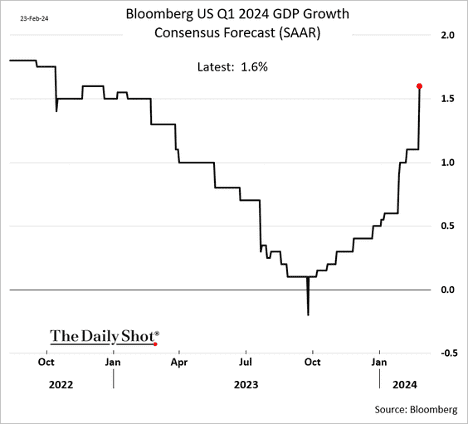

- Economists continue to boost their projections for the current quarter’s GDP growth. Forecasts for the full year also continue to rise, driven by expectations of resilient consumer spending.

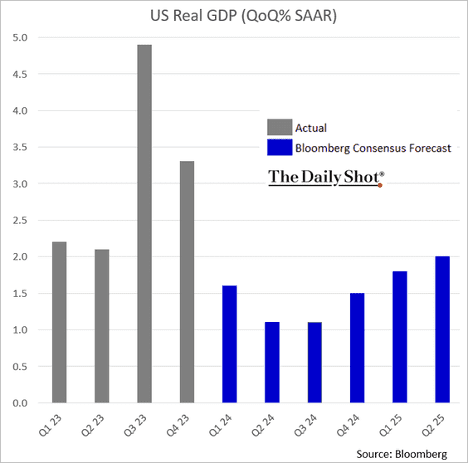

- Consensus projections show slower growth over the next couple of quarters, with momentum picking up in Q4.

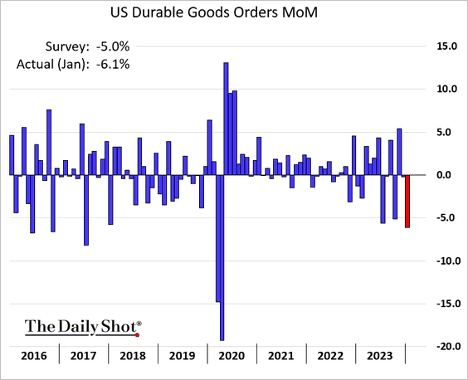

- Durable goods orders dropped sharply in January, primarily due to a decline in aircraft sales (which tend to be lumpy).

- Excluding transportation, there was still a slight reduction in orders for durable goods.

- Moreover, capital goods orders are now lagging shipments, signaling weaker future demand.

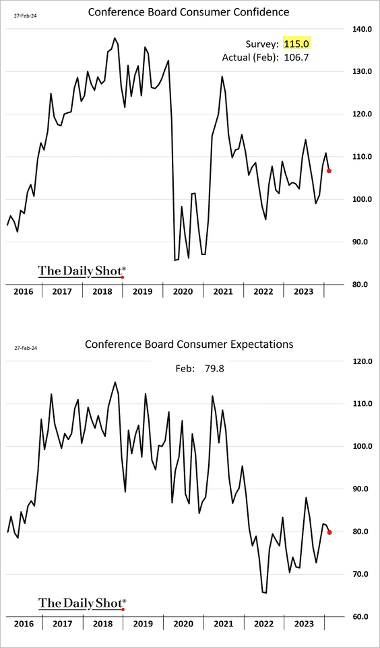

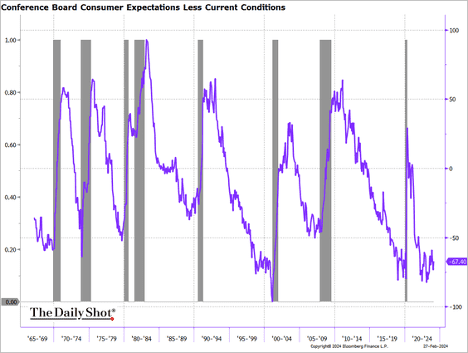

- The Conference Board’s index of consumer confidence unexpectedly declined this month.

- The spread between expectations and current conditions remains at recessionary levels.

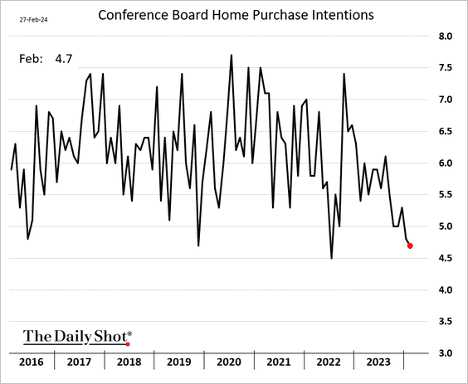

- The Conference Board’s survey showed deteriorating intentions to purchase homes.

- The Q4 GDP growth was revised slightly lower, to 3.2%, driven by inventories. Domestic demand was adjusted upwards.

- Mortage applications are holding at multi-year lows, as rates climb.

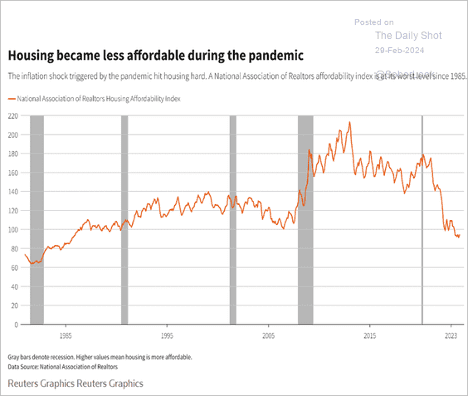

- Here is the affordability index.

- Housing inflation may end up being stubbornly high for some time.

- Although nominal personal income saw a significant increase in January, real disposable personal income remained essentially unchanged (due to a surge in inflation), with real spending experiencing a decline.

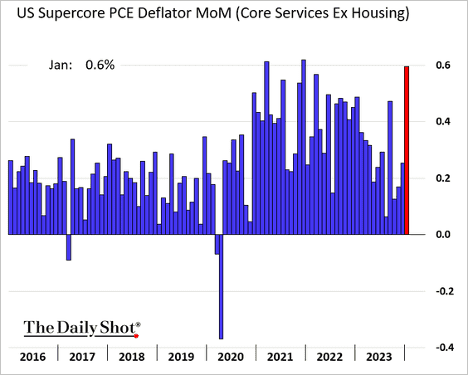

- The supercore PCE inflation, closely monitored by the Fed, surged in January. This picture does not scream “rate cuts.”

Market Data

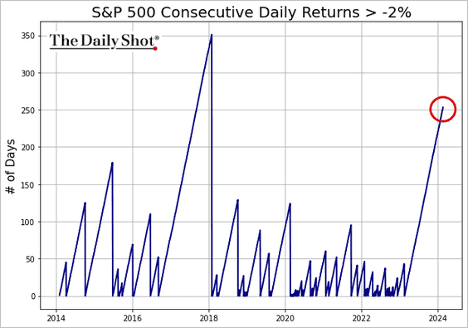

- The S&P 500 experienced 253 trading sessions without a 2% daily drop.

- The Conference Board’s consumer sentiment report shows growing bullish sentiment among US households.

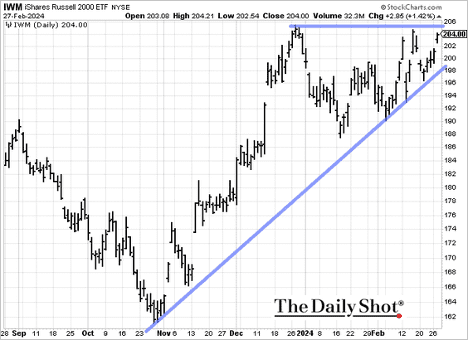

- A breakout ahead for Russell 2000?

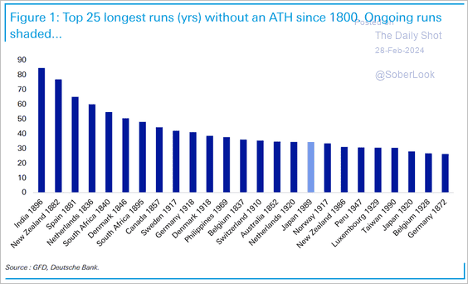

- This chart shows the longest equity market runs without an all-time high. (Japan’s TOPIX is shown here, which is still slightly below its high from 1989)

Source: Deutsche Bank Research

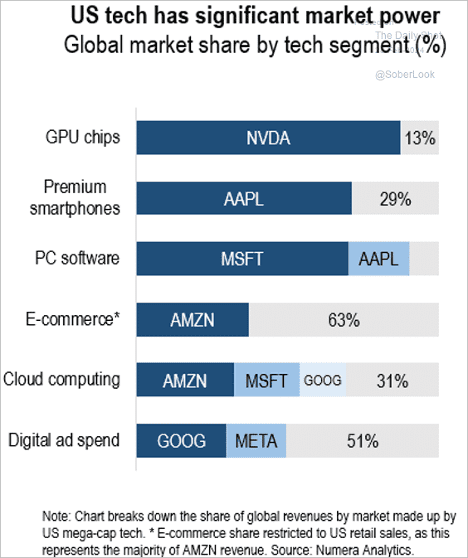

- US companies have significant market power across major global tech segments.

Source: Numera Analytics (@NumeraAnalytics)

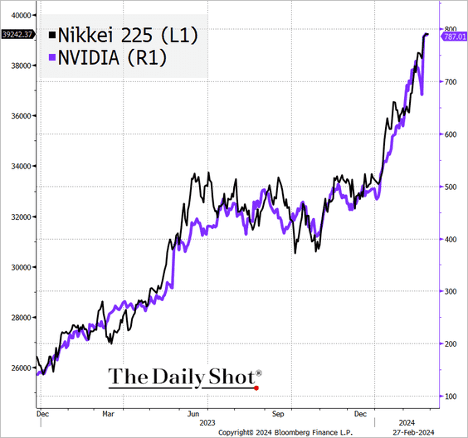

- A remarkable correlation …

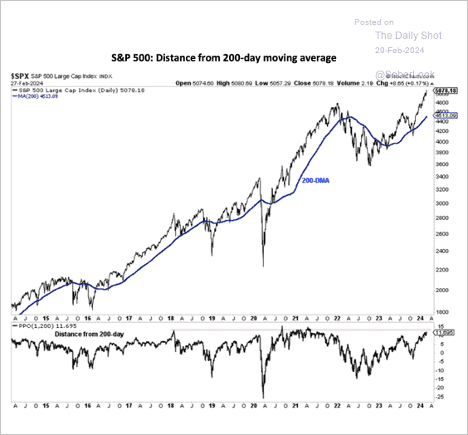

- The S&P 500’s distance above its 200-day moving average is stretched.

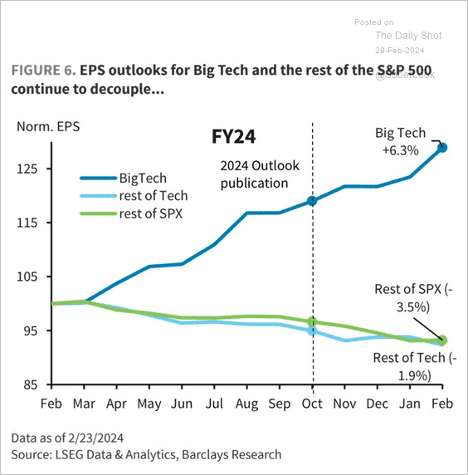

- This year’s earnings projections for tech mega-caps continue to diverge from the rest of the S&P 500.

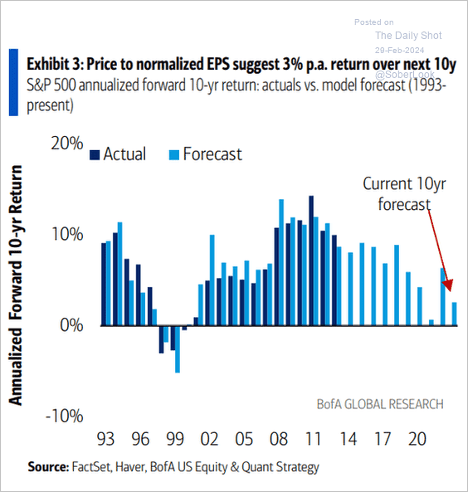

- Current valuations point to sub-5% returns over the next decade.

Great Quotes

“Never argue with stupid people, they will drag you down to their level and then beat you with experience.”

― Mark Twain

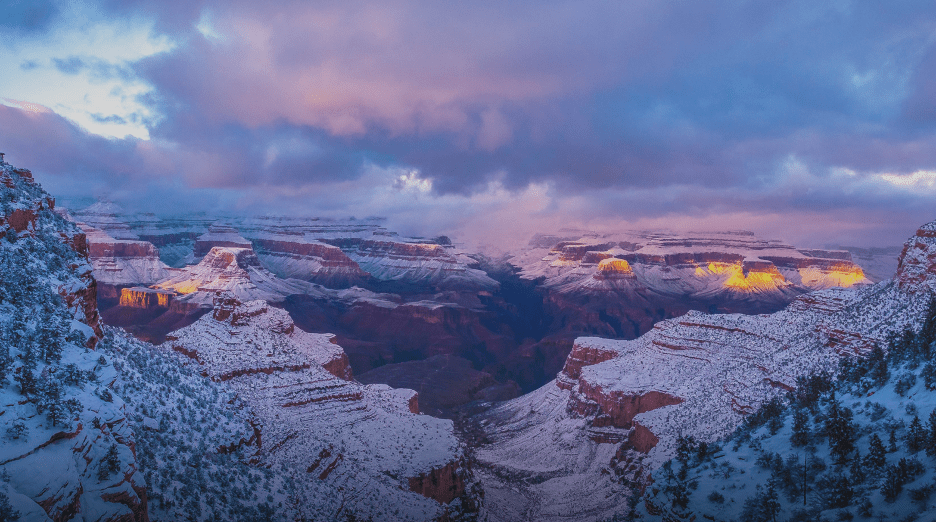

Picture of the Week

Grand Canyon National Park, AZ

All content is the opinion of Brian Decker