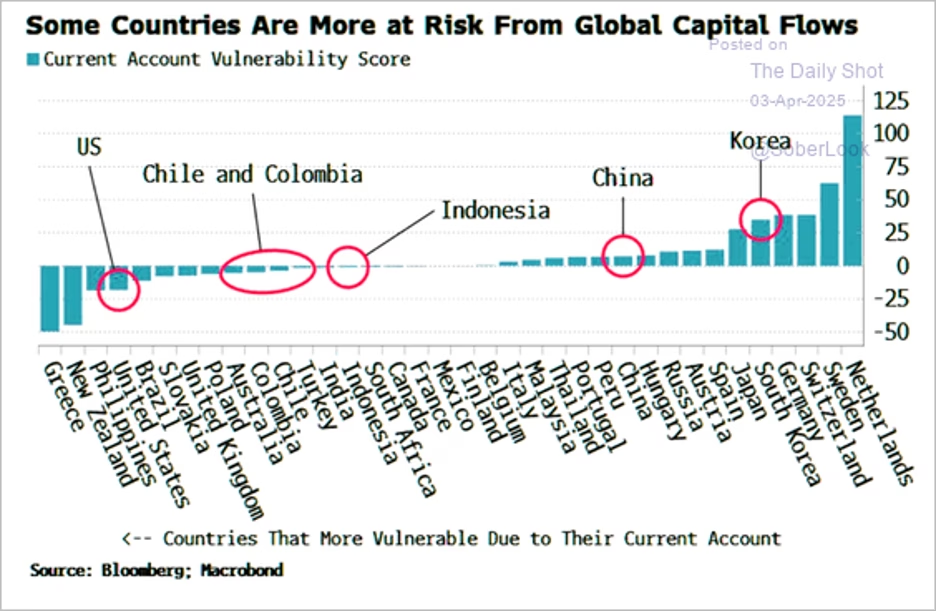

US stock futures and global equity markets tumbled on the announcement. Countries with large and worsening current account deficits—such as the US, Greece, and New Zealand—are most exposed to capital flight risk. In contrast, surplus economies like the Netherlands, Switzerland, and Korea are positioned more defensively in the event of a global capital shock. Notably, several EMs (e.g., Chile, Colombia, Indonesia, China) fall near the middle, indicating more resilient external accounts despite broader macro risks.

The effective US tariff rate is now at its highest level in 125 years.

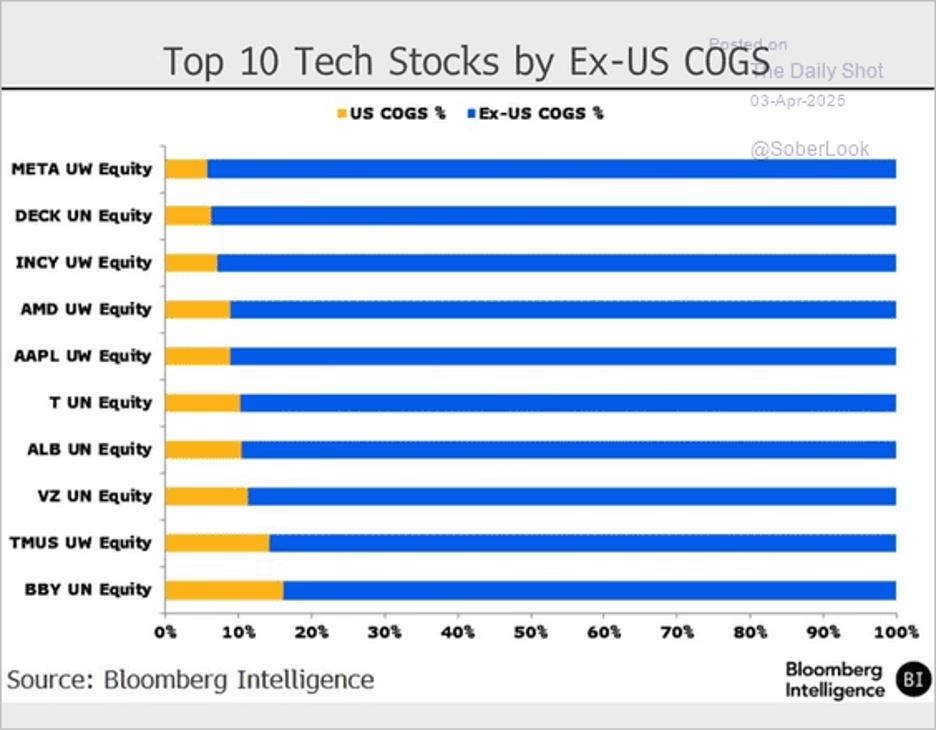

Recession probability for 2025 has climbed to 50% in the betting markets. The Mexican peso strengthened as the announced US tariffs on Mexico were milder than anticipated. The loonie strengthened as the announced US tariffs on Canada were milder than anticipated. Industrial metals are under pressure after the US tariff announcement. Treasury yields have declined after the announcement. Brent crude dipped below $74/bbl after the US tariff announcement. Tech stocks fell sharply after the US tariff announcement (after hours), driven by concerns over significantly higher-than-expected tariffs on Asia. Tesla’s sales disappointed. This chart underscores how heavily many US tech multinationals rely on foreign supply chains, highlighting their vulnerability to escalating tariffs and trade tensions, which could severely impact margins and profitability.

Treasury Secretary Scott Bessent’s mission is threefold: a weaker dollar, cheaper oil, and lower 10-year Treasury yields. It’s difficult to see how he can achieve these without a recession.

Mission accomplished.

The Fed:

The market now sees four Fed rate cuts this year.

Great Quotes

“Anyone who stops learning is old, whether twenty or eighty. Anyone who keeps learning stays young. The greatest thing you can do is keep your mind young.” – Mark Twain

Picture of the Week

Japan Cherry Blossom festival

All content is the opinion of Brian Decker