The war in the Middle East has escalated and associated inflation risks have risen, too.

Over the weekend, a U.S. destroyer ship along with helicopters and military personnel clashed with Iranian-backed Houthi militants from Yemen, resulting in U.S. forces sinking three Houthi boats and killing 10 fighters.

The Houthis have been fighting a civil war with the Yemeni government for years. But now they’ve also begun attacking commercial freight ships in the neighboring Red Sea and Gulf of Aden in support of the Hamas group fighting Israel in the Gaza Strip.

The U.S. is part of a coalition of nations, with the United Kingdom, France, Italy, Canada, and others, that started patrolling these international waterways critical to global trade a few weeks ago. According to The Hill…

Houthi rebels have plagued the Red Sea since the Israel-Hamas war broke out, firing sometimes a dozen rockets at U.S. ships. They seized a merchant ship in November and damaged another one last month.

The U.S. task force, made up of several nations primarily in Europe and the Western world, seeks to deter the Houthi threat by patrolling the Red Sea and defending merchant ships, many of which have canceled trips through the transit corridor near Yemen, hiking up prices.

Cut to Saturday night in the Red Sea…

First, the USS Gravely shot down a pair of missiles from Houthi-controlled areas of Yemen while the ship was responding to a report about a commercial ship being struck by a missile itself. As CBS News reported…

According to U.S. Central Command, the container ship Maersk Hangzhou – which is Danish-owned but sails under a Singaporean flag – reported at 8:30 p.m. local time that it had been struck by a missile in the Southern Red Sea.

No one was hurt and the ship remained seaworthy, CENTCOM reported in a social media post.

However, while responding to assist the Maersk Hangzhou, the USS Gravely shot down two anti-ship missiles which had been fired from Yemen, CENTCOM said. The missiles appeared to have been directed at the USS Gravely and the USS Laboon, which was also responding to the Maersk Hangzhou, CENTCOM said.

A few hours later, four boats tried to attack the same Maersk ship. Then things got really heated. According to CBS News…

The container ship issued a second distress around 6:30 a.m. local time on Sunday, CENTCOM said, with boats originating from Houthi-controlled areas in Yemen, fired crew served and small arms weapons at the Maersk Hangzhou. CENTCOM said the small boats got within 20 meters of the Maersk Hangzhou, and attempted to board the vessel, leading to a contract security team to return fire.

U.S. helicopters from the USS Eisenhower and Gravely responded to the distress call and in the process of issuing verbal calls to the small boats, the small boats returned fire upon the U.S. helicopters and crew, CENTCOM said. The U.S. Navy helicopters returned fire in self-defense, sinking three of the four small boats, and killing the crews. The fourth boat fled the area.

In the days since, an Iranian warship has entered the Red Sea. In an announcement of that move, Iranian media tried to play it off as no big deal. As the state-run Islamic Republic News Agency put it…

The Iranian Navy’s 94th flotilla of warships, comprising of Alborz destroyer, entered the Red Sea on Monday amid heightening tensions in the strategic maritime route.

Since 2009, Iranian warships have been operating in open waters to secure shipping lines, fight against pirates and carry out other missions.

The flotilla’s arrival in the Red Sea comes amid rising tensions following Yemen’s retaliatory attacks on Israeli-owned and -bound vessels in support of the Palestinians in the Gaza Strip.=

Believe Iran’s take as you wish… But obviously, the presence of U.S. and Iranian ships closer to each other than a few days ago raises the risk of direct conflict, in addition to the militants from Yemen already creating impacts. (A separate escalation came today in Lebanon, where a blast killed a Hamas leader in territory controlled by the Hezbollah militant group, which is also clashing with Israel.)

Today, a Houthi official vowed revenge on the U.S. and the United Kingdom for the attack on boats that “were in the Red Sea to conduct a military operation against the Maersk Hangzhou vessel that was heading for the ports of occupied Palestine.”

The Houthis have reportedly found the Red Sea attacks politically popular for their own civil war, promising recruits they’ll fight in Gaza (which hasn’t happened).

The group might also be using the attacks to raise the stakes in other negotiations with Saudi Arabia – Iran’s rival in the region, which was discussing a partnership in Israel months ago – according to some analysts.

You might be wondering why we’re spending all this time on the policy aims of a Yemeni rebel group.

I can’t tell you exactly what’s going to play out in this multifaceted Middle East war in the next few weeks and months or years but I do know that it’s going to matter. With violence in the Red Sea, formerly routine major shipping channels and businesses at the heart of global trade are being disrupted.

Freight prices have been on the rise for weeks as shippers have been adjusting plans to go around the southern tip of Africa instead. That takes about nine days and costs at least 15% more than going through the Red Sea to ship cargo between Europe, Asia, and beyond.

Some shipping industry sources say redirecting ships around Africa costs up to $1 million extra in fuel for every round trip between Asia and Northern Europe. Rates for some freight from China to the United Kingdom have doubled since October to around $4,400 per container.

According to global news service Reuters…

Vessel owners already have begun rationing the less expensive, contract-rate space they reserve for customers, said Anders Schulze, head of the ocean business at digital freight forwarder Flexport.

For example, he said, a customer who delivers five containers a month versus the 10 promised in their contract may only get five containers at contract rates. The remainder would be subject to expensive spot market rates.

This has set off a scramble to reserve space ahead of the early February deadline to get goods out of China before factories there close for the extended Lunar New Year celebrations, logistics experts said.

“Every single booking (out of China) now needs to be reconfirmed. The dates could change, the routing may change,” said Alan Baer, CEO of OL USA, which handles freight shipments for clients. OL has contracts with ship owners and is part of the rush to secure spots on ships.

Small shippers are most at risk of being elbowed out.

Marco Castelli, who has an import/export business in Shanghai, has been trying to rebook three containers of Chinese-made machinery components bound for Italy after the shipments were cancelled due to the crisis.

“Transfer my situation to a large corporation and you get what’s going on,” he said.

I don’t need to remind you how important global supply chains and freight ships are. Pandemic disruptions illustrated how limited supply and steady demand can drive prices higher (especially when paired with government stimulus and ultra-low interest rates).

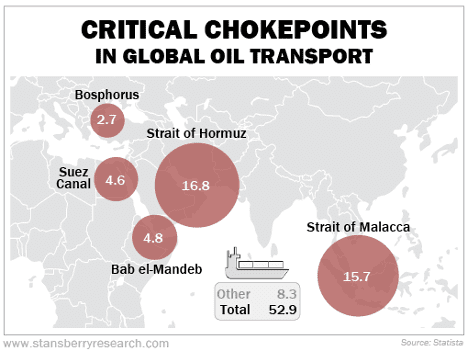

As much as 15% of global trade moves through the Red Sea, U.S. officials said last month. That’s when they announced “Operation Prosperity Guardian” to serve as “highway patrol” of the Red Sea and Gulf of Aden (two bodies of water between Africa and the Middle East connected by the Bab el-Mandeb Strait).

Roughly 10% of the world’s oil and liquefied natural gas moved by ship goes through the area, mostly headed to Europe, that includes nearly 5 million barrels of oil per day through these waterways and more nearby. Here’s a graphic they shared…

Some of the dangers of these “chokepoints”…

In March 2022, well before this war was raging in Gaza, Houthi militia launched booby-trapped boats from Yemen’s coast toward oil tankers passing through the Bab el-Mandeb Strait. And in May 2017, the same group fired rocket-propelled grenades at a Marshall Islands-flagged crude tanker.

In July 2018, Saudi Arabia was forced to temporarily suspend all oil shipments through the Bab el-Mandeb Strait after Houthi militia attacked two of the kingdom’s very large crude carriers (“VLCCs”), threatening to sink a combined 4 million barrels of oil into the sea.

These were sporadic attacks meant to harass Western allies in the region. And they involved relatively simple weaponry that lack the firepower capable of doing real damage to VLCCs. But this time around, the Houthis have a vast arsenal of long-range weapons that includes several different kinds of cruise missiles, like the Quds guided missile. If the Houthis launch them, they could easily sink a handful of these massive seagoing oil tankers in both [the Bab el-Mandeb and Hormuz] straits and close off 21 million [barrels per day] of oil from the world market almost overnight.

Cutting off even one of these chokepoints would potentially knock off more oil from the world market than has ever been done since the Arab oil embargo in 1973. That crisis sent oil prices quadrupling in less than a year.

At least a dozen shipping companies had already suspended travel through the Red Sea before this weekend. If they haven’t already, we suspect they’ll be on alert even more. Just today, shipping giant Maersk – whose ship was targeted in the recent Houthi attack – announced to customers it will pause all shipping through the area “until further notice.”

When we first reported on Hamas’ attack on Israel and the potential influence on global markets, we explained how the risk of the conflict expanding would matter more than the trigger point itself… Also, we explored how war is inflationary in general.

we wrote…

As we said when Russia invaded Ukraine, and now can sadly repeat 18 months later, war is ultimately an inflationary pressure – for myriad reasons depending on the context, including creating commodity-supply issues.

Russia and Ukraine, for instance, are tied to global supplies of food and oil. And in the Middle East, many battles have been fought over the decades with oil concerns squarely in the middle of many disputes.

And then there’s the knock-on effects…

Developments in Israel’s war against Hamas in Gaza will likely change the calculus of relationships not just between the enemies, but also among global powers like the U.S., Saudi Arabia, Iran, and others in ways that we can’t predict.

Already today, for example, Germany and Austria announced they are suspending aid worth tens of millions of euros to Palestinians – drawing battle lines in their association with the conflict. The U.S. has moved warships closer to Israel and is promising to help by providing resources to the Israeli Defense Force.

The gunfight in the Red Sea over the weekend marked the most significant U.S. military engagement in the waters since the war broke out in Gaza.

Like they did after Hamas attacked Israel in October, oil prices rose this morning but then traded lower throughout the day. The energy sector of the S&P 500 was in the green all day and closed 1% higher.

A meaningful rise in prices in the weeks or months ahead, for Red Sea-related or any other reasons, could change the discussion around the Federal Reserve and other central banks possibly cutting interest rates in 2024.

In other words, central banks won’t be as likely to cut interest rates if inflation risks remain high. And that could change market expectations for stocks, bonds, and other rate-sensitive assets.

Or it could all be much ado about nothing. After all, maybe the peace-loving Iranian military sent a warship to the Red Sea for well-intentioned reasons??

The Fed

Let’s begin with the December FOMC minutes.

The Fed sees risks becoming more balanced, but inflation risks are still skewed to the upside.

In light of the policy restraint in place, along with more favorable data on inflation, participants generally viewed risks to inflation and employment as moving toward greater balance. However, participants remained highly attentive to inflation risks.

Inflation reduction’s next phase hinges on weakening demand. The economy and the labor market may need to ease further for inflation to keep slowing.

Several participants assessed that healing in supply chains and labor supply was largely complete, and therefore that continued progress in reducing inflation may need to come mainly from further softening in product and labor demand, with restrictive monetary policy continuing to play a central role.

The message of “higher for longer” remains intact.

Several [participants] also observed that circumstances might warrant keeping the target range at its current value for longer than they currently anticipated.

Participants … reaffirmed that it would be appropriate for policy to remain at a restrictive stance for some time until inflation was clearly moving down sustainably toward the Committee’s objective.

There is some concern about a rapid deterioration in the labor market.

Several participants noted the risk that, if labor demand were to weaken substantially further, the labor market could transition quickly from a gradual easing to a more abrupt downshift in conditions.

Fed officials are beginning to talk about tapering QT, partially attributable to heightened repo market volatility (see the rates section here).

Several participants remarked that the Committee’s balance sheet plans indicated that it would slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level judged consistent with ample reserves. These participants suggested that it would be appropriate for the Committee to begin to discuss the technical factors that would guide a decision to slow the pace of runoff well before such a decision was reached in order to provide appropriate advance notice to the public.

The market cut back on rate cut expectations but is still pricing almost double the rate reductions projected by the FOMC.

US Economy

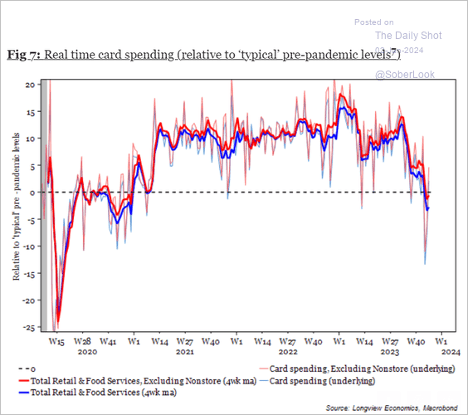

- The US consumer remained resilient going into the holiday season, with spending rising in November.

- However, card spending shows a slowdown.

- November’s durable goods orders topped expectations.

- Recent regional manufacturing data persistently indicate subdued activity levels.

- Initial jobless claims remain very low for this time of the year.

- Labor force participation among Americans aged 55-64 is hitting new highs.

- Job growth is increasingly concentrated in non-cyclical sectors like government and healthcare. Looking only at the private sector, average gains in 2023 were 169,000 vs 376,000 in 2022. The last quarter was only 115,000. The trend is clearly slowing but, for now, remains positive.

- Growth in single-family construction spending has been outpacing multifamily housing projects.

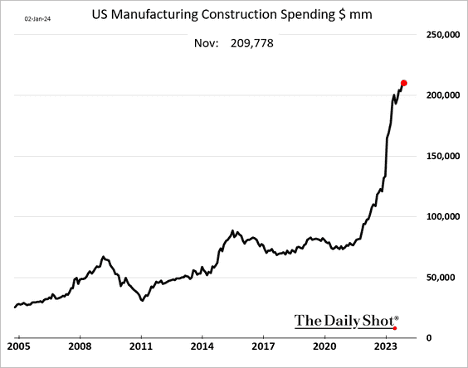

- Manufacturing construction spending continues to climb, driven by semiconductor facility investment.

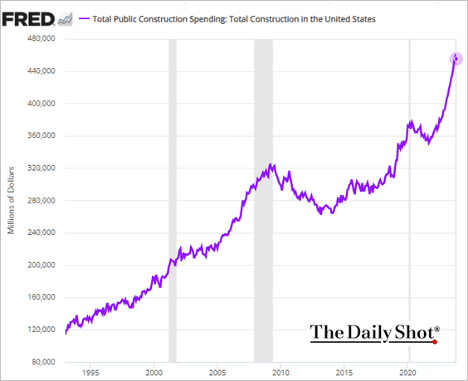

- Public construction spending has been surging, …

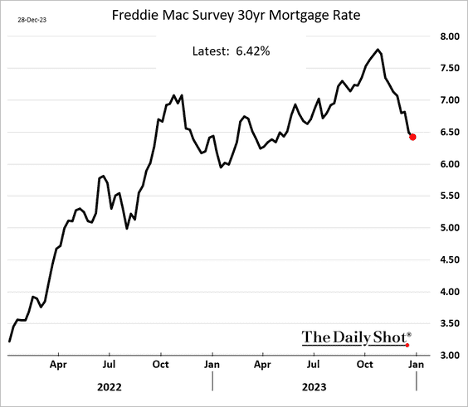

- Mortgage rates are below 6.5%.

- Home prices continued to climb in October, rising by almost five percent relative to 2022.

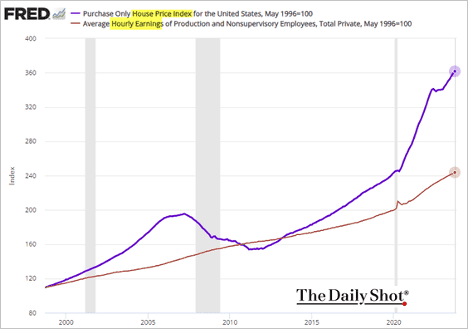

- The gap between home prices and wages keeps widening.

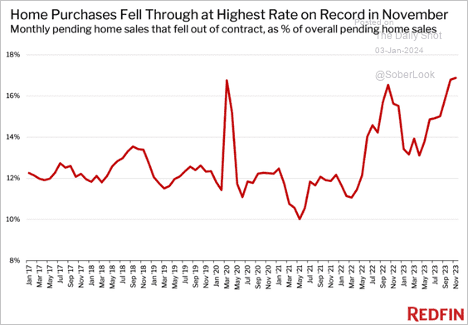

- Many home sales are falling through.

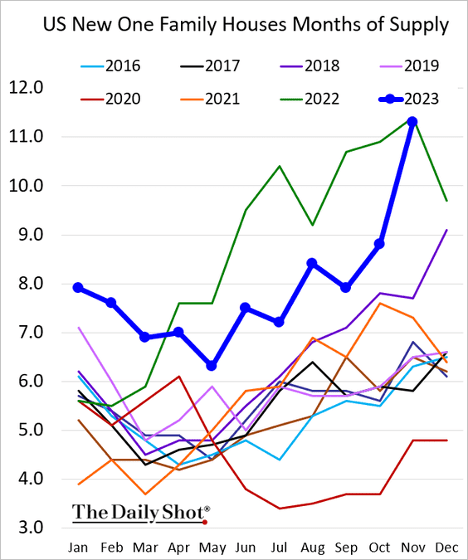

- Measured in months of supply, new home inventories surged.

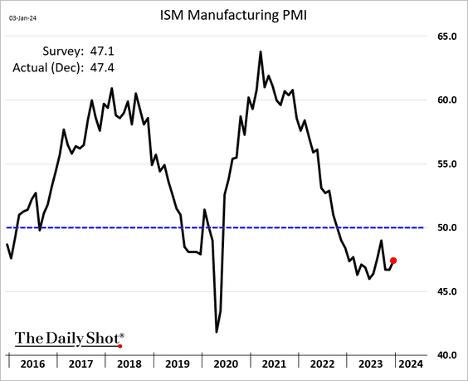

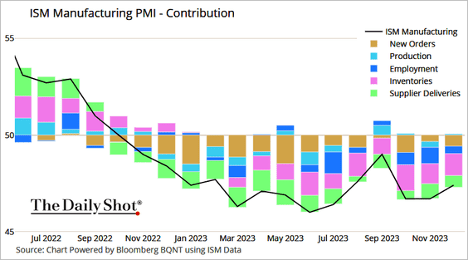

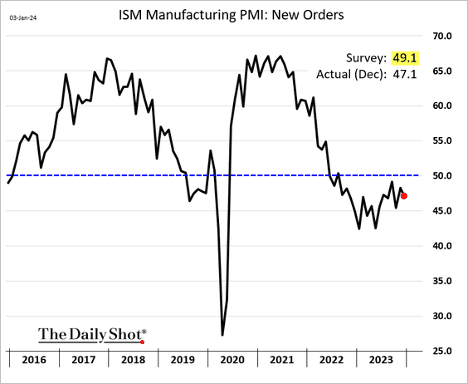

- The US (and global) manufacturing recession remains intact, …

Source: @TheTerminal, Bloomberg Finance L.P.

- … amid falling demand.

- The December ADP private payrolls index surprised to the upside.

Market Data

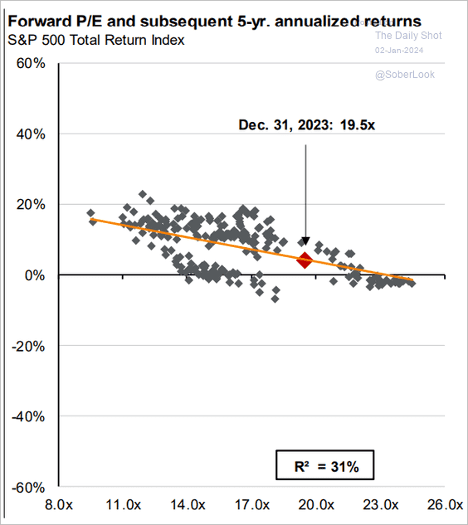

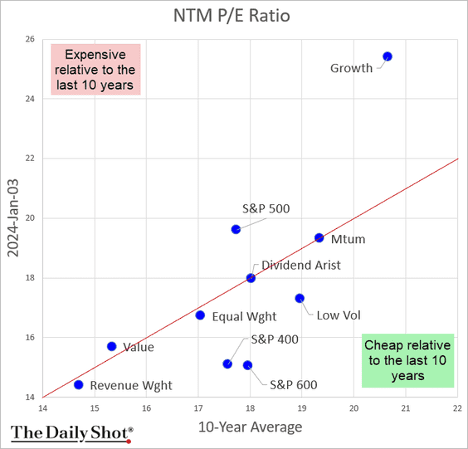

- Current valuations point to sub-5% returns for the S&P 500 over the next five years.

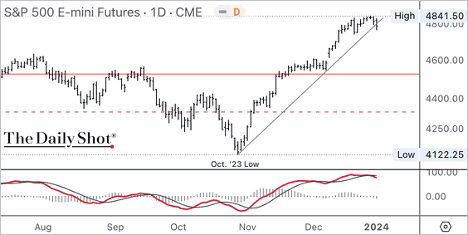

- The S&P 500 is starting to break below its uptrend from October 2023.

- Here is a look at equity valuations relative to the past ten years.

Great Quote

Darkness cannot drive out darkness, only light can do that. Hate cannot drive out hate, only love can do that.

– Martin Luther King, Jr.

Picture of the Week

Pillars of Creation – James Webb Telescope

All content is the opinion of Brian Decker